De-novo Master Directions on PPIs

I. Introduction

The Reserve Bank of India (RBI) on August 27, 2021, issued the Master Directions on Prepaid Payment Instruments[1] (‘Master Directions’) repealing the Master Directions on Issuance and Operation of Prepaid Payment Instruments[2] (‘Erstwhile Master Directions’) with immediate effect. These Master Directions have been issued keeping in mind the recent updates to the Erstwhile Master Directions.

In this write-up we aim to cover the major regulatory changes brought about by the Master Directions.

II. Overview of key changes

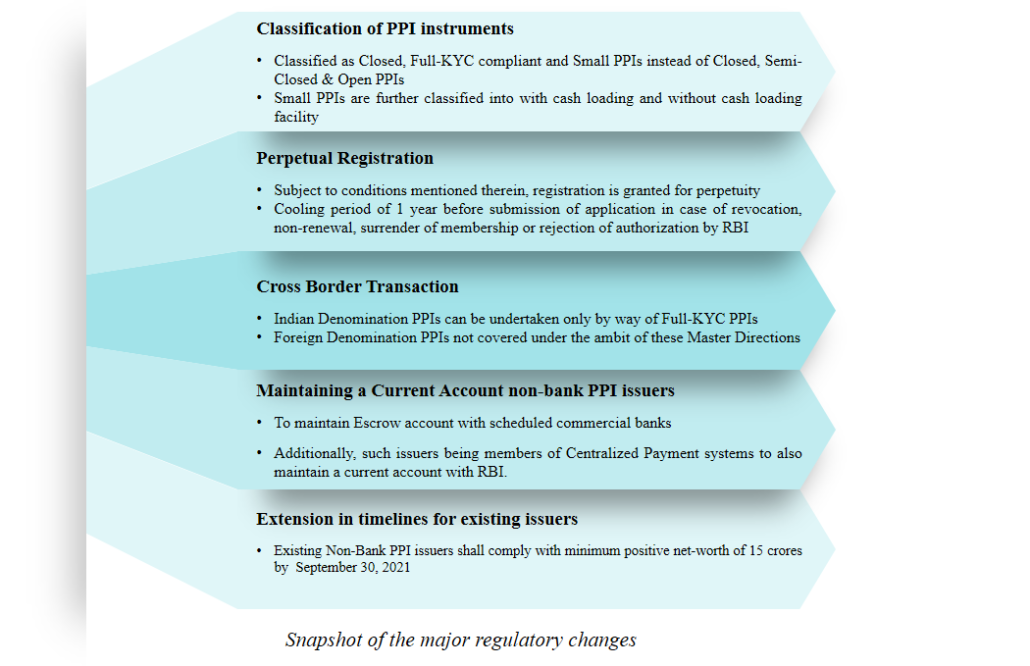

1. Classification of PPIs instruments

The Erstwhile Master Directions classified PPIs into three categories namely closed ended PPIs which could be issued by anyone and required no RBI approval, semi-closed PPIs and open ended PPIs which could be issued only by Banks. The new Master Directions have also classified PPIs in three categories i.e. Closed-ended PPI, Small PPIs and Full-KYC PPIs. However, since closed-ended PPIs are not a part of the payment and settlement system, they are not regulated by the RBI. A brief snapshot of the nature of the other two types of PPIs is presented below:

| Basis | Small PPI | Full KYC PPIs | |

| With cash loading facility | Without cash loading facility | ||

| Issuer | Banks and non-banks after obtaining minimum details of PPI holder (mobile number verified with OTP; self-declaration of name and unique identity/identification number of any OVD) | Banks and non-banks after completing KYC of holder | |

| Identification Process | Verification of mobile number through an OTP

Self-declaration of name and unique identify number of any OVD as recognized in KYC Master Directions |

Video-based Customer Identification Process | |

| Nature of PPI | Reloadable and can be issued in electronic form.

Electronic payment transactions have been divided into two categories- transactions that do not require physical PPIs and those which require. Hence, even cards could be issued. |

Reloadable and can be issued in card or electronic form.

Loading/Reloading shall be from a bank account / credit card / full-KYC PPI.

|

Reloadable and can be issued in electronic form.

Electronic payment transactions have been divided into two categories- transactions that do not require physical PPIs and those which require. Hence, even cards could be issued. |

| Maximum amount that can be loaded | In a month: INR 10,000

In a year: INR 120,000 |

No maximum limits | |

| Maximum outstanding amount at any point of time | INR 10,000 | INR 200,000 | |

| Limit on debit during a month | INR 10,000 per month | No limit | No limit |

| Usage of funds | For purchase of goods and services only.

Cash withdrawal or fund transfer not permitted

|

Transfer to source or bank account of PPI holder, other PPIs, debit or credit card permitted subject to:

Pre-registered benefit – maximum INR 200,000 per month per beneficiary

Other cases – maximum INR 10,000 |

|

| Cash Withdrawal | Not permitted | Permitted subject to limits:

INR 2000 per transaction and INR 10,000 per month |

|

| Conversion | To be converted into full-KYC PPIs within a period of 24 months from the date of issue of the PPI. | Small PPI with cash loading can be converted into Small PPI without cash loading, if desired by the PPI holder. | Not applicable |

| Restriction on issuance to a single person | Cannot be issued to same person using the same mobile number and same minimum details more than once. | No such restriction | No such restriction |

| Closure | Funds transferred back to source or Holders bank account after complying with KYC norms

|

Funds transferred to pre-designated bank account or

PPIs of the same issuer |

|

The concept of ‘Small PPI’ and ‘Full-KYC PPI’ cannot be said to be a new introduction, rather, it is more of a merger of the existing variety of semi closed PPIs in Small PPI and the open ended PPI to Full KYC PPI. However, an important change that has been inserted is the recognition of non-bank PPI issuers to issue Full KYC PPI, who were earlier not allowed to issue open ended PPIs.

2. Validity of Registration

Earlier, the Certificate of Authorisation was valid for five years unless otherwise specified and was subject to review including cancellation of the same. However, under the Master Directions, the authorisation is granted for perpetuity (even for existing authorisation which becomes due for renewal) subject to compliance with the following conditions:

- Full compliance with the terms and conditions subject to which authorisation was granted;

- Fulfilment of entry norms such as capital, net worth requirements, etc.;

- No major regulatory or supervisory concerns related to operations, as observed during onsite and / or offsite monitoring;

- Efficacy of customer grievance redressal mechanism;

- No adverse reports from other departments of RBI / regulators / statutory bodies, etc.

Also, the concept of ‘cooling period’ was introduced in December 2020[3], for effective utilisation of regulatory resources. PPI issuer whose CoA is revoked or not-renewed for any reason; or CoA is voluntarily surrendered for any reason; or application for authorisation has been rejected by RBI; or new entities that are set-up by promoters involved in any of the above categories; will have a one year cooling period. During the said cooling period, entities shall be prohibited from submission of applications for operating any payment system under the PSS Act.

3. Cross border transactions in Indian denomination

The Erstwhile Master Directions provided that Cross Border Transactions in INR denominated PPIS was allowed only by way of KYC compliant semi-closed and open PPIs which met the conditions specified therein. However, under the Master Directions, such issuances have been permitted only in the form of Full-KYC PPI and other conditions as prescribed earlier have not been altered.

4. Maintenance of Current Account

Apart from maintaining an escrow account with a scheduled commercial bank, non-bank PPI issuer that is a member of the Centralised Payment Systems operated by RBI i.e. non-bank issuers as covered under Master Directions on Access Criteria for Payment Systems[4] which have been allowed to access Real Time Gross Settlement (RTGS) System and National Electronic Fund Transfer (NEFT) Systems and any other such systems as provided by RBI, shall also be required to maintain a current account with the RBI.

Transfer from and to such current account is permitted to be credited or debited from the escrow account maintained by the PPIs.

5. Ensuring additional safety norms

- To ensure safety and security, PPIs issuers are now required to put in place a Two Factor Authentication (2FA) in place for all wallet transactions involving debit to wallet transactions including cash withdrawals. However, it is not mandatory in case of PPI-MTS and gift PPIs.

- The Erstwhile Master Directions required PPI issuers to put in place a mechanism to send alerts to the PPI holder regarding debit/credit transactions, balance available /remaining in the PPI. In addition to the same, the Master Directions now require issuers to send alerts to the holder even in case of offline transactions. The issuer may send a common alert for all transactions as soon as the issuer receives such information. Separate alerts for each transaction shall not be required.

6. Miscellaneous

- In case of co-branding, additionally it has been specified that the co-branding partner can also be a Government department / ministry.

- The Erstwhile Master Directions provided banks and non-banks a period of 45 days to apply to the Department of Payment and Settlement Systems (DPSS) after obtaining the clearance under the Payment and Settlement Systems Act, 2007. The same has now been reduced to 30 days from obtaining such clearance.

- In addition to the satisfactory system audit report and net worth certificate, RBI also requires issuers to submit a due diligence report for granting final Certificate of Authorisation (CoA).

- Transfer of funds back to source account in case of Gift PPIs has been allowed after receiving the consent of the PPI holder.

- To improve customer protection and grievance redressal, the Master Directions have provided customers of non-bank PPI issuers to have recourse to the Ombudsman Scheme for Digital Transactions.

7. Effect on existing issuers

The timeline for complying with the minimum positive net-worth of 15 crores by non-bank PPI issuers has been extended and shall now be met with by September 30, 2021 instead of March 31, 2020. Non-bank issuers shall submit the provisional balance sheet indicating the positive net-worth and CA certificate to the RBI on or before October 30, 2021, failing which they may not be permitted to carry on their business.

III. Conclusion

In this write-up we have aimed to cover the gist of changes introduced in the Master Directions as compared to the Erstwhile Master Directions. The changes made in the regulatory framework for the PPIs have created a level playing field for banks and non-banks, especially, with respect to issuance of full KYC PPIs. Comparatively, the new directions are way more liberal than the earlier one, which only indicates how bullish the regulator must be with respect to PPIs.

[1] https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=12156#MD

[2] https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11142

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12001&Mode=0

[4] MD51170116C65788DE8A564165B74D5FECE0626A73.PDF (rbi.org.in)

Leave a Reply

Want to join the discussion?Feel free to contribute!