Ushering the new-age TReDS Platform

– Anirudh Grover, Executive | finserv@vinodkothari.com

Receivables or debtors though from the face of it is considered as a positive thing for businesses, however when you lift the tag of positivity one can assess the true color of trade receivables. This essentially means that despite it being classified as an asset it may not be helping the business when required. For instance, ABC Ltd has 1 lakh recorded as debtors in its financials however these debtors are of no substantial use unless it is converted into liquid forms of funds. This in essence is the reason why TReDS was introduced, RBI vide Guidelines for the Trade Discounting System (TReDS) opined that the scheme for setting up and operating the institutional mechanism for facilitating the financing of trade receivables of MSMEs from Corporate and other buyers, including Government Departments and Public Sector Undertakings (PSUs), through multiple financiers is known as TReDS.

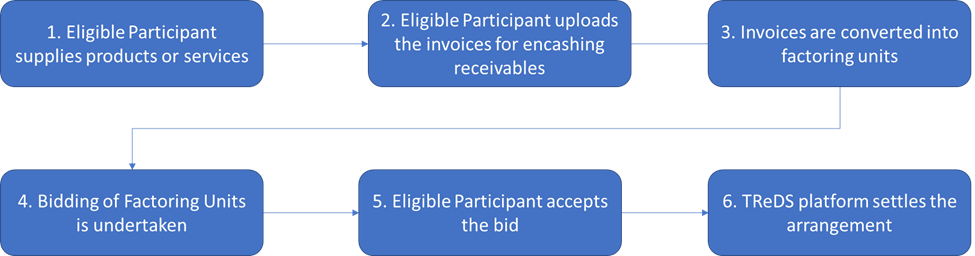

For the convenience of readers and better understanding of the TReDS mechanism a brief overview of the process is depicted below. However for the purposes of comprehending the dynamics of the process, one may refer to our Factoring Report 2023.

Market Overview of TReDS

Presently, there are three entities- RXIL, Invoicesmart and M1 Exchange which have received the RBI’s license to operate the TReDS. Additionally, there are 2 new entities who have been granted in principle authorization. These entities process about ₹60,000 crore worth of transactions annually.

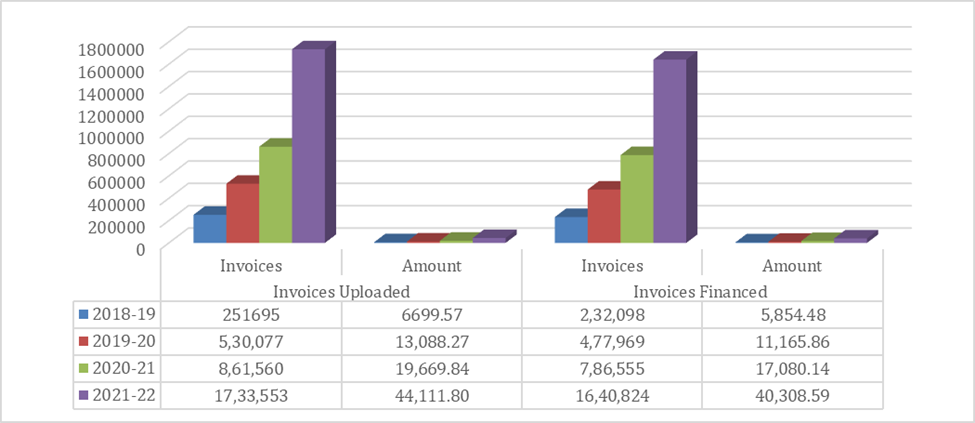

As per the RBI Report on Trend and Progress of Banking in India 2021-22, the number of invoices uploaded and financed through the platform more than doubled and the success rate improved to 94.7 per cent from 91.3 per cent a year earlier. The year-on-year growth can be seen from the table below which clearly signifies the penetration TReDS scheme is having as years are passing by. The one thing of concern which has to be taken cognizance of by the RBI is the lack of identified companies getting registered for TReDS. As per the Government data on MSME Dashboard out of the 4714 companies identified only 1673 companies have as of January 30, 2023 registered for the TReDS scheme. [1]

Fig 2: Progress in MSME Financing through TreDS

RBI Proposals

Given the importance, TReDS has been receiving the RBI vide Circular dated February 08, 2023 introduced some new measures with the intent of providing further impetus to the TReDS platforms. Arguably these measures would to some extent help in further improving the cash flows of MSMEs.

- In addition to the three traditional categories of participants namely Buyers, Sellers and Financiers, now insurance companies will also be allowed to be a participant in the TReDS mechanism making them the fourth participant in this framework. The intent behind this can be to encourage financing/discounting without worrying about the credit rating of the buyer. The issue which was prevailing before the advent of this proposal was that Financier had limited recourse available (in the case of with recourse) and no recourse (in the case of without recourse), however now since insurance facilities will be available as an option Financier would be more secured with respect to the underlying receivables. Eventually enabling them to take more risks in the form of offering higher interest rates. Further to paint the picture clear, the RBI would be following up with detailed guidelines in this regard, but the questions to ponder upon would include who will be liable to pay insurance premiums, and at what point insurance has to be undertaken. If MSME sellers are obligated then wouldn’t that lead to further enhancements of costs and compliances which in essence is against the objective of this TReDS platform.

- Entities eligible under the Factoring Regulation Act, 2011 will also be now allowed to be a financier in the TReDS platform. Prior to this proposal only banks, and NBFC-Factors were permitted to be a Financier in the TReDS platform which did not serve the purpose as only few transactions were being conducted through the TReDS framework. With the advent of this proposal apart from the aforementioned entities, NBFC-ICC will also be permitted to be a part of the TReDS ecosystem. This would eventually increase the options for the MSME-suppliers to choose from a pool of financiers available and thereby make this facility more competitive. As a result, the MSME sellers would also be able to get higher interest rates while undertaking discounting of their receivables in this platform.

- Lastly, since assignment of receivables is an off-balance sheet exposure, the RBI has allowed secondary market operations. This would allow financiers to offload their existing portfolio to other financiers within the same TReDS platform, if required. Arguendo this is a step which is in the interest of the Financiers as it allows them to resell the assets to other Financiers. However, from the perspective of the overall risk, a key issue that needs to be addressed is in relation to the extent to which a Financier can further resell the Factoring Unit.

Conclusion

The focus of the government in supporting the MSME sector which acts as the backbone of our economy cannot be less emphasized. The government has time and again come up with innovative solutions by virtue of which it has intended to enhance the liquidity flow of MSME entities. This can also be captured in the 2023 Budget Proposal of the Government of India wherein it has proposed to restrict the deductions claimed by Entities only in situations where they have actually paid the amount to the specific entity. Coming back to the TReDS proposals, we feel that the proposals made by the RBI are a mixed bag with mostly each side of the platforms getting some incentive or the other, however detailed guidelines to the some of the preliminary questions have to be laid down in order to fructify the purpose or intent behind these proposals.

[1] https://dashboard.msme.gov.in/12_nnouncements.aspx

Leave a Reply

Want to join the discussion?Feel free to contribute!