Non-Performing Assets: A Solution at Last?

– Shreyan Srivastava (resolution@vinodkothari.com)

Background

In India, Non-Performing Assets (“NPAs”) have been a chronic plaque in the economy for decades. Although recent reports indicate that the Gross NPA (“GNPA”) and Net NPA (“NNPA”) have been systematically declining, in comparison to other economies, the country still faces a high volume of NPAs. For this reason, for the last several budgets, economic policies in India have been tailored to provide relief from the existing NPAs and to provide mitigatory steps to reduce the rate of such NPAs.

In this article, we discuss the current situation of NPAs in the country and assess the feasibility of the steps taken by the Government to mitigate, control and resolve the same, specifically through measures introduced by the Union Budget 2021-22[1] leading upto the Union Budget 2022-23[2] and the extent of the reliefs they provide.

A Two-Decade History

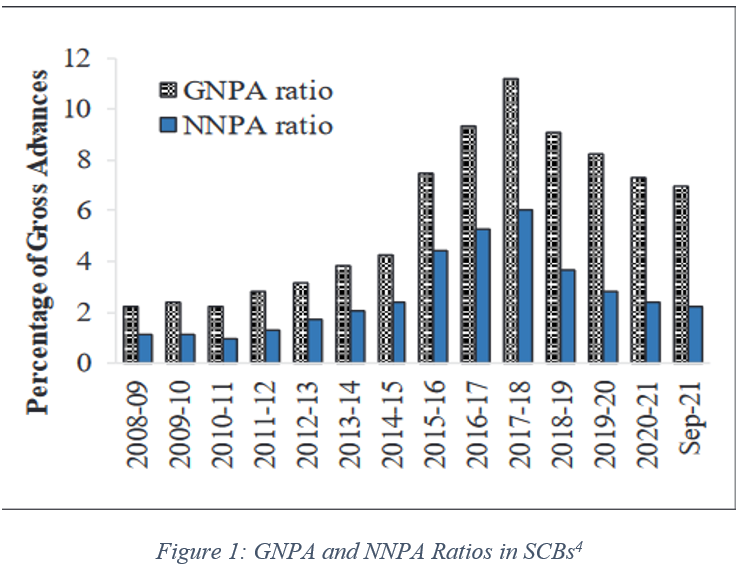

As illustrated in Figure 1, from the fiscal year of 2008-09, both Gross NPA (“GNPA”) and Net NPA (“NNPA”) for Scheduled Commercial Banks (“SCBs”) were following an upward trend with a slight dip in 2010-11. The highest NPA was recorded for the financial year of 2017-18, following which a structural decline was observed despite the overwhelming impact of the pandemic on all economic sectors in 2020.[3]

As per data provided by the RBI, there has been a constant decline of Net and Gross NPA Ratios in Scheduled Commercial Bank ever since the fiscal year of 2018-19:-

- As of September-end 2021, the NNPA ratio sits at 2.2% compared to 6% in 2017-18.

- As of September-end 2021, the GNPA ratio sits at 6.9% compared to 11.2% in 2017-18.

Similarly, the NNPA and GNPA ratios for NBFCs stood at 6.55% and 2.93% and 6.55% for September-end 2021.

A large portion of this declining rates of GNPA and NNPA ratios can be attributed to various available resolution mechanisms, including the Insolvency and Bankruptcy Code (IBC), SARFAESI Act, Debt Recovery Tribunals, etc, which have proved to be useful to certain extent. However, there still remains a large stock of legacy NPAs which are yet to be resolved. As per a report issued by RBI[5], in F.Y. 2019-20, the total amount of NPAs recovered was merely 23% of the total NPAs worth a whopping Rs. 7,42,431 crores.

The Indian Council for Research on International Economic Relations (“ICRIER”) studied Asset Management in various foreign jurisdictions such as the United States, Sweden, Italy and Indonesia all of which had instituted a centrally owned Asset Management Company (“AMC”) during a financial crisis with a sunset clause. Thus, once the financial crises had been lifted the AMC would be dissolved via its sunset clause.

Union Budget 2021-22: Creation of the Bad Bank

The need for a government owned ARC to manage the NPA problem on a large scale was identified as early as 2017 by the ICRIER and recognising the same the Governor of the RBI: Shri Shaktikanta Das observed: “If there is a proposal to set up a bad bank, the RBI will look at it”.[6] Subsequently, the Finance Minister of India during the Union Budget Speech of 2021-22 stated:

“An Asset Reconstruction Company Limited and Asset Management Company would be set up to consolidate and take over the existing stressed debt and then manage and dispose of the assets to Alternate Investment Funds and other potential investors for eventual value realization”.[7]

Soon after the Union Budget of 2021-22, the Government incorporated the National Asset Reconstruction Company Limited (“NARCL”) under the Companies Act, 2013 and registered the same with the RBI. The NARCL is essentially the first government owned ARC in India, set up in a manner similar to Asset Management Companies in the foreign jurisdiction, and is owned primarily by public sector banks.

As provided in its mandate, the Indian Debt Resolution Company Limited (“IDRLC”) was set up to act as the operational entity designed to manage the NARCL such that while the latter would offer the purchase stressed assets of the lead bank and acquire them, the IDRLC would engage with the management (market professionals and turnaround experts) and value addition of such assets. Thus, what was born was a unique Public-Private Partnership of NARCL-IDRLC with the mandate to mitigate the NPA problem in the economy.

The NARCL had proposed to acquire stressed assets worth Rs 2 lakh crore in a phased manner in the proportion of 15% Cash and 85% in Security Receipts (SRs), all the while operating within the existing framework for ARCs as issued by the RBI.[8]In fact, the NARCL had already planned for Phase I with fully provisioned assets of about Rs. 90,000 crores expected to be transferred to NARCL before the end of the current financial year of 2021-22.[9] From what is understood, NARCL shall focus on the legacy assets, worth Rs. 500 crores or more, which are generally not targeted by the privately owned ARCs.

However, despite being proposed a year back, NARCL was only made live on 27th January, 2022, merely 4 days prior to the Union Budget 2022-23. Hence, we are currently in a very nascent and premature stage to gauge if at all the public-private relationship would give the expected results.

The National Bank for Financing Infrastructure and Development

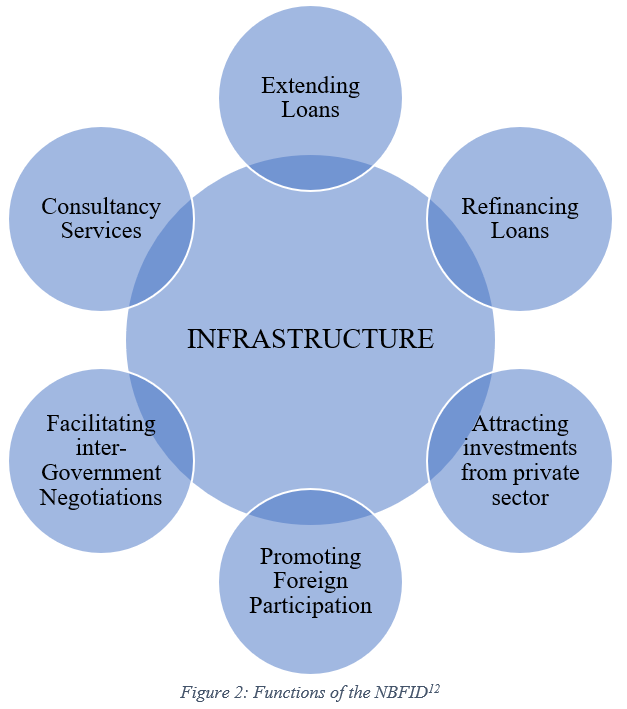

With the NARCL due to begin their operations of Phase I, the Ministry of Finance issued a notification on 28th January 2022 (close to the Union Budget Speech of 2022-23) which formally established the National Bank for Financing Infrastructure and Development (“NBFID”).[10]As elaborated by the PRS India, the NBFID is to operate as a corporate body with authorised share capital of one lakh crore rupees which can only be held by selected public sector enterprises.[11] Its mandate would be to directly or indirectly lend, invest, or attract investments for infrastructure projects as selected by the Central Government located entirely or partly in India. The various sectors have been identified in Figure 2 below: –

Thus, unlike any other jurisdictions, India appears to adopt a three-fold sectoral approach to rectify their NPA problem:

- Private Sector: Private ARCs registered with the RBI.

- Public-Private: The NARCL-IDRLC

- Public: The NBFID.

Concluding Remarks

While the Union Budget 2021-22 had formally recognised the commencement of the NBFID and NARCIL, its performance and efficacy is yet to be investigated. Moreover, what makes the NBFID stand out from its government owned AMC counterparts in foreign jurisdictions is the lack of a sunset clause given that it targets the Infrastructure Sector. Similarly, not much can be said about the NARCL-IDRLC which is also due to begin its Phase I sometime before 31st March 2022.

[1] https://www.indiabudget.gov.in/budget2021-22/doc/Budget_Speech.pdf

[2] https://www.indiabudget.gov.in/doc/Budget_Speech.pdf

[3] https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf#page=55

[4] https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf#page=55

[5] https://rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1188

[6] 39th Palkhivala Memorial Lecture

[7] https://www.indiabudget.gov.in/budget2021-22/doc/Budget_Speech.pdf

[8] https://pib.gov.in/PressReleseDetailm.aspx?PRID=1755466

[9] https://pib.gov.in/PressReleseDetailm.aspx?PRID=1755466

[10] https://egazette.nic.in/WriteReadData/2021/226210.pdf

[11] As per PRS India: the shares may be held by: (i) central government, (ii) multilateral institutions, (iii) sovereign wealth funds, (iv) pension funds, (v) insurers, (vi) financial institutions, (vii) banks, and (viii) any other institution prescribed by the central government.

[12] https://prsindia.org/billtrack/the-national-bank-for-financing-infrastructure-and-development-bill-2021

Leave a Reply

Want to join the discussion?Feel free to contribute!