Proposed changes under the LLP Act are much more than decriminalisation

More regulation for LLPs including business limitation, accounting standards and more!

By Pammy Jaiswal and Megha Saraf

Background

A Limited Liability Partnership (LLP) being a hybrid form of an entity has always been seen with lesser regulatory burden as compared to a company and is regulated by the Limited Liability Partnership Act, 2008 (LLP Act). Having said that, it is imperative to note that currently there are various provisions under the LLP Act that provide for levying penalty, fine and also imprisonment. The offences have been bifurcated into compoundable and non-compoundable offences as in the case of companies under the Companies Act, 2013 (CA, 2013/Act).

Further, the fact that an LLP in the course of its business can undertake debt obligations cannot be argued, however, the mode of undertaking debt obligations in the case of instruments has not been dealt with under the Act.

Continuing with the policy and intent of the Government of India to decriminalise minor and procedural non-compliances, the Ministry of Corporate Affairs (MCA) has constituted a Company Law Committee (CLC/Committee) on 18th September, 2019 with a view to revamp the LLP Act, 2008 (LLP Act) and bring necessary amendments in line with the economic scenario. The Committee was chaired by Mr. Rajesh Verma and had eminent personalities from regulatory bodies like SEBI etc.

While the main agenda for the constitution of the CLC was decriminalisation, however, when we look at the Report[1] which has been presented on 18th January, 2021 and is open for public comments till 2nd February, 2021, it is seen that it is much more than just decriminalisation.

Highlights of the Report

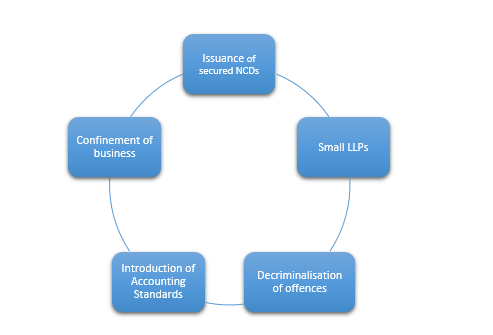

The proposed reforms go wide enough to confining the business of LLPs to non-financial business, creating a structure for issuance of non-convertible debentures by LLPs, having a separate classification called small LLPs with lower filing or additional fees, extending accounting standards for LLPs and decriminalisation of offences.

We shall now critically discuss the proposed reforms in detail.

Raising of funds through issuance of secured Non-Convertible Debentures (NCDs)

Debentures are one of the widely used instruments for raising funds. It is not only a structured mode of raising funds as it is in form of a security but also more flexible as compared to loans. As per the Act, a company can raise borrowed funds both by way of loan or issuance of debentures. However, the LLP Act has always been silent on the same.

Having said that, it is observed that the Report recommends issuance of secured NCDs only to bodies corporate and trusts which are regulated by SEBI or RBI with certain fetters as given below:

- The LLP agreement shall have a provision in this regard and the same should have been registered with the Registrar;

- Maintain a register of NCDs so issued in such form and manner as may be prescribed;

- Creation of debenture redemption reserve (DRR) out of the profits of the LLP for such quantum and in such manner as may be prescribed;

- Offer or invitation to subscribe to the secured NCDs to not more than 200 person in a financial year;

- Payment of interest and redemption to be made in accordance with the terms of issue;

- Filing of prescribed details about the secured NCDs so issued with the Registrar;

- In case of failure on the part of the LLP to pay interest or redeem the NCDs, the Tribunal may direct for doing so on the basis of the application made by any or all of the NCD holders;

- Issuance shall be made on such terms and conditions as may be prescribed;

- Any LLP who makes a default in compliance with the provisions of the proposed insertion of section 33A, will make the partners liable for punishment with imprisonment for a term which may extend to one year or with fine which shall not be less than Rs. 2 lacs and may extend upto Rs. 5 lacs or both.

International scenario

- United Kingdom

The Limited Liability Partnerships (Application of Companies Act 2006) Regulations, 2009[2] specifically lays down the provisions for issuance of debentures. The provisions broadly say the following:

- Provision to issue perpetual debentures;

- Registration of the allotment of debentures within 2 months after the date of allotment;

- Debentures to bearer issued in Scotland are valid and binding according to the statue of Scots Parliament Act, 1696;

- Maintenance of register of debenture holders;

- Right to inspect register of debenture holders and take extracts of the same;

- Time limit for claims arising from entry in register;

- Providing for right to debenture holder to copy of deed;

- Providing for the liability of trustees of debentures;

- Power to re-issue redeemed debentures;

- Priorities where debentures secured by floating charge;

- Deposit of debentures to secure advances

FAQs on LLPs by United Kingdom[3]

As per the FAQs, LLPs can create a charge on its assets and issue debentures. Further, para 53A.80 of the same provides that “An LLP, as it has a separate legal identity, is able to create and issue debentures to secure its borrowing”.

Hence, the LLP Act of United Kingdom provides for issuance of Debentures by an LLP.

-

Singapore

As per para 11 of the Fourth Schedule of the Singapore LLP Act, 2005[4], “Where a receiver is appointed on behalf of the holders of any debentures of a limited liability partnership secured by a floating charge or possession is taken by or on behalf of debenture holders of any property comprised in or subject to a floating charge, then, if the limited liability partnership is not at the time in the course of being wound up, debts which in every winding up are preferential debts and are due by way of wages, salary, retrenchment benefit or ex gratia payment, vacation leave or superannuation or provident fund payments and any amount which in a winding up is payable in pursuance of paragraph 76(6) or (8) of the Fifth Schedule shall be paid out of any assets coming to the hands of the receiver or other person taking possession in priority to any claim for principal or interest in respect of the debentures and shall be paid in the same order of priority as is prescribed by that paragraph in respect of those debts and amounts.”

This implies that the Singapore LLP Act also allows raising of funds by way of debentures.

Related Indian laws and guidance

- Banning of Unregulated Deposit Schemes Act, 2019 (BUDS Act)

The Ministry of Law and Justice has laid a comprehensive mechanism to ban any unregulated deposit schemes by introducing Banning of Unregulated Deposit Schemes Act 2019 (BUDS Act). Section 2(4)(e) of the said Act stated that where a capital contribution is received by an LLP, the same is an exempt deposit.

Further, the introductory paragraph as well as Section 41 of the BUDS Act states that the said Act shall not apply to deposits taken in the ‘ordinary course of business’. While ‘ordinary course of business’ has not been defined, however, the same should be construed as funding raised in order to carry out business operations for which the LLP has been formed since every business requires funding to operate.

- SEBI’s Informal Guidance[5] in the matter of Vijay Suraksha Realty LLP

In the said case, the LLP intended to raise funds through listed NCDs under the SEBI (Issue and Listing of Debt Securities) Regulations, 2008 (ILDS Regulations) and list them in the wholesale debt market. While the definition of ‘debt securities’ as per ILDS Regulations covered such securities issued by an LLP by virtue of it being a body corporate, however, the definition of ‘Issuer’ specifically covered company, public sector undertaking or any statutory corporation.

While the said informal guidance discussed on the issue of listed NCDs, it nowhere discussed or stated regarding any restriction in the LLP Act to issue NCDs.

VKC Comments

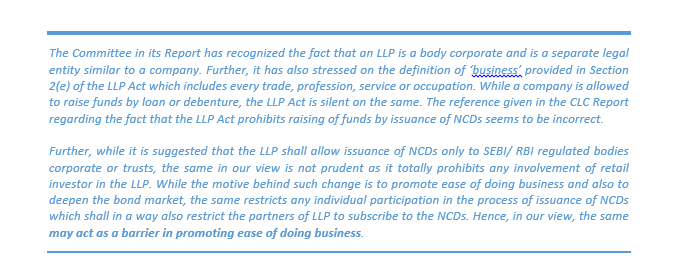

The Report states that an LLP Act can contract debt, however, the LLP Act along with the allied Rules do not permit the LLPs to raise funds. While the Report talks about the restriction on issuance of NCDs, however, it is significant to note that the LLP Act and the rules are silent on the same. Accordingly, in the absence of any express restriction for the said matter, construing that the same tantamount to a restriction is not correct in our view.

The Report also focuses on the fact that it is important to boost the debt market in India and allow LLPs to raise funds by issuance of NCDs. Further, in order to protect investors’ interests and to prevent any fraudulent misuse of funds, such issuance will be allowed to be made only to SEBI or RBI regulated entities thereby prohibiting any issuance to retail investors. While this is a welcome move to insert an express provisions for enabling and at the same time regulating the issuance of NCDs by an LLP, however, the following things should also be considered at the time of bringing the final changes in the law:

- Change to be prospective – This change in law is expected to be prospective and not retrospective considering the fact that the existing set of laws was silent on the same. If the same is made retrospective, it may have serious consequences to those LLPs which have actually raised funds in the form of NCDs based on the existing text of the LLP Act and allied rules.

- Allowing issuance of NCDs to individuals – The intent of proposed change is very clear to allow issuance of NCDs by LLPs and at the same time protect the interest of the investors. Having said that, it can be noted that the Act allows issuance of NCDs to all categories of investors including the individuals along with certain conditions or fetters. Similarly, allowing LLPs to issue NCDs to retail investors with several safeguards should also be allowed considering that an LLP may not always have the outreach to the regulated investors. In the absence of such outreach, the proposed change may fall short of meeting its intent.

Introduction of Small LLPs

The CA, 2013 provides for the concept of small companies. Such small companies enjoy several privileges under the CA, 2013 such as reduced no. of board meetings, preparation of concise board’s report, lesser penalties, concise financial statements etc. The rationale behind such relaxations/ privileges is to promote ease of operations by small companies or MSMEs.

With similar intent, the CLC Report has proposed the introduction of small LLPs. Such a provision will facilitate lesser compliances, lesser fee or additional fees for small LLPs.

The proposed definition of small LLPs will be based on contribution and turnover not exceeding 25 lacs or 40 lacs respectively, or such higher amount as may be prescribed. Such small LLPs will be able to enjoy several privileges such as:

- Reduced filing fees;

- Lesser compliances;

- Lesser additional fees;

- Lesser penalties;

- Accounting Standards for only certain class of LLPs mainly engaged in manufacturing LLPs

The same will reduce cost of compliances and will facilitate business by MSMEs/ small LLPs.

Confinement of business activities

The LLP Act does not prohibit an LLP from carrying out a particular business activity. However, it has been seen that RBI has raised concerns on an LLP carrying out non-banking financial activities. The Report has discussed that RBI is not the regulator of LLPs and hence, should not be regulating non-banking financial activities of an LLP.

Considering the same, the Report has proposed insertion of a new proviso wherein the definition of ‘business’ comes with a proviso. This proviso gives the power to the Central Government to include or exclude any business activities by way of a Notification.

Express restriction proposed for merger of LLPs with a company

The CLC Report has also placed a proposal to restrict any amalgamation of an LLP with a company by amending Section 62 of the LLP Act.

Since, an LLP is also a body corporate hence, putting such restriction on amalgamation of a body corporate with another body corporate does not seem to be a welcome move.

Decriminalisation of offences

The CLC has recommended various offences to be decriminalized and to be shifted to the In-house Adjudication Mechanism. Similar to the CA, 2013, where several provisions have been decriminalized both either by amending the CA, 2013 or by Companies (Amendment) Act, 2020. The motive behind the same is to de-clog the courts or the NCLTs thereby reducing their burden from non-serious matters. A list of the offences decriminalized are as follows:

- Section 9- Changes in Designated Partners

- Section 10- Punishment for contravention of section 7,8 and 9

- Section 13- Registered office of limited liability partnership and change therein

- Section 21- Publication of name and limited liability

- Section 25- Registration of changes in partners

- Section 34- Maintenance of books of account, other records and audit, etc.

- Section 35- Annual Return

- Section 60- Compromise, or arrangement or limited liability partnerships

- Section 62- Provisions for facilitating reconstruction or amalgamation of limited liability partnerships

- Section 74- General penalties

Introduction of In-house Adjudication Mechanism (IAM)

In order to ease out and de-clog the Courts, various offences have been proposed to be decriminalized and brought under the In-house Adjudication Mechanism (IAM), similar to the CA, 2013. The CLC Report has introduced Section 77A in the LLP Act thereby enabling the Central Government to appoint officers for adjudging penalty under the provisions of the LLP Act.

Reduction in filing fees

Section 69 of the LLP Act deals with the provisions of additional fee on delayed filings of documents/ returns of the LLPs. There are situations when the returns/ documents are not filed timely due to technical glitches. The Report also proposes reduced additional fees in cases of delayed filings which will facilitate ease of doing business. Further, the introduction of reduced additional fees in case of small LLPs will incentivize the operations of such LLPs.

Introduction of accounting standards

As per the extant provisions in the law, in absence of any specific provision, LLPs are required to comply with the Generally Accepted Accounting Principles (GAAP). It has been discussed that it is important to make accounting standards applicable on certain class of LLPs particularly LLPs engaged in manufacturing activities. Further, it is also proposed to lay down standards for auditing to certain classes of LLPs. Accordingly, it has been recommended to insert new sections 34A and 34AA in the LLP Act in respect of the same.

Alignment with the provisions of CA, 2013

Considering the enactment of the CA, 2013, it was prudent to align the references of the Companies Act, 1956 provided in the LLP Act with that of the CA, 2013. A list of the sections where the alignment of the sections has been made is as follows:

- Section 2(1)(c)- Definition of ‘Appellate Tribunal’

- Section 2(1)(d)- Definition of ‘’Body corporate’

- Section 2(1)(e)- Definition of ‘Business’

- Section 2(1)(s)- Definition of ‘Registrar’

- Section 2(1)(u)- Definition of ‘Tribunal’

- Section 2(2)- General definition of words and expressions under the CA, 2013

- Section 7(6)- Designated Partners

- Section 58- Registration and effect of conversion

- Section 59- Foreign limited liability partnerships

- Section 67(1)- Application of the provisions of the Companies Act

Introduction of a new Section 68A- Registration Offices

In alignment with the provisions of Section 396 of the CA, 2013, which enables Central Government to appoint officers to carry out or discharge functions bestowed upon the Central Government, the CLC Report has also proposed similar provisions by introduction of Section 68A in the LLP Act.

Conclusion

With the plethora of changes proposed, it seems that the LLP Act is set to be amended significantly. While the title of the Report suggested that decriminalisation is the main agenda, however, after looking into the same, we understand that the proposed changes are deep and wide.

Some of the proposed changes related to the issuance of NCDs and restriction on amalgamation with a company will surely attract market reaction. Since the Report is currently open for public comments, it will be interesting to see the final set of changes proposed.

Our other related material:

To read our Articles on corporate laws, click here

To read our Articles on other matters, click here

[1] http://www.mca.gov.in/Ministry/pdf/Report%20of%20the%20Company%20Law%20Committee%20on%20Decriminalization%20of%20The%20Limited%20Liability%20Partnership%20Act,%202008.pdf

[2] https://www.legislation.gov.uk/ukdsi/2009/9780111479612/part/6

[3] https://www.insolvencydirect.bis.gov.uk/technicalmanual/Ch49-60/Chapter%2053A/Ch53A%20FAQs.htm

[4] https://sso.agc.gov.sg/Act/LLPA2005?ProvIds=Sc4-#Sc4-

[5] https://www.sebi.gov.in/sebi_data/commondocs/VijaySuraksha-SEBIRep_p.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!