Stock options entail multi-stage disclosure to stock exchanges

Requirement under SEBI Listing Regulations and SBEB Regulations

– Aisha Begum Ansari | corplaw@vinodkothari.com

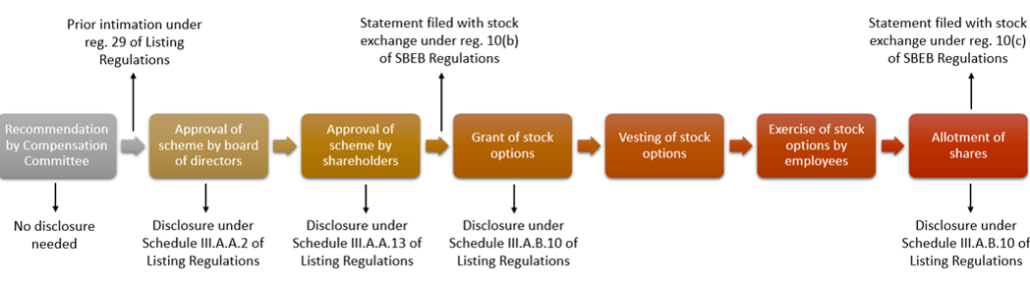

Employee share benefit schemes in the form of ESOP, ESPS, etc. (‘stock options’) facilitate the employees to participate in the growth of the companies. Since, the issue of shares pursuant to exercise of stock options leads to dilution of the share capital of the company, the same may be relevant or material event or information for the investors. Therefore, right from the board meeting in which the decision relating to ESOP scheme is undertaken till the time of allotment of shares, disclosure is required to be made at different stages either in terms of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) or SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021 (‘SBEB Regulations’). This article deals with the requirements and the stages when the disclosure is required to be made by a company.

Disclosure requirement under SBEB Regulations

Before grant of options

As per reg. 12(3), before grant of stock options, the company has to obtain in-principle approval from the stock exchanges where it proposes to the shares issued pursuant to exercise of options. While obtaining the in-principle approval, in compliance with reg. 10(b), a statement as per Part D of Schedule I is filed with the stock exchange, which broadly covers the details of the scheme such as validity period, employees covered, details relating to grant, exercise price or pricing formula, vesting and exercise period, etc.

Upon exercise of stock options

Once the stock options are exercised by the employees and the allotment is made, the company is required to notify the stock exchanges under reg. 10(c) r.w. Part E of Schedule I. The said information includes details relating to shares issued pursuant to exercise of stock options, exercise price, post issue capital, etc. Typically, this is submitted along with the listing application filed subsequent to allotment of shares.

Disclosure requirement under Listing Regulations

Reg. 30 of the Listing Regulations requires every listed entity to make disclosures of material events or information. The events specified in Para A of Part A of Schedule III to the Listing Regulations are deemed to be material events and hence, require disclosure, whereas, the events set out in Para B are considered to be material after applying the materiality test provided under reg. 30(4).

The erstwhile requirement, in terms of clause 25 of the Equity Listing Agreement was to notify the stock exchange upon grant of any options, wherein details relating to number of shares covered by such options, terms thereof and time within which it could be exercised, were required to be intimated and further, in case of any subsequent changes or cancellation or exercise of such options. However, under the Listing Regulations, the requirement was moved under Para B (10) of Schedule III requiring disclosure only in case of the event being determined as material under Reg. 30 (4). The rationale, as provided in the SEBI Board Meeting Agenda dated 22nd March 2015 (Para 2.5.2), was to avoid information overload.

Therefore, companies used to link the materiality with the quantum of options being granted and determined the same as material if it exceeded 1% -2% of the issued capital of the Company.

With the recent amendment in the Listing Regulations, quantitative thresholds have been prescribed for materiality. Therefore, it becomes relevant to discuss and address the query on (a) How to determine the materiality of stock options? and (b) What are the stages of disclosure of stock options?

Manner of determination of materiality of stock options

Reg. 30(4) provides both the qualitative criteria and quantitative criteria for determining material events. While the qualitative criteria is based on the significant market reaction, in case of quantitative criteria, the company has to assess if the value or expected impact in terms of value of the event or information exceeds the materiality threshold of the company.

In the case of stock options, the question arises as to which price should be considered for determination of materiality – exercise price or market price? Market price will not be the correct approach as the company does not gain anything from the market price of shares issued under stock options. Exercise price, on the other hand, is the consideration received by the company from the employee. Hence, exercise price should be considered to determine if the particular set of grant of options or exercise of shares crosses the materiality threshold of the company.

Stages of disclosure under stock options

Prior to the Board meeting

Reg. 29 (1) (d) mandates prior intimation about the Board meeting in which the proposal for fund raising by way of issue of securities and determination of issue price is due to be considered. While the intent of rolling out an ESOP Scheme is not fund raising, however, it has the impact of issue of securities to the eligible employees. Accordingly, prior intimation should be given at least two working days in advance, excluding the date of the intimation and the date of the board meeting.

As a deemed material event under Para A:

Disclosure after the board meeting

Once the Board approves the scheme, the disclosure is required to be made in terms of reg. 30 read with clause 2 of Para A of Para A of Schedule III i.e., issuance of securities. The disclosure should cover the minimum information as given in the SEBI Circular such as type of securities and number of securities proposed to be issued, type of issuance, etc. Such disclosure has to be made within 30 minutes of the conclusion of the board meeting.

Disclosure after shareholders’ approval

In terms of clause 13 of Para A, the company has to disclose the proceedings of the shareholders’ meeting. Hence, once the shareholders approve the stock option scheme, either to AGM or EGM or postal ballot, the disclosure is required to be made within 12 hours of the conclusion of the meeting providing the brief details of item deliberated and the voting results.

As a determined material event under Para B:

Para B (10) of Schedule III to SEBI LODR only indicates the requirement to disclose about options to purchase securities including any ESOP/ESPS Scheme. The stage of disclosure under the said clause has been provided in Annexure I of the SEBI circular dated July 13, 2023 (‘SEBI Circular’) as:

(i) at the time of instituting the scheme and

(ii) vesting or exercise of options.

Disclosure at the time of instituting the scheme

The reference of the term ‘institution of the scheme’ is found in Reg. 10(b) read with Part D of the SBEB Regulations that provides for the information to be filed with the stock exchange at the time of obtaining in-principle approval from the stock exchange, before grant of options. Therefore, in terms of SBEB Regulations, the term ‘institution of scheme’ is considered as the date when shareholders approve the stock option scheme.

However, let us take a look at the line items of the SEBI Circular and analyze at what stage the disclosure is required to be made:

| Sr. no | Details to be provided as per SEBI Circular | Remarks |

| a. | brief details of options granted | Can be furnished only once the stock options are granted. |

| b. | whether the scheme is in terms of SBEB Regulations (if applicable) | This is a general confirmation. |

| c. | total number of shares covered by these options | The details are in relation to point (a) i.e. grant of stock options and therefore, can be provided only once the grant is made |

| d. | pricing formula | Details as per scheme to be provided. Can be disclosed at the time of grant of stock options and vesting or exercise of stock options. |

| e. | options vested | Cannot be given at the time of shareholders’ approval or grant of stock options. Therefore, the same can be provided at the time of vesting or exercise of stock options. |

| f. | time within which option may be exercised | Details as per scheme to be provided. Can be disclosed at the time of grant of stock options and vesting or exercise of stock options. |

| g. | options exercised | Cannot be given at the time of shareholders’ approval or grant of stock options. Therefore, the same can be provided at the time of exercise of stock options. |

| h. | money realized by exercise of options | Cannot be given at the time of shareholders’ approval or grant of stock options. Therefore, the same can be provided at the time of exercise of stock options. |

| i. | the total number of shares arising as a result of exercise of option | Cannot be given at the time of shareholders’ approval or grant of stock options. Therefore, the same can be provided at the time of exercise of stock options. |

| j. | options lapsed | Cannot be given at the time of shareholders’ approval or grant of stock options. Therefore, the same can be provided at the time of exercise of stock options. |

| k. | variation of terms of options | This is event specific. |

| l. | brief details of significant terms; | Details as per scheme to be provided. Can be disclosed at the time of grant of stock options and vesting or exercise of stock options. |

| m. | subsequent changes or cancellation or exercise of such options; | Subsequent changes or cancellation are event specific. Exercise of stock options is already covered in point (g) above. The same is repeated here because the similar lines were used in Equity Listing Agreement. |

| n. | diluted earnings per share pursuant to issue of equity shares on exercise of options. | Cannot be given at the time of shareholders’ approval or grant of stock options. Therefore, the same can be provided at the time of exercise of stock options. |

As can be seen above, the details as per the SEBI Circular cannot be provided after shareholders’ approval. Therefore, for the purpose of reg. 30, the term ‘in case of instituting the scheme’ should mean upon grant of stock options pursuant to the scheme approved by shareholders.

Disclosure at the time of vesting or exercise of stock options

Vesting of options

Vesting is the process by which the employee becomes entitled to receive the benefit of grant made to him/her under the stock options scheme. Stock options are typically vested after a minimum waiting period of one year from the date of grant called ‘vesting period’, and in some cases along with the fulfillment of certain conditions, called ‘vesting conditions’.

Exercise of options

Once the stock options are vested, the employee is eligible to convert these vested stock options into shares through the process called ‘exercise’. Exercise involves making an application for allotment of shares against vested options, at the predetermined exercise price. The exercise of vested options takes place during the pre-determined exercise windows which is indicated in the scheme itself.

Here, it is pertinent to note that vesting happens as per the vesting schedule and the employees can exercise the stock options on various dates within the exercise period provided under the scheme. Hence, it will not be feasible for the company to make disclosure upon every vesting or exercise of stock options. Further, details relating to exercise may not be entirely available on the date of vesting as there is a likelihood of options getting lapsed or forfeited.

Hence, the disclosure is made at the time of allotment of shares upon exercise. The Compensation Committee or the appropriate authority, with the power delegated to make allotment of equity shares, meets frequently (monthly or bi-monthly) and takes note of the stock options exercised by the employees, exercise money received and passes a resolution for allotment of shares. Therefore, this stage becomes the ‘occurrence’ of the event and disclosure under reg. 30 is made.

Hence, under the Listing Regulations, the stage of disclosure in case of stock options will be at the time of grant of stock options and thereafter, at the time of allotment of shares pursuant to exercise of options, where the quantum exceeds the materiality threshold. However, the actual practice followed is to intimate about every allotment of shares pursuant to exercise of options.

Concluding Remarks

The stages and timeline of disclosure under the SBEB Regulations and the Listing Regulations are different. Unlike disclosures under Listing Regulations, the disclosures made under the SBEB Regulations are not available in public domain.

While the disclosure requirement has been prevailing since several years, as evident from the stock exchange intimations, listed entities follow diverse practices. Going by the rationale discussed above, in the view of the author, the disclosure under Listing Regulations is required prior to the Board meeting and thereafter, as a deemed material event after board and shareholders’ approval as well as a determined material event upon grant of options and allotment of shares pursuant to exercise of options.

Our resources related to the topic:-

Our Youtube Series related to the topic : Easy with ESOPs

Our Resource Centre on LODR

Leave a Reply

Want to join the discussion?Feel free to contribute!