Structured Default Guarantees

Analysing prevalent structures and their capital treatment

– Qasim Saif, Senior Manager | qasim@vinodkothari.com

The term that has been grabbing limelight in the world of finance, specifically for non-banking finance would be First Loss Default Guarantees (FLDGs). The growth of the fintech sector in India may be chiefly credited for making FLDGs as the latest buzzword. However, guarantees are not a new innovation; it has been commonly used in the finance sector since ages.

| We are organising a Workshop on Emerging Regulatory Framework for NBFCs and digital lending on 19th, 20th and 21st September 2022. See details here – https://vinodkothari.com/2022/09/workshop-emerging-regulatory-framework-for-nbfcs/ |

The growth of the fintech sector, made the instrument a very commonly used device for new players (like fintechs) to take exposures on loan transactions by using low cost funding from the established players, such as large NBFCs and Banks. The guarantees issued by fintechs or pure technological platforms helped them to gather trust of the large and recognised lenders to originate new loans using the digital platform of the fintechs. The tool used was structured guarantees. In this article we we would delve into the concept of structured guarantees.

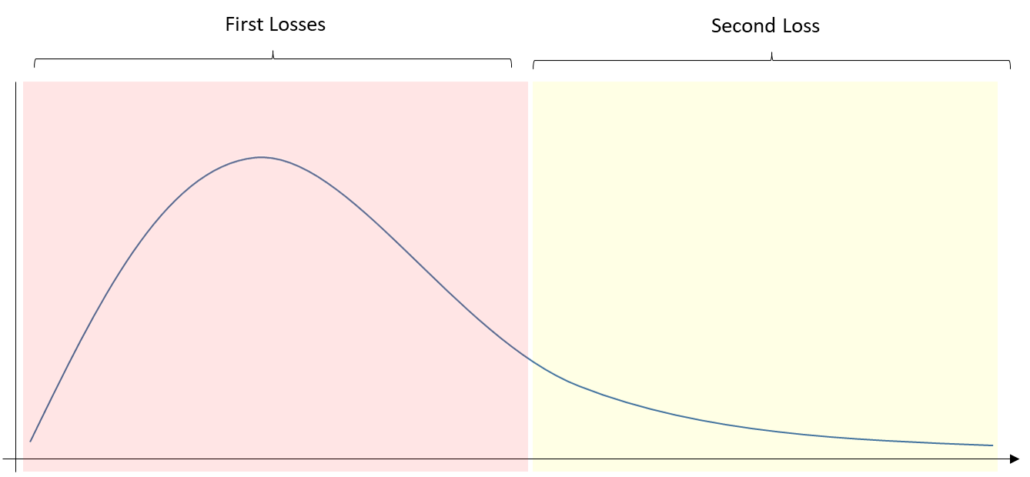

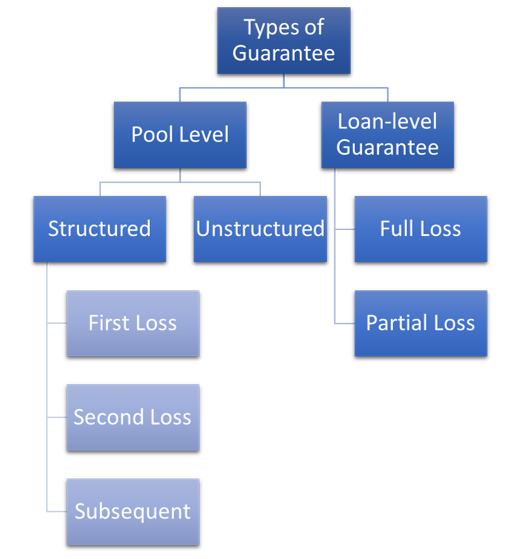

The usual construct of a structured guarantee is as follows: Let’s assume, there is a loan pool of Rs 100 crores. The guarantor guarantees the pool, subject to a limit of Rs 10 crores. This is, what one would call first loss default guarantee. Surfacially, the guarantee is only for Rs 10 crores, but really speaking, the guarantee covers every loan in the pool, with a loss limit of Rs 10 crores. It is also important to understand that the risk rigour of the first loss default guarantee increases as the pool is larger or more diversified. Smaller or more concentric the pool, the risk taken by the first loss protection seller reduces.

In an alternative structure, the protection seller (guarantor) may take losses, say, from Rs 10 crores to Rs 20 crores- this becomes a case of second loss protection or mezzanine protection. In this case, the protection seller will have no risk till the losses accumulate to Rs 10 crores.

There may be a case where the entire Rs 100 crores is fully protected by the protection seller – this is an unstructured guarantee. While in the first loss guarantee as well, the guarantor is exposed to the losses of the entire pool of Rs 100 crores, the risk of the protection seller is limited to Rs 10 crores only. The difference in case of the full loss guarantee is that the risk of the protection seller is the full value of Rs 100 crores.

The kind of structured guarantees happening in the market, were usually thick enough to absorb entire losses of a given pool. Hence, though the maximum losses that protection sellers can incur is limited, effectively, the guarantee provider would mostly absorb the entire losses of the pool, providing a double protection, if not the complete protection.

Let us now take the case of loan-by-loan guarantee. Assuming the guarantor agrees to guarantee all the loans in the pool, adding up to Rs 100 crores – there is no difference between the full loss guarantee at pool level, and loan-by-loan guarantee of all the loans in the pool.

Putting a variation – assuming the guarantor guarantees each loan in the pool and puts a limit of 10% of the losses from that particular loan. This is a case of a partial guarantee. It is not a pool-level guarantee. If one loan in the pool of Rs 100 crores goes bad, the guarantor takes only 10% of the losses, as opposed to the guarantor taking all the losses upto Rs 10 crores in the case of the first loss default guarantee.

Capital Treatment of Structured Guarantees

Financial sector entities are required to maintain capital against their “exposures”, to ensure risk absorption at equity level itself. Guarantees issued by a financial sector entity is an exposure for the entity and hence, capital is to be allocated by treating it as off-balance sheet exposure. Financial guarantees carry a conversion factor of 100%.

However, the point for consideration would be the amount of capital to be allocated. That is to say, in case the risk of the lender is capped at a certain percentage of the pool, will capital be provided against the entire pool or be limited to the capped exposure.

Undoubtedly, the capital allocation would be for the entire pool, as the exposure of the guarantee provider would be on the entire pool, that is to say if one loan defaults in the pool the entire default is to be provided for by the guarantee provider. The capping merely limits the losses and only to that extent the capital would also be limited.

Structured guarantee can also be equated to the credit enhancement in case of a securitisation transaction, where the credit enhancement provided by the originator is limited to a certain percentage, however, in essence it absorbs all the losses of the pool. Accordingly, the credit enhancements are completely deducted from the capital of the originator.

Reference can further be made to Para 2 (iii) of the Review of Prudential Norms – Risk Weights for Exposures guaranteed by Credit Guarantee Schemes (CGS)[1] which provides that:

“In case of a portfolio-level guarantee, effective from April 1, 2023, the extent of exposure subjected to first loss absorption by the MLI, if any, shall be subjected to full capital deduction and the residual exposure shall be subjected to risk weight as applicable to the counterparty in terms of extant regulations, on a pro rata basis. The maximum capital charge shall be capped at a notional level arrived at by treating the entire exposure as unguaranteed.”

Drawing the same reference, even for structure guarantees, capital will have to be maintained on the entire pool, however, the same will be subject to the maximum amount the guarantor is exposed to.

For example, for a FLDG against a pool of 100 crores, where the losses are capped at 10% the capital requirement would be lower of 15 crore (15% of 100 crores) and 10 crores (capping of losses), which is 10 crores.

Regulatory concerns on the Structured Guarantees

RBI has issued the Guidelines on Digital Lending on September 2, 2022 (‘Guidelines’). Guidelines were a major setback for the existing business model of several fintech entities and digital lenders, specifically due to the non-permissibility of structured guarantees.

Para 15 of the Guidelines reads as follows:

“15. Loss sharing arrangement in case of default:

As regards the industry practice of offering financial products involving contractual agreements such as First Loss Default Guarantee (FLDG) in which a third party guarantees to compensate up to a certain percentage of default in a loan portfolio of the RE, it is advised that REs shall adhere to the provisions of the Master Direction – Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021 dated September 24, 2021, especially, synthetic securitisation contained in Para (6)(c).”

Further, the footnote 8 states- “synthetic securitisation” means a structure where credit risk of an underlying pool of exposures is transferred, in whole or in part, through the use of credit derivatives or credit guarantees that serve to hedge the credit risk of the portfolio which remains on the balance sheet of the lender.

Synthetic securitisation is a structure whereby instead of transferring a pool of loans, the risk of the pool is transferred. Mostly, the device used is credit default swaps, but the more traditional instrument of guarantee is also referred to in the definition of synthetic securitisation by the RBI.

Going by the text of the aforesaid para, it could mean that any form of risk transfer in a pool of loans by any lender, to a third party, is not permitted.

However, it may be noted that the regulator has compared structured guarantees to synthetic securitisation. A synthetic securitisation relates to pool level credit risk. Hence, there is no reason to apply the regulations to loan-specific guarantees, commonly provided in the form of bank guarantee.

[1] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12384&Mode=0

Related write-ups:

- FAQs on Digital Lending Regulations – https://vinodkothari.com/2022/08/faqs-on-digital-lending-regulations/

- Digital lending: Footnote prescriptions heavier than the headlines – https://vinodkothari.com/2022/09/digital-lending-footnote-prescriptions-heavier-than-the-headlines/

- RBI Regulations on Digital Lending: FLDGs come under regulatory ambit – https://vinodkothari.com/2022/08/rbi-regulations-on-digital-lending/

- Refer to our article on the revival of synthetic securitisation here –https://vinodkothari.com/2022/03/resurgence-of-synthetic-securitisations/

- Lending without risk and risk without lending: The new paradigm of lending partnerships in India – https://vinodkothari.com/2022/07/lending-without-risk-and-risk-without-lending/

So useful article