Ablution by Resolution

The Insolvency and Bankruptcy Code (Second Amendment) Bill, 2019 seeks to wash out liability of corporate debtors resolved under IBC

-Sikha Bansal (resolution@vinodkothari.com)

Resolution under the Insolvency and Bankruptcy Code, 2016 (‘Code’) is a harbinger of fresh start of the corporate debtor, which passes into the control of a new management by the very application of section 29A. The fresh start would have no meaning if the corporate debtor or the new management thereof have to bear the brunt of offences which the corporate debtor or its officers committed prior to ablution under the Code – that is, one cannot be made to reap what they did not sow. As such, it was important to provide immunity to the corporate debtor and its assets, the successful resolution applicant and the new management personnel.

The Insolvency and Bankruptcy Code (Second Amendment) Bill, 2019 (‘Bill’) seeks to give effect to the same by way of insertion of section 32A in the Code. Seemingly vast and expansive in terms of drafting, the section broadly operates on 3 fronts, of course, subject to conditions –

(i) cessation of liability of the corporate debtor in respect of an offence committee prior to the commencement of corporate insolvency resolution process,

(ii) prohibition on any action against any property of the corporate debtor covered under the resolution plan,

(iii) requirement from the corporate debtor and other persons to extend assistance and co-operation to any investigating authority, notwithstanding the immunity granted as above.

At the outset, it is important to note that while releasing the liability against ‘offences’, the section does not define the scope of the word ‘offence’ – hence, the same will have to interpreted broadly so as to cover any offence which the corporate debtor might have committed under any law including but not limited to corporate laws, tax laws, labour laws, environmental laws, and commercial laws. The view finds support in opening non-obstante phrase of section 32A(1). Here, it is equally important to draw a line between offences committed by the corporate vehicle and offences committed by those running the corporate vehicle, as we discuss ahead.

Each of the three aspects are discussed threadbare as follows –

Cessation of liability

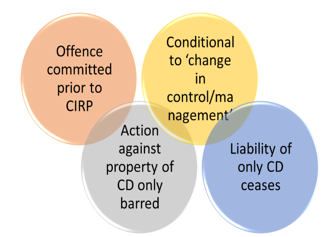

Sub-section (1) of section 32A is a non-obstante provision operating against anything contrary contained in the Code or any other law for the time being in force. The provisions can be summarized in the points –(i) The sub-section grants immunity to the corporate debtor from any liability in respect of an offence committed prior to the commencement of CIRP.

(ii) The liability shall cease and the corporate debtor shall not be prosecuted from the date of approval of resolution plan. If prosecution was initiated during CIRP, the same shall stand discharged from the date of approval of resolution plan.

(iii) The benefit under this sub-section is conditional – the same is available only when the resolution plan has resulted into a change in management/control of the corporate debtor, such that a person who was a promoter or who was the person in management or control or who was a related party of such persons are no more in the management/control of the corporate debtor post approval of resolution plan.

(iv) Further, the person in management/control (post resolution) should not be the one with respect to whom any investigating authority has given adverse opinion vis-à-vis the offence committed, and has furnished a report/compliant to relevant statutory authority/court. Notably, the person might not be a direct accused, but the one who has been alleged to have abetted or conspired for the commission of offence (the persons, collectively with persons mentioned in (iii) above called debarred persons hereinafter).

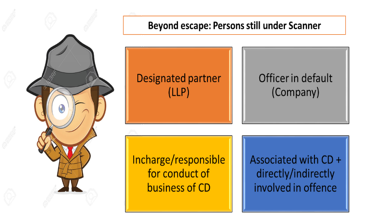

(v) The sub-section though releases the corporate debtor, but continues to hold the concerned persons (individuals) liable for the offences. The concerned persons are –

a. designated partner (in case of LLP) or

b. an officer in default (in case of a company), or

c. every person who was, in any manner, incharge of, or responsible to the corporate debtor for the conduct of its business, or

d. every person associated with the corporate debtor in any manner and who was directly/indirectly involved in the commission of the offence as per report of the investigation authority.

Certain quick observations which flow from a reading of sub-section (1) are –

- In view of the provision, the resolution applicant and the persons who have assumed the seat of drivers of the corporate debtor post resolution have been explicitly saved from dealing with an array of punitive provisions of laws which the corporate debtor might have violated earlier.

- The sub-section does not speak of liquidation or where there is a sale during liquidation (especially a going concern sale). The law propounded in sub-section (1) is based on equity and justice, and shall appropriately apply to going concern sales in liquidation too. Going by principle and conventional provisions in laws across, only such persons are liable to be prosecuted and punished, who were in charge of the entity, at the time the offence was committed. Hence, it may be viewed that inspite of absence of explicit provision, the principle as incarnated in sub-section (1) of section 32A will hold good in liquidation (going concern) sales too. Note that sub-section (2) makes a reference to liquidation though.

- There is no exemption for MSMEs. Note that MSMEs have been exempted from certain provisions of section 29A. Thus, there can be instances where the promoter remains the same. If the lack of exemption is seen as an omission-by-will of the lawmakers, then the corporate debtor will continue to be liable for the offences committed prior to resolution. That is, resolution will ease only the financial burden of the MSMEs.

- The sub-section should not be taken as the only guide to prosecution of the persons allowed to be prosecuted. Ultimately, the prosecution shall take place in accordance with the law under which the offence was committed. Certain laws provide for liability irrespective of whether there was active participation of the accused, and certain laws provide for exemption where offence was committed without knowledge or connivance of the person.

Prohibition on action against property

While sub-section (1) operates in favour of corporate debtor as an entity, sub-section (2) bars action against property of the corporate debtor. Here, ‘action’ has been described to include attachment, seizure, retention or confiscation of such property under such law as may be applicable to the corporate debtor. For instance, tax laws generally provide for attachment of properties for default in payment of tax dues (including penalties). Such an action cannot be taken in view of this sub-section.

The sub-section makes the following provisions –

(i) The protection is again with respect to an offence committed prior to CIRP.

(ii) The property, against which action is proposed to be taken, is covered under the resolution plan approved by the AA or sale under liquidation.

(iii) The resolution plan should have resulted in change in management/control of the corporate debtor such that debarred persons are not in management/control of the corporate debtor post resolution. In case of sale in liquidation, the sale should not have been made to a debarred person.

(iv) The action is not barred against property of other persons (for instance, say officers in default, guarantors, etc.)

As regards sub-section (2), the following points may be noted –

- Here again, there is no exemption for MSMEs.

Assistance and co-operation in investigation

Notwithstanding the immunity given in sub-sections (1) & (2), the corporate debtor or any person who may be required to extent assistance/co-operation to any authority investigating an offence committed prior to the commencement of CIRP, has been mandated to assist and co-operate accordingly.

Author remarks

The immunity purported to be given to the corporate debtor after resolution, will boost confidence of resolution applicants. The authorities, however, intending to proceed against the corporate debtor, will be barred to proceed as such.

Leave a Reply

Want to join the discussion?Feel free to contribute!