Identifying Senior Managers: Listing rules may force companies to relook at the tag

Identification as a “senior management person” brings information needs as well as obligations

– Pammy Jaiswal and Mahak Agarwal

Background

The concept of Senior Management ( herein, ‘SM’, and senior management person or personnel as ‘SMP’ or ‘SMPs’) was not there under the regime of the Companies Act, 1956 and was first introduced under Section 178 of the Companies Act, 2013 (Act, 2013). The law requires the Nomination and Remuneration Committee to get into compensation policies of SMPs. The definition under the Listing Regulations has, over time, been aligned with that under the Act, 2013. These definitions have been around for almost 10 years now, and therefore, largely seem to have settled.

However, the LODR (2nd Amendment) Regulations[1] have introduced several new information requirements and obligations pertaining to SMPs, which has given rise to the need for relooking at the said position from a fresh perspective.

Given the fact that the amendments specify new and stricter obligations and disclosure norms for SMPs, it becomes imperative for companies to look back and revisit on the following fronts:

- Who are the currently designated SMPs; and

- Identifying, with a new perspective, the persons who shall explicitly fall under this definition and accordingly, attract the applicability of various requirements as discussed herein below.

Our detailed FAQs on the LODR (2nd Amendment) Regulations can be viewed here.

The Concept of Senior Management under the Act, 2013

The scope of law revolving around ‘Senior Management’ under the Act, 2013 is limited. It discusses the meaning of and the manner of appointment and removal of SMPs.

Meaning

The meaning of the term ‘Senior Management’ under the Act, 2013 provides to mean personnel of the company who are members of its core management team excluding Board of Directors comprising all members of management one level below the executive Directors, including the functional heads.

Appointment, Removal and Remuneration of SMPs

Section 178 of the Act, 2013 requires the Nomination and Remuneration Committee to be responsible for identifying persons who may be appointed in senior management and are also required to recommend to the Board their appointment or removal. Further, the law also provides emphasis on formulation of requisite criteria for ensuring balance between fixed and incentive pay w.r.t the remuneration payable to SMPs.

Definition and meaning of SMPs

Regulation 16 of SEBI LODR, 2015 define senior management as under:

“Senior management” shall mean the officers and personnel of the listed entity who are members of its core management team, excluding the Board of Directors, and shall also comprise all the members of the management one level below the Chief Executive Officer or Managing Director or Whole Time Director or Manager (including Chief Executive Officer and Manager, in case they are not part of the Board of Directors) and shall specifically include the functional heads, by whatever name called and the Company Secretary and the Chief Financial Officer”

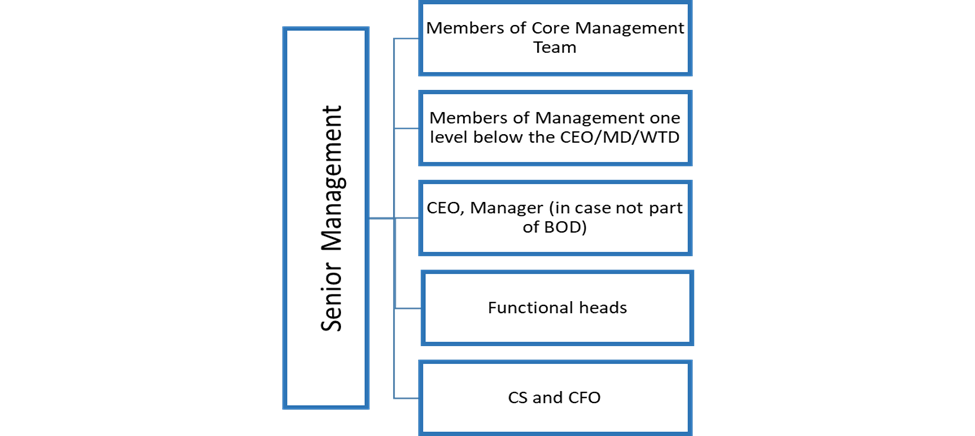

Accordingly, following are the inclusions and exclusions in the definition:

Inclusions:

- Members of core management team

- All members of the management one level below the CEO or MD or WT

- CEO, Manager (in case not part of BOD)

- Specifically include Functional heads

- CS and CFO

Exclusions:

- Board of Directors

On reading of the aforesaid definition of SM personnel, it is understood that the same is an inclusive definition and therefore, the actual identification of SM in a company will depend on several factors like the meaning and participants of core management group, members falling under one level below the board, organizational hierarchy, etc. For defining the offices falling under ‘core management group’ one may consider the members of the promoter group taking part in the crucial management discussions, in case there is a formal committee/ group to that effect. As regards, the members falling under ‘one level below the board’ is concerned, the ones who report to the MD/ CEO or officers responsible for general management of the company would be regarded as an inclusion in the said category.

Understanding ‘Core Management’ and ‘functional heads’

Generally speaking, core management would mean members of the management responsible for core business functions of the organization.

Core Management

To further understand who shall fall under the ambit of core management, reference may be taken from Singapore Guidelines on Individual Accountability and Conduct applicable to Financial Institutions [regulated by Monetary Authority of Singapore (MAS)]which provides a list of persons to be included in ‘core management functions’[2]. The list includes CEO, CFO, Chief Risk Officer, Chief Operating Officer/Head of Operations, Chief Information Officer/Chief Technology Officer/Head of Information Technology, Chief Information Security Officer/Head of Information Security, Chief Data officer, Chief Regulatory officer, heads of business functions, head of actuarial/appointed actuary/certifying actuary, Head of HR, Head of Compliance, Head of Financial Crime Prevention, Head of Internal Audit.

Similarly, the Ministry of Economic, Trade and Industry (METI), Japan in its revised CGS Guidelines has laid emphasis on the composition and delegation of powers to ‘top management[3]’. It provides an indication on the nature of work done and the members falling under the said category which includes president, CFO, CXO, etc.

Functional heads

[4]Business functions are the activities carried out by an enterprise; they can be divided into core functions and support functions. Core business functions would mean those functions which yield income for an enterprise and these functions generally make up the primary activities of the enterprise. These would normally include Operations, Marketing, Finance, Compliance and could otherwise vary based on the nature of the enterprise. [5]Support business functions are ancillary (supporting) activities carried out by the enterprise in order to permit or to facilitate the core business functions, its production activity. These activities may include distribution and logistics, IT services, technical services, etc.

However, in the context of defining SMPs, what shall be relevant are the heads of the core functional departments of the company who report directly to the MD or WTD and the ancillary or supporting heads shall be disregarded while interpreting the definition of SM.

On the joint reading of the aforesaid discussion on core management as well as functional head, it becomes clear that senior persons from ancillary or support services may form part of the core management, however, the same need not be categorized under functional head for the purpose of these regulations.

Example to understand core management team and functional heads

For a large-scale organization, the identification becomes even more crucial since a liberal interpretation of the meaning would involve number of employees under the said definition and thus, lead to several implications as discussed below. To understand the same, if we consider an example of K Ltd which has several plant locations around the country with plant heads controlling the functions at each plant. All the plant heads report to the head of operations as well as the CFO. Further, the said company has around 15 functional departments, out of which 12 are main line functions and the rest are ancillary to one of the main functions. Every main line function has a functional head and the ancillary functions have controllers reporting to the one of the functional head of the main line function. The heads of the main line functions report to the MD of K Ltd.

In the given case, if we take a close look at the definition of SM, then the following should be the result of the identification of SMs in K Ltd:

- Plant heads – Not an SM since they report to Head of operations, therefore, not falling under one level below the board.

- Heads of main line functions – Should be categorized as an SM since they fall under one level below the board

- Controllers of ancillary functions – Not an SM since they report to head of main line functions

Understanding the implications

On SM personnel

The amended regulations along with the existing regulations applicable to SMs impose the following obligations on them:

- SM are required to act with operational transparency while also maintaining confidentiality of information [Regulation 4(2)(f)]

- They are required to disclose to the board, all material, commercial and financial transactions in which they have personal interest and which may lead to potential conflict of interest with the listed entity at large [Regulation 26(5)]. Here, conflict of interest relates to:

- Dealing in shares of listed entity

- Commercial dealings with bodies, which have shareholding of management and their relatives

- SPs shall also be required to affirm compliance with code of conduct of senior management on an annual basis [Regulation 26(3)]

On listed companies

- Fraud by SM [Clause 6 of Para A of Part A of Sch III]

The definition and implications of being identified as an SM under the amended regulations is very wide and it is therefore, likely that the companies may not consider covering several persons under its ambit. Fraud with respect to SM has been inclusively defined to also mean fraud under Regulation 2(1)(c) of Securities and Exchange Board of India (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 which itself has a very wide scope. The same covers wide range of activities including misrepresentation of truth, concealment of material facts, a suggestion as to an untrue fact, active concealment of fact in knowledge of the person making such representation, promise made without intention of performing it, reckless/careless representation, any act or omission which law declares as fraudulent, deceptive behavior, false statement, misinformation about securities that affects market price of such securities.

Having said that, companies which take a liberal interpretation of the definition of SM and accordingly, keep a long list of such persons, might have to keep constant track of such activities being undertaken by their SM which, goes without stating, is a cumbersome task.

Furthermore, such cases of fraud have been classified as deemed material event under Regulation 30 read with Para A Part A of Schedule III, which will have to be reported by the company to the stock exchange within 12 or 24 hours, as the case may be.

- Default by SM [Clause 6 of Para A of Part A of Sch III]

The meaning of ‘default’ with regard to SM shall be seen in the following light:

- non-payment of the interest or principal amount in full on the date when the debt has become due and payable; and

- such default which hasimpact on the listed entity

Further, such defaults by SM, pursuant to the recent amendments, shall be considered a deemed material event and accordingly required to be disclosed to the stock exchange within 12 hours of such default coming into notice.

- Change in SM [Clause 7 of Para A of Part A of Sch III]

Pursuant to recent amendments, change in SM shall now be a deemed material event under Regulation 30 read with Para A Part A of Schedule III. In addition, the particulars of SM along with changes therein since the close of the previous financial year shall also be required to be disclosed by the company in its Corporate Governance Report.

- Resignation of SM [Clause 7C of Para A of Part A of Sch III]

The amended Listing Regulations require companies to disclose to the SE, the letter of resignation as given by the concerned SM along with detailed reasons for such resignation within seven days from the date such resignation comes into effect.

Such resignation letters carry a grave potential for the outgoing SM to negatively portray the image of the company. Accordingly, identification of SM personnel becomes of immense relevance.

- Announcement/Communication through social media intermediaries or mainstream media by SM [Clause 18 of Para A of Part A of Sch III]

It is stated by the recent amendments that if the SMPs of the listed entity make any announcement or communication through social media intermediaries or mainstream media and such information is material in terms of Regulation 30 and is not already made available in the public domain by the listed entity, the same shall be deemed to be a material event under Para A Part A of Schedule III and consequently required to be disclosed to the SE.

Approvals required for appointment and remuneration of SMPs under the Listing Regulations

Part A of Schedule II (minimum information to be placed before the Board) specifies that information on recruitment and remuneration of senior officers just below the level of board of directors, including appointment or removal of CFO and the Company Secretary shall be placed before the Board. Further, clause 4 of Para A of Part D of Schedule II (Role of NRC) requires it to identify persons who may be appointed in the senior management pursuant to its recommendation and approval by the Board. On a conjoint reading of the aforesaid provisions, we understand that the appointment of an SMP is not simply a matter to be noted by the Board, the same is recommended by the NRC to the Board which is again required to be specifically approved by the same.

As regards the remuneration payable to SMPs, Clause 6 of Para A of Part D of Schedule II requires the NRC to recommend to the Board all remuneration payable to Senior Management. Further, the specific thresholds with respect to such remuneration payable to the SMPs shall be as per the Nomination and Remuneration Policy of the Company.

Appointment/ designation of non-SMPs as SMPs

While fresh appointment to the position of SMPs is one of the ordinary ways to induct SMPs in the company, another organic or primitive manner of introducing officials to the position of SMPs is by way of internal promotions in an organization. Another means may also include re-recognition of an existing position in the company as that of an SMP position. In both scenarios, it will be interesting to understand the implications with respect to approvals and intimations are concerned.

- Introducing SMPs as a result of internal promotion

As discussed earlier, the recommendation for appointment of SMPs need to come from the NRC to the board. Therefore, in cases of internal promotion or role change, in addition to the senior officer’s decision sourcing this change, the same needs to be routed through the NRC as well as the Board. As far as the effective date of such promotion or change is concerned, the same would depend on the NRC which may ideally refer to the date indicated by such senior officer or any other date as they deem fit.

Now, coming to the date of intimation for such change, the same should be given once the NRC has approved such recommendation to the Board, unless, the Board also decides on the same day regarding such role change through a circular resolution within the permitted timelines.

- Re-recognizing an existing organization position from a non-SMP position to an SMP position

As far as re-recognition is concerned, the same procedure needs to be adopted, which means the recommendation and approval of the NRC as well as the Board needs to be obtained even if no new person is being inducted on from outside. Similar timelines as in case of any other mode of change in SMP would be applicable in this case.

Conclusion

In essence, the existing Listing Regulations deal with several provisions revolving around SM, imposing several disclosure norms on the company and on the SM as well. Considering these disclosures include some very sensitive areas, an immediate step for companies now will be to take a close re-look and identify the personnel that fall in this comprehensive definition in such a manner that enhanced compliances in relation to such personnel, as brought about by the recent amendments are being adequately adhered to without any adverse implications on the listed entity.

[1] SEBI LODR (2nd Amendment) Regulations, 2023

[2] Guidelines on Individual Accountability and Conduct issued by Monetary Authority of Singapore

[3] Revised CGS Guidelines by METI, Japan

[4] https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Business_functions#:~:text=Business%20functions%20are%20the%20activities,market%20or%20for%20third%20parties

[5] https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Business_functions#:~:text=Business%20functions%20are%20the%20activities,market%20or%20for%20third%20parties

Read our other resources on SEBI LODR (2nd Amendment) Regulations:

- SEBI prescribes thresholds for determining material events, stringent approval for sale of undertaking and more

- Stricter framework for sale, lease or disposal of undertaking by a listed entity

- Getting material on “material” events and information

- Powerpoint presentation on SEBI LODR (Second Amendment) Regulations, 2023

- Outline for SOP in the context of Regulation 30 of the Listing Regulations

In case of Banks particularly PSB’s, roles of SMP are getting changed frequently as per the discretion of the Top Management of the Bank to meet the emerging requirements. Whether, every such change needs to be intimated to SE ?

Kindly share your views whether role realignment within the organisation would be regarded as change in SM and be intimated under reg 30 pursuant to revised lodr??

Yes