Trading window restrictions get hardwired as trading freeze at PAN level for DPs

SEBI extends the requirement to all listed entities in phased manner

Vinita Nair & Aisha Begum Ansari | Vinod Kothari & Company | corplaw@vinodkothari.com

July 20, 2023 (Updated as on March 30, 2024)

Background

SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) inter-alia prohibits trading by a Designated Person (‘DP’) when the trading window is closed. Despite the express prohibition, there are instances of deliberate or inadvertent trades by the DPs that results in violation of the Code of Conduct to regulate, monitor and report trading by its DPs and immediate relatives of DPs followed by disciplinary action by the listed entity, reporting of violation to the Stock Exchange (‘SE’) and followed with SEBI proceeding against the DP for the violation. This causes reputational loss for the listed entity as well as the DP and loss of investor confidence on the internal controls and systems prevalent in the listed entity. There is also a practice followed by certain financial sector entities where the demat account of DPs are opened with the SEBI registered depository participants in the group and trading in the said security of the listed entity is locked/ freezed during the trading window closure period. In case of financial results the closure period commences the 1st day immediately following the end of quarter (for e.g. Oct 1, Jan 1, April 1 and July 1) and ends after 48 hours post disclosure of financial results.

SEBI vide Circular dated August 05, 2022 (‘original circular’), had proposed a framework for restricting trading by DPs by freezing PAN at security level during the Trading Window Closure (‘TWC’) period making it applicable on listed companies that are a part of Nifty 50 or Sensex 30 commencing from declaration of financial results for quarter ending September 30, 2022

On similar lines, on June 28, 2023, BSE and NSE issued a circular extending the requirement phase wise in case of financial results to rationalize the compliance requirement and to prevent inadvertent non-compliances of provisions of PIT Regulations. While the phase was indicated in the circular and was to apply to all listed entities effective April 1, 2023, the details of companies covered under the obligation for quarters ending September 30, 2023 and December 31, 2023 was to be indicated by way of a separate circular.

Present Circular

On July 19, 2023, SEBI issued a circular (‘present circular’) on similar lines of BSE and NSE specifying the companies covered for freezing their PAN which has been discussed in this article. In order to provide further clarity on the practical implications, BSE and NSE issued the FAQs on the subject on March 28, 2024 (‘SE FAQs’).

Applicability of the present circular

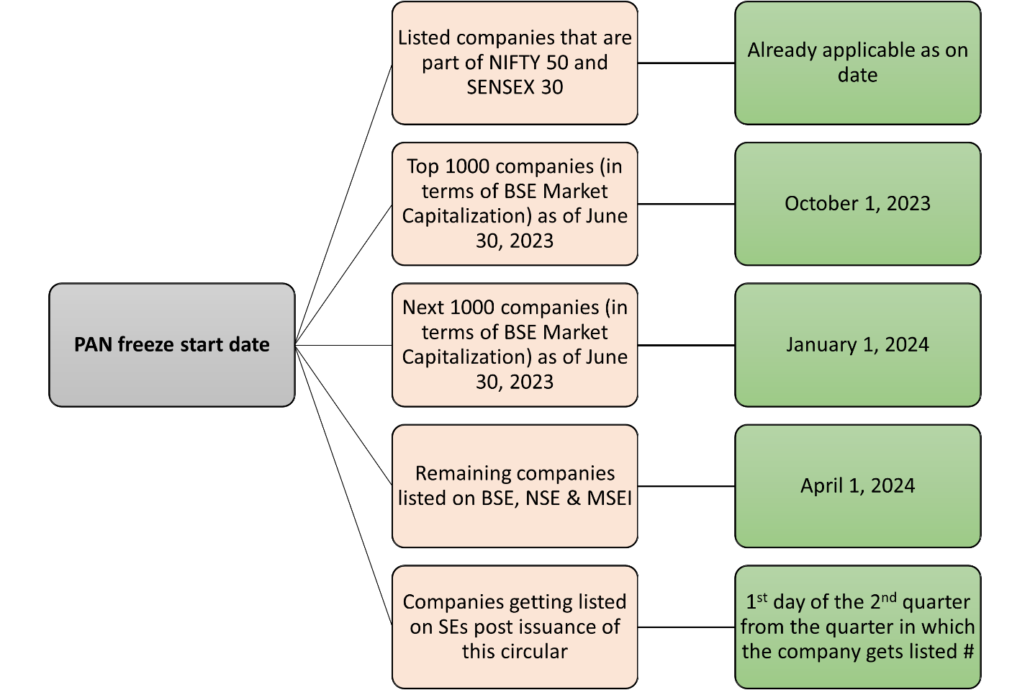

This Circular will be applicable for on-market transactions, off-market transfers and creation of pledge in equity shares and equity derivatives contracts (i.e. Futures and Options) of listed entities in a phased manner as explained in figure 1 below.

Figure 1: Applicability of provision relating to freezing of PAN

# Illustration: For a company getting listed during October 01 to December 31, 2023, PAN of DPs should be frozen at security level as per prescribed framework latest from April 01, 2024.

For trading in derivatives, the SE FAQs states that the listed company will be required to educate the DPs about freezing of PAN at ISIN level. Consequently, all open positions in the derivative segment should be squared off before the commencement of TWC.

Process for implementing through Designated Depository (‘DD’)

In terms of SEBI Circular dated May 28, 2018, listed companies were required to select one of the depositories as a Designated Depository (‘DD’) for disclosing the details of the company for the purpose of implementing system driven disclosures in the capital market. Further in terms of SEBI Circular dated September 09, 2020, for further automating the system driven disclosures, listed companies were required to submit PAN of promoters/ promoter group, DPs and directors (hereinafter collectively referred to as entities) to the DD and for PAN exempt investors, the demat account number(s) were required to be provided. Further, In case of any subsequent changes in the directors/ employees of the listed company, the companies were required to provide the information of the changes to the depositories on an immediate basis and not later than 2 working days.

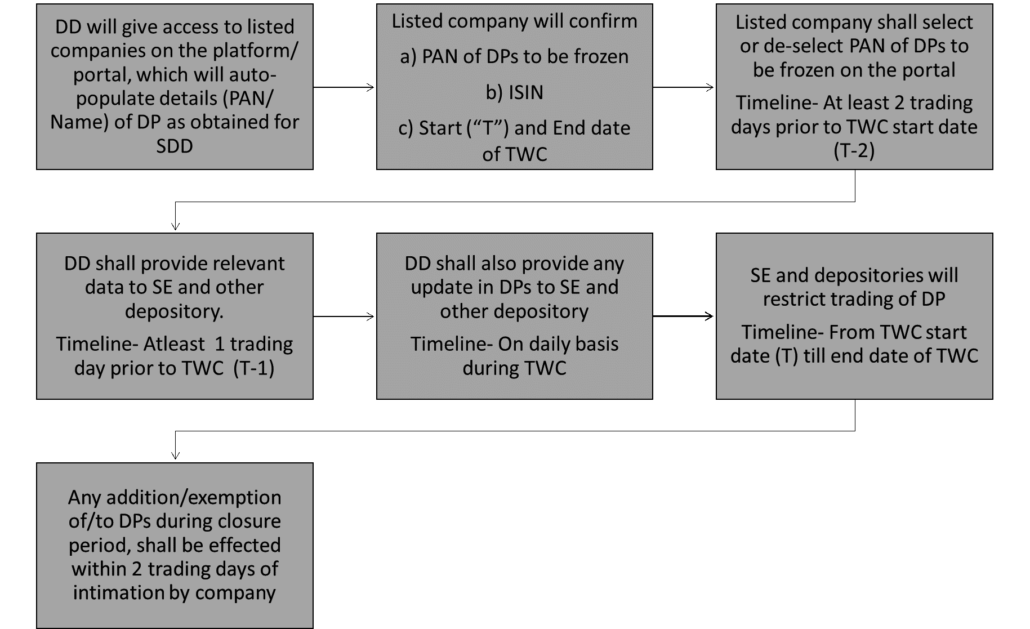

The original circular prescribed the following procedure for prohibiting trading during TWC as explained in figure 2 below.

Figure 2: Procedure of prohibiting trading during TWC

Quarterly reporting by Depositories

The present circular requires quarterly reporting by the depositories giving details of number of listed entities on which the requirement is applicable and that appointed the depository as a DD, number of PAN of DPs provided for the freeze, total number of accounts in which PAN-ISIN level freeze was levied for the quarter and total number of exemptions given to DPs.

Accordingly, the DDs are expected to keep a track of all the quantitative data to be able to report at the end of quarter.

Disclosure of TWC to stock exchange

The PIT Regulations are silent on the requirement to disclose TWC period to the stock exchange.The relevance of TWC is for DPs and not the general public at large. The circular of BSE dated February 03, 2014 as well as that of NSE dated December 18, 2013 also provided for disclosure of the TWC period at the time of disclosing the price sensitive information. The original circular provides that after the listed company enters the TWC period, the DD shall disclose the TWC period and other details received from the listed company to the SE and other depository atleast 1 trading day prior to the commencement of TWC.

Presently, the scope of the original circular and the present circular is limited to TWC for financial results. However, going forward, if this mechanism is adopted for various trading window closures for all DPs or few of them, SEBI will have to reconsider the requirement of informing about TWC to SE or anywhere in public domain as it signals the world at large about the existence of UPSI within the company.

The stock exchanges also rolled out XBRL format for public comments w.r.t informing about TWC to the stock exchange. In our view, the requirement of intimation of TW closure period is unwarranted and should be done away with in entirety in order to avoid creation of a false market for reasons discussed below:

- Right from the germination of UPSI till its disclosure to the stock exchange, its confidentiality is required to be maintained, and hence, the TW is closed for the DPs who are having access to such UPSI. There is no requirement of ‘intimation’ of TW closure to the stock exchange at the time of generation of UPSI as TW closure is for DPs (insiders) and not outsiders. When the information is in a shape concrete enough to be disclosed, the listed entity will do a disclosure under Regulation 30. Before the information is made public, the TW is closed. In that case, how can the listed entity go public on TW closure before the information is itself public, this is in contradiction with the requirement of law. 3.

- If the listed entity discloses that its TW has been closed stating the purpose of the TW closure (as indicated in the proposed format) this itself is sufficient to convey a message to the market that a UPSI has, in fact, originated in the organization, leading to speculations, market rumour, attempt to procure the information and fluctuations in the price of the listed security, thereby, defeating the very purpose of TW closure.

Applicability of the restriction to off-market trades

PIT Regulations permit off-market inter-se transfer between insiders who were in possession of the same unpublished price sensitive information without being in breach of regulation 3 and both parties had made a conscious and informed trade decision.

The system provides for the flexibility to the listed company to exempt the transaction by de-freezing the PAN of such DP in the system. In such cases, the restriction shall be removed within 2 trading days from the date of receipt of request from the listed company.

For example, if the listed company provides exemption to any DP on April 3, 2024, then the change i.e. de-freeze shall be effected on or before April 5, 2024. The restrictions shall be re-introduced automatically post lapse of the exemption period or completion of the transaction by the DP.

Determination of TWC period and alteration to the same

The original circular mandates listed companies to specify the TWC period atleast 2 trading days before the TWC start date. While the period within which the financial results are to be approved are provided in the Listing Regulations, it is likely that the company may not be certain about the Board meeting date for approval of the financial results and therefore, not in a position to specify the end date for TWC. In such cases, the SE FAQs have clarified that the end date is modifiable. The listed entity can put a notional end date initially and once the board meeting date is decided it can be modified on the basis of T-2 days.

Compliance in case of companies having stricter TWC period

Some companies follow the practice of a stricter TWC period where the TW is closed much prior to the end of quarter. For e.g. for the financial results of the quarter ended March 2024, the TWC would be closed from 15th March, 2024. Presently, the portal freezes the PAN from the 1st day of the month following the end of quarter. In such cases, theSE FAQs provide that the listed companies will be required to close the TW internally by sending intimations to the DPs.

Applicability of the restriction to creation of pledge on equity shares

Para 4 (3) of Schedule B to PIT Regulations expressly permit pledge of shares for bonafide purposes such as raising of funds subject to pre-clearance by the compliance officer during the trading window closure period. However, the original circular restricts the same.. Further, with regard to invocation of pledge, the SE FAQs provides that pledge invocation is not allowed in the tenure of PAN freeze, unless pledge is created before the TWC period.

The meaning of DPs under PIT Regulations includes promoters and it will be quite challenging for business if the ability to pledge the shares is prohibited during the result declaration period. Hence, in order to allow pledge of shares, the listed company will have to specifically exempt such DP by updating in the system, on a case to case basis.

Further, the Supreme Court ruling in the matter of PTC India Financial Services Limited v. Venkateshwar Kari and Another[1] highlighted the modus operandi in case of pledge and also reiterated the need of aligning laws like SEBI’s Takeover Regulations – see para 11.8 of the said ruling. We have also discussed the relevance of PIT Regulations in the context of pledge in another article[2]. This needs to be revisited by SEBI.

Conclusion

The SE FAQs provide further clarity for the entire regime. This will certainly help in minimising the instance of violations on account of trading during TWC period. The mechanism will work well in case of TWC for financial results, however, may require a re-look in case extended to all TWC for all UPSI.

[1] Refer article: https://vinodkothari.com/2022/06/broken-pledge-apex-court-reviews-the-law-on-pledges/

[2] Refer article: https://indiacorplaw.in/2022/07/supreme-court-on-pledge-of-shares-insider-trading-regulations-may-require-review.html

| Our other related resources can be accessed here |