RBI Issues Draft Directions on Relief Measures in Areas Affected by Natural Calamities for Regulated Entities

Simrat Singh | finserv@vinodkothari.com

When nature unsettles the ordinary course of life, the regulatory hand should neither be withdrawn nor clenched; it should extend a humane touch, easing distress and guiding the return of order. In this spirit, the RBI has released draft directions on Relief Measures in Areas Affected by Natural Calamities, setting out a framework under which banks, NBFCs and other Regulated Entities (REs) may provide relief to borrowers impacted by natural calamities or similar external events. The framework enables REs to extend resolution plans to eligible borrowers, while permitting retention of standard asset classification and lower provisioning, benefits that would otherwise not be available if such restructuring were undertaken under the normal IRACP framework.

It may be noted that earlier RBI had issued guidelines for banks in connection with matters relating to relief measures to be provided in areas affected by natural calamities consolidated under ‘Master Direction – Reserve Bank of India (Relief Measures by Banks in Areas affected by Natural Calamities) Directions 2018 – SCBs’ dated October 17, 2018. In 2016, these guidelines were made applicable, mutatis mutandis, to all NBFCs as well, in areas affected by natural calamities as identified for implementation of suitable relief measures by the institutional framework viz., District Consultative Committee (DCCs)/ State Level Bankers’ Committee (SLBCs). However, given that the provisions were drafted considering the banking operations, the implementation by NBFCs was ambiguous and the provisions were often overlooked.

While the proposed framework applies to both banks (Commercial, RRB, Local area banks etc) and NBFCs, there are separate draft Directions issued for each RE. In case of banks the provisions carry additional system-level and public service responsibilities, reflecting their role within SLBCs and DCCs.

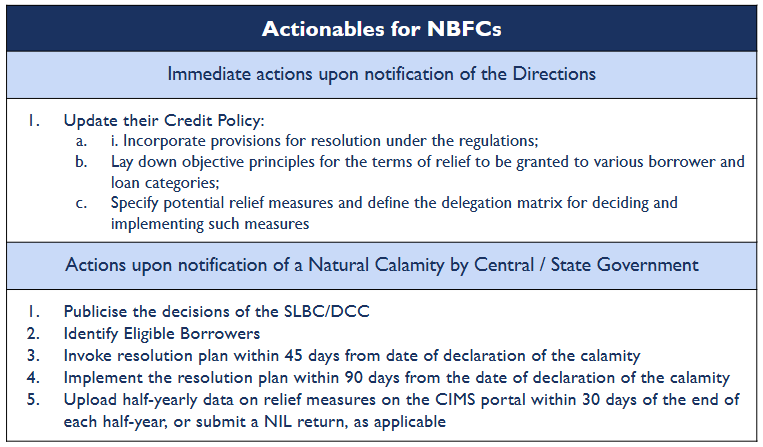

Fig 1: Actionables for NBFCs under the draft directions

Applicability and process flow

The draft directions are proposed to come into effect from 1 April 2026, after the final directions are notified. The framework is triggered upon formal notification of a natural calamity by the Central Government or the concerned State Government.

Where a calamity affects a substantial part of a State, it is proposed that a special meeting of the SLBC shall be convened within 15 days of such declaration. If the impact is confined to one or more districts, the corresponding DCC(s) are required to meet within the same timeframe. These committees assess the severity of the impact on economic activity, determine objective criteria for identifying impacted borrowers and indicate the nature and extent of relief such as moratoriums that may be extended by regulated entities operating in the affected areas. The decisions taken in these meetings are communicated to regulated entities and are required to be given adequate publicity, primarily by banks, through field outreach and public communication. The relief framework becomes operational in line with such Government notifications and the decisions of the SLBC or DCC, as applicable.

Amendments in the Credit Policy

The draft directions propose that the REs update their credit policies to incorporate a structured and pre-defined framework for dealing with borrower stress arising from natural calamities. The credit policy is expected to provide for resolution in line with the provisions and to set out objective principles governing the terms of relief across different borrower segments and loan categories.

While the precise parameters may vary depending on the nature and severity of the calamity, the decisions of the SLBC/DCC/Governments, the credit policy is expected to lay down a consistent framework to be applied by the REs when extending relief. This includes identifying potential relief measures, specifying verifiable parameters for determining eligibility of borrowers and extent of relief and defining the delegation matrix for approval and implementation. The emphasis is on ensuring timely decision-making, particularly in relation to restructuring of existing exposures and sanction of additional finance.

Eligible Borrowers and Coverage

Relief under the draft Directions is proposed to be available only to borrowers who meet the prescribed eligibility conditions as on the date of occurrence of the natural calamity. To qualify, the borrower’s account must be classified as ‘Standard’ and must not be in default for more than 30 days with the concerned RE in respect of any facility. Other additional conditions may be laid down in the credit policy.

Borrowers who do not meet these conditions fall outside the scope of the calamity relief framework and may instead be considered for resolution under the applicable Resolution of Stressed Assets Directions. In such cases, however, the RE does not receive the benefit of standard asset classification or lower provisioning (see discussion below). The framework extends its shelter only to those borrowers who, till the moment the calamity struck, had kept their financial obligations substantially intact. The protection is not meant to rescue infirm credit, but to steady sound accounts momentarily shaken by forces beyond human control.

Resolution Plan and Permissible Relief Measures

Where a RE decides to extend relief, the resolution plan is to be structured based on an assessment of the borrower’s post-calamity viability. The draft Directions propose a range of relief measures, including rescheduling of repayments, grant of moratorium, and conversion of accrued or future interest into another credit facility. Regulated entities may also consider sanctioning additional or fresh finance to address temporary financial stress, subject to appropriate assessment of viability and credit risk.

Notably, the framework is enabling rather than mandatory. It does not require automatic restructuring of all eligible accounts, thereby allowing REs to exercise credit judgement while operating within the prescribed regulatory parameters.

Timelines for Invocation and Implementation

It is proposed that resolution under the framework must be invoked within 45 days from the date of declaration of the natural calamity, unless an extension is granted by the Regional Director or Officer-in-Charge of the Reserve Bank. This would mean that the aggrieved borrower must approach the lender and the terms of restructuring must be agreed between both of them within the said timeframe. Once invoked, the resolution plan must be implemented within 90 days from the date of invocation.

In practice, this means that following the Government notification and the SLBC or DCC meeting, typically held within the first 15 days from the notification, REs have a limited 30-day window to complete borrower identification, viability assessment, documentation and approval. Failure to adhere to these timelines results in loss of the regulatory benefits available under the framework.

Asset classification treatment

The most significant regulatory benefit under the proposed framework relates to asset classification. Where a resolution plan is implemented in compliance with the Directions, borrower accounts classified as ‘Standard’ may be retained as such upon implementation instead of facing any downgrade. Further, accounts that may have slipped into NPA status between the date of occurrence of the calamity and the implementation of the resolution plan are permitted to be upgraded to ‘Standard’ upon implementation. However, as per the ECL Policy of the RE, generally any restructuring would automatically be treated as a SICR and therefore, the staging may change and a higher ECL would be required to be provided on such restructuring which may nullify the benefit.

After implementation, subsequent asset classification is governed by the applicable IRACP norms. The proposed framework also addresses cases of repeated restructuring. Where a borrower account is restructured again under these Directions before the reversal of additional provisions (see below), it may continue to be classified as ‘Standard’, subject to recognition of interest on a cash basis from the second restructuring onwards and maintenance of an additional specific provision of five per cent of the outstanding debt for each restructuring, subject to an overall ceiling of 100 per cent.

Income Recognition and Provisioning

For restructured accounts, it is proposed that interest income may be recognised on an accrual basis. At the same time, REs are required to maintain an additional specific provision of 5% of the outstanding debt, over and above the applicable provisioning under IRACP norms. Reversal of this additional provision can happen only where the borrower repays at least 20% of the outstanding debt, the account does not slip into NPA status after implementation of the restructuring and no further restructuring is undertaken during the relevant period. Specifically for banks, if the outstanding debt post-restructuring is only in the form of non-fund-based facilities or facilities in the nature of cash credit / overdraft, the additional provisions can be reversed after one year, post implementation of the restructuring, provided the borrower was not in default at any point of time during the period concerned.

Ancillary relief measures and government support

It is proposed that the REs be required to extend interest subvention or prompt repayment incentive benefits notified by the Government to all eligible borrowers. They must also ensure that any relief already provided, or being provided, by the Central or State Governments is duly factored into the resolution process.

For agricultural loans secured by land, the draft Directions propose acceptance of certificates issued by Revenue Department officials where original title documents have been lost due to the calamity. In areas governed by community ownership arrangements, certificates issued by competent community authorities may also be accepted. REs may also, at their discretion, provide additional relief such as waiver or reduction of fees and charges for borrowers in affected areas, for a period not exceeding one year. Expected proceeds from insurance policies may also be kept while deciding the relief. Additionally for banks it is proposed that they shall open small accounts for displaced borrowers and take immediate action to restore ATM services in the impacted areas. They may operate their natural calamity affected branches from temporary premises under advice to the RBI. For continuing the temporary premise beyond 30 days, banks may obtain specific approval from the concerned Regional Office of RBI. A bank shall also make arrangements to render banking services in the affected areas by setting up satellite offices, extension counters or mobile banking facilities etc. under intimation to the RBI.

Reporting Requirements

It is proposed that the REs shall upload data on relief measures extended under the framework in the prescribed format on a half-yearly basis. The data points include ‘Outstanding eligible for restructuring as on the date of notification of natural calamity’, ‘Credit facilities restructured/rescheduled during the half year’, ‘Additional/fresh loans provided to affected borrowers during the half year’ etc. The data must be submitted within 30 days from the end of each half-year, i.e., as of 30 September and 31 March, through the CIMS portal. Where no relief measures are extended during a reporting period, a NIL statement is required to be submitted.

See our other resources:

Leave a Reply

Want to join the discussion?Feel free to contribute!