Special Situation Funds: Funds into asset reconstruction business

Aanchal Kaur Nagpal (Assistant Manager) | Parth Ved (Executive)

Introduction

The intent behind asset reconstruction is not merely concerned with realisation of bad loans but also ‘reconstruction’, that is, to try and resurrect bad loans or bad borrowers into good ones. This almost always leads us to one name i.e. Asset Reconstruction Companies (‘ARCs’). Today, financial institutions are eager to sell their non-performing assets to clean-up their books while stressed companies find ways to get access to capital to anchor themselves. The Indian financial sector is known to be laden financial entities struggling to survive with their mammoth stressed assets. The COVID-19 pandemic has only added fuel to the fire. As at September, 2021, GNPA of banks was at INR 4,53,145 crore and that of the top 30 NBFCs, including HFCs stood at around INR 84,000 crore. Out of these loans, In 2019-20, the amount recovered as per cent of the amount involved under IBC was 45.5 per cent, followed by 26.7 per cent for ARCs. While the amount recovered through ARCs as per cent of amount involved was significantly higher in the initial years of their inception, in the recent years, it has dipped below 30 per cent except for a spurt in 2017-18.

Securities and Exchange Board of India (‘SEBI’) on January 24, 2022[1] along with its circular dated January 27, 2022[2], has further widened the NPA market to a specifically dedicated class of AIFs called Special Situation Funds (‘SSFs’), that shall exclusively invest in the distressed asset market. The intent behind the same is to use these cash-filled alternative funds to supplement ARCs in acquiring such stressed assets and aid banks and other financial institutions to release critical money choked up in such assets. AIFs are currently already permitted to invest in security receipts of ARCs and/ or invest in securities of distressed companies, however, SSFs will be additionally permitted to even acquire stressed loans. These SSFs also have been granted additional exemptions/ benefits over and above regular AIFs to facilitate stressed asset resolution.

This article attempts to cover the adoption of the concept of SSF from the global markets, and the characteristics of this peculiar kind of investing.

Global scenario –

The idea of a special situation funds aka special situation investing emanates from a well-recognised global concept of special situation investing. It is an advantageous, albeit a differentiated, investing approach based on specific events such as corporate mergers, demergers, delistings, distress etc. Special situation investing provides diversification to a portfolio. One such branch of special situation investing is distress investing/ distressed debt investing. This is also known as ‘vulture’ investing.

With a global market size of US$4 trillion[3], this investment strategy is used by a diverse group of investors, including investment banks, private equity firms, distressed debt hedge funds etc. Private equity and hedge fund investors are the most active distressed debt investors. Today, in some places, distressed debt has replaced venture capital as the hotspot for investment[4].

Distressed debt and special situations funds, which profit from buying debt or assets at deep discounts, have $131.8 billion of cash — or dry powder — to deploy globally as of November 2020, almost 40% more than five years ago, and 150% more than ten years ago, according to Preqin.

However, the distressed market did not grow as much as anticipated by global players during the COVID-19 pandemic, due to various assistance schemes launched and liquidity infused by central banks.

USA

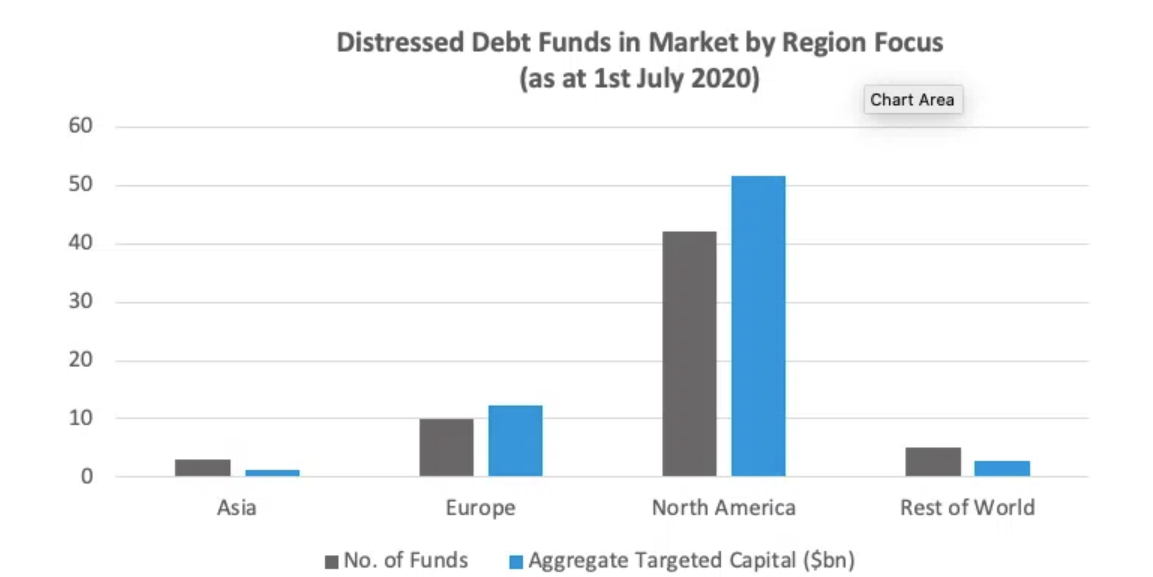

As the chart shows, the 60 funds, in June 2020, in the US market represent a combined $72bn in capital targeted – this is more than double the amount of capital targeted by distressed debt funds during 2019, and the highest total in the past five years[5].

Further, as per a Bloomberg report, in addition to the $68 billion of distressed dry powder as of June 2020, distressed funds in the market were seeking to raise an aggregate $70 billion in capital.5 Together, this translates to approximately $140 billion of capital targeting a global opportunity set of $320 billion or more — an attractive imbalance in favor of distressed investors.[6][7].

As per Institutional Investor Report, distressed funds raised during both the GFC and the Dot Com crash outperformed their counterparts from other vintages, as well as other private debt funds. Vintage 2008 distressed funds generated a median net IRR of 15%.In the years following the Dot Com crash, the HFRI Distressed Index was up over 100% in the five years post-2000. If we are entering a similar slowdown period that affects multiple aspects of the global economy, then we may be in the early phases of a distressed opportunity set that lasts for several years[8].

In April 2021, a Los Angeles-based distressed asset manager Oaktree Capital Management also announced its intention to raise the largest distressed debt fund in history, at a target size of $15bn that will be used to buy debt in struggling companies that have been hit the hardest by COVID-19 and will opportunistically seek control of businesses during restructurings across North America and Europe.

UK –

In the UK, the performance of distressed funds outran all other kinds of investment funds in 2021. As per the diagram below, distressed dent funds provide a return higher than even hedge funds and equity funds.

Europe –

The amount of debt classified as distressed in Europe has surged to more than 13 billion euros from only 2 billion euros at the start of 2020, according to Bloomberg Barclays index data.

Yet, managers say they were left disappointed with the amount of such opportunities available, as the window to invest at steep discounts or buy into a company in restructuring or insolvency was cut short by the scale of central bank liquidity pumped into the financial system. “There has been a window of opportunity of around 3-4 months this year amid the market dislocation in March, but overall the opportunity for deployment in stressed and distressed debt opportunities has disappointed given the amount of liquidity in the market and government interventions this year have shielded many critical situations to evolve[9].

Italy-

Currently, it has been estimated that there are approximately €340bn of NPE in the financial system of Italy, of which about €220bn are controlled by distressed credit investors and €120bn sitting on banks’ balance sheets.

Revolution of distressed market in India –

Prior to 2016, investors were wary of entering into the distressed asset market, considering the lack of a strong regulatory resolution framework. The Insolvency and Bankruptcy Code, 2016 (‘IBC’) gave the much required impetus to the Indian resolution process thereby giving comfort to distressed assets investors and gave a ray of hope to these drowning companies.

The stressed asset market in India is still approximately USD 150+ bn, indicating significant potential for investments, either through IBC or mechanisms outside IBC such as the “Prudential Framework for Resolution of Stressed Assets” provided for in the RBI circular released on 7 June 2019.

The Indian market already has certain SSFs operating within the ambit of the existing AIF regulations. Tata Capital SSF[10] for instance, has been investing in various stressed companies[11] being turned-around. Axis SSF[12] has been generating long-term capital appreciation by investing in mis-priced stocks facing special situations like regulatory/policy changes, management restructuring etc.

Concept of investment in stressed loans –

‘Distressed asset’ refers to an investment in an asset that is undervalued typically due to default by the borrower of such asset. Investment in stressed loans is the process of investing in the existing debt of a financially distressed company, which are usually overleveraged entities, basically ‘a good company with a bad balance sheet’. Distressed debt investing means investing in companies that have filed for bankruptcy or are likely to become bankrupt in the future.

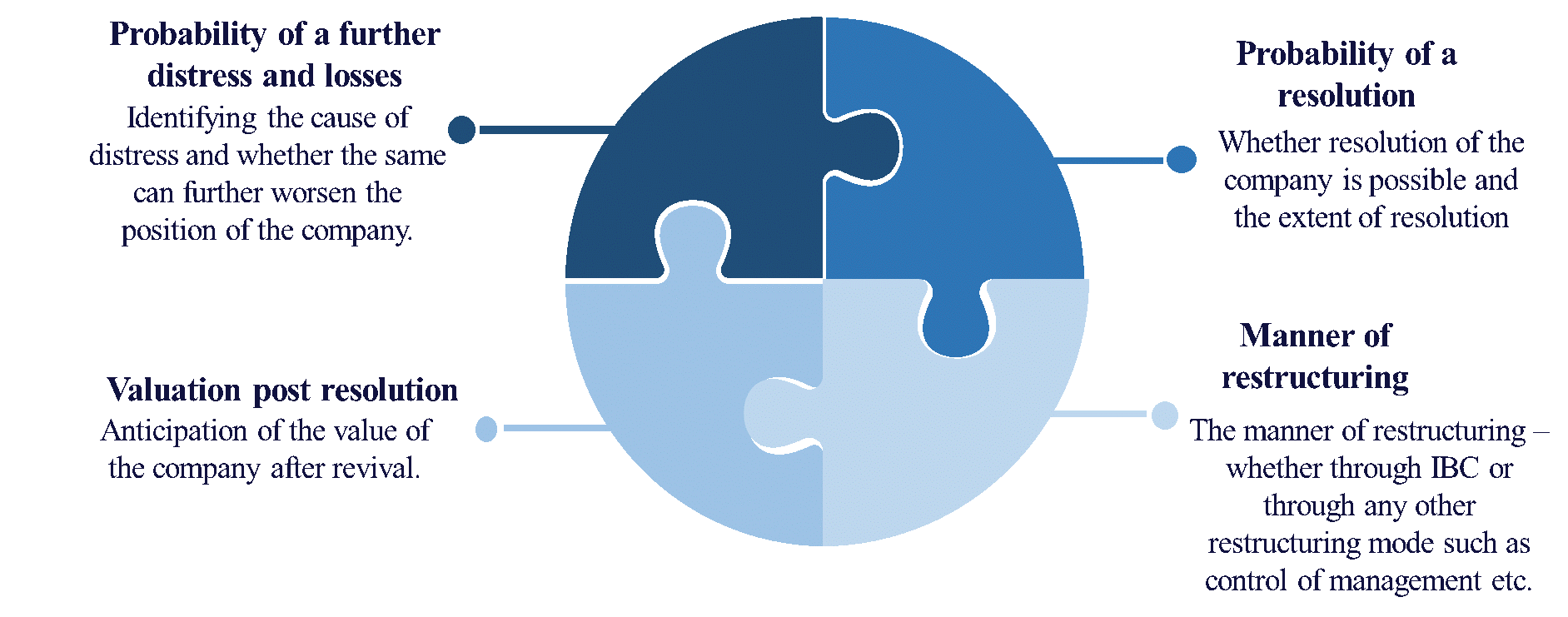

Investee companies are those that have a strong business but are struggling to meet their debt obligations and thereby can be bought at lower valuations. Here, investors need to identify the reason behind the distress of such companies while striking a balance with the probability of further downfall. The motive of such investors may also be to gain control over a promising company in a bad phase. These investors invest in these funds with an expectation that the company will emerge from its resolution phase as a financially viable entity.

An investor may, therefore, take the following positions –

- Restructure a distressed company – get a controlling position and influence the restructuring process

- Bankruptcy of a distressed company – resolution applicant i.e. purchasing claims under IBC

- Selling of such stressed loans to other investing companies (mostly ARCs) i.e. hold these assets as a part of a diversified portfolio.

Distressed debt market is indirectly proportional to the performance of the economy i.e. as the economy slows down, opportunities for distressed debt investors increases.

Consideration by an investor in case of distressed investing –

Why AIFs –

- AIFs are pooled investment vehicles usually with high net-worth and sophisticated investors having higher risk appetites. Further, the growth of AIFs in recent times along with higher investible funds has further concretised them as a good medium for such investments.

- AIFs also have the ability to raise capital for a longer duration which becomes a necessity in case of distressed investing as distressed loans/ companies take that much time to turnaround/ revive.

- AIFs also, usually, have managerial personnel with expertise in fund/ asset management which could support such companies in distress.

- Currently as well, AIFs are permitted to invest in security receipts of ARCs or securities of distressed companies and therefore there may be certain AIFs that have the required investment strategies in place.

SSFs – an extension of existing powers of an AIF

Existing AIFs are permitted to invest in securities of a company which include security receipts (‘SRs’) of ARCs. They are also allowed to invest in stressed companies by purchasing their debt and equity instruments. However, whether or not an AIF can acquire loans has been a matter of long debate. This development however, puts all speculations to rest, and this category has been permitted to invest in special situation assets/ loan exposures in addition to distressed securities.

SSFs- How are they different from an ARC

| Basis | ARC | SSF |

| Registration and governing provisions | ARCs are companies registered under the SARFAESI Act to undertake asset restructuring business | SSFs are not required to get registered under SARFAESI and will be registered with SEBI. |

| Power under SARFAESI | ARCs have been granted various powers for resolution of distressed debt under the SARFAESI Act, including but not limited to enforcement of security interest | Currently, SSFs have not been accorded such status |

| Acquisition of stressed assets and NPA

(para 73 of the RBI TLE Directions) |

As per RBI TLE Directions[13], ARCs can only acquire stressed loans that are in default for more than 60 days or those that are classified as NPA. | However, SSFs have been allowed to acquire all stressed loans and NPAs. |

An alternative to the existing AIF-ARC model

An ARC is focused on managing NPAs and stressed loans and is engaged in recovery of such acquired loans. However, ARCs usually find it difficult to raise liquidity by way of debt. The typical structure prevalent in the market is where the originating entity acquires SRs issued by the ARC and does not give relief from NPA treatment, if the SRs are acquired beyond 10%.

Therefore, in order to fund its business, ARCs sometimes depend on AIFs. In this model an ARC is set up for NPA resolution while the AIF facilitates funding of the build-up of assets. The funds pooled in the AIF are then used to subscribe to the SRs issued by the ARCs. Such AIFs are funded by HNIs, family offices, or other investors. An SSF combines the advantages of an ARC i.e. stressed asset resolution and AIF i.e. pooled funding; into one single entity.

Permissible and non-permissible investments by SSF

Permissible investments

1. Investment in stressed loans:

SSF can directly purchase the stress loan exposure which are available for acquisition:

- Under clause 58 of TLE Directions[14] (after a lock-in of 6 months);

- As a part of resolution plan approved under IBC, 2016;

- In terms of any other policy of the Government / RBI.

In the above cases, namely under clause 58 and under IBC, there is no scope of acquiring a retail category loan. In both cases, the defaulter would be a corporate entity. By permitting direct purchase of stressed loans, SSF will be able to acquire said loans at a discounted price and undertake the recovery of loans to make a profit. The power to initiate recovery rests with the secured creditor as defined under the SARFAESI Act, 2002 and currently, SSFs do not come under its meaning. SEBI[15] has represented to the concerned regulators to classify SSFs as ‘Secured Creditor’ under SARFAESI.

2. Investment in securities* of the company in following cases:

1. Company whose stressed loans are available for acquisition:

- under clause 58 of TLE Directions;

- as a part of a resolution plan approved under IBC, 2016;

- in terms of any other policy of the Government / RBI.

2. Company against whose borrowings, security receipts have been issued by an ARC.

3. Company[16] whose borrowings are subject to CIRP process under IBC, 2016.

4. Company[17] which has disclosed default in payment of interest / principal on

- loans from banks, FIs, NBFC-ND-SI, NBFC-D or

- listed/unlisted debt securities

in terms of SEBI (ICDR) Regulations, 2018 and the default continues for atleast 90 calendar days.

*The AIF Regulations[18] use the word securities – this may mean that any investment in any of the securities covered under the wide definition of ‘securities’ will be permitted.

3. Investment in security receipts

SSF can invest in security receipts issued by an ARC registered under SARFAESI.

4. Investment in other SSF

SSF can also invest in units of other SSFs but not in units of other AIFs since SSFs will only be committed towards stressed assets.

5. Investment in distressed companies under IBC

SSF can act as a Resolution Applicant under IBC. It is pertinent to note that prior to the amendment too, there was no bar on AIFs to act as Resolution Applicant under IBC, 2016. Since AIFs are classified as ‘financial entity’ under section 29A of IBC, the restrictions on criteria placing a restriction on entities whose accounts are classified as NPA (See section 29A(c)) is not applicable to AIFs. AIFs could thus be used by the promoter to circumvent the restrictions and the promoter could easily re-enter the corporate debtor disguised as a resolution applicant. Introduction of SSF now puts a halt to this roundabout as SSFs are not allowed to invest in its associates (discussed below under non-permissible investments).

Non-permissible investments

1. Cannot invest in associates:

SSF is not permitted to invest in its associates. The AIF Regulations define “associate” as a Company / LLP / Body corporate in which specified persons, either individually or collectively, hold more than 15% of its paid-up equity share capital / partnership interest. Specified persons include directors, trustees, partners, Sponsor, Manager and directors/ partners of the Sponsor and/ or Manager.

As discussed earlier, AIFs are currently already permitted to act as Resolution Applicants under IBC. Concerns were raised regarding possible round-tripping of funds in terms of acquisition of stressed loans by SSFs of their associates/connected entities; persons who are otherwise ineligible under Section 29A of IBC for purchasing stressed assets. With this express restriction, the AIF route can no longer be used by ineligible persons, including a promoter of a corporate debtor, to act as resolution applicant since SSFs will be required to meet the eligibility conditions under section 29A of IBC, 2016 as applicable to AIFs, along with the restriction to not invest in its associates, either by way of investment in its securities or purchase of loan exposures.

2. Cannot invest in units of certain SSFs

An SSF is not permitted to invest in the units of other SSFs which are managed or sponsored by its 1) Manager, 2) Sponsor or 3) Associates of its manager or sponsor.

3. Cannot invest in units of other AIFs

Although the AIF Regulations allow different categories or subcategories of AIFs to invest in units of other AIFs (subject to certain conditions), SSFs are therefore not permitted to invest in units of other AIFs. Additionally, other AIFs are also not permitted to invest in a SSF. While the first condition seems to permit an SSF to whole-heartedly remain dedicated to the distressed market, the restriction on other AIFs to invest in units of SSF does not seem appropriate.

Investment conditions

Non-applicability of concentration norms on SSF

In case of normal AIFs, a maximum of 25% of the total corpus of the AIF can be invested in a single investee. Since acquisition of stressed loans/ investing in such companies is not a mere investing activity and the aim is to revive the defaulting entity, the same will require extensive monitoring and resolution efforts on the part of SSF. It may not be able to invest in 4 different companies (in case the investment is capped at 25%) since sufficient attention might not be possible. This would have stopped SSFs from taking full advantage of its investible funds. Accordingly, SSFs are exempted from this criterion. They can invest up to 100% of their funds in a single investee company.

Due Diligence Requirements

An ARC is required to carry out initial and continuous due diligence of SR investors as mandated by RBI. To ensure that there is no regulatory arbitrage, the same initial and continuous due diligence requirements mandated for ARCs in respect of such investors by RBI has been made applicable to SSFs acquiring stressed loans in terms of the RBI TLE Directions.

Recognition as Qualified Buyer

Under the SARFAESI Act, 2002, ARCs can raise funds only from qualified buyers for acquiring financial assets. RBI, vide notification dated March 10, 2021[19], has allowed SEBI-registered Category-I AIFs set-up in the form of a trust as ‘qualified buyers’ under SARFAESI Act subject to the following conditions –

Such investment by AIFs in SRs were subject to the following conditions:

- AIF which has invested in an ARC shall not be permitted to invest in the SRs issued by that ARC;

- AIFs shall not invest in SRs issued on the underlying loans of any of its associate or group company; and

- AIFs shall not invest in SRs backed by NPA of banks which hold equity of more than 10% (ten percent) in that AIF.

SSFs have been a subcategory of Category-I, any SSF set-up as a trust will be eligible to purchase SRs issued by ARCs. However, as per SEBI, exemption with respect to restriction on investment in SRs issued by an ARC in which the fund has made investment, with respect to SSFs, has been represented before relevant regulators. It is yet unclear whether the other conditions will still apply to SSFs or not.

Taxation

AIFs Category-I have been accorded a pass-through status for income (other than business income) earned by them, under the Income Tax Act, 1961. Accordingly, any income (other than business income) earned by such AIF, is exempt from tax in the hands of the AIF under Section 10(23FBA) of the Act and income shall be taxable directly in the hands of the investors under Section 115UB of the Act. Since SSFs are also a sub-category of AIF Category-I, the same exemption will also be enjoyed by them.

Conclusion –

SSF is not a novel idea and has been in the global market for a long period of time now. Finally having caught up with this globally prevalent concept, it is to be seen how the Indian investment market will capitalise on this opportunity.

[1] https://egazette.nic.in/WriteReadData/2022/232844.pdf

[2]https://www.sebi.gov.in/legal/circulars/jan-2022/introduction-of-special-situation-funds-as-a-sub-category-under-category-i-aifs_55625.html

[3] Preqin

[4] Eurekahedge – https://www.eurekahedge.com/Research/News/921/An-Overview-of-Distressed-Debt

[5] Source – Preqin

[6] Bloomberg, “America’s Zombie Companies Rack Up $2 Trillion of Debt,” November 2020.

[7] iCapital – Distressed Debt – A Compelling, and Timely, Opportunity

[8] Institutional Investor, “History Suggests Distressed Debt Funds Raised This Year Will Outperform,” October 2020.

[9] https://www.spglobal.com/marketintelligence/en/news-insights/blog/global-ma-infographic-q3-2021

[10] https://www.tatacapital.com/private-equity/ssf_overview.html

[11] https://www.tatacapital.com/private-equity/ssf_portfolio.html

[12]https://www.moneycontrol.com/mutual-funds/axis-special-situations-fund-regular-plan/investment-info/MAA912

[13]https://rbidocs.rbi.org.in/rdocs/notification/PDFs/86MDLOANEXPOSURESC6B1DFB428C349D885619396317F04DE.PDF

[14] Master Direction – Reserve Bank of India (Transfer of Loan Exposures) Directions, 2021 – https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=12166

[15] Agenda for SEBI Board Meeting dated December 28, 2021 –

https://www.sebi.gov.in/sebiweb/about/AboutAction.do?doBoardMeeting=yes#

[16] The credit rating of the financial instruments or credit instruments or borrowings of the company should be downgraded to “D” or equivalent.

[17] Ibid.

[18] https://www.sebi.gov.in/legal/regulations/jan-2022/securities-and-exchange-board-of-india-alternative-investment-funds-regulations-2012-last-amended-on-january-25-2022-_55672.html

[19] https://lexcomply.com/pdfview3.php?file=gFjstLWOYz2Jqwv+b6uysA==

Leave a Reply

Want to join the discussion?Feel free to contribute!