Revised ODI Norms: A step towards greater clarity & liberalization?

FCS Vinita Nair | Senior Partner, Vinod Kothari & Company | corplaw@vinodkothari.com

Investments by Indian entities outside India is a very common phenomenon and several companies have presence outside India by virtue of forming a Joint Venture (‘JV’) and Wholly Owned Subsidiaries (‘WOS’). While the intent is to permit investment overseas, however, with reasonable fetters to ensure that money is not siphoned outside India. Hence, the prescribed limits along with approval and reporting requirements.

With the enforcement of amendment proposed in Finance Act, 2015 in October, 2019[1] powers vested with Central Government (CG) and Reserve Bank of India (RBI) with respect to permissible Capital Account Transaction were revisited. Power to frame rules relating to Non-Debt instruments (‘NDI’) were vested with CG and to frame regulations relating to debt instruments were vested with RBI. The scope of NDI inter alia covers all investment in equity instruments in incorporated entities: public, private, listed and unlisted; acquisition, sale or dealing directly in immoveable property.

RBI, with effect from August 22, 2022 has combined erstwhile FEMA (Transfer or Issue of Foreign Security) Regulations, 2004[2] (‘erstwhile ODI regulations’) and FEMA (Acquisition and Transfer of immovable property outside India) Regulations, 2015[3] into FEMA (Overseas Investment) Rules, 2022[4] (‘OI Rules’) and FEMA (Overseas Investment) Regulations, 2022[5] (‘OI Regulations’) and the erstwhile regulations stand superseded. The draft rules and regulations were rolled out for public comments on August 9, 2021[6]. Our article on the draft regulatory framework is available on our website[7]. RBI has also issued the compiled FEMA (Overseas Investment) Directions, 2022 (‘OI Directions’) [8] covering the operational requirements under OI Rules and OI Regulations along with guidance on the interpretation, grouping the requirements under three categories viz. General provisions, Specific provisions and Other operational instructions to the AD Banks. It also provides for certain compliance requirements from the erstwhile ODI Master Directions, not covered in OI Rules or Regulations.

Overseas Investments are prohibited unless made in accordance with the FEMA Act, OI Rules and OI Regulations. The investments already made in accordance with the erstwhile ODI Regulations will be deemed to have been made under OI Rules and Regulations. This article provides an overview of the notified rules and regulations and the broad amendments as compared to the erstwhile norms and also highlights on certain points which bring clarity or ambiguity to be able to justify the question as stated in the title of the article.

OI Rules v/s OI Regulations

OI Rules provides the regulatory framework for making of overseas investment covering the permissions, conditions for making overseas investment, restrictions from making Overseas Direct Investment (‘ODI’), pricing guidelines, transfer, liquidation and restructuring of ODI. While the OI Rules have been framed by CG, however, the same will be administered by the RBI as per Rule 3 (1).

OI Regulations, on the other hand, provides only the operational part covering conditions for undertaking Financial Commitment (‘FC’), investment in debt instruments, consideration in case of acquisition or transfer of equity capital of a Foreign Entity (‘FE’), mode of payment, obligations of Persons Resident in India (‘PRII’), reporting requirements, consequence of delay in reporting and restrictions on further FC/ transfer.

Non-applicability of OI Rules and Regulations (Rule 4) [Clarified]

- Investments made by a financial institution in an IFSC. The draft OI Rules provided for exclusion of any investment made in IFSC, however the OI Rules prescribes the conditions for investment in IFSC vide Schedule V to OI Rules;

- Acquisition or transfer of any investment outside India made out of Resident Foreign Currency Account (draft rules provided for exception only in case of acquisition of an immoveable property outside India by an individual from a person resident outside India. However, Para A.5 of erstwhile ODI Master Directions[9] exempted purchase/ acquisition of securities out of the funds held in the RFC account);

- Acquisition or transfer of any investment outside India made out of foreign currency resources held outside India by a person who is employed in India for a specific duration irrespective of length thereof or for a specific job or assignment, duration of which does not exceed three years; or

- Acquisition or transfer of any investment outside India made in accordance with Section 6 (4) of FEMA Act i.e. where the investment in the foreign security or any immovable property situated outside India was acquired when the person was resident outside India or inherited from a person who was resident outside India.

Further, the erstwhile ODI Master Directions provided general permission for purchase/acquisition of securities by a person resident in India as bonus shares on existing holding of foreign currency shares and also for rights shares against holding of shares in accordance with provisions of law. The OI Rules cover the same under Rule 7.

Concept of control [Rule 2 (1) (c)] [Ambiguous]

The definition of control has been newly inserted. The definition provides for exercise of control evident from the right to appoint majority of directors or to control management or policy decisions. This right may be exercised by a person or persons acting individually or in concert. It may be direct or indirect. The mode of exercising the right in the entity could be i) by virtue of their shareholding or ii) management rights or iii) shareholder agreements or iv) voting agreements that entitle them to 10% or more of voting rights or v) in any other manner.

The mode of exercising control could be any of the five modes, however, the fact of exercising control should be evident either from the right to appoint majority of directors or to control management or policy decisions. Similar definition, except for the 10% voting rights threshold in case of voting agreements, is provided under Companies Act, 2013.

The concept of control is relevant for the purpose of determining eligibility to invest in debt instruments or lend to or provide guarantee to or on behalf of the foreign entity of subsidiaries and for identifying subsidiary and step down subsidiary (‘SDS’) of a listed foreign entity.

However, the note provided in the OI Directions for restriction on layers of subsidiaries provides that foreign entity will be said to have control if it holds a stake of 10% or more in an entity. This will frustrate the criteria provided in the definition.

Concept of Foreign Entity (‘FE’) [Rule 2 (1) (h)] [Clarified, Liberalized]

The OI Rules substitute the term JV and WOS with FE that comprise of entities with limited liability, formed or registered or incorporated outside India or in an IFSC, and of unincorporated entities with core activities in strategic sector. The OI Directions further explain that the underlying condition is that the liability of PRII should be clear and limited. The term strategic sector has been defined to include energy, natural resources sectors such as Oil, Gas, Coal, Mineral Ores, submarine cable system and start-ups.

While the OI Rules and Regulations are silent in case of investment vehicle set up in the form of trust, the OI Directions stipulates the conditions that liability of the PRII should be clear and limited to the extent of interest or contribution in the fund and that the trustee should be a PROI.

Components of Overseas Investment (Rule 2) [Clarified, Liberalized]

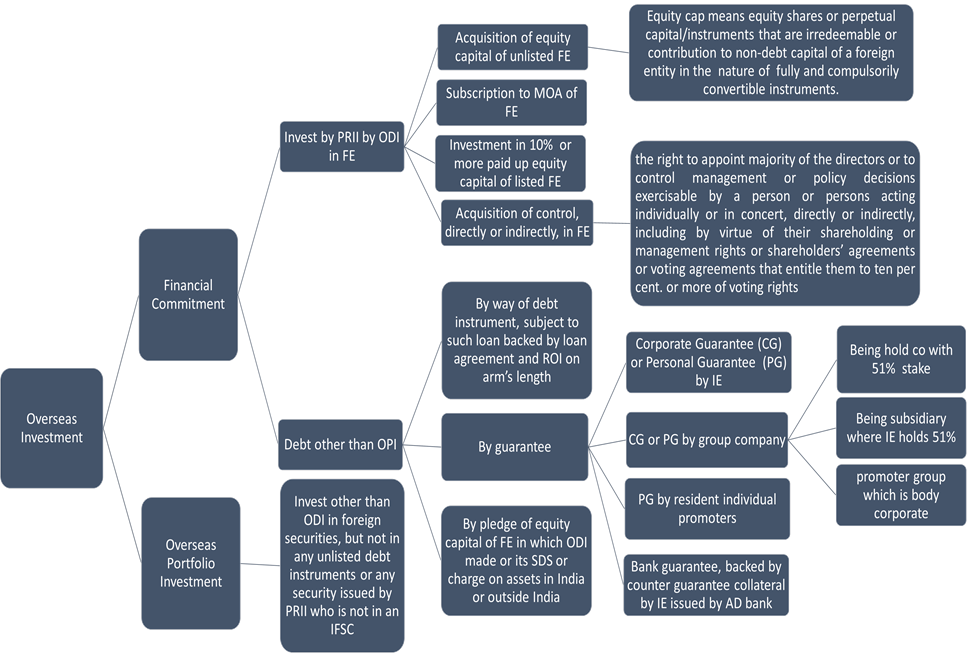

Under the erstwhile ODI regulations, effective till August 21, 2022, there was a concept of direct investment outside India in JV and WOS, which excluded portfolio investment, and FC. OI Rules combine the two to define FC and separately define the term Overseas Portfolio Investment (‘OPI’). Overseas Investment (‘OI’) is FC + OPI. The classification as ODI depends on the nature of instruments in which investment is made, the nature of the entity in which investment is made and whether control has been acquired or not. The diagram below provides a snapshot of the same.

Classification of ODI is also important for determining the eligibility in lending or investing in any debt instrument or extending fund or non-fund based commitment to or on behalf of a foreign entity or its subsidiary or SDS.

ODI v/s OPI [Clarified, not Liberalized]

OPI means investment in foreign securities that is not ODI and excludes investment in any unlisted debt instruments or any security issued by a person resident in India who is not in an IFSC. The classification is relevant as Schedule I and II to the ODI Rules provides for the manner in which ODI and OPI can be made by an Indian Entity. The limits for OPI and ODI are different. In case of ODI by IE, the limit for FC[10] in all FEs taken together is 400 % of the net worth as on the date of the last audited balance sheet, while in case of OPI the limit is 50% of the net worth as on the date of the last audited balance sheet.

The limit of FC does not include capitalization of retained earnings but includes utilization of balances in the EEFC a/c., utilization of the amount raised by issue of ADR, GDR and stock swap and utilization of ECB proceeds. This was excluded under the erstwhile regime and in order to ensure smooth transition, as indicated in the OI Directions, the amounts invested till August 21, 2022[11] shall not be reckoned towards FC. FC through such resources from the date of notification will be reckoned towards FC limit. Limits for investment by resident individual is pegged to the limit under the Liberalized Remittance Scheme (‘LRS’). Further, the limit for investment by mutual funds, venture funds etc are similar to erstwhile regime.

A listed IE is eligible to make OPI within the aforesaid limit, however, an unlisted IE is eligible to make OPI only towards rights issue or bonus issue by FE, capitalization of any amount due, swap of securities and schemes of arrangement.

Restriction on layers of subsidiary (Rule 19) [Ambiguous]

RBI FAQs on erstwhile ODI Regulations[12] prohibited an India Party to set up an Indian subsidiary(ies) through its foreign WOS or JV and also prohibited an Indian Party to acquire a WOS or invest in JV that already had direct/indirect investment in India under the automatic route. In such cases, the Indian Parties were required to approach the Reserve Bank for prior approval through their AD Banks which were considered on a case to case basis, depending on the merits of the case.

Under the present OI Rules, the prohibition is applicable only where it results in a structure with more than two layers of subsidiaries. The exemption is provided to the entities covered under Rule 2 (2) of Companies (Restriction on Number of Layers) Rules, 2017. The OI Rules seems to have diluted the stringent approval based norms under the erstwhile provisions.

Further, the restriction is applicable only when there is an inward remittance in India. Few illustrations:

Case 1: X Ltd ————–> Y Inc ————–> Z gmbh ————–> A Pte = No restriction

Holds 51% Holds 51% Holds 51%

Case 2: X Ltd ————–> Y Inc ————–> Z Ltd ————–> A Ltd = More than 2 layers

Holds 51% (L1) Holds 10% (L2) Holds 51% (L3)

In view of the definition of subsidiary and SDS, control by FE is a pre-requisite. However, the OI Directions provide that holding of 10% stake will result in a control. This will result in a complex situation, as given below:

Case 3: X Ltd ————–> Y Inc ————–> Z Ltd ————–> A Ltd = More than 2 layers?

Holds 51% (L1) Holds 10% (L2) Holds 10% (L3)

If the threshold of 10% is considered for determining subsidiary and SDS, irrespective of whether there is a right to appoint majority of directors or to management or policy decisions, this will be breached by several entities as 10% stake is not a significant limit. Additionally, as per the OI Directions, no further layer shall be added post notification of the OI Rules/ Regulations. If this is to mean 10% stake, it will be bit far stretched. Hence, the primary condition of control through any of the 5 modes should be the ideal interpretation of the definition.

As per OI Directions, the subsidiary and SDS is also required to comply with the structural requirements of FE i.e., limited liability unless the core activity is in strategic sector.

The carve out of investing upto 2 layers of subsidiaries is available only to an IE. There is an absolute prohibition for resident individuals from making or holding ODI in FE that has subsidiary or SDS, even if the individual has control in FE. Only carve provided to individuals in cases of ODI pursuant to inheritance, acquisition of sweat equity shares, qualification shares for holding management post in a foreign entity and acquisition of shares or interest under ESOP or Employees Benefits Scheme. Similarly, resident individuals are prohibited from making ODI in FE in IFSC if that FE has any subsidiary or SDS outside IFSC.

Investment in debt instruments by Indian Entity (IE) (Reg. 3) [Clarified]

The distinction between debt and non-debt instruments as provided in Rule 5 of the OI Rules is relevant as OI Regulations provide for conditions to be complied by an Indian entity while investing in any debt instrument. The components of non-debt instruments are the same as defined under FEMA (Non-Debt Instruments) Rules, 2019. Debt instrument means government bonds, corporate bonds, all tranches of securitisation structure which are not equity tranche, borrowings by firms through loans and depository receipts whose underlying securities are debt securities.

The underlying conditions for investing in debt instruments of an FE, as provided in Reg. 3 of OI Regulations, is that the entity should be eligible to make ODI and should have made ODI in the foreign entity and the entity should have acquired control in such foreign entity at the time of making such financial commitment. Here as well, the interpretation of control cannot be regarded as 10% of the stake as it will be extremely easy to acquire such stake and start investing in debt securities of an unlisted FE, with the FC limit.

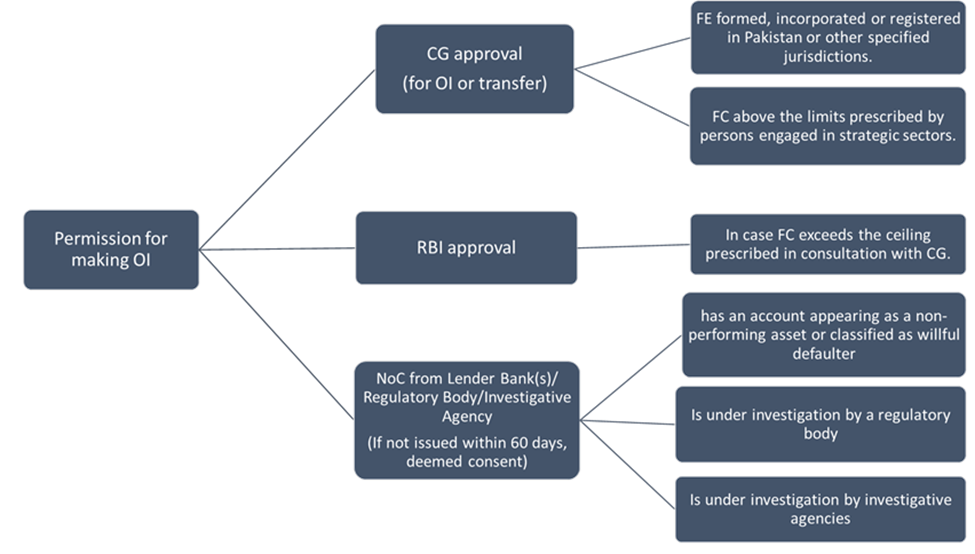

Approval requirement [Liberalized]

The OI Rules provide for investments that will require prior approval of CG, RBI and NOC from lender banks/ regulatory bodies etc. The Erstwhile ODI Regulations only mandated prior approval of RBI in case eligibility conditions stipulated were not met by the Indian party or resident individual.

The erstwhile ODI Master Directions prohibited an Indian Party from making direct investment in countries identified by Financial Action Task Force (‘FATF’) as ‘non co-operative countries and territories’ as per the list available on FATF website or as notified by RBI. The OI Rules do not expressly provide for such prohibition, however, empowers the CG to advise countries or jurisdictions where overseas investment shall not be made.

Further, as provided in the erstwhile ODI Master Directions for prior approval of RBI for any FC exceeding USD 1 billion or its equivalent in a financial year even when the total FC of the Indian Party was within the eligible limit under automatic route (i.e. within 400% of the net worth as per the last audited balance sheet), the requirement continues under the current regime as well.

Procedure for seeking approval of RBI has been provided in the OI Directions.

Approval requirement has been dispensed for deferred payment of consideration, investment/ disinvestment by PRII under investigation by any investigative agency/ regulatory body, issuance of corporate guarantee to or on behalf of second or subsequent step down subsidiary and write-off on account of disinvestment.

The concept of ‘deemed consent’ in case of NOCs upon expiry of sixty days from the date of application may be a cause of concern for the lenders/ banks/ regulatory agencies etc.

OI by Resident Individuals (RIs) (Rule 13, Sch. III) [Clarified]

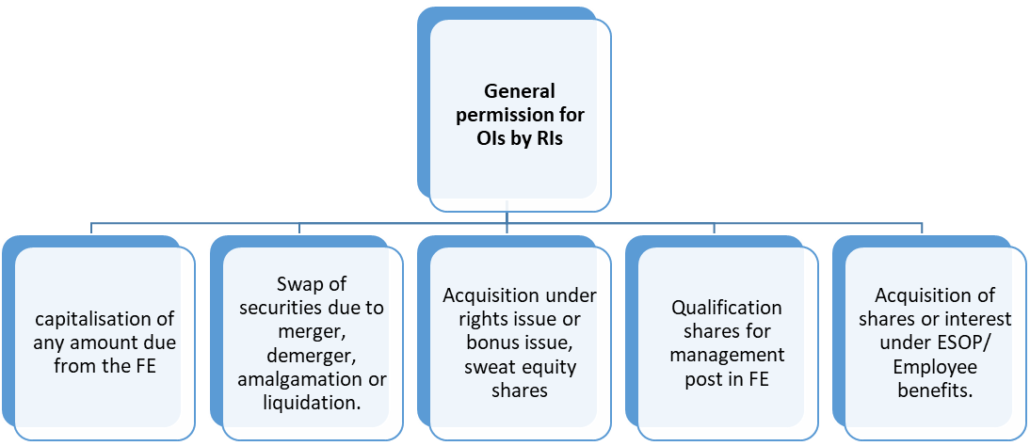

ODI by RIs in JV/ WOS under Reg. 20A read with Schedule V of the erstwhile regime was permitted subject to the entities being engaged in bonafide business activity and located in FATF compliant countries. The limit of investment was capped at the limit under Liberalised Remittance Scheme (LRS) including investment out of balances held in EEFC/ RFC account. It was required to be an operating entity with no SDS acquired or set up by the said JV/WOS. Sectors prohibited for investments were real estate business, banking business and financial services. Similar condition is provided in the present regime. Additionally, investment in FE engaged in gambling activity and dealing with financial products linked to the Indian rupee without specific approval of RBI are also prohibited. OPI is permitted by RIs, including by way of reinvestment. Further, the provisions provide general permission for OI by way of following

ODI in financial services activity [Liberalized]

The OI Rules permit an IE not engaged in financial services activity in India to make ODI in an FE, which is directly or indirectly engaged in financial services activity, except banking or insurance, subject to the condition that such IE has posted net profits during the preceding three financial years. With respect to insurance, an IE not engaged in the insurance sector can make ODI in general and health insurance where such insurance business is supporting the core activity undertaken overseas by such an IE. OI Directions clarify that a foreign entity will be considered to be engaged in the business of financial services activity if it undertakes an activity, which if carried out by an entity in India, will require registration with or regulated by a financial sector regulator in India.

The erstwhile provisions permitted only regulated entities in financial service activity to invest in JV or WOS, with approval of the regulator in India. Present regime makes it easier for a non-financial entity to invest in financial service activity as profit history is the only criteria.

Other key amendments notified

- Prohibition for making ODI, in addition to FE engaged in real estate activity, extended to gambling activity of any kind and dealing with financial products linked to the Indian rupee without specific approval of RBI. The OI Directions clarify that financial products linked to the Indian rupee include non-deliverable trades involving foreign currency-INR exchange rates, stock indices indexed to Indian market etc. [More Stringent]

- In case of ODI in start-ups, investment cannot be made out of borrowed funds. Necessary certification is to be provided to the AD Bank from statutory auditors or chartered accountants of IE. [More Stringent]

- In case of disinvestment of ODI by a PRII, the transferor must have held investment for atleast 1 year from the date of making OI (erstwhile ODI Master Directions provided for the overseas concern to have been in operation for at least one full year and submission of APR together with the audited accounts for that year to RBI); [Liberalized]

- In case of pledge or charge in favor of an overseas lender, the lender should be from a country or jurisdiction in which FC is permitted under OI Rules. [More Stringent]

- The OI Rules permit acquisition or transfer by way of deferred payment. The period of deferment to be decided upfront. In case of acquisition, the deferred part of the consideration in case of acquisition of equity capital of an FE by a PRII will be treated as a non-fund based commitment. Subsequent payments to be reported in Form FC as conversion of non-fund based commitment to equity. [Liberalized]

- In case of restructuring, under the erstwhile regime, RBI approval was required for an unlisted IE for restructuring the balance sheet of the overseas entity involving write off of upto 25% of the investment. In case of listed IE, the same was permitted upto 25% of the investment under automatic route. The present OI Rules, restructuring of the balance sheet is permitted for FE which has been incurring losses for the previous two years as evidenced by its last audited balance sheets, compliance has been ensured for reporting and documentation and the diminution in the total value of the outstanding dues after such restructuring does not exceed the proportionate amount of the accumulated losses. Prerequisite is a certification for the diminution in value on an arm’s length basis by a registered valuer as per the Companies Act, 2013 (18 of 2013) or corresponding valuer registered with the regulatory authority or certified public accountant in the host jurisdiction, dated not more than six months before the date of the transaction shall be submitted to the designated AD bank. The requirement of certificate will apply only where the amount of corresponding original investment is more than USD 10 million or in the case where the amount of such diminution exceeds twenty per cent of the total value of the outstanding dues towards the Indian entity or investor. [Liberalized]

- Limit of FC upto 400% of net worth not applicable to FC made by “Maharatna” PSUs or “Navratna” PSUs or subsidiaries of such PSUs in foreign entities outside India engaged in strategic sectors. Strategic sectors defined to include energy and natural resources sectors such as Oil, Gas, Coal and Mineral Ores, submarine cable systems, start ups and any other sector that may be advised by CG. [Clarified]

- Definition of net worth has been aligned with Companies Act, 2013. [Clarified]

- Bonafide activity defined to mean such business activity permissible under any law in force in India and the host country or host jurisdiction, as the case may be. [Clarified]

- AD Banks to put in place a board approved policy, within 2 months from the date of the OI Directions i.e. by October 22, 2022 inter alia providing documents to be taken by the AD Bank, method of valuation to be taken into consideration, scenarios when valuation will not be insisted for etc.

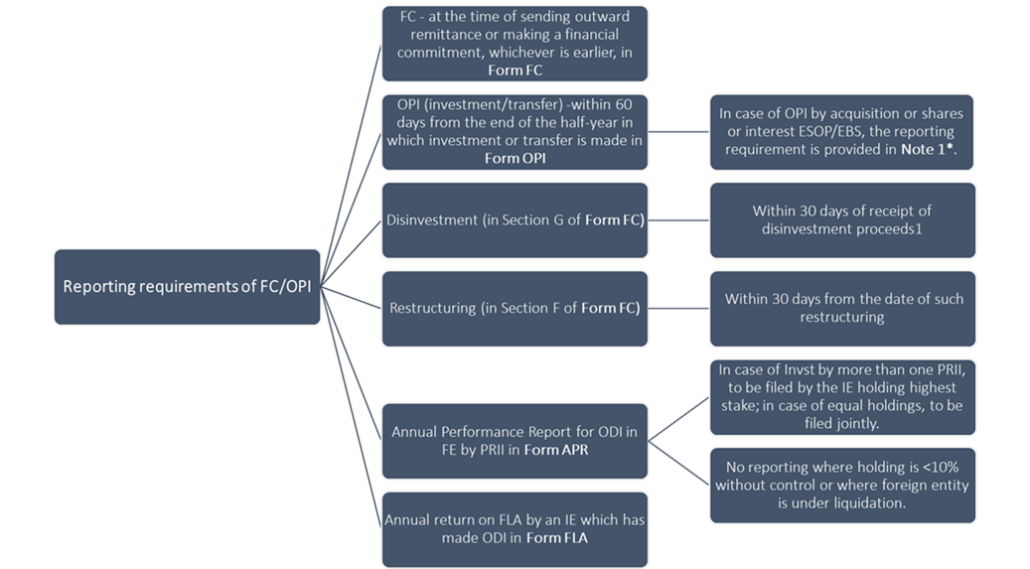

Reporting requirements (Reg. 10) [Clarified]

The OI Regulations provide for various reporting requirements for FC and OPI including in case of disinvestment and restructuring. Reporting is very crucial as the OI Rules provide for prohibition on further FC or transfer to continue until any delay in reporting is regularized with payment of Late Submission Fees (‘LSF’) for an amount and in the manner as provided in the OI Directions. LSF amount is levied per return and the maximum amount for LSF will be limited to 100% of amount involved in the delayed reporting. The erstwhile ODI regulations restricted only in case of non-filing of Form APR. The format of forms have been provided in the Master Directions on Reporting under FEMA Act[13]. Incomplete filing will be considered as non-submission.

*Note 1: In case of OPI by way of acquisition of shares or interest under Employee Stock Ownership Plan or Employee Benefits Scheme, the reporting is required to be done by the office in India or branch of an overseas entity or a subsidiary in India of an overseas entity or the Indian entity in which the overseas entity has direct or indirect equity holding, where the resident individual is an employee or director.

Further, as per the OI Directions, similar to the requirement under the erstwhile regime, evidence of investment that classify as ODI is required to be submitted within a period of six months to the AD Bank.

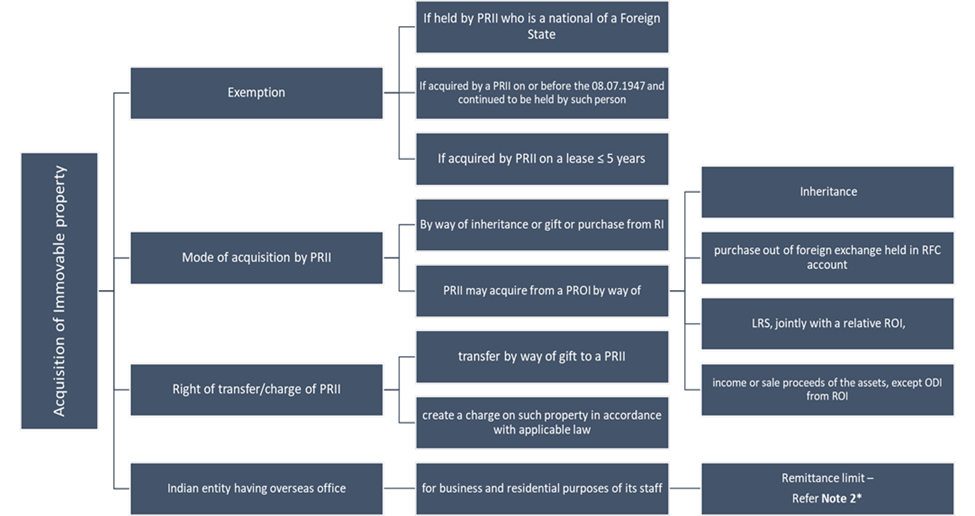

Acquisition and transfer of immovable property outside India [No change]

- Restriction on acquisition of immovable property outside India will not apply in case the same is acquired on lease by PRII for a period not exceeding 5 years. Manner of transfer of immovable properties also prescribed.

- Source of funds for acquiring immovable property outside India to include limits under Liberalised Remittance Scheme (LRS) and out of income/ sale proceeds of the assets, other than ODI, acquired overseas.

*Note 2: In case of acquisition by Indian entity, the existing limits for remittance towards initial and recurring expenses remain intact, as provided below:

- Initial expense – higher of 15% of the average annual turnover during last 2 years or 25% of the net worth of the IE;

- Recurring expense – 10% of the average annual turnover during last 2 years

Amendments proposed but not notified

- ODI in technology ventures through an Overseas Technology Fund (OTF) permitted for listed IE with minimum net worth of Rs. 500 crore, for the purpose of investing in overseas technology startups engaged in an activity which is in alignment with the core business of such IE.

- Permissible range of 5% of the fair value arrived on an arm’s length basis as per any internationally accepted pricing methodology for valuation duly certified by a registered valuer as per the Companies Act 2013; or similar valuer registered with the regulatory authority in the host jurisdiction to the satisfaction of the AD bank provided along with period of validity of valuation certificate upto 6 months before the date of the transaction.

Concluding remarks

The new regime for OI, substituted after 18 years of the erstwhile regime, is more clear and liberal in several matters and covers conditions for investments overseas by IE, resident individual and entities other than the IE and the individuals. Certain compliance requirements have been liberalized, where approval requirements have been done away with as discussed in above paragraphs; at the same time consequence of delayed reporting has been made more stringent. Few of the amendments w.r.t meaning of control, layers of subsidiaries are ambiguous and may either result in a hurdle or a loophole, depending on the objective.

Most of the amendments proposed in the draft rules and regulations have been notified except for very few. IEs are required to take note of the components of the existing investments, the reporting compliances ensured and structure further overseas investments in line with the revised OI Rules/ Regulations.

[1] https://egazette.nic.in/WriteReadData/2019/213265.pdf

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=2126&Mode=0

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=10257&Mode=0

[4] https://rbidocs.rbi.org.in/rdocs/content/pdfs/GazetteRules23082022.pdf

[5] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12380&Mode=0

[6] https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=52026

[7] https://vinodkothari.com/2021/08/rbi-rationalizes-regulatory-framework-overseas-investment/

[8] https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NT110B29188F1C4624C75808B53ADE5175A88.PDF

[9] https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10637#F1

[10] Does not include capitalisation of retained earnings but includes utilization of the amount raised by issue of ADR, GDR and stock swap and utilisation of ECB proceeds.

[11] Prior to the date of notification of OI Rules/ Regulations

[12] https://m.rbi.org.in/scripts/FAQView.aspx?Id=32#Q64

[13] https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10202

For the filing of 31st Dec 2022 — whether filing needs to be carried out in revised format ?

Hi Vinita,

Through this article you have very well covered the insights nitty gritty of ODI rules & regulations. Truly apprehensible.

I just want one clarity on Overseas Investment proposed to be made by Resident Indian.

1. Mr. X (Resident Individual) being a promoter of Company ‘A’ (Unlisted Public Company) in India wants to make foreign/outward remittance by way of acquiring equity shares of Foreign Entity ‘B’ (Unlisted Foreign Company) within the threshold of 10%. Can Mr. A make outward remittance within the overall limit prescribed under Liberalized Remittance Scheme. i.e. 2,50,000$ per FY.

2. As per recently changed guidelines, rules or regulations, Whether Mr. X (Resident Individual) can make investment through ODI or OPI route.

Your response will be highly appreciated

https://www.taxmann.com/post/blog/opinion-rbi-notifies-revised-regulatory-framework-on-overseas-investment/

Taxmann has copied the exact article and pasted on their website, above is the link for reference.

Hi Sir,

Thank you for your comment and concern! This post was also sent to Taxmann for publishing on their website.