Revising minimum public holding requirements for large issuers and companies under CIRP

Securities Contract (Regulations) Amendment Rules, 2021 notified

Payal Agarwal, Executive ( corplaw@vinodkothari.com )

Background

SEBI had released a consultation paper on 20th November, 2020 order to review the requirements of minimum public offer for large issuers. The Consultation Paper proposed to reduce the requirements of minimum public offer for large issuers while also reducing the time period to meet the minimum public shareholding requirement (“MPS”). Further, SEBI had released another consultation paper on 19th August, 2020 for review of minimum public shareholding requirements for companies undergoing CIRP under IBC, wherein the Consultation Paper suggested three different modes of recalibrating the requirement for MPS upon approval of resolution plan.

Consequently, the Ministry of Finance has notified the Securities Contract (Regulations) Amendments Rules, 2021 (“the Amended Rules”) on 18th June, 2021 to amend Rule 19 and 19A of the Securities Contract (Regulations) Rules, 1957 (“the Rules”) giving effect to the above-mentioned proposals.

Reduction in minimum public shareholding requirement for large issuers

Who are large issuers?

Large issuers are issuers with post issue market capitalisation (‘MCap’) equal to or above Rs. 4000 crores. Currently all issuers with an MCap of Rs. 4000 crores are required to dilute 10% of an IPO to public shareholding. Large issuers have now been bifurcated into large issuers (MCap of Rs. 4000 crores and above) and very large issuers (MCap of Rs. 1 lakh crores).

New minimum public offer requirements for large issuers as per the Amended Rules

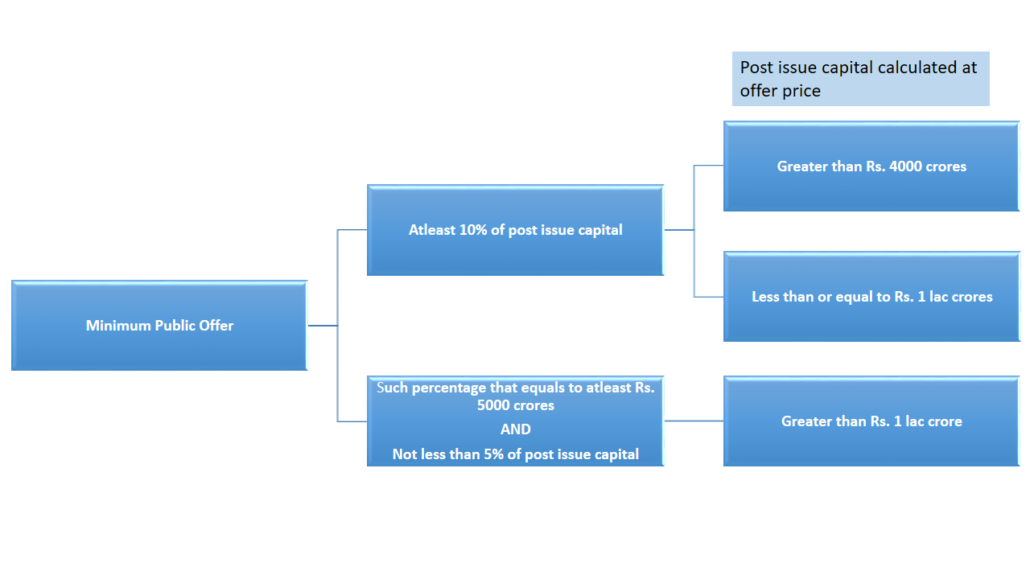

The post issue MCAP requirement for large and very large issuers has now been amended as below –

Accordingly, a flat rate of 10% has been set for large issuers while an incremental rate has been set for very large issuers with a post issue MCap of Rs. 1 lakh crores and above. For issuers below these thresholds, the existing requirements continue.

Accordingly, a flat rate of 10% has been set for large issuers while an incremental rate has been set for very large issuers with a post issue MCap of Rs. 1 lakh crores and above. For issuers below these thresholds, the existing requirements continue.

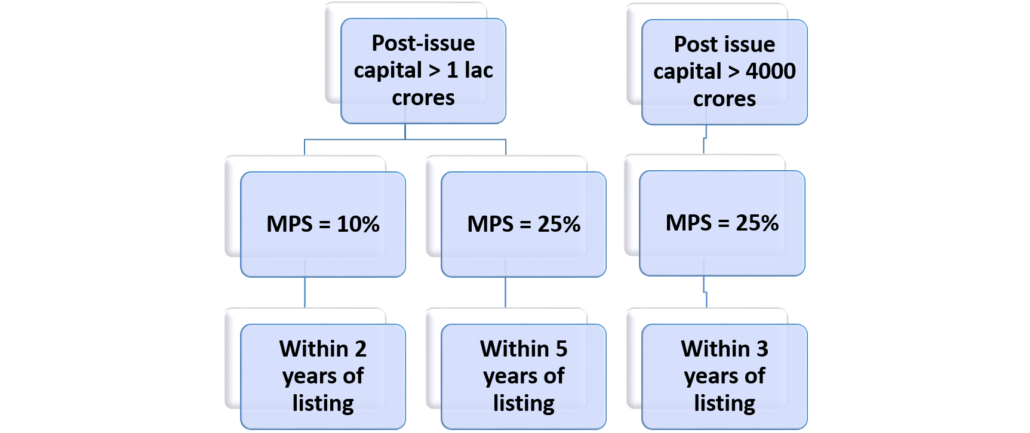

New MPS requirement

Currently, companies are required to meet the MPS within 3 years from the date of listing. However, in case of large issuers, the MPS is to be met as follows –

Rationale as proposed in the Consultation Paper

The reduction in the minimum public offer requirements for large issuers was proposed due to the following reasons –

- The compliance of such minimum public shareholding requirements is cumbersome for the large issuers.

- The large issuers already have investments from strategic investors who are classified as “public shareholders” post listing. Therefore, the requirement of minimum public offer results in unnecessary dilution of control of promoters thereby imposing constraints on issuers.

Minimum public shareholding requirement for companies under Resolution Plan

Further, amendments have been made in Rule 19A of the Rules, with respect to the minimum public shareholding requirements for a company under CIRP under Insolvency and Bankruptcy Code, 2016 (‘IBC’).The Amended Rules provide a strict-er timeline for post-CIRP companies to comply with the MPS requirements upon implementation of resolution plans

Change in the requirements as per the Amended Rules are as follows –

| Particulars | Requirement before amendment | Requirement as per Amended Rules |

| Public shareholding falls below 25% | Bring to 25% within 3 years of such fall | No change |

| Public shareholding falls below 10% | Bring to 10% within maximum 18 months of such fall | Bring to 10% within maximum 12 months from such fall |

| Minimum public shareholding to be maintained | No such requirement | Shall not fall below 5% |

Rationale as proposed in the Consultation Paper

The relaxations with respect to the strict enforcement of Rule 19 of the Rules have been given in order to ensure revival of a Corporate Debtor pursuant to a resolution plan. However, while the same seems to be in favour of Corporate Debtors, specifying no MPS requirement may result in cases where the public shareholding will become extremely low, leading to less float, thereby hampering the market integrity and price discovery in secondary market.

The Consultation Paper suggested three different alternatives out of which the second one has been preferred since the MPS of 5% being a lower threshold will incentivise the companies to stay listed post-CIRP whereas higher thresholds may cause total delisting

The said requirement shall have significant ramifications for resolution applicants who otherwise are more focused on operational aspects over regulatory requirements. While resolution plans relaxes several requirements like an open offer under SAST regulations, it is significant to note that requirements w.r.t. MPS were never completely waived off. The present step of giving more stringent timelines is introduced with the objective of protecting the investors’ interest and shielding them from the possible loss of value due to delayed MPS adherence. The loss of value can be on account of delisting of such corporate debtors under CIRP, whereas the shareholders may recover potential value from the shares of such corporate debtor if it continues to remain listed post implementation of resolution plan.