FAQs on Large Exposures Framework (‘LEF’) for NBFCs under Scale Based Regulatory Framework

Financial Services Division | (finserv@vinodkothari.com)

1. Applicability –

1.1. What is the intent behind the LEF?

Response: Regulation and control of “large exposures” is a part of financial sector regulations globally to control concentration of exposures (thus, risks) to a few individuals/entities/groups. The Basel Committee of Banking Standards has been having recommendatory pieces on this topic since 1991, if not earlier. The Basel standard subsequently became a part of the Basel capital adequacy framework.

There is a large exposures framework in case of banks as well.

The intent behind the large exposure framework, which essentially limits the exposures to a single entity or group or group of economically interdependent entities is to strengthen the capital regulations. Capital regulations prescribe minimum capital in case of financial entities. The adequacy of capital is obviously connected with the risks on the asset side – hence, if the assets represent exposure in a single borrower or economically connected group of borrowers, a credit event with respect to such borrower may deplete the adequacy of capital very quickly. Hence, regulators limit the exposure to a single entity or a group.

There might be other forms of credit concentrations – for example, sectoral or geographical concentrations – these are not captured by the Framework.

1.2. To which entities shall the LEF be applicable?

Response: The Framework is applicable only to Upper Layer entities. Additionally, it is to be noted that since LEF is to be applied at group level (para 3.1), entities which are subsidiaries or associates of UL entities will also have to report their exposures, for the purpose of consolidation at the consolidating parent’s level.

1.3. Are there any credit concentration limits in case of entities not covered by the LEF?

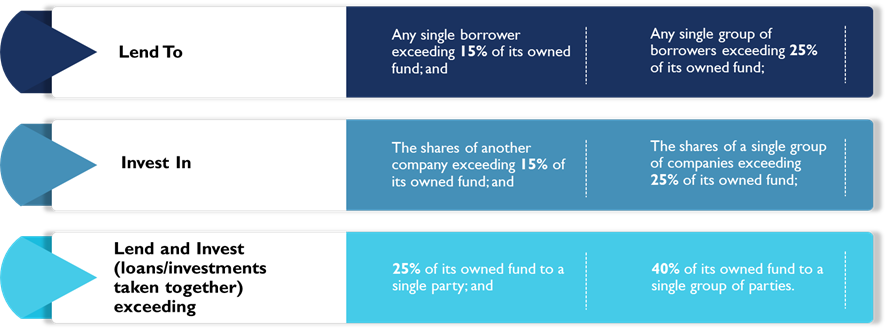

Response: The NBFC- NDSI Master Directions (para 23) already prescribe concentration norms for NBFC-NDSI (which would . Therefore, an NBFC-NDSI not falling under the LEF will still be required to comply with the existing concentration norms prescribed by the NBF-NDSI Master Directions. The same have been provided below –

1.4. How do we compare the existing credit concentration limits, applicable to UL entities, and the LEF? What are the significant changes?

The existing credit concencentration limits apply to all NBFC-NDSI which would even include entities that will be classified as NBFC-UL. Once an NBFC is identified as an NBFC-UL, the LEF shall become applicable instead of the credit concentration limits. The following are the significant changes brought by the LEF.

I. Changes in limits on exposures –

The limits on exposures are stricter under the LEF.

| Exposure | Limits under credit concentration norms | Limits under LEF |

| Exposure on individual/ single counterparty | 15% investment or lending exposure of NOF25% total exposure (lending and investment) of NOF (Single counterparty limit shall not exceed 25% in any case) | 20% of eligible capital baseAdditional 5% with Board approvalAdditional 5% if exposure towards Infrastructure loan/investment |

| Exposure on group exposure | 25% investment or lending exposure of NOF40% total exposure (lending and investment) ‘Group’ to be determined by the NBFC | 25% of eligible capital baseAdditional 10% if exposure towards Infrastructure loan/investment ‘Group’ to mean group of ‘connected counterparties’ as specified under LEF. |

II. Eligible capital base

The exposures shall be calculated as a percentage of the eligible capital base i.e. Tier I capital plus profits accruing for the year.

III. Concept of ‘connected counterparties’

Determination of borrowers that will be identified in a ‘group’ while calculating group exposure is left to be determined by the NBFC under its policy on exposures to a single party / a single group of parties. However, under the LEF, group exposure is to be determined by way of exposure to a ‘group of connected counterparties’ in line with the specifications provided by RBI, where entities either satisfy the control criteria or the economic independence criteria or both (explained later).

IV. Disclosure and reporting requirements

Any breach in the LEF limits will be reported to RBI and the NBFC shall not be allowed to undertake any further exposure (at the entity or group level, as the case may be) until the exposure is brought down within the limit.

Further, all large exposures shall be reported to RBI in the specified manner.

1.5. Please explain the general schematic of the LEF.

The following points may explain the general schematic:

- Disclosure requirements: Disclosure is required in case of all “large exposures”, that is, an exposure to a counterparty, or a group of connected counterparties (GCCs), equal to or exceeding 10% of the “eligible capital base” (ECB). Eligible capital base is the same as Tier 1 capital.

- Exposure limits:

- Single counterparty – 20% of ECB

- Single counterparty, with board approval under exceptional circumstances – 25% of ECB

- GCCs: 25% of ECB

- GCCs, with board approval under exceptional circumstances: 35% of ECB

- Limits in case of IFCs: additional exposure of 5% if ECB to a single courterparty and 10% in case of group of connected counterparties.

- How to compute the value of the exposure:

- Exposure is the total of on-balance sheet and off-balance sheet exposure. Off balance sheet exposure is captured as per the capital adequacy norms

- Exposure is allowed to be adjusted for any credit risk mitigation (CRM), as permitted under capital adequacy norms. This includes guarantees, credit derivatives, collateral, etc.

- How to establish GCCs:

- GCCs arise based on two parameters – control, and economic interdependence.

- GCC based on control: One person controlling the other, or both being under common control. See meaning of control below. Control may be direct as well as indirect.

- GCC based on economic interdependence: There are 8 indicia of economic interdependence between entities. Note two important points – economic interdependence may exist without any formal relationship, contract, common ownership or management between two entities. Hence, completely unrelated entities may be economically interdependent. Second, the 8 indicia are only indicative and not exhaustive. The idea is to test correlation risk between two entities, such that the credit risk in one entity is also associated with the credit risk of the other.

- Meaning of control: The two classic modes of control are still the same here – voting control and management control. However, control may be either by a person or persons, acting individually or in concert. Further, control may be direct or indirect. The instrumentalities of control may be voting rights, management rights, shareholders’ agreements, etc.

- Indicia of economic interdependence: Note that interdependence is mutual – it is not as if it is to be tested with reference to a particular entity. Therefore, if A depends on B, even if B does not depend on A, they are still interdependent.

- Transactional: 50% or more of the gross receipts or gross expenses derive from the same counterparty.

- Guarantor’s liability: The guarantor is economically dependent, if the beneficiary’s default may trigger the guarantor’s default due to the size of the exposure.

- Customer dependence: One party is a customer of another for a significant part of the output of the latter, and the customer cannot easily be replaced. “Significant part” not defined. However, it should be such that would make the business of the supplier economically unviable.

- Source of repayment: Common source of repayment of liabilities for both, and neither having independent source of income.

- Default correlation: Financial problems of one would impair the ability of the other to meet its obligations.

- Consequential insolvency risk: Insolvency of one is likely to cause insolvency of the other.

- Common and non-replaceable source of funding: The two parties rely on the same source of funding, and on default of the source, may not be able to replace the same

- Testing of economic interdependence necessary in all cases where exposure to a single party is 5% or more of the ECB.

1.6. What is meant by the eligible capital base of an NBFC? What is the significance of eligible capital base under the LEF?

Response: Eligible capital base shall mean Tier I capital + profits accrued during the year. The exposure limits are to be calculated as a percentage of the eligible capital.

1.7. What is meant by exposure? Which exposures qualify as large exposures?

Response: Exposure shall mean the total of on-balance sheet and off-balance sheet exposure of an NBFC in an entity, and the same shall be considered at solo as well as the group level i.e. for arriving at the aggregate exposure to an entity, the NBFCs exposure as well as exposure by other NBFCs in the group of the NBFC in question has to be aggregated. For instance, NBFC A and NBFC B are a part of the same group. While NBFC A has given loans to company D, NBFC B has given guarantee to a third party in favour of company D. Thus, here, for reckoning whether NBFC A is having a large exposure towards company D or not, NBFC A’s exposure will be aggregated with exposure value of NBFC B

Merely having an exposure to another entity will not bring such exposure under the regulatory lens under the LEF, since the intent of the RBI is to monitor exposures that shall have a bearing on the NBFC. Accordingly, a minimum cap of 10% of the NBFC-UL’s eligible capital base has been prescribed i.e. if the aggregate exposure to an entity or to a group of connected counterparties amounts to 10% or more of the NBFC-UL’s eligible capital base, the same would be classified as a “large exposure”.

1.8. Is exposure to sovereign or government-owned or controlled entities also covered by the Framework?

Response: Following exposures to sovereigns are exempted –

- Exposure to the Government of India and State Governments which are eligible for zero percent risk weight under capital regulations applicable to NBFC-UL;

- Exposure where the principal and interest are fully guaranteed by the Government of India i.e. any portion of an exposure guaranteed by, or secured by financial instruments issued by, sovereigns would be similarly excluded from the scope of this framework

Further, entities falling outside the scope of the above sovereign exemption are controlled by or are economically dependent on an entity that falls within the scope of the sovereign exemption and are otherwise not connected, those entities will not be deemed to constitute a group of connected counterparties.

1.9. Whether exposure to group entities of the NBFC shall also be covered?

Response: The NBFC’s exposure to group entities to the extent deducted from its Owned Funds to arrive at the NOF are exempt from the LEF.

1.10. Whether exposures to any specific sector are excluded from the LEF?

Response: Investment in the equity capital of an insurance company to the extent specifically permitted in writing by the RBI shall be exempted from LEF .

1.11. How do we calculate the value of exposures?

Response: As mentioned earlier, an exposure to a counterparty shall constitute both on and off-balance sheet exposures. The exposures shall be permitted to be offset with credit risk transfer instruments permitted in NBFC-Master Directions.

On-balance sheet exposure values will be based on accounting values while off-balance sheet exposure values will be converted to credit exposure equivalents through application of the credit conversion factors.

1.12. What are the exposure limits prescribed under the LEF?

| (as % of eligible capital base) | ||

| NBFC-UL (Other than IFC) | NBFC-UL (IFC) | |

| Single Counterparty | 20%Additional 5% with Board approvalAdditional 5% if exposure towards Infrastructure loan/investment (Single counterparty limit shall not exceed 25% in any case) | 25%Additional 5% with Board approval |

| Group of connected Counterparties | 25%Additional 10% if exposure towards Infrastructure loan/investment | 35% |

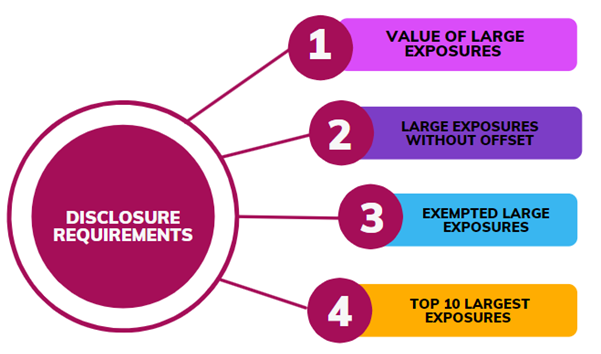

1.13. What are the reporting requirements under the LEF?

Response: There are two kinds of reporting to be made under the LEF –

- Reporting of large exposures –

NBFC-UL shall report its Large Exposures to RBI covering the following:

- All large exposures as per the definition;

- All other exposures, measured as specified in paragraph 6 of the LEF without offsetting exposure value with credit risk transfer instruments, where values stand equal to or above 10% of the eligible capital base;

- All exempted exposures with values equal to or above 10% of the eligible capital base;

- 10 largest exposures included in the scope of application, irrespective of the values of these exposures relative to the eligible capital base

- Breaches

- Any breach of Large Exposure limits shall be reported to RBI immediately.

1.14. Do concentration norms prescribed under the RBI Master Directions still apply to NBFCs?

Response: All NBFC-NDSI not classified as NBFC-UL shall still be governed by the credit concentration norms under the NBFC-NDSI Master Directions while NBFC-UL will follow the LEF.

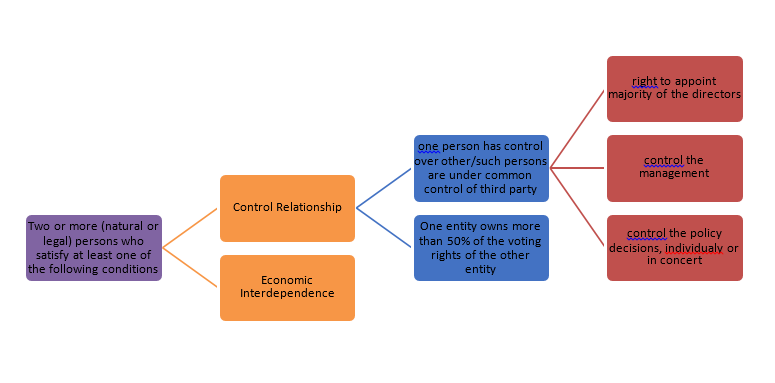

2. Definition of ‘Control’

2.1. What is the meaning of control?

Response: The two modes of control provided under the LEF are i) voting control and ii) management control.

Two parties will be considered to have a control relationship if one person directly or indirectly-

I. Will be having control over the other, or

II. If one entity owns more than 50 % of the voting rights of the other entity;

III. Such entities are under the common control of a third party (irrespective of whether the NBFC has exposure to the third party or not), or

The definition of control has been adopted from Section 2(27) of the Companies Act, 2013 to mean the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders’ agreements or voting agreements or in any other manner.

Control may be either by a person or persons, acting individually or in concert. Further, control may be direct or indirect. The instrumentalities of control may be by way of voting rights, management rights, shareholders’ agreements, etc.

Determination of a control becomes crucial as existence of a control relationship is one of the factors of determining exposure to a ‘group of connected counterparties’.

2.2. Does the definition of Control continue to apply to a corporate entity undergoing insolvency resolution process or an entity undergoing liquidation?

Response:

CIRP (where not initiated by the corporate debtor itself) or liquidation (except voluntary liquidation) is an involuntary process.

When an entity enters into a CIRP or liquidation, the resolution professional or the liquidator respectively, takes over the management and control of such entity. Control, in such cases, ceases to rest with the promoters/ Board and all the decisions with respect to such entities are taken by the RP or the liquidator, as the case may be. Further, due to section 29A of the IBC, 2016, the management or the promoters cannot even subsequently take control/ ownership in such entity. Therefore, presence of a control relationship cannot not be assumed in such cases.

Accordingly, once an entity enters into CIRP or liquidation, the definition of control ceases to apply and such exposures cannot be considered for the purpose of determining a group of connected counterparties.

For example, an NBFC has extended loans to entities A, B and C where B and C are controlled by A. Going by the definition of control, the NBFC shall consider all the three entities to determine its group exposure. However, in case entity C enters into CIRP, A ceases to exercise any control over A and therefore, the group exposure of the NBFC shall be computed only as an aggregate of its exposures to A and B.

2.3. Does the definition of Control apply to Government companies?

Response: Entities that are controlled or are economically dependent on sovereigns which shall include Government companies will not be deemed to constitute a group of connected counterparties and therefore, shall be exempt from the definition of control.

3. Definition of ‘Group of connected counterparties’

Large exposures not only to single counterparty but also to a group of ‘connected counterparties’ are intended to be regulated by the LEF. When a group of counterparties are connected with specific relationships and dependencies in a way that a failure of one of the connected counterparties could lead to cascading effect on the other counterparties as well, the exposure limit applies to the aggregated exposures to such group of connected counterparties also instead of only to an individual counterparty. The LEF Framework specifies that two parties are connected if at least one of the following criteria is satisfied: (i) a control relationship, where one of the counterparties has direct or indirect control over the other; and/or (ii) economic interdependence, where, if one of the counterparties were to experience financial problems, the same would also impair the financial position of the other counterparty as well.

3.1. If following the chain of control the NBFC-UL (‘Applicable Company’) reaches a non-corporate entity does it need to investigate further the control/ownership structure of such an entity?

Response: One entity is said to have control over the above when:

One person directly or indirectly, has control over the other(s), or such persons are under the common control of a third party (irrespective of whether the NBFC has exposure to the third party or not). Control relationship criteria is automatically satisfied if one entity owns more than 50 percent of the voting rights of the other entity;

For determining a control relationship, reference is made to the term “person”. Herein, person, shall include both, natural as well as legal persons. Thus, in case parameters provided under the LEF are satisfied, non-corporate entities will also come under the purview of control relationship. Thus, applicable NBFCs shall be required to investigate till the last layer of persons – whether legal or natural to determine if a control relationship exists between a group of persons.

3.2. If following the chain of economic dependence the applicable NBFCs reaches a non-corporate entity does it need to investigate further the economic interactions of such an entity?

Response: As we see above, non-corporate entities shall also be considered for the purpose of determining control relationship between parties. Similarly, natural as well as legal persons shall be considered for determining economic dependence between parties. Thus, the company will be required to investigate till the last layer of persons – legal or natural – to determine if one person is economically dependent on the other.

3.3. In calculating the 50% threshold (in terms of the counterparty’s gross receipts/expenditure) should the NBFC-UL consider the entity’s last audited financial statements?

Response: For determining the 50% threshold limit, gross receipts or gross expenditure shall be considered on an annual basis. For conclusively determining the same on an annual basis, the receipts/expenditure should be considered as per the last audited financial statements of the entity.

3.4. The indicia of economic interdependence includes a contract of guarantee where one counterparty has fully or partly guaranteed the exposure of the other counterparty, and the exposure is so significant that the guarantor is likely to default if a claim occurs. Will obtaining a declaration of solvency from the guarantor by the NBFC-UL be sufficient for it to conclude that the guarantor is unlikely to default for the purpose of determining economic interdependence between the debtor and the guarantor?

Response: For determining solvency of such other party, a declaration of solvency may serve as a proof that the guarantor is not likely to default in case the . However, the same cannot be treated as a conclusive proof of the guarantor’s solvency. In case the guarantor defaults subsequently, the same shall be factored in while considering the economic interdependence between the parties.

3.5. Will economic interdependence not arise if the source of funds to repay the loans is from the Government or a Government backed entity (Refer para 4.3 of these Guidelines)?

Response: Where two (or more) entities falling outside the scope of the sovereign exemption are controlled by or are economically dependent on an entity that falls within the scope of the sovereign exemption {paragraph 4.1(a)}, and are otherwise not connected, those entities will not be deemed to constitute a group of connected counterparties.

3.6. Is there any regulatory prescription as to what will constitute ‘difficulties’ in terms of full and timely repayment of liabilities by the counterparty?

Response: The Guidelines prescribes certain parameters on the basis of which two parties may be said to have “economic interdependence”. One such parameter is as follows:

Where it is likely that the financial problems of one counterparty would cause difficulties for the other counterparties in terms of full and timely repayment of liabilities;

The scale based framework does not prescribe any parameter for determining “difficulties” with respect to repayment of loans. In this context, “difficulties” would mean that there is a high probability of default of the borrower on its repayment obligations, which is caused due to financial problems of the counterparty.

3.7. If the common provider’s likelihood of default is low does the NBFC-UL still need to consider two or more entities relying on such a common provider as economically interdependent?

Response: The LEF prescribes certain parameters on the basis of which two parties may be said to have “economic interdependence”. One such parameter is as follows:

When two or more counterparties rely on the same source for the majority of their funding and, in the event of the common provider’s default, an alternative provider cannot be found – in this case, the funding problems of one counterparty are likely to spread to another due to a one-way or two-way dependence on the same main funding source.

From the aforesaid para, it is clear that the following parameters have to be present between both the parties for establishing economic interdependence:

- Both entities rely on the same source for the majority of their funding;

- No alternative to the current fund provider is available;

- Both the entities are facing financial problems due to disruption in funding.

As we see above, the likelihood of default of the fund provider does not influence the relation of “economic interdependence” between the parties. Thus, even though the likelihood of default of the fund provider is low, in case the relationship satisfies the aforesaid criteria, the same shall be treated as a case of economic interdependence.

3.8. At what point/intervals should the NBFC-UL calculate the 5% threshold in terms of the “sum of all exposures to one individual counterparty”?

Response: The LEF requires NBFCs to identify only those connected counterparties in cases where exposures to individual counterparties exceeds 5% of the eligible capital base.

For this purpose, the LEF does not specify any frequency at which the exposure limit is to be assessed, Thus, the exposure amount has to be continuously monitored to determine the time when the 5% limit will be breached.

3.9. If calculating the 5% threshold is an ongoing exercise, what action should an NBFC-UL take when the exposure to a single counterparty exceeds the 5% threshold?

Response: Upon breaching the said threshold, the NBFC shall identify other connected counterparties on which such individual entity is economically interdependent. Upon identification as such, the Company shall ensure that exposure to such group of connected counterparties do not exceed 25% of the eligible capital base of the company (35% in case of exposure towards infrastructure loan/investment).

Further, in case exposure to such connected counterparties qualifies in the top 10 largest exposures of the NBFC, the same shall be reported to the RBI.

4. Scope of counterparties and exemptions

4.1. If a counterparty falls under the exempted category, should the exposure to the group of counterparties be reduced to the extent of the exposure to the exempted counterparty?

Response: Yes. The LEF prescribes that for considering the aggregate limit of exposures to all its counterparties and groups of connected counterparties, the exempted exposures listed under para 4 of the LEF shall be excluded.

4.2. Is there any regulatory prescription to determine who the “individuals associated with the Promoter Group or the NOFHC” are?

Response: For the purpose of determining individuals who are associated with the promoter group, reference may be drawn to section 2(76) of the Companies Act, 2013 which defines the scope of ‘related party’ in relation to a company.

Referring to the aforesaid section, the following individuals may be said to be associated with the promoter group or NOHFC:

- a director of the company or his relative;

- a key managerial personnel of the company or his relative;

- any person on whose advice, directions or instructions a director or manager of the company is accustomed to act.

Herein, relative (under section 2(77)) in relation to an individual means:

- they are members of a Hindu Undivided Family;

- they are husband and wife; or

- one person is related to the other in such manner as may be prescribed. In this context, the following has been prescribed:

- Father (includes step-father)

- Mother (includes the step-mother)

- Son (includes the step-son)

- Son’s wife

- Daughter

- Daughter’s husband

- Brother (includes the step-brother)

- Sister (includes the step-sister)

5. Large Exposure Limits

5.1. At what point/interval should the values against “exposure limits” be calculated?

Response: Since the LEF does not prescribe intervals at which the exposure limits are to be ascertained, the limits should be monitored on a constant basis. At all times, the company should ensure that the exposure to any entity does not exceed the limits prescribed under the LEF.

6. Breach

6.1. In case of a breach, may the NBFC-UL still incur additional exposure arising as a result of its contractual commitments existing before such breach?

Response: An NBFC-UL cannot undertake exposure in other entities in excess of the limits prescribed under the LEF. The limits shall apply to the company even if the exposure arises due to contractual commitments prior to the breach of the limits. However, in case the exposure is beyond the control of the company, the same shall be communicated to the RBI immediately and necessary rectifications shall be carried out at the earliest.

7. Implementation date and transitional arrangements

7.1. In case an NBFC-UL has an exposure exceeding the large exposure limit specified in these guidelines, does it need to rectify such breach before 1st October 2022 when these Guidelines become applicable?

Response: Yes. The time granted from the date of notification of the LEF till the effective date of the LEF is a window for Applicable NBFCs to smoothly transit from their existing practices to the practices prescribed under the new framework. Thus, the Applicable NBFCs should off-load the exposures which are in excess of the limits prescribed under the LEF. Further, for subsequent exposures undertaken on entities, the Applicable NBFCs should take into account the existing exposures on the entity and ensure the exposure does not exceed the limit when aggregated with exposures previously undertaken.

Leave a Reply

Want to join the discussion?Feel free to contribute!