Decoding the New Norm

Framework for SROs for financial sector entities

-Srinithi Sreepathy | finserv@vinodkothari.com (Updated as on 29.03.2024)

On December 21, 2023, the Reserve Bank of India presented its first ‘Draft Omnibus Framework for recognising Self-Regulatory Organisations for Regulated Entities’(‘Draft Omnibus Framework’) in pursuance of its Statement on Developmental and Regulatory Policies dated October 06, 2023. RBI subsequently finalized and issued the Omnibus Framework for SROs on March 21, 2024.

The Omnibus Framework is in response to a vacuum located between Regulators and the ever-evolving industry dynamic. The RBI had proposed a draft and later finalised the framework, for Self-Regulatory Organisations (SROs) indicating a willingness to enter a collaborative approach to regulatory frameworks.

The Omnibus Framework, taking the increasing number of regulated entities and their growing scale of business into consideration recognises the lack of sufficient industry standards for self-regulation. Identifying this need and being aware of the futility of increasing the burden on regulatory bodies like the RBI, SEBI, or IRDA, (in this case, specifically: the RBI) the framework finds a middle ground by recognising self-regulation amongst members of various industry entities.

What are Self-Regulatory Organisations? What do they Do?

Self-Regulatory Organisations (SRO) are not-for-profit organisations that attempt to bridge the gap between regulation and industry-specific requirements.

Read more: Decoding the New NormIn the Indian context, the most popular example remains the Association of Mutual Funds India, or the AMFI, an entity incorporated under Section 8 of the Companies Act 2013 as a not-for-profit organisation with the stated intent to act as a facilitator between the Regulatory Body of SEBI/RBI/the Government of India and the Mutual Fund ecosystem. It also aims at formulating standards or “best practices” which shall in turn become the industry status quo for all members to follow and live by. The AMFI also acts as a licensing body for all Mutual Fund distributors in India as per the duties assigned to it by the SEBI.[1] MFIN (Mutual Fund Investment Network) is another example of a successful SRO infrastructure in India. With the emergence of the FinTech Sector in India: Section 8 companies like FACE and DLAI have cropped up with both significant membership and the aim to establish industry standards and Codes of Conduct. The current omnibus[2] offers these institutions the opportunity to get regulatory sanction from the RBI.

The Omnibus Framework defines its intent by stating:

“Self-Regulatory Organisations (SROs) enhance the effectiveness of regulations by drawing upon the technical expertise of practitioners and also aid in framing/ fine- tuning regulatory policies by providing inputs on technical & practical aspects, nuances and trade-offs involved. SROs can also help in fostering innovation, transparency, fair competition, and consumer protection. In sum, self-regulation shall complement the extant regulatory/ statutory framework for better compliance, in letter and spirit.”

To enable the SRO to fulfill the above obligations, the Omnibus Framework gives power to the SROs to frame necessary standards or codes within the regulatory framework prescribed by RBI. The adoption of the code, however, should not be a substitution for adhering to the necessary RBI Regulations.

What is the purpose of an SRO? Why do they exist?

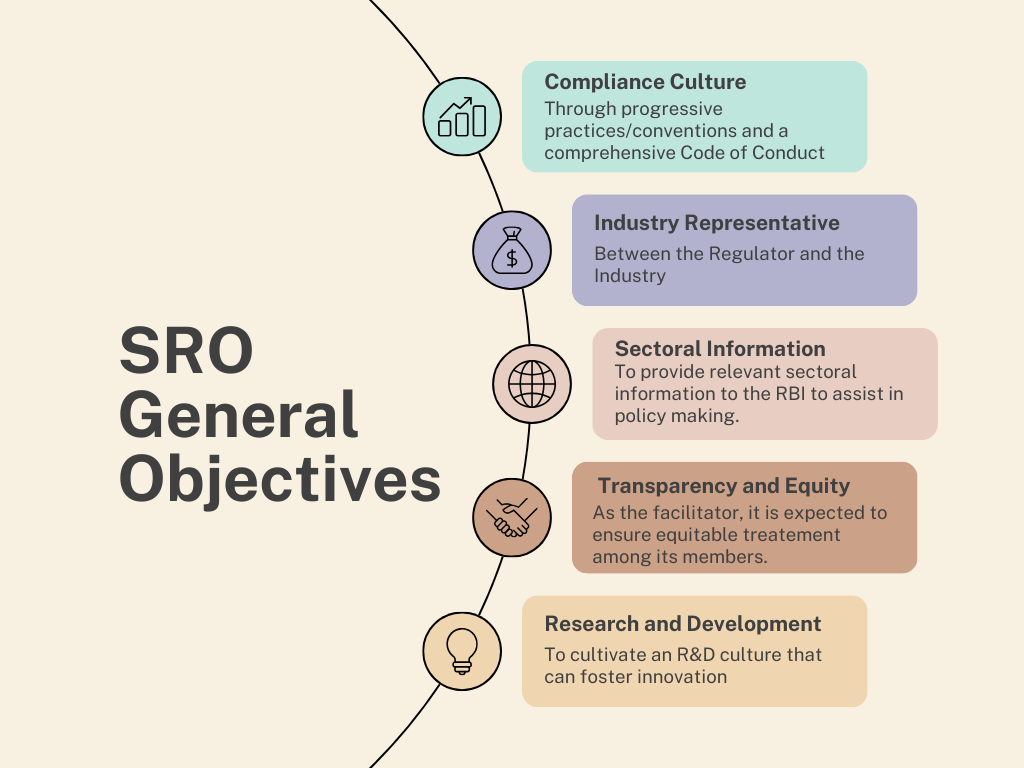

As per the Omnibus Framework, SROs are expected to primarily act as an interface between the regulatory body and regulated entities. Thus, one of their primary duties extends toward collecting and providing relevant industry-specific data[3] to the Reserve Bank to aid more efficient policy making. Apart from this SROs are also expected to foster greater research, promote compliance practices, ensure inclusive development and effectively act as an industry representative before the regulatory body.

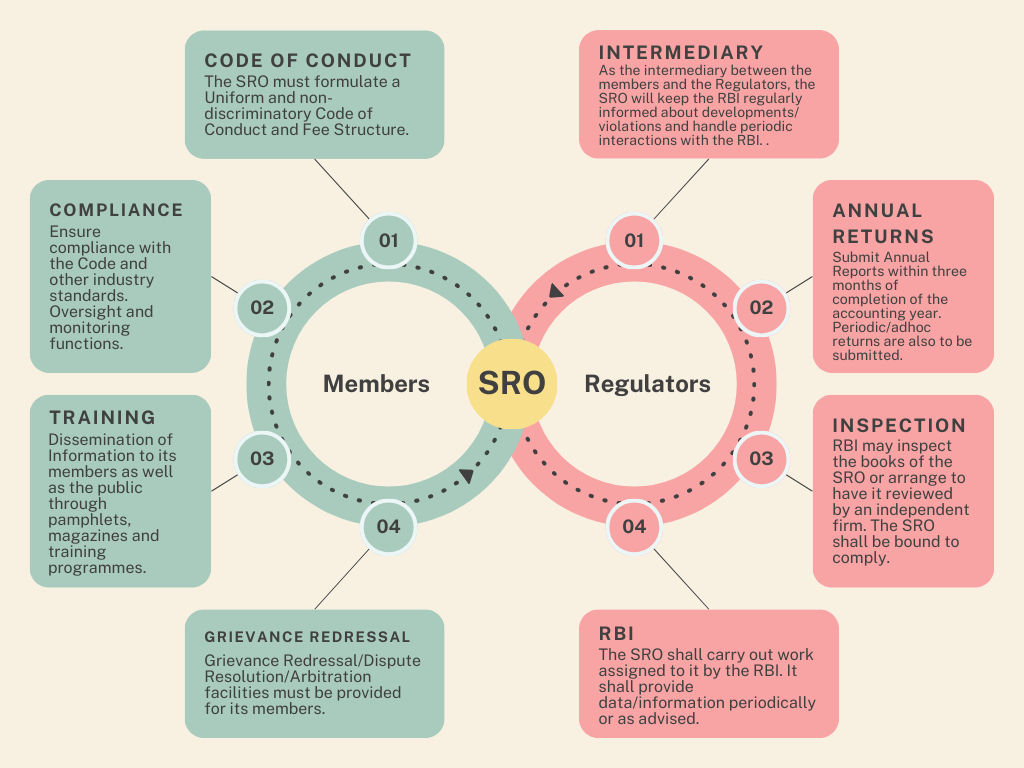

SROs have certain general objectives, as well as specific responsibilities to be undertaken toward both its members as well as the RBI that gives it its credibility. Their responsibilities can be construed in a trifecta of general and specific duties, with specific duties being toward their members and the regulatory body to whom they represent their members. The Omnibus Framework defines “members” as the Regulated Entities which accept the membership of SRO.

Figure 1 SRO General Objectives

[Clause(s) 6 and 7 of the Omnibus Framework]

Through the establishment of “best practices” and industry benchmarks that may be emulated by most if not all entities in a particular industry and recognising that it may be impossible for the average pedestrian to undertake thorough due diligence independently, the SRO acts as a “stamp of approval” toward the validity and trustworthiness of a particular entity. To ensure that the SRO in itself is reliable, they may be subject to periodic audits by the regulatory body, and are also required to submit their annual reports to the Reserve Bank within three months of completion of the accounting year.

They are also required to frame a code of conduct that should be adhered to by their members, provide periodic sector-specific information through bulletins, pamphlets and magazines to increase awareness amongst its members, establish grievance redressal and dispute resolution mechanisms for its members and also educate the public about the grievance redressal mechanisms available to them. The Omnibus Framework allows the SROs to counsel, caution, reprimand, and expel the members as a consequence of violation of the code established by it. However, such consequences cannot result in the imposition of a monetary penalty on the member.

Figure 2: Responsibilities Towards Members and Regulators

Clause(s) 8 and 9

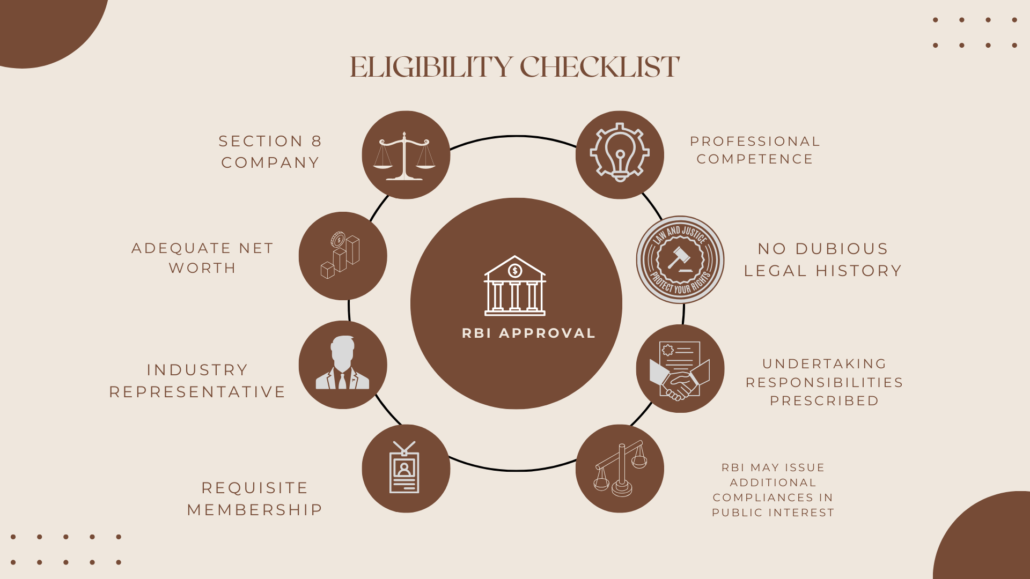

What are the eligibility criteria for forming an SRO?

Figure 3: Eligibility Criteria for SRO Recognition

Further, the Omnibus Framework specifies that the shareholding of an applicant should be sufficiently diversified. The applicant will not be eligible if an entity either singly or acting in concert holds 10% or more in the paid-up share capital of the applicant.

Who are the key stakeholders?

The RBI envisions the present omnibus primarily for entities regulated by the RBI. The SRO, once it receives its Letter of Recognition from the RBI will consequently impact the institutions/entities that comprise the sector it is representative of.

Thus, in the present context, some of the primary stakeholders are:

- Banking and Financial Institutions: As the RBI framework is directly impacting regulated entities, the Banking and Financial Institutions Sector becomes the primary stakeholders as they need to ensure compliance with the new standards.

- Industry Associations: As the Omnibus Framework aims to solemnise industry bodies and associations for responsible growth in the Financial Sector, these bodies will need to comply with the new framework. These bodies need to comply with the new standards as well as ensure that their members are similarly compliant. For e.g.:

- DLAI (Digital Lenders Association of India): Comprising over 80 members and involved in over $5 Billion in annual disbursements, DLAI’s stated objective remains the support of development and best practices in the Digital Lending Industry.

- FACE (FinTech Association for Consumer Empowerment): A Section 8 Company, stated to be a “Self-Regulatory industry body of fintech lenders” FACE aims to establish an ecosystem of responsible lending and borrowing.

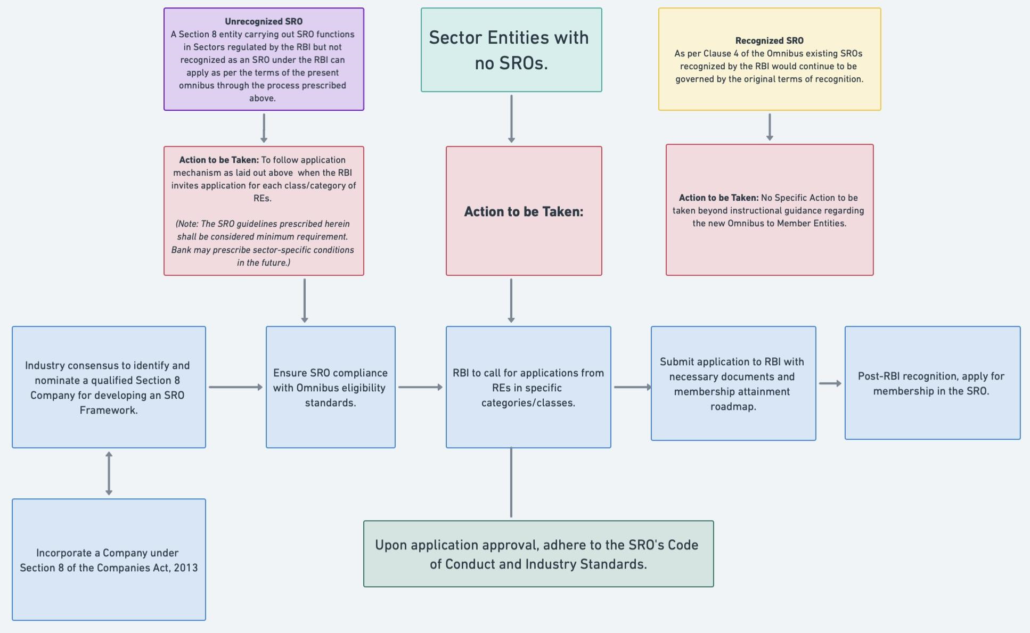

Figure 4: Stakeholder Action Items

Regulated Entities are advised to proactively comply with emerging industry and governance standards, as well as emerging trends or shifts in interpretation of applicable guidelines/regulations/laws. It is recommended that REs promptly align with these standards, effectively articulate their challenges, and ensure full compliance to maintain industry integrity and operational excellence.

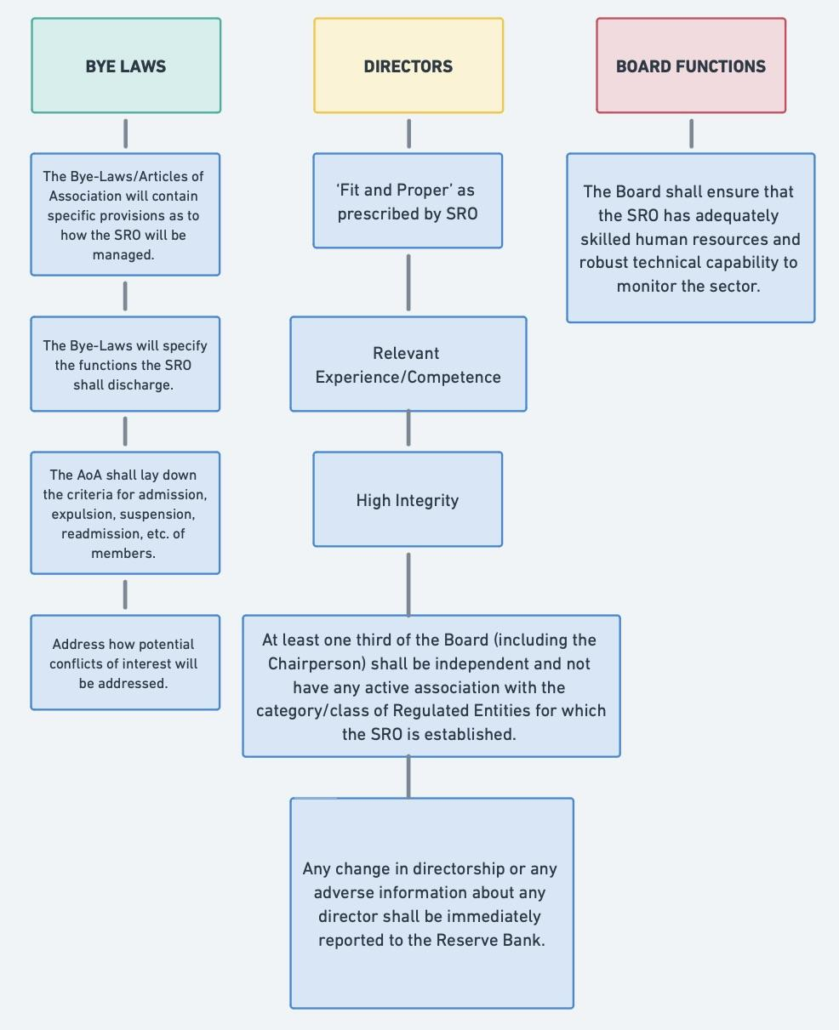

SRO Governance

To ensure a systemic and reliable mode of self-governance, and the ideal operational excellence envisioned above, the SRO in itself, must be reliable. Thus, SROs are subject to certain stringent governance standards.

Figure 5: SRO Governance Mechanism

The Omnibus Framework requires the Board of SROs to frame a policy on the rotation of directors for important positions in the Board of SROs.

How does an entity get recognised as an SRO?

For an entity to be recognised as an SRO it must receive a “Letter of Recognition” from the Reserve Bank. To receive the same, it is required that the SRO submit certain documents to the RBI including but not limited to: A copy of its Memorandum of Association and Articles of Association, details regarding the constitution of its board: its duties, and mode of discharge of obligations. It shall contain the roadmap to achieve minimum membership as prescribed by the RBI within prescribed timelines (which shall not be greater than two years from the date of recognition) and any such further documents as may be necessary. Whilst membership should ideally be achieved by the time of application itself, if not, a clear roadmap on achieving the requisite membership should be provided. The RBI may stipulate a timeline (not exceeding two years) within which this should be achieved.

Membership in SROs shall be voluntary for the members.

Application that does not fulfil criteria liable to be rejected. A fifteen day window, commencing from date of dispatch of intimation from RBI, will be provided to the applicant for rectification.

Figure 6: SRO Application Process

Way forward:

In summary, SROs are the necessary bridge between the regulatory body and the industry. They represent the industry to the regulatory body and interpret directions issued by the regulatory body to the industry so as to ensure consensus and uniformity in interpretation.

Whilst the Omnibus Framework is fairly comprehensive and takes most relevant factors into account, some clarifications and further considerations are required as presented herein:

- There is no specific provision as to how many SROs shall be recognised per sector/vertical. As the objective of the SRO is primarily to act as a facilitator between industry bodies, ensure consensus in interpretation and represent the interests of the industry before regulatory bodies, the objective may be defeated if the sector is populated by too many SROs. This issue warrants more comprehensive and detailed attention.

- The Omnibus Framework characterises the relationship between the SRO and RBI as an “allyship”. However, further clarification is necessary to define the specific terms and nature of this relationship.

- It is essential to clearly delineate the status of Section 8 Companies that undertake SRO functions but fail to secure recognition from the RBI, ensuring a comprehensive understanding of the implications and subsequent procedural actions.

- Introducing a mechanism whereby SROs shall grant accreditation to compliant members could also be beneficial and serve dual purposes: it would incentivise new members to join and simultaneously enhance the SRO’s credibility. This practice could also foster an atmosphere of competitive excellence in governance.

- It is also imperative that issues of conflict of interest are comprehensively and meticulously addressed to pre-empt potential challenges and maintain operational integrity

[1] However, it is to be noted that the current Omnibus does not make any specific mention of licensing activities that may be carried out by SROs in the future. At this stage it is difficult to predict whether licensing powers similar to AMFI will be granted to other SROs.

[2] read with the RBI SRO-FT Framework

[3] Omnibus Framework for Recognizing Self-Regulatory Organizations for Regulated Entities, Page: 3