Neo-banks and their confluence with India’s Financial Landscape

-Sameer Gahlot | Financial Services Division (finserv@vinodkothari.com)

Introduction

Since the beginning of the 21st century, technological and digital innovation has improved the efficiency, productivity, and competitiveness in the delivery of financial services[1] and continue to do so. This resulted in benefitting and enhancing the reach and experience for the end customers. These innovations could be possible only due to the dynamic environment whose impetus is on recalibrating the traditional models currently in vogue and to redefine them suiting the current needs. It won’t be surprising, if one could recognize this era with certain buzzing words like digital servitization, circular economy, glocaslisation etc. The disruption caused by the pandemic seems to be the turning point for this century, which outlandish the entire situation and persuaded different players to ponder for out of the box solutions. The innovation has probably reached its zenith during this phase where traditional market players, mainly relying on the physical marketplace, collapsed at a blink of eye whilst many more opportunities emerged. One such innovation is evolution of the concept of neo-banks, which has become the recent buzzword in the financial sector. To put it simply, neo-banks are a digital version of a traditional bank. Several ‘neo-banks’ have been set up in India and abroad during the previous couple of years.

With this write-up, let us try to understand what neo-banks are. As we move forward in this article, we will establish an understanding of the concept of neo-banks, based on their features in several jurisdictions and how these new banks are becoming necessity especially after the pandemic, spreading its wings in areas which are untouched by the traditional banking sector.

Concept of Neo-banks

Neo-banks are banks operating on digital models. The meaning of the term neo-banks, however, has slight variation in different geographies, based on their regulatory frameworks. These banks developed completely on digital interfaces are known as digital-only banks or neo-banks or internet-only banks or virtual banks with distinct nomenclature used in different jurisdictions. They emerged to overcome the shortcomings depicted by the incumbent banking system and led to the development of novel business models which enable contactless or paperless transactions. A neo-bank, in essence, is a bank which primarily carries out its operations through digital mediums. These models have gained traction after the outbreak of the pandemic, which initiated the need for having completely contactless transactions from anywhere at any time. Even before the pandemic, these models were prevalent, but in a different format, working in-tandem with the conventional brick-and-mortar models, popularly known as ‘Partnership Model’ wherein specified services are outsourced by a licensed traditional banks to companies operating on a digital platform.

Broad Features of Neo-banks

The following can be termed as the broad features of neo-banks:

- Licensed bank operating independently;

- Providing services digitally without any physical existence;

- Personalized services offered to the customers;

- Primarily serving retail customers and/or MSEs

| Advantages of Neo-banks | Disadvantages of Neo-banks |

| ★ Hassle free delivery of services | ★ Bouquet of services is limited or restricted |

| ★ Minimum charges on transactions | ★ Grievance redressal might not be satisfactory |

| ★ User friendly for GenZ generation | ★ Might not be user friendly for Generation X & Xennials |

| ★ Personalized services can be offered | ★ Need to comply with regulations applicable to regular banks |

Based on the characteristics and features of neo-banks mentioned above, we can easily differentiate a neo-bank with:

- Internet Banking: Internet banking is a kind of facility offered by licensed traditional banks to allow their customers to access services 24/7 whereas neo-banks operate completely on digital platform 24/7*365.

- Challenger Banks: Neo-banks challenging the existence of traditional banks in a region are generally known as Challenger banks. This term is sometimes used interchangeably with neo-banks.

- Digital Banks: A Digital bank operates as an agent and extended arm of a licensed traditional bank whereas a neo-bank operate independently.

Significance in current environment

Neo or digital-only banks leverage emerging technologies like cloud computing, machine learning, block-chain etc., with the ultimate aim of enhancing the reach of the formal banking sector. The traditional banking system provides access to various kinds of services like deposit and credit support, but their operations seem limited to areas where cost-to-profit ratio is desirable, leaving behind unbanked areas where this ratio is significantly low. The convergence of traditional and technological models like neo-banks, opens up a sea of opportunities thereby expanding the reach of formal banking services to the under-served or unserved population of our country, kicking off engines of growth which were dwindling after the depression caused due to the pandemic.

Neo-banks with its capability to reach the hinterlands of our country, betting on flexibility and simplicity vis-a-vis the traditional banking system, promise huge potential with its unique delivery solutions creating a better and sustainable future. These banks are a step ahead of the traditional banks in suggesting/proposing well curated offerings to its customers.

Regulatory Framework

Global Overview

The concept of neo-banks started gaining traction even before the Global Financial crisis of 2008 in countries like Hong Kong, Singapore but the major overhaul in the banking sector started after 2008. The opaqueness in the banking sector led to collapse of major financial institutions, which demands transparency and interconnectedness through the integration of finance and technology to avoid another crisis. There exists a stark difference between the models prevailing in India and in other jurisdictions like Singapore, Hong Kong, South Korea, and the United Kingdom. The same is discussed below in brief.

Jurisdictions with Licensing Framework

Singapore

The financial sector regulator, Monetary Authority of Singapore (‘MAS’), announced an enabling framework[2] for internet banking in 2000. It stated that existing banks are allowed to use the internet for providing banking services. Alternatively, banks were also allowed to set up a subsidiary specifically created for this purpose. It has also laid down entry restrictions through minimum capital requirements on such banking subsidiaries. Further, such subsidiaries shall be regulated by the same norms as that of the bank itself.

In 2019[3] MAS announced two concepts: (a) digital full bank (DFB) licenses and (b) digital wholesale bank (DWB) licenses. A DFB will be allowed to take deposits from and provide banking services to retail and non-retail customer segments whereas DWB will be allowed to take deposits from and provide banking services to SMEs and other non-retail customer segments. These banks will again be regulated as a bank.

Since these banks operate on a digital only model, they are allowed to have only one place of business.

In addition to the above, these banks are not allowed to operate ATMs or cash deposit machines but allowed to offer cash back services through electronic fund transfers at POS terminals at retail merchants.

Hong Kong

The Hong Kong Monetary Authority (‘HKMA’), being the central banking institution of the country, regulates the banking system in Hong Kong. It has issued the ‘Guidelines on Authorisation of Virtual Banks’[4] which define a ‘virtual bank’, as a bank which primarily delivers retail banking services through the internet or other forms of electronic channels instead of physical branches. A nomenclature used in Hong Kong is virtual bank and these banks cannot establish branches, however are required to have a head office to handle communications with MAS and customer grievances including ensuring compliance with norms for managing technology related risks. Major neo-bank players currently operating in Hong Kong include Ant, Livi and Welab bank[5].

South Korea

The Financial Services Commission (‘FSC’), regulates the financial sector in South Korea. In 2016, it has issued a legislation regulating Internet-Only banks named ‘Act on Special Cases Concerning Establishment and Operation of Internet-Only Banks’[6] with nomenclature used as Internet-only banks. Article 2 of the aforesaid act defines ‘Internet-Only banks’ as a bank which conducts the banking business mainly by means of electronic financial transactions.

These banks may not be allowed to provide credit to corporations, to the same borrower not exceeding 20% of the equity capital, and large shareholders of the bank. Major neo-bank players currently operating in South Korea include Kakao, K and Toss bank[7].

Jurisdictions where Neo-banks covered under the traditional banking framework

United Kingdom (UK)

The Prudential Regulation Authority and the Financial Conduct Authority oversees and regulates the financial market in the United Kingdom. With respect to regulation of neo-banks, no separate licensing framework is prescribed and these banks are required to comply with existing framework applicable to the traditional incumbent banks. Notable neo-banks functioning include Monzo and Starling[8].

United States (US)

The Federal Reserve System (FED), the central bank of the United States, performs functions to promote the effective operation of the U.S. economy and matters connected therewith[9]. In the United States, no specific regulations exists to regulate digital-only banks and these banks are required to comply with the laws applicable to the traditional banks[10].

Indian Context

There exists different kinds of banks in India, including but not limited to, scheduled & non-scheduled commercial banks, urban & rural cooperative banks, small finance and payment banks, each of them catering to a different set of customers. The concept of neo-banks is not recognized by the financial sector regulator of India.

As discussed above, neo-banks are licensed banks, operating through an entirely digital interface, without having any physical presence. In India, however, banks are compulsorily required to have a certain number of physical branches. Presently, the so called neo-banks in India operate under a partnership model with traditional licensed players. These may be operating as digital interface floated by the bank itself or fin-techs companies partnering with traditional banks to offer their services digitally.

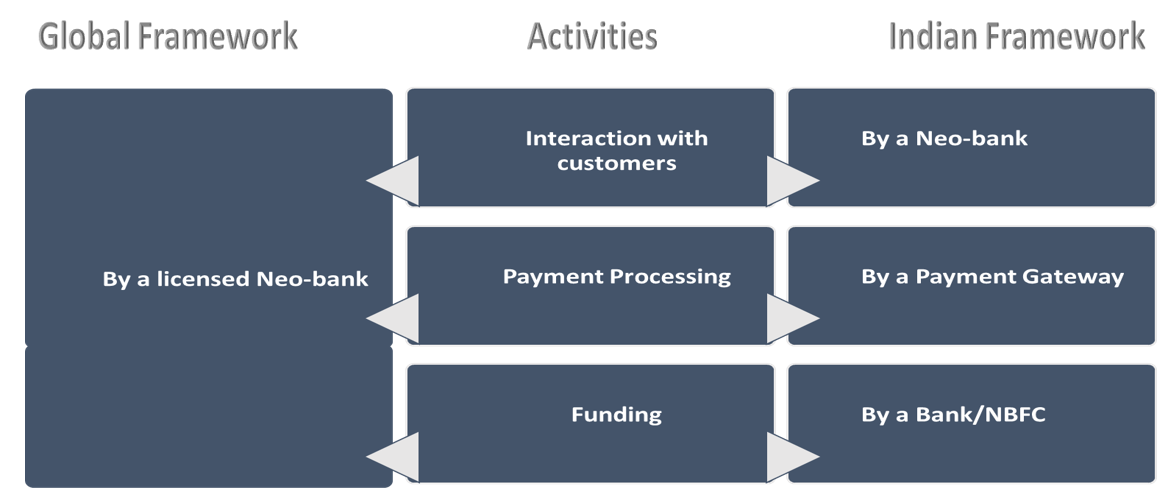

The following figure compares operation of a licensed neo-bank with that of a neo-bank operating in partnership model:

As per section 7(1) of the Banking Regulation Act, 1949 (‘BR Act’) “No company other than a banking company shall use as part of its name or in connection with its business any of the words “bank”, “banker” or “banking” and no company shall carry on the business of banking in India unless it uses as part of its name at least one of such words”[11].

As per section 7(1) of the Banking Regulation Act, 1949 (‘BR Act’) “No company other than a banking company shall use as part of its name or in connection with its business any of the words “bank”, “banker” or “banking” and no company shall carry on the business of banking in India unless it uses as part of its name at least one of such words”[11].

But, there exists few players claiming themselves to be operating as a neo-bank, interesting to highlight, even without the RBI issuing any license, they call themselves as a neo-bank. These so-called “neo-banks” are operating under a Partnership Model working in-tandem with a traditional incumbent bank. These actually are fin-tech companies, naming themselves as neo-banks. As discussed above, the BR Act bars using the words banking, bank etc. in the name of any entity other than a bank. By using the term neo-banks, these fin-techs give a public impression of being a bank licensed by the RBI. Some neo-banks do specifically indicate on their websites that they operate in partnership with existing scheduled banks, the same does not save them from violating the section 7 (1) of the BR Act. Fin-techs, by using the name neo-banks, without being regulated as a bank, are taking the benefit of the regulatory vacuum in this space.

The regulator acknowledges the development of neo-bank space in the country, which is why, the RBI and the Indian Government are considering enactment of a legislation to exercise control over these technology induced banks or full stack digital banks. NITI Aayog’s discussion paper proposes a new licensing/regulatory framework and defines “Digital Banks” as banks rely on the internet and other proximate channels to offer their services and not physical branches[12].

Conclusion

Contrary to countries like Singapore, South Korea, etc., the so-called neo-bank concept in India which is not backed by the RBI due to non-availability of any regulatory framework is still at a nascent stage. The digital lending landscape in India is growing exponentially with NBFCs taking a leap and banks exploring ways to remain discernible in the digital domain. It would be fascinating to see the future as technological advancement has just started evolving with the ensuing onset of bank 5.0, web 3.0 and Industry 5.0 providing required momentum to digital technologies.

[1] https://rbi.org.in/Scripts/BS_SpeechesView.aspx?Id=1193

[2] https://www.mas.gov.sg/news/media-releases/2000/internet-banking-announcement-mas-announces-policy-on-internet-banking–19-jul-2000

[3] https://www.mas.gov.sg/regulation/Banking/digital-bank-licence

[4] https://www.hkma.gov.hk/media/eng/doc/key-information/press-release/2018/20180530e3a2.pdf

[5] https://www.hkma.gov.hk/eng/key-functions/banking/banking-regulatory-and-supervisory-regime/virtual-banks/

[6] https://law.go.kr/LSW/eng/engLsSc.do?menuId=2&query=ACT%20ON%20SPECIAL%20CASES%20CONCERNING%20ESTABLISHMENT%20AND%20OPERATION%20OF%20INTERNET-ONLY%20BANKS#liBgcolor0

[7] https://vidhilegalpolicy.in/research/deconstructing-digital-only-banking-models-a-proposed-policy-roadmap-for-india/

[8] https://vidhilegalpolicy.in/research/deconstructing-digital-only-banking-models-a-proposed-policy-roadmap-for-india/

[9] https://www.federalreserve.gov/aboutthefed.htm

[10] https://www.mckinsey.com/industries/financial-services/our-insights/lessons-from-the-rapidly-evolving-regulation-of-digital-banking

[11] https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/BANKI15122014.PDF

[12] https://www.niti.gov.in/sites/default/files/2021-11/Digital-Bank-A-Proposal-for-Licensing-and-Regulatory-Regime-for-India.24.11_0.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!