Takeaways from Budget 2022-23 – Fast Track Exit for Companies

By Shaivi Bhamaria – Associate, [shaivi@vinodkothari.com]

Introduction

Over the past few years the Government of India has been increasingly focusing on ‘ease of doing business’ by corporates, and has taken several initiatives towards the same, such as exemption to private companies from the requirement of minimum paid up capital by way of the Companies (Amendment) Act, 2015; establishment to the Central Registration Centre (‘CRC’) under section 396 of the Companies Act, 2013 (‘CA, 2013’) for providing speedy incorporation related services; launch of the integrated web form SPICe+ and integration of the MCA21 system with the CBDT for issue of PAN and TAN to a company incorporated using SPICe+; launch of web based service R.U.N. (Reserve Unique Name) for reserving a name for a new company, etc..

However, the term ‘ease of doing business’ includes not only a seamless start to a business or making the journey less cumbersome, but also involves the ease of exit. While there are various modes of exit available to corporates, such as winding up, summary liquidation, mergers and amalgamations etc[1], given that in voluntary modes of exit like striking off or voluntary liquidation under IBC, the company is either solvent enough to meet its liabilities or holds nil assets and liabilities, ideally, the closure processes is expected to be fast and simple, However, it has been observed that these voluntary modes have not been essentially ‘easy’ given the significant delays associated with them.

It is in the backdrop of such delays, the Union Budget, 2022-23[2] has proposed certain reforms, specifically for speeding up the striking off process under section 248 (2) of the Companies Act. Further, the Insolvency and Bankruptcy Board of India (‘IBBI’) has issued a Discussion Paper dated 1st February, 2022[3] proposing amendments in the IBBI (Voluntary Liquidation) Regulations, 2016, for ensuring a faster closure of voluntary liquidation processes.

In this write up, the author discusses the two sets of proposed reforms as mentioned above, and attempts to gauge their effectiveness at present and post implementation of the proposed amendments.

Extant Modes of Voluntary Exit

Striking of under CA, 2013:

Under section 248(2) of CA, 2013, companies can suo moto make an application to the Registrar of Companies (‘RoC’) to strike off their names from the register of companies upon satisfaction of certain prerequisites as stated below:

- Nil assets and liabilities;

- No notice received from the RoC under 248 (1) of CA, 2013 for strike off[4];

- No change in the name or registered office of the company in the preceding 3 months;

- No compromise or arrangement pending before the National Company Law Tribunal (‘NCLT’);

- Non-active in the preceding 3 months[5].

- Directors to furnish a declaration stating that the company does not have any dues towards any government department.

If these prerequisites are satisfied the company can proceed to get its name struck from the register of companies by obtaining approval from its shareholders by way of a special resolution, obtaining a no-objection certificate from the regulatory authority with which it is registered (in case of NBFCs, HFCs, insurance companies and intermediaries registered with SEBI) and making an application to the respective RoC in form STK-2.

However, there is a restriction on the classes of companies that can opt for striking off – companies that are listed or have been delisted due to non-compliance of listing regulations; vanishing companies; companies against whom inspection or investigation is ordered or against whom any prosecution is pending in any court; companies whose application for compounding is pending; companies, accepting public deposits or those having charges that are pending for satisfaction; and section 8 companies cannot suo moto apply for striking off.

Voluntary Liquidation under IBC:

Another mode by which companies can suo moto exit its business is by opting for Voluntary Liquidation under section 59 of the IBC. As compared to regular liquidation which usually is the result of a failed Corporate Insolvency Resolution Process (‘CIRP’), voluntary liquidation as the name suggests is a process where the company by itself opts for such liquidation.

Like in the case of striking off, here too there are certain prerequisites that the company must satisfy. These being:

- Company should not have committed a default, in other words should be capable of paying its debt as when it becomes due.

- Board of directors must pass a resolution for initiation of voluntary liquidation and appointment of liquidator

- The board resolution must be accompanied by a Declaration of Solvency by majority directors.

- Within 4 weeks of the declaration of solvency a special resolution must be passed by the contributories giving their approval to the voluntary liquidation of the corporate person and appointment of an insolvency professional to act as the liquidator;

- Further if the corporate person owes any debt to any person, creditors representing 2/3rd in value of the debt of the corporate person shall approve the resolution by the contributories within 7 days of such resolution.

Once the liquidation has commenced the liquidator must complete the liquidation process of the corporate person within a period of 12 months from the date of commencement of voluntary liquidation. The process includes settlement of the list of stakeholders of the corporate person, preparation of a preliminary report of the assets and liabilities, realisation of assets and distribution amongst stakeholders as per the waterfall mechanism under section 53 of the IBC. Once liquidation is complete the liquidator has to prepare a final report containing details of actions taken under the liquidation and make an application to the NCLT for dissolution of the corporate person.

Striking off vs. Voluntary Liquidation

The basic difference between these two modes of fast track exit is that to opt for striking off under section 248 of CA, 2013 it is essential that a company have no liabilities or extinguishing its liabilities whereas in voluntary liquidation the company must be solvent enough to discharge its liabilities. Hence, the latter involves a case of capital payments being made during the liquidation process.

Thus in striking off there is no involvement of creditors but in voluntary liquidation approval of creditors is required for commencement of the process and under the waterfall mechanism secured creditors have priority for their claims. In striking off while the company remains in control of the company itself, voluntary liquidation is under the control of the liquidator appointed. Further while in striking off the NCLT has no role to play, in voluntary liquidation the NCLT is the Adjudicating Authority, which the company has to approach at the final stage for dissolution of the corporate person. The process of striking off takes one or months for completion while a voluntary liquidation normally lasts for one or two years.

In addition to the above, the table below enumerates key differences between the two modes, in terms of stakeholder and time involvement:

| Basis | Striking off | Voluntary Liquidation |

| 1. Distribution to shareholders | No distribution required during the striking off process | Surplus, if any, after paying all the liabilities, will be distributed among shareholders in proportion to their contribution |

| 2. Involvement of creditors | No creditor involvement during the striking off process | Approval of creditors needed for commencement of liquidation |

| 3. Appointment of professionals | None required | Board of directors to appoint liquidator subject to approval of shareholders |

| 4. Role of Adjudicating Body | The Adjudicating Body in case of striking off is the Regional Director – as per statistics, approval of the application by the RDs, leads to delay | The Adjudicating Body in case of striking off is the NCLT – while the commencement process does not require application to or approval of NCLT, dissolution requires application before the NCLT.

It has been observed that while the actual liquidation process is being wound up within the prescribed period of 1 year, the time lag is taking place at the NCLT level, a major chunk of applications for dissolution of have been pending for over a year |

| 5. Role of Tax Authorities

|

Notice has to be sent to the IT Department | Though not required by the Code, it was earlier understood that a No Objection Certificate was required from the IT Department. It was noticed that obtaining the said NOC was leading to significant delays in the dissolution process. Hence, IBBI by way of circular No. IBBI/LIQ/45/2021 dated November 15, 2021 clarified that such NoC is not required. |

Problem Statement

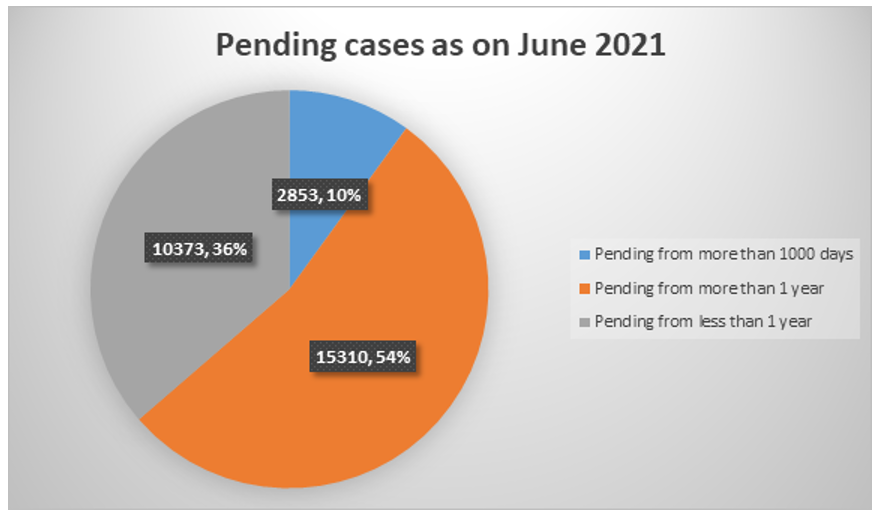

As per the provisions of law, the process of striking off a company under section 248 of CA, 2013 must normally take around one or two months to complete. However as per reports published in the Economic Survey of India for 2021-22 there has been no promising performance in completion of striking off matters. The chart below shows the status of pending cases in 2021[6].

As on January 01, 2022 the number of pending cases stands at 9,768, out of which about 16.3% i.e., around 1,500 cases are pending for more than a year.[7]

Again, as on September, 2021 out of 1042 cases filed under section 59 of IBC, final reports have been received for 483 cases and the final order of dissolution has been passed in only 257 cases. Out of the ongoing cases, nearly 32% of the cases are pending over 2 years and 19% between 1 and 2 years[8]. Moreover, as per data available on 31st December, with the total number of cases being 1105, final reports have been received only for 546 cases with 50% still pending and on closer perusal, 52% have crossed the one year mark.[9]

Proposed Solution

In view of the backlog of applications and inordinate delay in the process, the Hon’ble Finance Minister in the budget speech of Union Budget for 2022-23 announced establishment of the the Centre for Processing Accelerated Corporate Exit (C-PACE) to facilitate and speed up the voluntary winding-up, i.e., the process of striking off under section 248 of CA, 2013 from the currently required 2 years to less than 6 months[10].

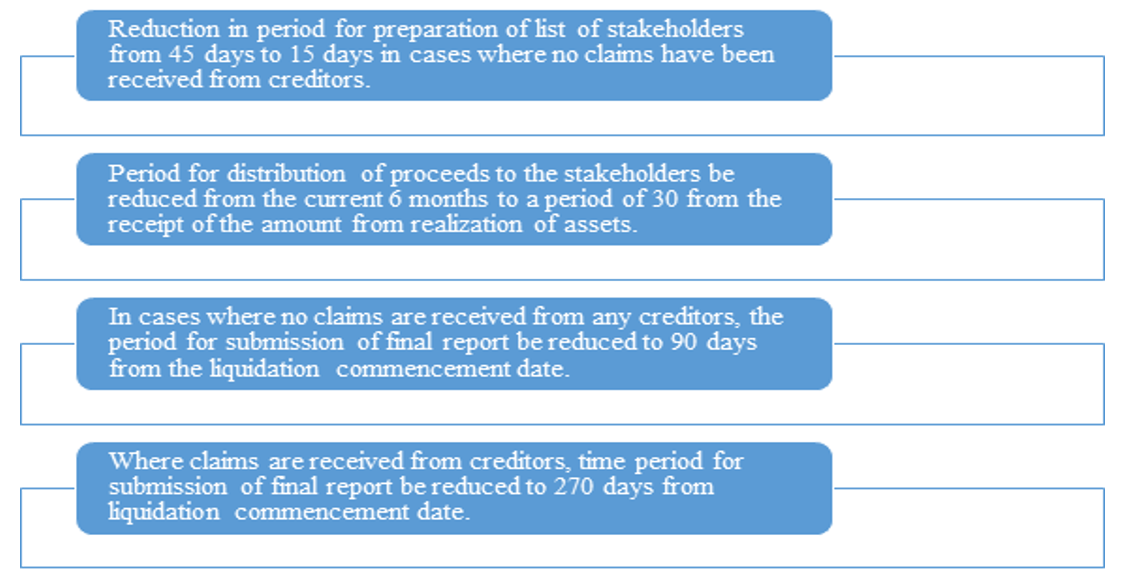

Similarly, to resolve the delays in the voluntary liquidation process, IBBI has on February 01, 2022 has put forth for public comments a ‘Discussion Paper on Amendment in IBBI (Voluntary Liquidation Process) Regulations, 2016’[11] (‘Discussion Paper’) for reduction of timelines in the voluntary liquidation process. The discussion paper has put forth the following proposals:

Analysis

While reforms were required and have been proposed both in case of striking off and voluntary liquidation, the author is of the view that the latter requires deeper attention. The case of striking off is one where no distribution etc are required to be done as a result of the process – hence, no significant stakeholder interest is involved. On the contrary, a voluntary liquidation is one where a significant stakeholder is involved – distributions are to be made to the creditors and shareholders. Thus, the more severe pain point lies in delays in the voluntary liquidation process.

The author is of the view that in addition to the waiver of NOC from the Income Tax Department, the role of the Adjudicating Authority, for dissolution of the corporate person, should also be done away with. The suggestion comes in light of the existing overburdened situation of the NCLTs and consequent delays. Given that Voluntary Liquidation does not involve haircuts and creditors are paid in full, the likelihood of wrongful actions or the like reduces. Hence, it is suggested that the involvement of the AA in VL cases must be done away with – dissolution may simply be done by way of resolution by the creditors and subsequent reporting to IBBI, as in the case of commencement. Additionally, amendments in these lines would be crucial to ensure that the timelines proposed in the Discussion Paper can be achieved in reality.

Conclusion

In light of the above, it must be noted that while the inordinate delays and slow-paced exit have been a matter of grave concern, the solutions are still at a proposal stage. Hence, what is required is faster implementation of the proposals in the case of striking off, and more emphasis on NCLT-level reforms in case of Voluntary Liquidation processes.

[1] For more information of modes of exit available for corporates, refer to our write up on Ease of exit of businesses in India by Sikha Bansal and Megha Mittal, Vinod Kothari and Company. Accessible at: https://vinodkothari.com/wp-content/uploads/2020/05/Ease-of-exit-article-1.pdf

[2] Union Budget 2022-23. Accessible at: https://www.indiabudget.gov.in/doc/Budget_Speech.pdf

[3] Accessible at: https://ibbi.gov.in/webfront/Discussion-Paper-on-Voluntary-Liquidation-process-Jan-2022.pdf

[4] Under section 248 (1) of CA, 2013 the RoC can suo moto strike off the name of the company from the register of companies on the grounds that the company has failed to commence business within 1 year of incorporation or that the company is not carrying on any business or operation for a period of 2 immediately preceding financial years and has not made any application for obtaining the status of a dormant company.

[5] Non-active company means a company that has not engaged in any activity except the one which is necessary or expedient for the purpose of making an application for striking off, or deciding whether to do so or concluding the affairs of the company, or complying with any statutory requirement [s. 249 (1) (c) of CA, 2013]

[6] Source: para 4.65 of ‘Chapter 4 – Monetary Management and Financial Intermediation’ of the Economic Survey of India – 2021-22. Accessible at: https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap04.pdf

[7] Source: para 4.65 of ‘Chapter 4 – Monetary Management and Financial Intermediation’ of the Economic Survey of India – 2021-22. Accessible at: https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap04.pdf

[8] Source: para 4.65 of ‘Chapter 4 – Monetary Management and Financial Intermediation’ of the Economic Survey of India – 2021-22. Accessible at: https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap04.pdf

[9] Accessible at: https://ibbi.gov.in/webfront/Discussion-Paper-on-Voluntary-Liquidation-process-Jan-2022.pdf

[10] Source: para 77 of the Union Budget 2022-23 speech dealing with ‘Accelerated Corporate Exit’. Accessible at: https://www.indiabudget.gov.in/doc/Budget_Speech.pdf

[11] Accessible at: https://ibbi.gov.in/webfront/Discussion-Paper-on-Voluntary-Liquidation-process-Jan-2022.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!