Posts

SEBI rationalizes eligibility and disclosure requirements for rights Issue in ICDR Regulations

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari ConsultantsSEBI’s measures towards resuscitation of financially “stressed” companies

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari ConsultantsHenil Shah | Executive

Introduction & Background

In layman’s term, a company with falling share prices, inability to pay off its obligations is said to be a company with financial distress. In most of the times, it is seen that the conventional means of fund raising such as borrowings, issuance of debt securities etc. do not work for such companies due to their ongoing stressed status even though generating cash is the foremost priority for them to fund their operations. Additionally, insolvency/ bankruptcy also becomes a matter of concern which may be caused due to the lack of funding and the resultant disruption in operation.

SEBI’s Primary Market Advisory Committee (PMAC) deliberated on the topic and came out with a Consultation Paper dated April 22, 2020[1] providing for the proposed measures for resuscitation of the stressed companies. The changes so proposed were w.r.t certain amendments under the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (ICDR Regulations) and SEBI (Substantial Acquisitions of Shares and Takeovers) Regulations, 2011 (SAST Regulations). Based on the public comments, SEBI vide Notifications dated June 23, 2020 has prescribed the final text of the amendments under the ICDR Regulations[2] and SAST Regulations[3]

The article covers a brief synopsis and the relevant impact/ actionable pursuant to the said amendments.

Rationale behind the proposed changes

Preferential issue seems to be one of the most sought options of fund raising by the companies due to the administrative as well as regulatory convenience it carries. Further, knowing the probable investors ready to invest in the company makes a preferential issue one of the most commonly used ways for raising funds.

For a listed company, under a preferential issue, the issue price has to be determined as per the pricing provisions of Chapter V of ICDR Regulations. The ICDR Regulations provides the pricing mechanism for both frequently traded shares and infrequently traded shares.

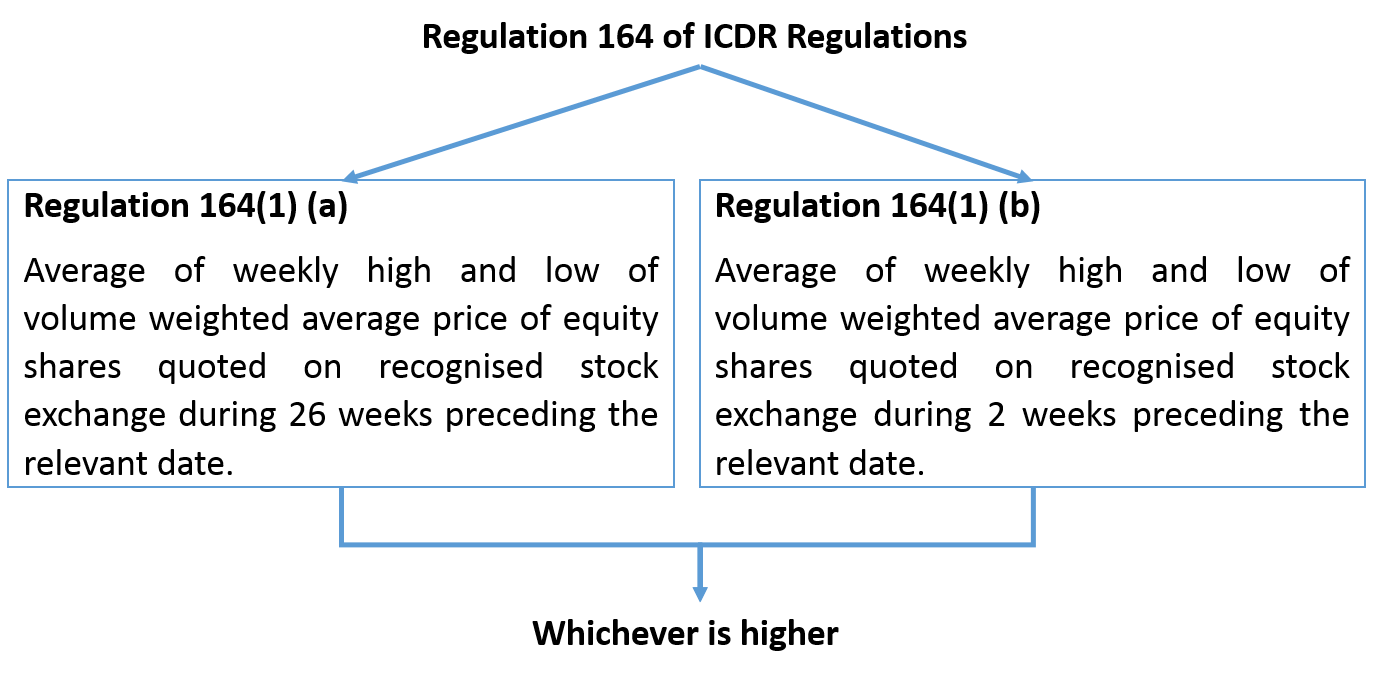

In case of frequently trades shares, the price shall be determined as per the provisions of Regulation 164(1) (a) & (b) of the ICDR Regulations which are as follows.

Even though a preferential issue may be a convenient way of fund raising for a well performed company, the same may not be the case for a company with financial distress for the following reasons:

1. Onerous pricing mechanism

Considering the continuous falling prices of the shares over a period of 26 weeks due to the company being in stress, the determination of the price as per the pricing mechanism provided in Regulation 164(1) (a) becomes too onerous for the investor. Further, the price under Regulation 164(1) (a) is much higher than that as determined as per Regulation 164(1) (b). Hence, the pricing mechanism acts as a major deterrent for the investors from subscribing to the shares offered under the preferential issue.

2. Exemptions only to 5 QIBs restricting investor pool

Though the ICDR Regulations allow issuance to QIBs at a price determined as per regulation 164(1) (b) however, the same is restricted to only 5 QIBs and is not applicable to the investors other than QIBs thereby restricting the investor pool.

3. Open offer obligations for the acquirer

Another roadblock which the issuers tend to face is from the view point of the investors i.e. an incoming investor who has an impending burden on complying with an open offer obligation in case where the subscription to the preferential offer leads to the triggering of the open offer obligations under SAST Regulations. In view of the procedural requirements and the huge costs involved, making an open offer discourages the investors seeking to have a substantial stake in the company in order to take control and thereby reverse the stress.

As per the extant provisions, the acquisition pursuant to a resolution plan approved under the Insolvency and Bankruptcy Code, 2016 is exempted from meeting the open offer obligations but no such exemption has been provided in case for acquisition in the financially distressed entity which are not under any resolution plan.

Rescue mechanism brought through the amendments

Insertion of regulation 164A in ICDR Regulations

The newly inserted provisions incorporate the changes that were proposed by PMAC into the existing regulations as discussed below:

When to consider a company at ‘stress’?

For a company to be classified as financially stressed and issue equity share in pursuance of regulation 164A of ICDR regulations it has meet certain conditions. Below is a comparative presentation between the text of the Consultation Paper and the final text of the Regulations. Further, any two of the three conditions shall have to be satisfied for considering a company as stressed.

| PMCA Recommendations | Final text of the Regulations | Remarks |

| A listed company which has made disclosure of defaults on payment of interest/ principal amount of loans from banks/ financial institutions and listed and unlisted debt securities for 2 consequent quarters in terms of the SEBI Circular dated November 21, 2019[4] issued in this regard.

|

The issuer has disclosed the default relating to the payment of interest/ repayment of principal amount on loans from banks/ financial institutions/ NBFCs- ND-SI and NBFCs-D and/ or listed on unlisted debt securities in terms of SEBI circular dated November 21, 2019 and such default is continuing for a period of at least 90 days after occurrence of such default.

|

The amendment regulation in slight contrast to the PMAC recommendations provided shorter timeline for calculating continuity of the default.

Further, even though NBFCs-ND-SI and NBFCs- D already get covered under the definition of Financial Institution provided under RBI Act, they have been specifically covered under the list of creditors. |

| Existence of Inter-Creditor agreement in terms of Reserve Bank of India (Prudential Framework for Resolution of Stressed Assets) Directions 2019[5] (RBI Directions)

|

Same as PMCA Recommendations | Inter-Credit agreement as provided in the RBI Directions stands for the agreement executed among all the lenders of a defaulting borrower, providing for ground rules for finalisation and implementation of resolution plan in respect to the borrower. |

| Credit rating of the listed instruments of the company has been downgraded to “D”. | The credit rating of the financial instruments (listed or unlisted), credit instruments/ borrowings (listed or unlisted) of the listed company has been downgraded to “D” | The final text of the amendments, in addition to the listed instruments, also brings unlisted instruments and as well as borrowings under its purview. |

Pricing of preferential issue of shares of companies having stressed assets

Unlike the current pricing requirements as provided in Regulations 164(1) (a) & (b) of ICDR Regulations for a preferential issue, the price of the shares to be issued by a stressed company as aforesaid shall be a price which shall not be less than the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognised stock exchange during the two weeks preceding the relevant date. Therefore, the price as determined under Regulations 164(1) (a) & (b) of ICDR Regulations shall not be considered.

Negative list of proposed investors

The following person(s) shall not be eligible to participate in the preferential issue under Regulation 164:

- Persons/entities part of promoter or promoter group will not be eligible to participate in the preferential issue;

- Undischarged insolvent in terms of Insolvency and bankruptcy Code, 2016 (IBC, 2016);

- Wilful defaulter as per RBI guidelines issued under the Banking Regulations Act, 1949;

- A person disqualified to act as director as per Companies Act, 2013

- Person debarred from trading in securities or accessing securities market by SEBI and period of debarment has not been over

- Person declared as fugitive economic offender

- Person is convicted of offence punishable with imprisonment

- For a period of 2 years or more under any as specified under 12th schedule of IBC, 2016

- 7 years or more under any law for time being in force

and a period of 2 years has not been subsisted from his release form imprisonment.

- Person who has executed a guarantee in favour of a lender of the issuer and such guarantee has been invoked by the lender and remains unpaid in full or part.

Approval from shareholders falling under ‘public’ category

For companies with identifiable promoters

The amendments provides for an approval for the preferential issue by the majority of the shareholders in the ‘public’ category. The ‘public’ category of shareholders does not include promoter shareholders and also any proposed allottee who is already a holder of specified securities of the issuer. Therefore, the same is said to be an approval with majority of the minority.

For companies with identifiable promoters

For companies with no identifiable promoters, the resolution shall have to be passed by 3/4th majority. Though in this case, there is no specific mention in the Regulation as regards the eligibility of voting by the proposed allottees being a security holder in the issuer, the same should apply here also.

Contents of explanatory statement annexed with the notice of shareholder’s meeting

The proposed use of the issue proceeds shall be mentioned in the explanatory statement sent for the purpose of the shareholders resolution. This requirement is already in existence as the provisions of regulation 163 of ICDR Regulations and Rule 13 of the Companies (Share Capital and Debenture) Rules, 2014 do provide for mandatorily mentioning object for which the preferential issue is being made in the explanatory statement of the notice.

Restriction on use of proceeds

Additionally it’s restricted to use the issue proceeds for the purpose of repayment of loans from promoters/ promoter group/ group companies effectively deterring the companies to raise funds to pay-off its promoters.

Appointment of public financial institution or schedule commercial bank as monitoring agency:

As per the amendments, it shall be mandatory for the issuer company to appoint a monitoring agency whoc shall be responsible to submit report on quarterly basis to the issuer until 95% of the proceeds are utilised in the format as specified in Schedule XI ICDR Regulations. All though there is no requirement of appointing a monitoring agency as per the provisions of chapter V (Preferential Issue) requirement of ICDR Regulations, the concept of the monitoring agency is not new as several chapters of the regulations provide for appointment and functions to be performed by the monitoring agency in case where offer size exceeds a predefined limit. However the considering issue by a financially stressed company there is no monetary limit set for the purpose of appointment of monitoring agency.

Responsibilities of Board of Directors

The board of directors and the management of the issuer shall be required to provide their comments on the findings in the report of monitoring agency and disseminate the same within 45 days of end quarter by publishing it on the website of the company as well as submitting the same with the stock exchange(s) were equity shares of the company are listed.

Responsibilities of Audit Committee

Additionally the audit committee of the issuer is entrusted with responsibility to monitor the utilization of the proceeds. This is nothing new the same already falls under the responsibility of the audit committee as laid in the SEBI (Listing Obligations and Disclosure Requirements), 2015.

Further, the audit committee of the company shall also be required to certify about the meeting of all conditions at the time of dispatch of notice and at the time of allotment.

Responsibilities of statutory auditors

The amendments require the statutory auditor also to certify about the meeting of all conditions at the time of dispatch of notice and at the time of allotment.

Lock in period

The allotment shall be lock-in for a period of 3 years from the date of trading approval.

Amendments to SAST Regulations

On same lines as mentioned in the Consultations Paper, SEBI has vide its amendments under the SAST Regulations inserted regulation 10 (2B) of SAST Regulations thereby granting immunity from open offer obligations to the investors under the preferential issue in compliance with regulation 164A of ICDR Regulations. Irrespective of the fact that equity shares are frequently traded or not.

Conclusion

Considering the stressed status of the company, it is believed that aligning the pricing requirement with that of pricing requirement in case of preferential issue to QIBs, shall effectively increase the pool of investors. Similarly, the proposed exemption from making of an open offer shall lessen the additional burden on an incoming investor to comply with the stringent requirements thereby attracting investors to put in money in such companies.

Accordingly, SEBI’s intention behind the changes may be said to be a welcome move as it will definitely help the financially stressed companies to revive.

Link to our other articles:

SEBI’s proposal to aid financially “stressed” companies: http://vinodkothari.com/2020/04/sebis-proposal-to-aid-financially-stressed-companies/

Prudential Framework for Resolution of Stress Assets: New Dispensation for dealing with NPAs: http://vinodkothari.com/2019/06/fresa/

[1] https://www.sebi.gov.in/reports-and-statistics/reports/apr-2020/consultation-paper-preferential-issue-in-companies-having-stressed-assets_46542.html

[2] http://egazette.nic.in/WriteReadData/2020/220093.pdf

[3] http://egazette.nic.in/WriteReadData/2020/220094.pdf

[4] https://www.sebi.gov.in/legal/circulars/nov-2019/disclosures-by-listed-entities-of-defaults-on-payment-of-interest-repayment-of-principal-amount-on-loans-from-banks-financial-institutions-and-unlisted-debt-securities_45036.html

[5] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11580&Mode=0

SEBI’s proposal to aid financially “stressed” companies

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari Consultants-Proposal for relaxation in pricing norms for preferential issue and making an open offer

Henil Shah | Executive

Introduction

In layman’s term, a company with falling share prices, inability to pay off its obligations is said to be a company with financial distress. It’s safe to say that for such a company, one of the foremost priority is to secure a source of funds in order to fund their operations to upturn its economic conditions thereby avoiding Insolvency/Bankruptcy. Keeping the same view in mind, the Securities and Exchange Board of India (‘SEBI’) deliberated the matter to its Primary Market Advisory Committee (‘PMAC’), which identified the following key issues to be addressed in order to assist the financially stressed companies to raise funds:

- Criteria for determining a company as stressed

- Determination of a reasonable price for preferential allotment

- Exemptions from open offer obligations under the SAST Regulations

Based on the recommendations given by PMAC, SEBI on April 22, 2020 released a Consultation paper “Pricing of preferential issues and exemption from open offer for acquisitions in companies having stressed assets”[1] seeking public comments till May 13, 2020.

Rationale behind the proposed changes

One of the key modes of raising funds by a company especially a financially distressed company is by way of preferential issue of equity shares or convertible instruments. Knowing the probable investors ready to invest in the company makes preferential issue one of the most commonly used ways for raising funds. For a listed company, under a preferential issue, the issue price has to be determined as per the pricing provisions of Chapter V of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (“ICDR Regulations”). The ICDR Regulations provides the pricing mechanism for both frequently traded shares and infrequently traded shares. In case of frequently trades shares, the price shall be determined as per the provisions of Regulation 164(1) (a) & (b) of the ICDR Regulations which are as follows.

i. Onerous pricing mechanism

Considering the continuous falling prices of the shares over a period of 26 weeks due to the company being in stress, the determination of the price as per the pricing mechanism provided in Regulation 164(1)(a) becomes too onerous for the investor. Further, the price under Regulation 164(1)(a) is much higher than that as determined as per Regulation 164(1)(b). Hence, the pricing mechanism acts as a major deterrent for the investors from subscribing to the shares offered under the preferential issue.

ii. Exemptions only to 5 QIBs restricting investor pool

Though the ICDR Regulations allow issuance to QIBs at a price determined as per regulation 164(1) (b) however, the same is restricted to only 5 QIBs and is not applicable to the investors other than QIBs thereby restricting the investor pool.

iii. Open offer obligations for the acquirer

Another roadblock which the issuers tend to face is from the view point of the investors i.e. an incoming investor who has an impending burden on complying with an open offer obligation in case where the subscription to the preferential offer leads to the triggering of the open offer obligations under SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011(‘SAST Regulations’).

As per the extant provisions, the acquisition pursuant to a resolution plan approved under the Insolvency and Bankruptcy Code, 2016 is exempted from meeting the open offer obligations but no such exemption has been provided in case for acquisition in the financially distressed entity which are not under any resolution plan.

Therefore, where the listed entity is already under distress and suffering from a financial crisis, huge open offer obligations and the cost involved therein discourage the probable investors from taking any controlling interest in such entity.

Rescue mechanism by way of proposed changes

What will be regarded as “stressed”?

It is proposed that only such listed companies which meet any 2 (two) of the following 3 (three) conditions will be determined as a “stressed” company and shall be able to avail the benefits while making an offer under preferential issue once the proposed changes come alive.

- A listed company which has made disclosure of defaults on payment of interest/ principal amount of loans from banks/ financial institutions and listed and unlisted debt securities for 2 consequent quarters in terms of the SEBI Circular[2] issued in this regard;

Default for the purpose of the above circular shall mean non –payment of interest or principal in full on the pre-agreed due date. Provided in case of revolving facilities default shall be considered when outstanding balance remains continuously in excess of the sanctioned limit or drawing power, whichever is lower for more than 30 days.

- Existence of Inter-Creditor agreement in terms of Reserve Bank of India (Prudential Framework for Resolution of Stressed assets) Directions 2019[3];

Inter-credit agreement in terms of the RBI directions stands for agreement executed among all the lenders of a defaulting borrower, providing for ground rules for finalisation and implementation of resolution plan in respect to the borrower.

- Credit rating of the listed instruments of the company has been downgraded to “D”.

Proposal for relaxed pricing norms under the ICDR Regulations:

Unlike the current pricing requirements as provided in Regulations 164(1) (a) & (b) for a preferential issue, the price of the shares to be issued by a stressed company as aforesaid shall be a price which shall not be less than the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognised stock exchange during the two weeks preceding the relevant date.

Exemptions proposed under the SAST Regulations

Where due to the subscription of shares offered under preferential issue by a financially stressed company triggers open offer obligations as per SAST Regulations, the same shall be exempted.

Additional conditions for availing the exemptions

The Consultation Paper also provides for an additional set of requirements to be complied in case were the benefits of the proposed exemptions are to be availed.

- Persons/entities that are not part of the promoter or promoter group will not be eligible to participate in the preferential issue.

- Obtaining of shareholders’ consent for the exemption to make an open offer by the proposed investors along with the proposal of preferential issue. The shareholders’ approval shall be an approval of majority of minority excluding the promoters and promoter group and any proposed allottee that already hold securities in the issuer.

- Disclosure of the proposed use of the proceeds of such preferential issue in the explanatory statement. This requirement is nothing new as the provisions of regulation 163 of ICDR Regulations and Rule 13 of the Companies (Share Capital and Debenture) Rules, 2014 do provide for mandatorily mentioning object for which the preferential issue is being made in the explanatory statement of the notice.

- Appointment of a monitoring agency. Though there is no requirement of appointing a monitoring agency as per the provisions of chapter V (Preferential Issue) requirement of ICDR Regulations, the concept of the monitoring agency is not new as several chapters of the regulations provide for appointment and functions to be performed by the monitoring agency in case where offer size exceeds a predefined limit.

- Mandatory lock in requirements of shares issued on preferential basis for 3 years which is same as provided in chapter V (Preferential issue) requirement of ICDR Regulations.

Conclusion

Considering the stressed status of the company, it is believed that aligning the pricing requirement with that of pricing requirement in case of preferential issue to QIBs, shall effectively increase the pool of investors. Similarly, the proposed exemption from making of an open offer shall lessen the additional burden on an incoming investor to comply with the stringent requirements thereby attracting investors to put in money in such companies.

Accordingly, SEBI’s intention behind the proposed changes may be said to be a welcome move as it will definitely help the financially stressed companies to revive.

Our write up on prudential framework for resolution for stressed assets can be accessed at:

http://vinodkothari.com/2019/06/fresa/

Our other write ups can be accessed at: http://vinodkothari.com/category/corporate-laws/

[1] https://www.sebi.gov.in/reports-and-statistics/reports/apr-2020/consultation-paper-preferential-issue-in-companies-having-stressed-assets_46542.html

[2] https://www.sebi.gov.in/legal/circulars/nov-2019/disclosures-by-listed-entities-of-defaults-on-payment-of-interest-repayment-of-principal-amount-on-loans-from-banks-financial-institutions-and-unlisted-debt-securities_45036.html

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11580&Mode=0

Highlights of SEBI’s temporary relaxations for Rights Issue

/0 Comments/in Corporate Laws, Covid-19, SEBI, SEBI and listing-related compliances - Covid-19, UPDATES /by Vinod Kothari ConsultantsAmbika Mehrotra & Ankit Vashishth

In line with various other relaxations introduced by the Securities and Exchange Board of India (‘SEBI’), amid the global pandemic, it has now come up with a Circular dated 21st April, 2020 [1]granting temporary relief under certain provisions of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (‘ICDR regulations’) in respect of Rights Issue. The rights issues opening on or before March 31, 2021 will get benefited from the said Circular.

It goes without saying that during the period of this of economical breakdown, the industrial undertakings are in need of funds for various purposes. In this hour of crisis, SEBI’s move seems to ease out the stringent requirements in the statues which hamper the facility of raising funds by companies especially through rights issue.

The amended provisions broadly serve the intent of having a relatively flexible eligibility criteria for a fast track rights issue and lesser chances of refund of the amount in case of non- receipt of subscription amount.

A snapshot of the relaxations and their impact is enlisted below: –

Eligibility conditions related to Fast Track Rights Issues

| Relevant Regulation

|

Pre- amendment | Post-amendment | Impact Analysis |

| 99(a) | the equity shares of the issuer have been listed on any stock exchange for a period of at least three years immediately preceding the reference date

|

the equity shares of the issuer have been listed on any stock exchange for a period of at least eighteen months immediately preceding the reference date

|

Relaxation in the pre-condition with respect to listing of equity shares from 3 years to 18 months. |

| 99(c ) | the average market capitalisation of public shareholding of the issuer is at least two hundred and fifty crore rupees

|

the average market capitalisation of public shareholding of the issuer is at least one hundred crores

|

Companies with smaller market size i.e. more Rs. 100 crore and above also permitted to enter into Fast Track Issue. |

| 99(f) and its proviso | the issuer has been in compliance with the equity listing agreement or the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as applicable, for a period of at least three years immediately preceding the reference date:

Provided that if the issuer has not complied with the provisions of the listing agrîment or the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as applicable, relating to composition of board of directors, for any quarter during the last three years immediately preceding the reference date, but is compliant with such provisions at the time of filing of letter of offer, and adequate disclosures are made in the letter of offer about such non-compliances during the three years immediately preceding the reference date, it shall be deemed as compliance with the condition; |

the issuer has been in compliance with the equity listing agreement or the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as applicable, for a period of at least eighteen months immediately preceding the reference date:

Provided that if the issuer has not complied with the provisions of the listing agreement or the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as applicable, relating to composition of board of directors, for any quarter during the last eighteen months immediately preceding the reference date, but is compliant with such provisions at the time of filing of letter of offer, and adequate disclosures are made in the letter of offer about such non-compliances during the three years immediately preceding the reference date, it shall be deemed as compliance with the condition;

|

The timeline for being in compliance with listing regulations has been reduced from 3 years to 18 months.

This is in line with the requirement under Regulation 99(a) wrt listing of equity shares for a period of atleast 18 months instead of 3 years. |

| 99(h) | No show-cause notices have been issued or prosecution proceedings have been initiated by the SEBI and pending against the issuer or its promoters or whole-time directors as on the reference date. | No show-cause notices, excluding under adjudication proceedings, have been issued by the SEBI and pending against the issuer or its promoters or whole-time directors as on the reference date.

In cases where against the issuer or its promoters/ directors/ group companies,

i. a show cause notice(s) has been issued by the Board in an adjudication proceeding or

ii. prosecution proceedings have been initiated by the Board; necessary disclosures in respect of such action (s) along-with its potential adverse impact on the issuer shall be made in the letter of offer. |

Regulation 99(h) restricts the company to make fast track rights issue in case there had been any show-cause notices or prosecution proceedings issued/initiated against the company/ its promoters/ WTDs.

The temporary relaxation however allows the company to be eligible for rights issue to the extent where adjudication proceedings or prosecution proceedings in respect of the above as well as the group companies are concerned, on making the required disclosures in this regard and its adverse impact, in the letter of offer |

| 99(i) | the issuer or promoter or promoter group or director of the issuer has not settled any alleged violation of securities laws through the consent or settlement mechanism with the Board during three years immediately preceding the reference date;

|

The issuer or promoter or promoter group or director of the issuer has fulfilled the settlement terms or adhered to directions of the settlement order(s) in cases where it has settled any alleged violation of securities laws through the consent or settlement mechanism with the Board. | Prior to the relaxation, any violation in the securities laws by the issuer/ promoter/ promoter group/ director made the issuer ineligible. This however has now been relaxed to permit the issue in case the above violators, having violated the securities laws at anytime during the past have fulfilled the settlement terms or followed the directions under the settlement order(s) |

| 99(j) | The equity shares of the issuer have not been suspended from trading as a disciplinary measure during last 3 years immediately preceding the reference date. | The equity shares of the issuer have not been suspended from trading as a disciplinary measure during last 18 months immediately preceding the reference date. | In line with Regulation 99(a) and (f) |

| 99(m) | There are no audit qualifications on the audited accounts of the issuer in respect of those financial years for which such accounts are disclosed in the letter of offer | For audit qualifications, if any, in respect of any of the financial years for which accounts are disclosed in the letter of offer, the issuer shall provide the restated financial statements adjusting for the impact of the audit qualifications.

Further, that for the qualifications wherein impact on the financials cannot be ascertained the same shall be disclosed appropriately in the letter of offer. |

Prior to the Circular, any qualification in the audit report led to ineligibility. This condition has now been re-framed to make the companies eligible on providing the restated financial statements adjusting for the impact of the audit qualifications or providing clarifications in case such impact cannot be ascertained |

Relaxation with respect to Minimum Subscription:

| Relevant Regulation

|

Pre- amendment | Post-amendment | Remarks |

| 86(1) | The minimum subscription to be received in the issue shall be at least ninety per cent. of the offer through the offer document. | The minimum subscription to be received in the issue shall be at least seventy five percent of the offer through the offer document.

Provided that if the issue is subscribed between 75% to 90%, issue will be considered successful subject to the condition that out of the funds raised atleast 75% of the issue size shall be utilized for the objects of the issue other than general corporate purpose. |

The minimum subscription amount has been reduced from 90% to 75%.

However, the Circular seems to put another restriction on the utilization of atleast 75% of the funds for the objects of the issue other than general corporate purpose if the actual subscription goes beyond 75% but within 90% of the offer. |

Minimum threshold for not filing draft letter of offer

| Relevant Regulation

|

Pre- amendment | Post-amendment | Remarks |

| Applicability of the Regulations:

3(b) |

rights issue by a listed issuer; where the aggregate value of the issue is ten crore rupees or more;

|

rights issue by a listed issuer; where the aggregate value of the issue is twenty-five crores or more;

|

The conditions prescribed in Chapter III of ICDR Regulations shall not apply in case of Rights Issue carrying an issue size of less than Rs. 25 crores. |

|

Proviso to Reg. 3 |

Provided that in case of rights issue of size less than ten crore rupees, the issuer shall prepare the letter of offer in accordance with requirements as specified in these regulations and file the same with the Board for information and dissemination on the Board’s website. | Provided that in case of rights issue of size less than twenty-five crore rupees, the issuer shall prepare the letter of offer in accordance with requirements as specified in these regulations and file the same with the Board for information and dissemination on the Board’s website. | The change is made considering the revised limit of applicability of the Regulations for a rights issue. |

|

60 |

Unless otherwise provided in this Chapter, an issuer offering specified securities of aggregate value of ten crore rupees or more, through a rights issue shall satisfy the conditions of this Chapter | Unless otherwise provided in this Chapter, an issuer offering specified securities of aggregate value twenty-five crore rupees or more, through a rights issue shall satisfy the conditions of this Chapter. | The change is made considering the revised limit of applicability of the Regulations for a rights issue. |

One-time Relaxation on opening of issue

In addition to the above Circular, SEBI has also issued another circular on the same date i.e. April 21, 2019[2] for granting one-time relaxation on the basis of the representations received from various stakeholders with respect to the opening of issue period within 12 months from the date of issuance of the observations by SEBI, for an Initial Public Offer (IPO), Further Public Offer (FPO) or Rights Issue as per Regulation 44, 140 and 85 respectively of the ICDR Regulations, expiring during this period of lockdown i.e. between March 1, 2020 and September 30, 2020 to be extended by 6 months, from the date of expiry of the above-mentioned observations received from SEBI.

However, the extension to this issue opening period shall be granted on obtaining an undertaking from lead manager of the issue confirming compliance with Schedule XVI of the ICDR Regulations with respect to the nature of changes in the offer document which require filing of updated offer document, while submitting the updated offer document to SEBI.

Conclusion

These temporary relaxations will surely bring in a sigh of relief for the stakeholders including the companies intending to raise funds through rights issue, during this interim period of disruption due the outbreak of COVID-19, considering the stagnancy of operations in the country.

Read our related articles below –

SEBI ICDR Regulations, 2018– Snapshot on changes in rights, bonus, QIP and preferential issue;

SEBI (ICDR) Regulations, 2018-Key Amendments;

Covid-19 – Incorporated Responses | Regulatory measures in view of COVID-19.

[1] https://www.sebi.gov.in/legal/circulars/apr-2020/relaxations-from-certain-provisions-of-the-sebi-issue-of-capital-and-disclosure-requirements-regulations-2018-in-respect-of-rights-issue_46537.html

[2] https://www.sebi.gov.in/legal/circulars/apr-2020/one-time-relaxation-with-respect-to-validity-of-sebi-observations_46536.html