Investments from neighbouring countries under stringent scan of GoI

– Prapti Kanakia | corplaw@vinodkothari.com

Recently, the Ministry of Corporate Affairs (MCA) has implemented a series of amendments which relates to investments in India by foreign nationals or entities incorporated in a country which shares a land border with India. These amendments are in tandem with the amendment made by the Department for Promotion of Industry and Internal Trade (DPIIT) in FDI Policy and by the Ministry of Finance, Department of Economic Affairs, in FEM (Non Debt Instruments) Rules, 2019 (NDI Rules).

DPIIT amended the FDI policy vide press note no. 3 dated 17 April, 2020 to curb the hostile takeovers of Indian Companies by nationals/entities of neighbouring countries. Erstwhile, only a citizen of Bangladesh & Pakistan or an entity incorporated in Bangladesh & Pakistan were required to take government approval for investing in India. Pursuant to amendment, any entity incorporated in a country, citizen or beneficial owner of a country, which shares land border with India, needs to obtain government approval for investing in the equity instrument of the Indian Company. Thus, nationals/entities from Pakistan, Afghanistan, China, Bhutan, Nepal, Myanmar and Bangladesh can invest in India only under approval route.

FDI related amendment

Any entity or a citizen of a country sharing land border with India, which intends to invest in India will need to take prior approval from GOI for investing in the shares of the Company. Here the amendment will come into play in following cases;

- In case of purchase of shares directly from the Company or

- In case of purchase of shares from existing shareholders.

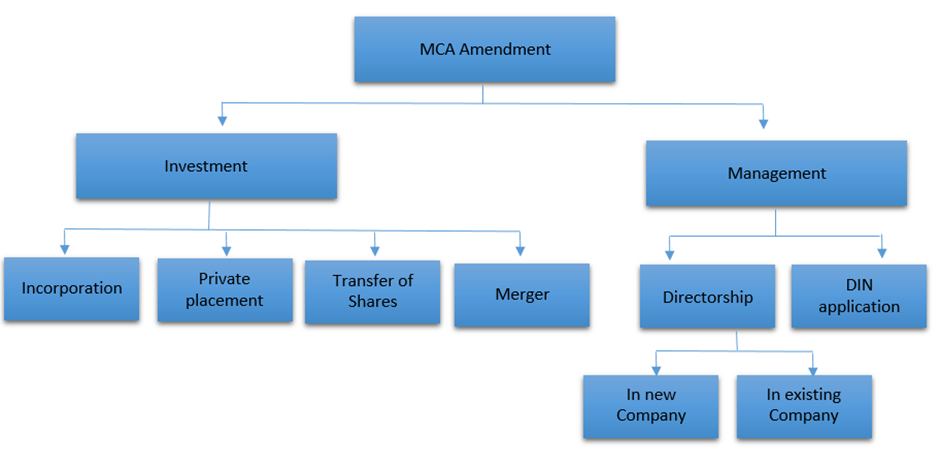

Amendments brought by MCA

The Indian Company issuing shares needs to enquire about the status of the proposed shareholder. In case the proposed shareholder is from a country sharing land border with India, the Company needs to ensure that prior approval is taken by the proposed shareholder from GOI. Thus, to make sure that approval has been taken, MCA has amended Companies Act by making it mandatory to report compliance of NDI rules. The following regulatory changes are implemented by MCA;

- Incorporation

MCA has amended the Companies (Incorporation) Rules, 2014 w.e.f. 01 June, 2022 to ensure that the subscribers belonging to a country sharing land border with India, have obtained the necessary government approval under NDI Rules. Pursuant to the amendment, subscribers need to declare whether they are required to obtain approval from the Government of India (‘GoI’) and if applicable the said approval shall be attached along with the Incorporation form i.e. SPICe+.

- Private placement

In case of private placement, if the proposed allottee is from a country sharing land border with India, it has to attach the government approval along with the private placement offer cum application letter i.e. PAS-4. A declaration regarding applicability of NDI rules is to be given by the proposed allottee in the PAS-4. This amendment is brought vide Companies (Prospectus and Allotment of Securities) Amendment Rules, 2022 effective from 05 May, 2022.

- Transfer of shares

In case of transfer of shares to a person belonging to or an entity incorporated in a country sharing land border with India, the said person/entity will need to obtain government approval pursuant to NDI Rules, and attach the said approval with the share transfer form i.e. SH-4. The transferee is required to give a declaration regarding applicability of NDI Rules, pursuant to amendment in Companies (Share Capital and Debentures) Rules, 2014 effective from 04 May, 2022.

- Merger

In case of Merger/compromise/arrangement of an Indian Company with an entity incorporated in a country which shares land border with India, the said entity will need to obtain prior government approval under NDI rules and attach the same with Form CAA-16 and submit it along with the merger application before National Company Law Tribunal. This amendment is brought vide Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2022 effective from 30 May, 2022.

- Appointment of Director in a Company

Additionally, MCA made it mandatory to obtain security clearance from the Ministry of Home Affairs (MHA), for nationals of a country which shares a land border with India, before becoming a director of an Indian company. The director has to attach the approval along with consent letter i.e. DIR-2. This amendment is brought vide Companies (Appointment and Qualification of Directors) Amendment Rules, 2022 effective from 01 June, 2022.

In case of incorporation as well, a declaration is to be given as to whether security clearance has been obtained from MHA, in case the proposed director is a national of a country which shares a land border with India. The said security clearance is required to be attached along with incorporation form pursuant to Companies (Incorporation) Second Amendment Rules, 2022. These rules are effective from June 01, 2022.

- Application for Director Identification Number (DIN):

Where a national of country which shares land border with India, applies for DIN, the individual has to attach the security clearance along with DIN application i.e. DIR-3. A declaration in this regard, has been inserted in the e-Form DIR-3 vide Companies (Appointment and Qualification of Directors) Amendment Rules, 2022 effective from 01 June, 2022.

Conclusion

From implementation of revised FDI policy to 16 March, 2022, GoI has received 347 proposals which fall under the above mentioned norms. The estimated value of these projects is Rs. 75,951 Crore. Out of these 347 proposals, GOI approved 66 projects from sectors including automobile, chemicals, computer software and hardware, pharma, education, electronics, food processing, information and broadcasting, machine tools, petroleum and natural gas, power & services sector. The total value of investments of these 66 proposals aggregated to Rs 13,624.88 crore. GOI rejected 193 proposals of FDI. Thus, GOI is closely monitoring the investments from neighbouring countries[1].

From these regulatory changes, it becomes clear that GoI is closely monitoring the inflow of funds from neighbouring countries. FDI policy talks about investment in equity instruments of Indian Companies. One of the loopholes in FDI policy is that only investment in a company is covered in the NDI rules and not investments through other business structures like LLP, partnership etc. To keep a close track on investments by neighbouring countries through other business structures, the GoI will need to further strengthen the FDI policies.

[1] https://economictimes.indiatimes.com/news/economy/finance/347-fdi-proposals-received-from-countries-sharing-land-border-with-india-66-approved/articleshow/90268118.cms

Leave a Reply

Want to join the discussion?Feel free to contribute!