FAQs on CSR 2021 Amendments

FAQs on CSR 2021 Amendments

[These FAQs pertain to the amendments made vide the Companies (Amendment) Act, 2020 and the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021. These FAQs need to be read with our FAQs on CSR]

Team Vinod Kothari and Company

Version: 21st November, 2022

Contents

Ongoing project / Unspent CSR Account

Carry forward of Excess CSR spending

Registration of implementing agencies [CSR-1]

Taxation and Accounting aspects

Responsibilities and functions of the Board and Committee

General Background

The long-awaited amendments to the CSR provisions brought by the Companies (Amendment) Act, 2020, (‘CAA, 2020’) have finally been made effective by MCA, vide its notification dated January 22, 2021. Along with this, MCA has notified the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021 (Amendment Rules).

CSR has recently been subjected to close regulatory review. With the recent amendments in place, including the amendments introduced by the Amendment Act, 2019, read with these Amendment Rules, the entire regime of CSR has undergone a substantial change, making the understanding of CSR law and amendments thereto all the more important. Various new concepts have been introduced, e.g., The concept of ‘ongoing projects’, transfer of unspent amounts to a designated fund, registration of implementing agencies, preparing a detailed annual report on CSR, CFO certification, impact assessment for certain companies, annual action plan, disclosures on the website and so on.

Accordingly, through these FAQs, we have listed down the probable questions that one may have with respect to the recent amendments in CSR provisions.

In case you wish to view our detailed FAQs on CSR, please refer to FAQs on Corporate Social Responsibility.

Scope and Applicability

1. When will the Amendment Rules be effective?

The Amendment Rules have been notified with immediate effect and thus would be applicable with effect from the date of the Gazette Notification, that is, 22nd January, 2021.

2. Are the Amendment Rules retroactive?

Going by the general principle, we are of the view that the amendments are not retrospective or retroactive. That, however, does not mean the amendments do not affect matters or things done in FY 20-21. For example, any shortfall of spending in FY 2020-21 may well be covered by the amendments. Further, there is a potential view that even the impact assessment may be required for projects undertaken in earlier years (see later FAQ).

Penal provisions

3.What are the implications of not spending post the amendments coming into effect?

The proposed amendments intend to switch the CSR mechanism from “comply or explain” i.e. COREX to a “comply or pay penalty” i.e. COPP provision. Any non-compliance with the new requirements of law may attract the following penal provisions:

- Penalty on company:

Up to twice the amount required to be transferred to fund specified in Schedule VII or Unspent CSR account or Rs. 1 crore, whichever is lower;

- Penalty on officers in default:

1/10th of the amount required to be transferred to Fund specified in Schedule VII or Unspent CSR account or Rs. 2 lakhs, whichever is lower.

4. Are the penal proceedings in addition to the obligation to transfer the unspent amount to the National Unspent CSR Fund, or other Funds mentioned in Schedule VII? Or is it one of the two implications- the obligation to have the unspent money transferred, and the obligation to pay penalty?

In our view, the obligation to transfer the unspent amount to a National Fund, as stipulated in section 135 (5), is to add force to the mandate of spending contained in the law. The penalty is the consequence of infraction of the law. For example, not transferring the money to the National Fund within time will still be a breach of the law, and may thus attract penalty. In other words, penalty is the consequence of not abiding by the law, and not an alternative for the same. Hence, the penalty would not relieve the company from the obligations under the law.

5.Are the penal provisions only for failure to spend the amount, or for any other breach of the law as well? For example, will the failure of disclosures, or other non-compliance of section 135 also lead to penal implications referred to section 135 (7)?

Section 135 (7) is clearly related to breach of section 135 (5) and section 135 (6). If the default pertains to any other provision of the section, or of the Rules, like failure to form a Committee or any issue with the CSR Policy, then the implications will be the general penalty provisions of section 450 of the Act. (Also Refer Q. No. 39 of ICSI FAQs)

6.Will the offenders necessarily be required to pay, say, in case of companies, twice the amount of penalty or Rs. 1 crore, whichever is lower, (or in the case of officer in default), as specified in section 135(7) of the Companies Act, 2013?

No, since the provision uses the words ‘upto’ the said amount, the particular amount of penalty levied on a particular company will be decided by way of adjudication. Adjudication principles are laid down in the Companies (Adjudication of Penalties) Rules, 2014. The quantum of penalty will be based on several factors like size of the company; nature of the business carried on; nature and repetition of default; injury to the public, if any (See Rule 3 (12) of Companies (Adjudication of Penalties) Rules, 2014)

7. Apart from transfer of the unspent amount to the specified CSR funds, whether the Board will still be required to provide a reason for not spending the required CSR amount as specified under the erstwhile provisions?

The second proviso to section 135(2) of the Act still requires the Board to explain, in the Board’s report, reasons for not spending the required CSR amount. Thus, the Board is not absolved of its responsibility to provide an explanation if the required CSR spending is not met and the existing requirement is still in place, over and above the transfer of the shortfall.

CSR Committee

8. In situations where the CSR spending is less than 50 lakhs, whether the existing CSR committee will be dissolved or is required to continue?

Section 135(9) and Rule 3(2) are slightly different – Please note section 135 (9) of the Companies Act, 2013 and rule 3 (2) of the CSR Policy Rules cannot be read to mean the same thing. The section talks about the non-constitution of the CSR committee where the CSR budget does not exceed Rs. 50 lacs and bestows the responsibility of the CSR committee on the Board. On the other hand, Rule 3 (2) talks about the conditions when the CSR committee constitution is not applicable and where it requires the company to check its applicability under sub-section (1) of section 135 for three consecutive preceding financial years. Accordingly, the cases which can attract sub-sec (9) may be those companies which are covered under sub- section (1) for the first time or which are otherwise also covered however, have a temporary fall in their profits because of which their csr obligation may have come down. In such cases, the board has to decide on the CSR matters.

Dissolving of the CSR committee can only be done where the company fulfills the conditions under rule 3(2) and not otherwise.

Scope of CSR Expenditure

9. Which all activities would not qualify as CSR expenditure as per the new definition of ‘Corporate Social Responsibility’ defined in the Amendment Rules?

Rule 2(1)(d) of the Amendment Rules defines “Corporate Social Responsibility (CSR)” which seeks to exclude a list of 6 items from CSR expenditure.

Following are the list of exclusions:

- Activities undertaken in pursuance of normal business of the company (see below);

However, exemption is provided for three financial years till FY 2022-23, to companies engaged in R&D activity of new vaccine, drugs and medical devices in their normal course of business which undertakes R&D activity of vaccine/ drugs/ medical devices related to COVID-19. This exclusion will be allowed only in case the companies are doing such R&D in collaboration with organisations as mentioned in item (ix) of schedule VII and disclose the same in their board’s report.

- Activities undertaken outside India, except for training of Indian sports personnel representing any State or Union territory at national level or India at international level;

- Contribution of any amount, directly or indirectly, to any political party under section 182 of the Act;

- Activities benefiting employees of the company as defined in section 2(k) of the Code on Wages, 2019;

- Sponsorship activities for deriving marketing benefits for products/ services;

- Activities for statutory obligations under any law in force in India.

10. What is the meaning of ‘normal course of business’ in the context of CSR?

The term is neither defined in the Act nor in the Amendment Rules. Black Law’s Dictionary defines the term “ordinary course of business” as “normal routine in managing trade or business”. In general, a normal course of business refers to something that a company does ordinarily to conduct its business activities. E.g. Normal course may include sale/supply of goods or services in the course of business of the company.

On the contrary, MCA on 28th March, 2014 vide an affidavit clarified that CSR activities which is core part of its business also can be undertaken if it is not done with profit motive.

“pharmaceutical company donating medicines/drugs within section 135 read with Schedule VII to the Act is a CSR Activity, as the same is not an activity undertaken in pursuance of its normal course of business which is relatable to health care or any other entry in Schedule VII”

The question is, whether mere absence of a profit motive will take an activity out of the purview of normal course of business? In light of the fact that CSR is what the Company does with a social objective in mind, CSR activities should not be what the Company does in an ordinary course of business. If the Company sells, say, flour in an ordinary course of business, using such flour for a social objective will, in our view, not be a proper CSR activity. Same goes for pharmaceuticals or anything else that the company makes, sells or provides. Our opinion is based on the fact that mixing ordinary course of business activities, though done with a profit motive, and the same activities done without profit motive, will have a very thin borderline of distinction.

While activities done under normal course of business would not fall under CSR expenditure, expenditure undertaken for awareness programme towards COVID-19 vaccination will be allowed as CSR expenditure, as clarified by MCA vide its circular dated 13th January, 2021.

11.Activities “benefiting employees” have been excluded from the scope of CSR. Does that mean the company has to oust the employees from any CSR activity it undertakes?

If the activities are intended for larger good, and there is neither a distinctive reservation for employees, nor a distinctive exclusion, it does not offend the intent of CSR.

In our view, if employees participate in activities which are generally open for all, they can also benefit themselves from such activity as it is not exclusively conducted for them only.

MCA FAQs on CSR also that the spirit behind any CSR activity is to benefit the public at large and the activity should be nondiscriminatory to any class of beneficiaries. However, any activity which is not designed to benefit employees solely, but the public at large, and if the employees and their family members are incidental beneficiaries, then, such activity would not be considered as “activity benefitting employees” and will qualify as eligible CSR activity. (refer Q. No. 4.2 of MCA FAQs)

ICAI FAQs on CSR further clarify that projects, programmes or activities that benefit only the employees of the company and their families shall not be considered as CSR. However, programmes or activities that are for the generic benefit or good, but which also cover some employees or their families will still be considered as CSR as long as such benefits are not exclusively for the benefit of such employees.

The view was further reiterated by the ICSI FAQs on CSR which contains that where a medical camp has been organised exclusively for the benefit of unskilled labour engaged by the Company, the same will not qualify as CSR. (refer Q. No. 20 of ICSI FAQs)

For example, recreational facilities provided for employees and their families in the employee quarters shall not be considered as CSR. However, if the Company maintains a stadium for promotion of sports in a city used by residents of that place and not exclusively by its employees then such spending shall be still considered as a spending towards CSR, even if some of the Company’s employees participate in the same, or derive benefits from the same, as a part of the common beneficiaries.

CSR is a ‘social’ responsibility and not an ‘employer’ responsibility. The intent is that employer’s obligation to employees, or employee welfare activities are not taken as CSR. This will include not just wholetime employees but even part time or contractual employees. In essence, there should be no sense of quid pro quo or employee welfare in case of CSR activities. However, that idea cannot be extended so as to deprive the employees completely from social benefit programmes. The idea is to avoid making them the sole beneficiaries. Hence, if employees are not targeted beneficiaries solely, nor have any special status, the spirit of CSR is not breached.

12. Who are employees in the context of the Amendment Rules? Can the company have CSR activities towards workers engaged in unskilled activities? What if the Company spends towards apprentices/ interns or contract labour?

Earlier, there was an ambiguity as to who would be included under the term ‘employees’ and thereby be ineligible with respect to CSR spending. The same has been clarified by the Amendment Rules to include all employees as defined under the Code of Wages Act, 2019.

Employees as defined under the Code of Wages Act, 2019 include all employees whether skilled, unskilled or semi-skilled. Accordingly, if CSR expenditure is made for unskilled workers, the same would not be considered as CSR expenditure. However, apprentices and interns engaged under the Apprentices Act, 1961 are specifically excluded from the definition and thus would be eligible for CSR expenditure.

13.What is the meaning of sponsorship activities deriving marketing benefits for company’s products or services?

Sponsorship basis implies a company being a sponsor of an event with an aim of taking marketing advantage for its product or services.

The intent is not to rule out any brand image or marketing benefits arising from CSR expenditure. CSR expenditure, in most cases, creates brand value and provides various marketing benefits. For example, a company creating awareness w.r.t COVID-19 is specifically permitted as a CSR activity and may build a company’s brand value. A sponsorship of any activity which has large public eyeballs seems like a marketing exercise. On the other hand, if a company runs ambulances, say, for COVID patients, it may surely have its logo on the vehicles.

There is no reason to exclude any brand building objective while carrying CSR activities. CSR does not have to be altruistic and selfless. CSR appropriately is a part of the business model of the company. It is not intended for profit, but it is certainly a part of sustainable business strategy.

Therefore, companies shall not use CSR purely as a marketing or brand building tool for its business, but brand building as a collateral benefit does not vitiate the spirit of CSR.

13A. Whether it is mandatory for companies to carry out CSR in their local areas?

First proviso to section 135(5) states that the company shall give preference to the local area and areas around it where it operates, for spending the amount earmarked for Corporate Social Responsibility activities.

Erstwhile MCA General Circular No. 06/2018 clarified that this proviso has to be followed by the companies in letter of spirit and law.

However, MCA FAQs on CSR, which supersedes the said circular, has clarified that this proviso does not give any compulsion to the companies, rather it is only advisory in nature. MCA in its rationale states that-

“Some activities in Schedule VII such as welfare activities for war widows, art and culture, and other similar activities, transcend geographical boundaries and are applicable across the country. With the advent of Information & Communication Technology (ICT) and emergence of new age businesses like e-commerce companies, process-outsourcing companies, and aggregator companies, it is becoming increasingly difficult to determine the local area of various activities.

The spirit of the Act is to ensure that CSR initiatives are aligned with the national priorities and enhance engagement of the corporate sector towards achieving Sustainable Development Goals (SDGs). the preference to local area in the Act is only directory and not mandatory in nature and companies need to balance local area preference with national priorities.” (Refer MCA FAQ Q No. 3.9)

14. Whether CSR expenditure is eligible for deduction under Sec 80G, if the implementing agency is registered under Sec 80G and issues a certificate to that effect? If not, why is there a provision requiring implementing agencies to hold Sec 80G certificate?

MCA FAQ states that : http://www.mca.gov.in/MinistryV2/faq+on+csr+cell.html

No specific tax exemptions have been extended to CSR expenditure per se. Finance Act, 2014 also clarifies that expenditure on CSR does not form part of business expenditure. While no specific tax exemption has been extended to expenditure incurred on CSR, spending on several activities like contributions to Prime Minister’s Relief Fund, scientific research, rural development projects, skill development projects, agricultural extension projects, etc., which find place in Schedule VII, already enjoy exemptions under different sections of the Income Tax Act, 1961.

As regards donation, we do understand that sec. 80G explicitly refers to donation, and pure donation does not qualify as CSR. We see a contradiction between CSR, which entails participation in certain social initiatives, and the idea of donation or philanthropy.

14A. Whether CSR expenditure on scientific research and development will be eligible for deduction under section 35 of the Income Tax Act, 1961?

Section 37 (1) of the Income Tax Act, 1961 explicitly provides that any expenditure incurred by an assessee towards CSR in terms of section 135 of the Companies Act, 2013, the same shall not be treated as a business expenditure – as such, would not be allowed.

However, it further states that any expenditure falling under the ambit of section 30 – 36 of the IT Act shall be allowed. Thus, while expenses towards scientific research and development (section 35) may be interpreted as being allowed, one must note that in view of the intent and objective of CSR, as also stated in the Finance Bill, 2014, the deduction shall not be available.

The analysis as above shall be applicable mutatis mutandis for ascertaining allowability of expenses towards agricultural development (Sec 35C); rural development (Sec 35CC); expenditure on skill development project (sec 35CCD), and such other expenses as enlisted from section 30 -36.

15.Whether salary paid to an employee ‘deputed’ for CSR Activities can be treated as a part of CSR spending?

Such remuneration would fall under administrative expenses and can be treated as a part of CSR spending to the extent of 5% of such total CSR spending, along with any other administrative expenses.

However, if the expenses pertain to a staff member who is a frontline employee carrying CSR activity, then, the expense is a proper CSR expenditure and not an administrative expense. For example, if the company engages doctors/nurses on its payroll for carrying health services during the pandemic, it is not an administrative expense.

MCA FAQs on CSR states that salary and training of employees who are working in CSR division of a company may be treated as administrative overheads. However, salary of school teachers or other staff, etc. for education-related CSR projects shall be covered under education project cost. (Refer MCA FAQ Q No. 3.2)

MCA FAQs on CSR further clarifies that involvement in CSR projects of a company cannot be monetized. MCA is of the view that involvement of employees generate pride in CSR work and should be encouraged to be involved in it.

On a conjoint reading of the two, we understand that the salaries of employees working in furtherance of CSR activities of a company cannot be monetized as CSR expenditure. Only a part of it can be treated as administrative overheads and can be claimed upto a maximum of 5% of the CSR obligations of a company.

15A. Whether the “administrative overheads” are expenses incurred by the company only, or the same can include the expenses incurred by the implementation agency?

The administrative overheads are defined to mean the expenses incurred in the general management and administration of the CSR activities. Therefore, where the CSR projects are implemented by agencies, the expenses incurred by them in the management of CSR activities will amount to “administrative overheads” and can be claimed by the company upto a maximum of 5% of the total CSR expenditure.

However, MCA FAQs on CSR holds a different view. They are of the view that rule 2(1)(h) defines administrative overheads as the expenses incurred by the company in the general management and administration of CSR functions in the company. Therefore, expenses incurred by implementing agencies on the management of CSR activities shall not amount to administrative overheads and cannot be claimed by the company. (Refer MCA FAQ Q No. 3.3)

We respectfully differ from the view taken by MCA in this regard. An implementing agency, acting as an agent for the company, should be allowed to claim administrative overheads upto a limit of 5% of total CSR expenditure.

16. Whether a Company with negative net worth will be required to undertake CSR expenditure?

A negative net worth refers to the fact that the company is not able to even meet its shareholders’ demands.

One of the face of it, it seems that if the average of the profits/ losses of the last 3 years is positive, then the company will be required to make the required CSR spending.

However, one has to carefully compute the profits for the purpose of CSR, as the section refers to computation done as per sec. 198. Sec 198 (4) (l) provides that the excess of expenditure over income which is brought forward, will be deducted from profits. Hence, it is not conceivable that a company with negative net worth will still have profits for the purpose of CSR.

16A.Whether contribution to the corpus of an entity is an admissible CSR expenditure?

Erstwhile MCA General Circular 21/2014, considered contribution to Corpus of a Trust/ society/ section 8 companies etc. will qualify as CSR expenditure as long as (a) the Trust/ society/ section 8 companies etc. is created exclusively for undertaking CSR activities or (b) where the corpus is created exclusively for a purpose directly relatable to a subject covered in Schedule VII of the Act.

Corpus to a trust is similar like what capital is to a company. Therefore, corpus of an entity is also required to be kept intact like capital of a company. Contributing to corpus of an entity is similar to subscribing share capital of a company. Therefore, corpus contribution is not considered as an admissible CSR expenditure. MCA FAQs on CSR, which supersedes the said circular, has also clarified that contribution to corpus is not an admissible CSR expenditure. (Refer MCA FAQ Q No. 3.5)

16B.Whether expenses related to transfer of capital asset as provided under rule 7(4) of Companies (CSR Policy) Rules, 2014, will qualify as admissible CSR expenditure?

Rule 7(4) of the Amendment Rules states that

“The CSR amount may be spent by a company for creation or acquisition of a capital asset,…”

As per the Rule, capital assets can come into existence by two ways, i.e., by creation or by acquisition. Acquisition of capital asset will also include transfer of capital asset. Thus, expenses related to transfer of capital asset shall also be treated as admissible CSR expenditure.

MCA FAQs on CSR also clarifies that expenses relating to transfer of capital asset such as stamp duty and registration fees, will qualify as admissible CSR expenditure in the year of such transfer. (Refer MCA FAQ Q No. 3.6)

17. Whether CSR contributions can be done in kind?

The requirement comes from Section 135(5) that states that “The Board of every company shall ensure that it spends…” Therefore, it can be understood that the obligation is to spend. The contribution made in kind cannot be considered as CSR. (Refer ICSI FAQs Q.55 and General Circular No. 1/2016 dated 12th January, 2016)

The view has been reiterated by MCA in the FAQs released by it (FAQ No. 3.12).

Ongoing project / Unspent CSR Account

18. What will be the actionables if a company spends less than the amount required to be spent under CSR obligation?

If a company spends less than the amount required to be spent under CSR obligation, the Board shall specify the reasons for not spending such amount, in the Board’s report.

The company shall deal with the unspent amount in the following manner:

| Analysis of Unspent Amount | Actionable | Timeline |

| Unspent amount pertains to ‘ongoing project’ | Transfer such unspent amount to a separate bank account to be called as ‘Unspent CSR Account’. | Within 30 days from the end of the financial year. |

| Unspent amount does not pertain to ‘ongoing project’ | Transfer unspent amount to the National Fund or the Fund prescribed under Schedule VII. | Within 6 months from the end of the financial year. |

While the time for transferring the unspent money to the Fund prescribed under Schedule VII is 6 months, the Board will have to decide on the retention of money for ongoing projects, disclose reasons for not spending the amount, etc. in its Board’s Report.

Hence, the analysis of what may actually be retained by the Company will have to be done before approval of the Board’s report.

19.What is the meaning of ‘ongoing project’? Which projects will be considered as an on-going project?

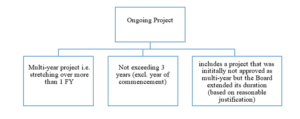

Rule 2(1)(i) of Amendment Rules defines the term ‘ongoing project’ as:

- a multi-year project, stretching over more than one financial year;

- having timeline not exceeding three years excluding the year of commencement

- includes such project that was initially not approved as a multi-year project but whose duration has been extended beyond one year by the Board based on reasonable justification.

The same should have commenced within the financial year to call it ‘ongoing’. This includes a project that was initially not approved as a multi-year project. The intent is to include a project which has an identifiable commencement and completion. The expenses which are recurring in nature should not be included in the ongoing project.

For example, if a company contributes to the annual running expense of a cancer hospital, the spending for the next year cannot be regarded as an “ongoing project”. However, if installation of a new facility at the same hospital is already undertaken during the year, such expense should be regarded as an “ongoing project”.

19A. There is a multi-year project, on which the scheduled spending was as follows: FY 21: Rs 2 crores; FY 22: Rs 2.5 crores; FY 23: Rs 50 lacs. During FY 21, out of the scheduled amount of Rs 2 crores, only Rs 1.20 crores was spent. What is the unspent amount that the company may park into Unspent CSR Account?

In order to understand the meaning of “unspent amount”, one needs to understand that the amount was scheduled to be spent. What was to be spent may have remained unspent, and therefore, may be parked for spending. What was not scheduled to be spent during the year cannot be regarded as unspent amount. Therefore, unspent amount will only mean such outlay as was expected or scheduled to be spent during FY 21, and could not be spent. – In the instant case, it is only Rs. 0.80 crores.

20.When will an ongoing project be regarded as ‘commenced’?

An ongoing project will be considered as ‘commenced’ when concrete steps have been taken towards such project. However, the requirement of spending on such a project is not necessary if the company has undertaken a binding commitment towards such project.

MCA FAQs on CSR reiterates that “An ongoing project will have ‘commenced’ when the company has either issued the work order pertaining to the project or awarded the contract for execution of the project.” (Refer MCA FAQs Q.6.2)

21. What if the Board has identified a project with an estimated gestation period of 5 years? Will that qualify as ‘ongoing project’?

In terms of the definition of ongoing projects prescribed u/r 2(1)(i) of Amendment Rules, the project shall not stretch beyond three years excluding the year of commencement to qualify it as an ongoing project.

There can be projects that may stretch beyond 3 years, for example, building of a hospital or a school. In such cases, though the on-going project is for a period of 5 years, in our view, the company will be permitted to retain the CSR amount to be spent for the 3 years out of the total life of 5 years of the project. The rationale behind the restriction of 3 years is to avoid retaining the unspent amount indefinitely.

The project in question may be split into phases, such that the company does not commit itself to a project having a very long execution period. For instance, the CSR Committee may commit itself only to Phase I of the project, which may stretch to 3 years.

22. Since the company is required to spend the unspent amount in the next 3 financial years, does that mean that the maximum period for an on-going project can be 3 financial years upon which the amount will be transferred to the Fund?

Yes, the same is correct. The unspent amount for ongoing projects can be maximum retained for 3 financial years, while the excess amount shall be transferred to the Fund.

23. Whether amount transferred to a third party implementing agency (Intermediary) for a project eg. school building, will that be considered as an ongoing project?

Irrespective of the facts whether the project is implemented by the company itself or through a third party implementing agency, if such project meets the criteria of ongoing project i.e. being a multi-year project having timelines not exceeding three years excluding the year of commencement, the same shall be treated as an ongoing project.

However, the implementing agency is an agency for the company. An agent acts on behalf of the principal. so, if there is an unspent amount lying with the agent, that is as good as an unspent amount lying with the company. To conclude:

- mere transfer of the money to an implementing agency does not amount to spending.

- if there is an amount lying unspent with the implementing agency, such amount is still unspent amount, and has to be either preserved for an ongoing project, or transferred to the Central Govt funds.

- However, the position is different as money has been given to the end beneficiary of the spending. The end beneficiary is not an agency. if money has been transferred to the beneficiary irretrievably, that is an expense itself.

(Please refer to our article on the same)

24. If an Intermediary utilises x% of the amount received from the company in an FY. Will the entire amount received by the Intermediary qualify as a CSR spend? If not, how will the balance amount be dealt with?

CSR expenditure shall be considered as spent only if the intermediary has in turn spent such amount. Mere transfer of funds to the intermediary will not be considered as CSR amount spent.

Only the x% utilized by the Intermediary shall be treated as CSR expenditure and the remaining amount is the unspent amount which shall be transferred to Unspent CSR A/c or Fund specified in Schedule VII, as the case may be.

25. Whether contribution to any non-profit organization etc, other than those set up by the Central Government for the purposes of Schedule VII can be claimed as CSR Expenditure?

No, the same cannot be claimed as CSR Expenditure. Contribution to any private fund, except those set up by the Central Government under Schedule VII will not qualify as CSR Expenditure and the same is not permitted under the Rules. (Refer Q No. 3.16 of MCA FAQ and Q No. 54 of ICSI FAQ)

The above is true in case of a contribution. However, if money is provided by the company to a private fund to be spent on a specific project, then the attention shifts from the fund to the project. The company is not contributing to the fund but to the project. If the project in question is a CSR eligible project, the contribution dedicated to such project will qualify as CSR spend.

26. Whether a project will be termed as on-going only if a substantial amount is spent for such project? Whether a committed disbursement i.e. a binding commitment for disbursement of CSR amount, would mean the project is ‘on-going’?

There might be situations where a company has agreed for a disbursement of amount before the end of the financial year, however, due to some reasons the actual disbursement/ implementation has not been made or the project for which the disbursement has been committed has not started. In such situations, while the actual amount is not disbursed or the project has not started, we may say that project has commenced within the same financial year if the company has already made a binding commitment to disburse the amount. Thus, spending of CSR amount is not necessary if the company has committed to such a project and steps towards such commitment have been taken.

Since the project has commenced within the same financial year, it is correct to regard the same as an ongoing project.

26A. If the Company has not yet identified CSR projects, but has parked the money in a separate Bank Account till it figures out the projects, is it said to meet compliance. How soon the projects should be identified.

By virtue of the very simple reason that law requires an ‘expenditure’ to be made, and not mere ‘earmarking’ of funds, setting aside the amount in a separate bank account/ escrow account does not meet the purpose set out under section 135 of the Act. Hence, the both the projects as well as funds should have been identified as well as allocated respectively as on 31st March.

26B. Will the unspent amount of previous financial year also be needed to be transferred to the Fund?

In our view, the requirement of mandatory spending came only by way of the present amendment, effective 22 Jan., 2021. Prior to this, CSR was on “comply or explain” basis.

Assume a company did not spend the requisite amount in FY 20, and had given an explanation which the board and the CSR committee found plausible. Is it to be contended that despite such explanation, the company was still required to carry the amount forward to FY 21 and spend the amount in FY 21? If such was the law prior to 22 Jan., then the amendment had no meaning at all.

However, it was the discretion of the board of the company to determine for itself that the company would spend the shortfall of FY 20 in FY 21. Therefore, if the board has explicitly brought forward the unspent amount of previous years, and added that to the target spending of FY 21, in our view, such accumulated target amount becomes the amount to be spent in F 21. We draft reference to the expression ‘such amount’ as provided in proviso to section 135(5), which refers to the amount targeted by the board to be spent. That amount could not have been lower than 2% of average profits, but if the board committed itself to a higher amount, by bringing forward unspent amount of previous years, such target amount becomes “such amount” referred to in the provisos.

MCA FAQs on CSR has reiterated that the aforementioned concept is prospective in effect and not applicable to projects of previous financial years. MCA has made it optional for the Board of the company to decide on unpent CSR amount of previous years, i.e., either to transfer it in ‘Unspent CSR Account’ or continue as per the previous accounting practices adopted by the company. (Refer MCA FAQ No. 7.7)

In short:

- if the board has simply explained the shortfall of previous years, and not carried the amount forward to be spent in FY 21, there was no offence of the law, and therefore, there is no question of applying sec. 135 (5) and (6) to previous years’ shortfall.

- If the board has brought forward the shortfall and added the same to the target of the current year, in our view, such higher amount becomes the target spending for FY 21, with all resulting consequences.

26C. A company puts its unspent CSR amount, retained for ongoing projects, into a special a/c, and creates a fixed deposit for the limited time before actual disbursal of the money. Will this interest on the fixed deposit also become a part of the amount to be spent on CSR, or can the company sweep the interest back to its regular banking account?

The ICSI FAQs on CSR says that the interest on the temporarily parked funds will also be construed as surplus arising out of CSR and therefore, rule 7 (2) pertaining to surplus arising out of CSR activities will apply. (Refer Q No. 46)

However, we respectfully differ. Rule 7 (2) refers to surplus “arising out of the CSR activities”. The fixed deposit in question was for money that has not even been spent for CSR still. It is money waiting to be spent. There is no question of such money being treated as surplus arising out of CSR activities.

In our view, the parking of money needed for ongoing CSR projects serves two purposes – first, it gets insulated from the rest of the operating funds of the company, and two, it indicates a firm commitment to spend the money. If the scheduled spend of a particular year went to the next year, it does not mean there will be cost overrun. If there was a cost overrun, it would amount to CSR spending of the next year. However, interest on the parked money is the company’s money. Merely segregation of the money into a separate account does not render the money as a third party or social fund, on which interest also belongs to the beneficiary of that money.

26D.What is the meaning of surplus arising from CSR activities?

Surplus arising from CSR activities shall mean the income, if any, arising out of the expenditure incurred by the company for the purposes of CSR activities. These are revenues generated out of CSR projects.

MCA FAQs on CSR further clarifies that “Surplus refers to income generated from the spend on CSR activities, e.g., interest income earned by the implementing agency on funds provided under CSR, revenue received from the CSR projects, disposal/sale of materials used in CSR projects, and other similar income sources.’ (Refer MCA FAQ Q No. 3.4)

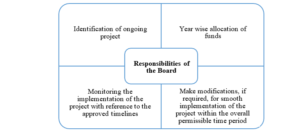

27. What is the responsibility of the Board in case any ongoing project is undertaken by the company?

The Board of Directors will be responsible for:

The Amendment Rules have put major responsibility, in case of on-going projects, on the Board.

28.What will happen if the company fails to spend the amount retained for ongoing projects?

The company shall transfer such unspent retained amount to Fund prescribed under Schedule VII within 30 days from the end of third financial year, for instance, if the company retained Rs. 50 lakhs in 2019-20 to be spent in 2020-21, and only Rs. 40 lakhs were spent towards the project in FY 2020-21, the shortfall of Rs. 10 lakhs will be transferred to the Fund.

29. Are there any restrictions on utilization of the money in the special account or can it be used for regular business purposes of the company?

The whole purpose of segregation of the money into a separate a/c is to ensure that there is no commingling with the rest of the company’s finances. Hence, the amount parked into the Special Account is only to be used for the expenditure for the project (s) for which the money was intended.

30. Can there be commingling of the money put into the special a/c, for various ongoing projects inter se? In other words, can funds earmarked for one project be used for another project, should there be an excess spending in one and deficit funding in another?

It does not seem logical to contend that the outlay earmarked for each “ongoing project” will be mutually ring fenced. Hence, there is nothing wrong in using the outlay dedicated for one project against another. In such a case, the board and CSR committee should appropriately record the alteration in the target spending, and modify the same in accordance with the actuals.

31. Is non-expenditure considered as non-compliance post amendments coming into force? What will be the role of the auditor wrt such non-compliance? Will he qualify his report?

Where earlier, the non-expenditure would only imply an explanation to be inserted in the Board’ report, the new provisions also impose a specific penalty on such non-spending. Penalty may also be imposed on the company as well as the officer-in-default. This means that the regulator has intended to make non- compliance of CSR expenditure penalty-driven and the liability of the company does not end with only an explanation. Thus, in our view, non- expenditure will be treated as non-compliance.

31A. Is a company required to make provisions for the unspent CSR amount?

Any sum representing unspent CSR may either be classified as a liability or a provision depending on whether the exact sum payable, and details of the payee (the fund) are known with certainty. (see discussion under “Accounting and Taxation Aspects”).

Where the amount is treated as a liability, it will be straight expensed out; whereas, where is to be provided for, the company shall create a provision for CSR expenditure for that financial year against the CSR Expenditure. Once such provision is created, any actual transfer to the fund, at a later stage, will be adjusted against such provision.

The accounting treatment may be as follows (assuming the unspent CSR amount for F.Y. 2020-21 was INR 2 crore) –

- At the time of creating the provision –

CSR for F.Y. 2020-21 A/c… Dr 2,00,00,000 /

To, Provision for CSR for 2020-21… A/c 2,00,00,000

- At the time of identification of the fund

Provision for CSR for 2020-21 A/c.. Dr 2,00,00,000/

To, (Name of the fund) A/c… 2,00,00,000

(c) At the time of transfer to the fund

(Name of the fund) A/c …. Dr 2,00,00,000/

To, Bank A/c…. 2,00,00,000

32. Whether the unspent CSR amount for each year shall be accounted for separately in case of ongoing projects?

CSR obligation is computed on a year-to-year basis – as such, the liability to spend in any given year is fixed. Thus, for accounting purposes, irrespective of the nature of the project, the total amount so determined shall be spent. Hence obligation to spend is year.

33. Whether a company is required to open “Unspent Corporate Social Responsibility Account” project- wise or whether there will be a single account managed for all on-going projects?

The language of section 135(6) is Any amount remaining unspent under sub-section (5), pursuant to any ongoing project, fulfilling such conditions as may be prescribed, undertaken by a company in pursuance of its Corporate Social Responsibility Policy, shall be transferred by the company within a period of thirty days from the end of the financial year to a special account to be opened by the company in that behalf for that financial year in any scheduled bank to be called the Unspent Corporate Social Responsibility Account’

The language seems to indicate that an account will be required to be opened for each financial year with funds pertaining to all on-going projects. However, an ICSI FAQs states if a company wants to open a separate account for each of the on-going projects that can also be done to ensure demarcation in respect of each of the ongoing projects. (Refer Q. No. 28 of ICSI FAQs). MCA FAQs on CSR further clarifies that a company is only required to open a separate ‘Unspent CSR Account’ for each financial year but not for each ongoing project. In our view, such project-wise segregation is neither necessary nor advisable. It is not advisable as no company can ever predict the actual outlay for an ongoing project with precision. There will, therefore, be inter-project commingling, and such commingling is not frowned upon by the rules as Rule 4 (6) states that “In case of ongoing project, the Board of a Company shall monitor the implementation of the project with reference to the approved timelines and year-wise allocation and shall be competent to make modifications, if any, for smooth implementation of the project within the overall permissible time period”

34.A company voluntarily decides to spend more than 2% of its profits. Thus, the target spending is stipulated both in the CSR Policy, and in the CSR action plan. However, the company fails to spend the whole of its target, such that the company has spent more than the statutory minimum of 2%, but less than the company’s own target. Will the company be required to transfer such amount to the National Funds, and failing that, pay a penalty?

The FAQs released by ICSI on CSR says that the requirement will not be applicable on non-mandatory expenditure.

We, however, respectfully, differ. We refer to the language of the section 135(5) which provides for a minimum spending of 2% of average profits, etc. This would mean it is open for the board to commit to spend more than 2% of profits. Second proviso to section 135 (5) refers to “such amount”. This expression, in our view, refers to the amount targeted to be spent by the Board. Thus, if the company has voluntarily and explicitly fixed for itself a higher target, it becomes obligated to spend such a higher amount and the provisions of section 135 apply to such higher target. Therefore, even if a company is able to meet the statutory target but cannot meet the internal target set by the Board, it does not seem logical to say that internal target shortfall is a mere statement of pious intent which the board may not meet, and still do nothing about it.

However, the issue is to be seen from the viewpoint of the definitive obligation to spend assumed by the board. Several boards may have simply permitted the company to spend more, not necessarily obligated. If the board has obligated itself, in our view, the obligation, though self-imposed, needs to be taken to its logical resting ground.

35. In what ways should the money for an ongoing project be treated where such an ongoing project is subsequently abandoned?

The remaining CSR amount of such projects should be transferred to the fund. However, if the company has any other ongoing project, such sum may be deployed towards such other project. However, this shall not waive the company from meeting its expenditure requires for any year – the obligation ascertained for each year shall be computed.

36. If the Company has transferred an amount towards an ongoing project to an intermediary, who in turn is not able to spend such amount in a financial year then who will transfer the unspent amount to unspent CSR A/c , whether the intermediary or the Company?

The responsibility of transfer of the unspent amount is on the Company. Having said that, the company, to comply with the said requirements, is required to ensure that the unspent amount has been transferred as required.

The intermediary can do the transfer to the unspent account of the company – in fact the Board of the company may authorise the trustees/ governing body of the implementing agency to open such unspent CSR account.

36A. If the company had met its 2% mandatory CSR spend, would the Company require to identify ongoing project?

The primary purpose of identification of an ongoing project by a company is to ensure the transfer of amounts unspent in respect of such projects into a separate unspent A/c by the company. However, where no amount remains unspent in respect of an ongoing project, such a project shall still be identified for the purposes of reporting of the status of CSR activities, and utilisation of proceeds.

Carry forward of Excess CSR spending

37. Can CSR spending be carried back, that is, to fulfil the shortfall of CSR spending in any year?

Pursuant to the third proviso to section 135 (5) of the Act, if the company spends an amount in excess of the requirements provided under this subsection, such company may set off such excess amount against the requirement to spend under this subsection for such number of succeeding financial years and in such manner, as may be prescribed. In this regard, Rule 7 (3) of Amendment Rules provides for a time frame of 3 immediately succeeding years for adjusting that excess CSR spending therefore, in case a company spends any amount in excess of its CSR obligation and sets off such excess expenditure against the shortfall of CSR spending in any immediately three succeeding financial years is regarded as carrying backward of CSR shortfall.

In other words, the shortfall of CSR spending in any year can be adjusted against excess spending in any previous year.

37A. From when can the benefit of set-off availed? Is it possible to set-off the excess expenditure incurred in FY 2019-20 or 2018-19?

As discussed above, the excess expenditure on CSR in a FY can be set-off against any shortfall of CSR in immediately three succeeding financial years. As regards the FY from which the benefits of set-off can be taken, will be from FY 2020-21 and onwards since the provisions for set-off became effective only from 22-01-2021. Accordingly, in our view, stress is required to be given on the timing of set-off being taken – which has to be only after 22-01-2021.

This would mean that the excess expenditure incurred in the FY 2019-20 or 2018-19 can also be set-off with the shortfall of expenditure in FY 2020-21.

Note that our view differs from the view taken in Q-3.7 of MCA FAQs Q-47 of the ICSI FAQs. As per the MCA FAQ and ICSI FAQ, since the provisions has come into effect from 22.01.2021, the benefit of set-off can be taken on expenditures incurred in the FY 2020-21 and onwards.

We respectfully differ from the view taken by MCA and ICSI, the rationale of our view, as explained above, is that the stress is required to be given on the timing of set-off being taken – which has to be only after 22-01-2021 and not the timing of excess expenditure being made.

Clarifications by MCA are being considered when most of the companies would have been done with their actionables for the FY 2020-21.

37B. Can the excess expenditure for previous years be set off against the spending mandate even if there is no shortfall in spending for the current year?

The third proviso to section 135(5) of the Act states that the excess expenditure of previous financial years is required to be set-off against the requirement to spend. The same does not mention about the shortfall in CSR spending for a financial year, rather, requires the excess expenditure of previous financial years to be deducted from the CSR obligation, being 2% of the average net profits of the company, to derive the actual CSR spending requirement for that financial year. Therefore, in our view, irrespective of whether there has been a shortfall in the current financial year, set-off may be availed for the excess CSR expenditure of the previous financial years, subject to necessary compliances in terms of Rule 7 of the CSR Rules. Further, the same is also clearly mentioned under FAQ no. 3.7 of thr MCA FAQs on CSR which again requires setting-off gainst the mandatory 2% CSR expenditure in succeeding financial years and not the defcit arising in each of these years.

Refer example below –

| Amount (Rs. ) | |

| 2% of average net profits of FY 21-22 | 500 |

| Amount available for set-off from FY 21-22 | 20 |

| Surplus arising out of CSR activities for FY 21-22 | 30 |

| CSR obligation for FY 22-23 | 510 |

| Expenditure incurred for FY 22-23 | 550 |

| Excess expenditure for FY 22-23 remaining available for set-off | 40 |

38. What is the meaning of capacity building spending referred to in Rule 4 (6)?

The expenditure on training the CSR staff regarding the CSR project. However, such expenditure is not to exceed 5% of the total CSR expenditure of the Company in one financial year.

39. Whether the benefit of carrying forward will be available to a company that had zero CSR expense to be incurred on account of losses, however, voluntarily incurred certain CSR expenses?

Excess spending, that is, spending in excess of what is required, is allowed to be set off. If there was no spending required by the company on account of losses, and the company had spent an amount, the said amount may be regarded as excess spending and may be carried forward.

In the event that the company engages in expenditure beyond its mandated Corporate Social Responsibility (CSR) obligations, any surplus spending is inherently reflected as unutilized CSR funds from the previous fiscal year, designated as CSR-2. This phenomenon arises as a result of inherent technical intricacies within the system.

39A . Can a project , the completion of which, is delayed due to COVID-19 be considered as an on-going project?

Since on-going project means a multi-year project undertaken by a Company in fulfilment of its CSR obligation having timelines not exceeding three years excluding the financial year in which it was commenced, and shall include such project that was initially not approved as a multi-year project but whose duration has been extended beyond one year by the board based on reasonable justification. Since the completion of the project was delayed due to COVID-19(considered reasonable justification) can be considered as an on-going project if the Board approves the same as such.

39B. Where a company is unable to excess spending on account of subsequent non-applicability of CSR provisions, will the excess amount lapse, or be continued till such year when the liability arises again.

The law states that the excess CSR can be carried forward for three years – however, it does make any carve-outs for a situation where a company is unable to do such set-off in full by reason of inapplicability of CSR provisions.

For instance in F.Y. 2020-21 a company had spent Rs. 2 crores in excess. In FY 2021-22, it sets-off Rs. 50 lakhs from such excess. However, from F.Y. 2022-23, the company is no longer subject to CSR provisions under section 135 (1). In such cases, the company shall continue to retain the remaining excess CSR of Rs. 1.50 crores upto F.Y. 2023-24, and thereafter lapse the same.

The benefit of excess CSR cannot be reaped indefinitely on account of inapplicability of provisions.

39C. How shall the company treat the excess CSR in its books – as an asset or an expenditure?

The excess spent CSR can be treated either as an asset (being prepaid expense), which shall be adjusted with the CSR expenditure for subsequent years; or may be treated wholly as an expense in that very F.Y., along with a note taking on record the excess spent CSR, and future obligations may be accordingly adjusted by virtue of such note in the financial statements.

For discussion and accounting entries, see – http://vinodkothari.com/2021/04/csr-accounting-and-taxation/

CSR Implementation

40. Are all companies who are mandated to undertake CSR expenditure as per the specified criteria under section 135(5) of the Act, required to have a CSR Committee under section 135(1) of the Act?

No. CAA, 2020 has provided relief to companies where the amount to be spent towards CSR does not exceed Rs. 50 lakhs in a year. Such companies are not required to constitute a CSR Committee. The functions and obligations in relation to the CSR activities will be discharged by the Board. The same is applicable from 22nd January, 2021 due to Enforcement Notification. However, temporary fall in the profit thereby leading to fall in the CSR expenditure, would not exempt a company from the requirement of having a CSR Committee.

41. What are the modes of implementing CSR activities available with the company post the amendments coming into effect?

Pursuant to Rule 4 of the Companies (CSRP) Amendment Rules, 2021, company may undertake CSR activities via following three modes of implementation:

- Self-implementation

- Implementation through eligible implementing agencies [Rule 4(1)]

- Joint implementation with one or more companies [Rule 4 (4)]

42.Which entities are eligible to qualify as implementing agencies for undertaking CSR activities as per the Companies (CSRP) Amendment Rules, 2021?

So far, a section 8 company, trust, or a society, having a track record of three years in carrying out similar activity were qualified to be an implementing agency. However, several amendments have been brought in the provisions relating to implementing agencies.

On or from April 01, 2021, following four types of agencies shall be eligible to carry out CSR activities on behalf of the company

- Category I: Entity established by the company itself or along with any other company – a company established under section 8 of the Act, or a registered public trust or a registered society, registered under section 12A and 80 G of the Income Tax Act, 1961(IT Act)

- Category II: Entity established by the Central Government or State Government (‘Government Agencies’) – a company established under section 8 of the Act, or a registered trust or a registered society.

- Category III: Statutory bodies – any entity established under an Act of Parliament or a State legislature

- Category IV: Public agencies – a company established under section 8 of the Act, or a registered public trust or a registered society, registered under section 12A and 80 G of the Income Tax Act, 1961, and having an established track record of at least three years in undertaking similar activities.

43. Whether all three types of bodies – a section 8 company or a registered public trust or a registered society, is required to have income-tax registration u/s 12A as well as 80G of the IT Act?

While the expression “registered under section 12A and 80 G of the Income Tax Act, 1961” appears exactly after registered society, however, it does not seem logical to attach the condition only in case of societies and therefore all three types of bodies – a section 8 company or a registered public trust or a registered society shall qualify for registration.

44. Whether societies are required to be registered under both section 12A as well as section 80G of the IT Act, to qualify as an implementing agency?

Yes, the requirement of obtaining registration under the aforesaid sections of the IT Act is also required for a society.

Whether there is any nexus between the requirement to obtain registration under section 12A or section 80G of the IT Act?

Prima facie there does not seem to be any nexus between carrying out CSR expenditure and requiring the implementing agencies to register themselves under the aforesaid sections of IT Act. Section 12A deals with the registration of trusts for claiming exemption of tax on their income, under sections 11,12 and 13 of the Income Tax Act, 1961. On the other hand, Section 80G enables the donor to seek tax deduction for a donation made to certain funds, charitable institutions, etc.

45. Whether the existence of any such public agencies for three years or more would suffice to meet the said requirement?

The criteria to qualify as an implementing agency for such public agencies is to have an established track record of atleast 3 years in carrying out similar activities which the company proposes to undertake as per the Schedule VII of the Act. Mere existence of an entity for three years or more should not suffice and therefore, the said agency should actually have to be involved in undertaking similar activities. The idea behind this requirement is to ensure the genuineness of the entity’s presence in the target area, local connect, knowledge and experience in undertaking the activities in which the company wants to contribute.

46.Whether ABC, a registered society, having experience of 3 years in holding medical / health camps can undertake the project of building a hospital as CSR activity? How would a company assess the experience of agency in carrying out similar activities?

It is the responsibility of the Board of the company to identify the credibility of the implementing agency. Necessary due diligence shall be carried out to ascertain the track record and capacity of implementing agency to undertake CSR activities.

In the given instance, holding medical / health camps and building hospitals are two different sets of activities and require different skills sets and experience. Company shall conduct proper due diligence so as to confirm the eligibility requirements of the society to undertake CSR activities on behalf of the company.

47. What is the role of International organizations in the context of CSR? Is it mandatory for the companies to engage such international organizations?

Rule 2(1)(g) of the Amended Rules defines international organization as an organization notified by the Central Government as an international organisation under section 3 of the United Nations (Privileges and Immunities) Act, 1947, to which the provisions of the Schedule to the said Act apply;

Pursuant to Rule 4(3) of the Amended Rules, a company may engage international organizations for designing, monitoring and evaluation of the CSR projects or programs or for capacity building of their own personnel for CSR. However, the said provisions are only directory not mandatory. Further, international organizations are not eligible to become implementing agencies for the companies in carrying our CSR activities.

48. Can an international organization undertake CSR activities on behalf of the company like any other implementing agency?

No, it shall not act as an implementing agency. In the draft CSR Rules, it was proposed that the companies may also undertake CSR activities through international organizations with the prior permission of the Central Government, however, this proposal has been dropped in the final rules.

49. An outside agency (trust / society / Sec 8 Company) has been mandated to have established track record of 3 years of undertaking similar activities. Whether existence of any trust/ society/ sec 8 company for three years or more would suffice to meet the above requirement?

Mere existence of such an entity for three years or more shall not suffice and it will actually have to be involved in undertaking similar activities. The idea behind this requirement is to ensure the genuineness of the entity’s presence in the target area, local connect, knowledge and experience in undertaking the activities in which the company wants to contribute.

50.Whether the agencies implementing the CSR activities on behalf of a company required to maintain proper documentation?

Maintenance of proper documentation is an integral part of any agreement or assignment, irrespective of whether the same is mentioned in the provisions of law or not. This ensures accountability and will help the board in satisfying itself regarding the use of proceeds and certification by CFO of the same.

51.In the CSR Amendment Rules, at various places the term ‘CSR project’ and ‘CSR program’ have been used. What is the difference between ‘project’ and ‘program’ in context of the CSR rules? What are the parameters and principles to differentiate any activity between the two, if needed?

Since these words are not defined anywhere in the statute, we will turn to the general meaning of these terms. A project is a set of activities while a program is a set of common and related projects. Thus, various projects under a common goal will form part of a program . For example, building a school will be a project, while various projects undertaken for a village such as a school, a hospital, etc. will be a program. The same will depend on the interpretation of the CSR committee and Board, however, as far as standing under the CSR law is concerned, both are treated at par.

51A.Whether a trust created by any company to carry out CSR activities shall be regarded as public trust or private trust?

Where a trust is created by a company to carry out CSR activities, it is required to be in the public trust mandatorily and is also required to be registered under section 12A and 80G of the Income Tax Act, 1961. Further, the trust will also be required to register under MCA by filing form CSR-1.

51B. What is the impact of the changes in the eligibility of implementing agency experience (previously three years’ experience to now minimum three years) and substitution of “similar projects and programs” by similar activities?

Nil impact

51C. When the Company contributes a certain amount to the implementing agency for construction of school and the construction of school will be completed in 2 years. Is such a project an ongoing project for the company where the company has paid such an amount at once?

A project that has commenced and which shall extend for more than a financial year (in order to fulfil the req of being a multi-year project) is considered to be an on-going project.

However, if the company has made the contribution to the beneficiary, then the question of regarding a project as on-going or not becomes irrelevant since the spending itself has happened before the end of the financial year.

On the other hand, if the funds have merely been transferred to an implementing agency, then the same will not constitute CSR expenditure. Accordingly, in such cases, the project will be considered as an on-going project and unspent amount shall be retained in the manner specified (transfer the amount within 30 days from the end of the financial year to unspent CSR account).

51D.Whether it is the obligation of the company to transfer the unspent amounts to the unspent CSR account or funds specified under Schedule VII (in case of not on going projects) and whether it is required to call back the amount transferred to implementing agencies for the said purpose ?

The amounts to be transferred by the company may be transferred by the company or the implementing agencies. Since the obligation is upon the company, it has to ensure that the amounts are transferred regardless of whether the same has been refunded by the implementing agency or not. (Refer Q No. 32 of ICSI FAQs)

51E.Whether the Entity specified under Category II and III under rule 4(1) of the Amended Rules, are not required to have an established track record of three years for undertaking similar CSR activities?

Established track record is required only for public agencies as mentioned in Rule 4(1)(d) of the Amended Rules.

51F. In cases where the company was unable to meet its CSR obligations, however transferred the said unspent amount to a fund under Schedule VII, figure any non-compliance u/s 135?

The current stand of CSR is “comply or suffer penalty”. The compliance is considered when the company spends the amounts as per its CSR obligation. However, where the company fails to spend the same, it may fulfil its obligation by transferring the same to the unspent A/C or funds specified under Schedule VII. The same will be considered as compliance of Sections 135(5) and (6) of the Act. Requisite disclosures are to be given in the Board Report and Annual Report.

52. What is the role of implementing agencies in carrying out CSR activities?

Rule 4 of the Companies (CSRP) Amendment Rules, 2021 allows companies to undertake CSR activities through the specified implementing agencies.

Such implementing agencies are the intermediaries, typically carrying the following functions:

- aggregation of spending by several group companies;

- identification of CSR opportunities;

- coordination with the end beneficiaries;

- monitoring of CSR implementation.

Undertaking CSR activities through a third party implementing agency saves the company from the drudgery and allows it to focus on strategizing, deciding and spending CSR expenditure and thereby meeting its CSR obligations.

Registration of implementing agencies [CSR-1]

53.Is registration of every implementing agency mandatory?

On and from April 1, 2021, all the four eligible implementing agencies discussed above shall mandatorily register itself with MCA. In addition to this, income tax registration under section 12A and 80 G of the Income Tax Act, 1961 is mandatory for Category I and IV entities i.e.

- Category I: Entity established by the company itself or along with any other company – a company established under section 8 of the Act, or a registered public trust or a registered society

- Category IV: Public agencies – a company established under section 8 of the Act, or a registered public trust or a registered society

Since the requirements of registration starts off from April 01, 2021, any on-going projects approved prior to April 01, 2021 may be carried out by unregistered implementing agencies.

54. What are the requirements prescribed under the Amendment Rules, 2021 for registration of implementing agencies with the MCA?

As discussed, on and from April 1, 2021, companies can undertake CSR activities only through implementing agencies which are registered with MCA.

Rule 4(2) of the Companies (CSRP) Amendment Rules, 2021 mandates all four categories of implementing agencies to register itself with the Central Government on and from April 1, 2021 by filing the Form CSR- 1 electronically with the Registrar of Companies.

The Form CSR-1 shall be digitally verified by a practicing CA/ CS/ CWA, post which a unique CSR Registration Number will be generated.

55. Considering every eligible implementing agency undertaking CSR activities is required to register itself with MCA, whether registration by filing CSR-1 is mandatory in case the company carries out CSR activities directly without engaging any implementing agencies?

Rule 4(2)(a) of the Amended Rules states that “Every entity, covered under sub-rule (1), who intends to undertake any CSR activity, shall register itself with the Central Government by filing the form CSR-1 electronically with the Registrar, with effect from the 01st day of April 2021”

Accordingly, where the company carries out its CSR activities through the implementing agencies as specified in rule 4, such implementing agencies will be required to file e-form CSR -1 for registering themselves.

However, in case the company carries out CSR activities directly, the question of registration by filing e- form CSR-1 does not arise.

56. What is the meaning of “registered trusts” in cases of such states where registration is not mandatory?

In such cases, the registration under the Income Tax Act, 1961 shall suffice. Please refer to MCA General Circular dated 18th June, 2014.

Impact Assessment

57. What is the meaning of ‘impact assessment’?

The purpose of impact assessment is to assess the social impact of a particular project, and hence, it may also be considered as a “social impact assessment”. Impact assessment intends to evaluate “social return on investment”. Further, “social impact assessment” and “social audit” are closely related to each other. Impact assessment is the exercise of taking a retroactive view on the CSR activities completed by the entity.

Impact assessment is seemingly an another step to encourage companies to take considered decisions before deploying CSR amounts and assess the impacts of their investments to capture the impact being generated by them. This shall not only serve as feedback for companies to plan and better allocate resources, but shall also deepen the impact of CSR.

58. Which all companies are required to undertake impact assessment?

Since impact assessment is cost-intensive and time consuming, the idea is to obligate only certain classes of companies which have large amounts of spending and have completed their large CSR projects. Accordingly, Rule 8(3) of the Amended Rules requires following class of companies to conduct impact assessment:

- companies with minimum average CSR obligation of Rs. 10 crore or more in the immediately preceding 3 financial years; and

- having CSR projects of outlays of minimum Rs. 1 crore and which have been completed not less than 1 year before undertaking impact assessment.

59. Whether companies are required to undertake impact assessment for FY 2020-21?

In our view, since the requirement of impact assessment applies immediately, companies should determine if it falls under the prescribed criteria and therefore, conduct impact assessment accordingly. CSR targets for FY 2017-18, 18-19 and 19-20 will be relevant to determine the requirement of impact assessment for FY 20-21. We are of the opinion that impact assessment may be taken for other projects as well, completed prior to the amendments coming into force. This may be looked upon as a good practice rather than a statutory requirement.

Having said this, you attention is also drawn to the FAQs released by ICSI on the same matter which demands that impact assessment has to be done for projects taken up or completed on or after 22nd January, 2021. MCA has further suggested that the Board may undertake impact assessment of completed projects of previous financial years as a good practice. (Refer MCA FAQ Q No. 9.3)

60. Whether the company is required to undertake impact assessment on a regular basis?

While the Amended Rules do not prescribe any timeline for impact assessment, however, in our view, if the project is recurring in nature, the impact assessment may be undertaken on a rotational basis, so as to cover all material projects, say, once in every 3 years.

61. Who can conduct impact assessment?

Rule 8(3) of the Amended Rules requires that the impact assessment shall be conducted by an independent agency.

While the Amended Rules has not clarified about eligible independent impact assessment agencies, academic or research entities capable of doing field surveys and which understand the objectives of the CSR compliance can conduct the impact assessment.

62.Whether the expenditure of impact assessment is over and above the ‘administrative overheads’ of 5% or inclusive of the same?

The expenditure of impact assessment is over and above the specified administrative overheads of 5%. In our view, expenditure upto a maximum of 5% or 50 lacs (lower of the two) can be booked separately in relation to impact assessment which can be a part of the total CSR expenditure.

63. Whether impact assessment is to be carried out for CSR projects as well as CSR programs, CSR activities as rule 8(3) states that “all CSR ‘projects’ having outlay of Rs. 1 core or more require “impact assessment”? Whether impact assessment is to be undertaken every year on an ongoing basis?

While the terms ‘projects’ and ‘programs’ have been loosely used under the CSR Rules, however, one needs to understand the meaning of each of these. Several activities make up a program and several programs make it a project. Single activities may not be eligible for impact assessment, however, large programs as well as projects fulfilling the quantitative threshold are required to undergo impact assessment.

The timeline for impact assessment will vary based on the nature of the project and will be undertaken as per the methodology adopted and at the discretion of the Board. For e.g. in case of an afforestation project, the benefits can be measured only after a few years, while in case of a project of building better sanitation facilities the benefits could be assessed within a year.

62A.Whether impact assessment is to be carried out project-wise or a combined report may be taken for all eligible projects?

The impact of each project will be different and will have its own significance, in terms of its impact. Accordingly, impact assessment should be carried out project-wise.

62B.When the average CSR contribution is not exceeding 10 crores, but a single project outlay is more than Rs. 1 crore, does the company need to have an impact assessment carried out?

The conditions for taking up impact assessment is cumulative and therefore, all the conditions need to be fulfilled [See Q.58] in order to require impact assessment.

Taxation and Accounting aspects

63A.Whether the CSR Expenditure is an operating expense or an appropriation of profits?

The CSR Expenditure is not an operating or business expense. It is a statutory expenditure shown as other expenditure in the profit or loss A/c and is not an appropriation of profits. Kindly refer to our article on the same subject matter here

63B. What will be the accounting implications w.r.t. transfer of funds to the unspent CSR account?

The unspent CSR account can either be treated as a liability or a provision. It can however not be treated as a contingent liability. This is because as per IND AS 37

A liability is a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.

- A provision is a liability of uncertain timing or amount.

- However, CSR expenditure is not a contingent liability as it is not a future liability occurring due to one or more uncertain future events nor is it present obligation arising out of unrecognised past events.