Fast Track Merger- finally on a faster track

– Barsha Dikshit, Partner | resolution@vinodkothari.com

The objective of promoting ‘ease of doing business in India’ had made the Ministries introduce some really momentous concepts and corresponding changes in law. One of such moves taken by the Ministry of Corporate affairs (‘MCA’), was introduction of section 233 of the Companies Act, 2013 (‘Act’) dealing with “Merger and amalgamation of certain types of companies” vide notification dated 7th December, 2016, [1] thereby offering an alternative mode to certain classes of companies for entering into scheme of merger or amalgamation. The idea was to process the scheme of arrangements involving wholly owned subsidiaries or small companies in a cost effective and comparatively swift way. However, upon the practical implementation of the provision, it was seen that the time taken by the authorities for disposal of such applications and issuing confirmation orders to the schemes was longer than expected and therefore, the provision was losing its relevance.

It is in the backdrop of such delays, MCA, vide notification dated 15th May, 2023 (yet to be published in e-gazette) has introduced certain amendments in the Companies (Compromise, Arrangements, and Amalgamations) Rules, 2015 (‘CAA Rules’) ensuring faster disposal of applications u/s 233 of the Act. The amendments shall be effective w.e.f. 15th June, 2023.

This article intends to discuss the amendments introduced by MCA and to gauge the effectiveness of the same.

Drawbacks in the pre-amendment provision dealing with fast track mergers

Section 233 of the Act read with rule 25 of the CAA Rules provides an alternate route to the scheme of arrangement(s) to be entered into between the following companies-

- two or more small companies;

- holding company and its wholly owned subsidiary

- two or more start-up companies; or

- one or more start-up company with one or more small company

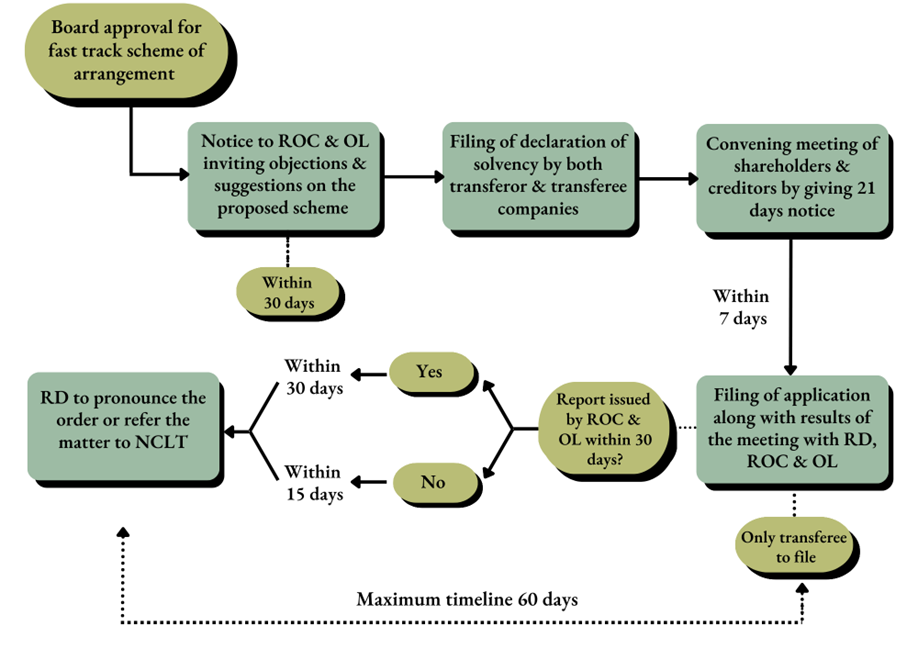

Earlier, the companies involved in scheme of arrangement were required to invite objections/suggestions, if any from their respective Official liquidator, Registrar of Companies, and from the persons affected by the scheme, within thirty days of sending the notice and thereafter, to hold meeting(s) of their respective members or class of members and creditors or class of creditors, as the case may be, for the purpose of seeking their approval on the proposed scheme. Within 7 days of getting the requisite approvals from the shareholders and creditors, an application u/s 233 was required to be filed by the transferee company with the Regional director, having jurisdiction over the transferee company, alongwith official liquidator and the Registrar of companies having jurisdiction over the respective transferee and transferor companies. The Regional director, after receiving objection or suggestion from the Registrar of companies and official liquidator, if any, was required to issue confirmation order or file the scheme with the tribunal within 60 days for considering the scheme in terms of section 232 of the Act.

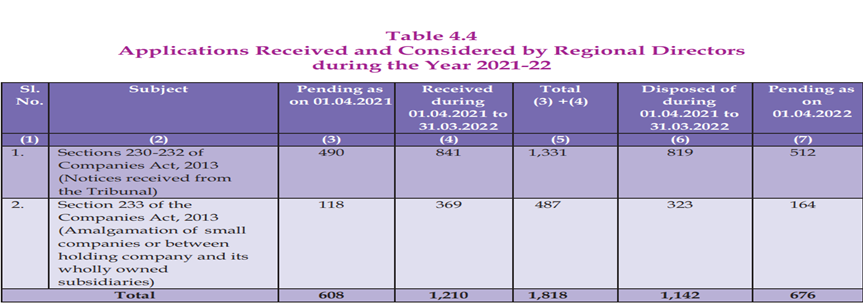

However, since the law did not provide and specific timeline for the Official liquidator and Registrar to issue their reports, it was seen that the time taken by the Official liquidator and Registrar for issuing their report on the scheme to the Regional director, was comparatively longer than expected, which lead to delay in processing the application and issuing confirmation order by the Regional Director. The chart below shows the status of pending applications u/s 233 of the Act before the Regional Directors as on 31st March, 2022.[2]

Solutions provided by MCA

Given the inordinate delay in approval of scheme of arrangements involving wholly owned subsidiaries or small companies, MCA vide notification dated 16th May, 2023, has specified the time-line of 30 days within which the Official liquidator and Registrar having jurisdiction over transferor and transferee company are required to give their suggestion/objection, if any, to the Regional Director, failing which, it shall be considered that they have no objection on the scheme. Further, Regional directors have also been given timeline of –

- 15 days, in case no objection/suggestion given by Official liquidator and Registrar; or

- 30 days in case objection/suggestion given by the Official Liquidator and Registrar

To issue confirmation order to such scheme of merger or amalgamation or file an application before the Tribunal stating the objection or opinion for consideration of the scheme u/s 232 of the Act. The amendment also provides that the application u/s 233 has be disposed of within 60 days from filing of the same with the Regional director, otherwise it shall be deemed that it has no objection to the scheme and a confirmation order shall be issued accordingly.

Applicability on ongoing matters

The general rule of prospective/retrospective application of laws is that an amendment which seeks to create or alter rights/obligations of parties cannot be applied retrospectively. Further, the notification itself provides that the Amendments shall come into force with effect from 15th June, 2023. Hence, the relief granted by MCA pursuant to the Notification dated 15th May, 2023 will be available to the schemes to be filed on or after 15th June, 2023.

Process u/s 233 in a nutshell post implementation of the Amendments

Concluding remarks

The concept of fast track merger was introduced to simplify the procedural aspect of merger or amalgamations for a certain class of companies by eliminating the requirement of approaching the Tribunal, thereby resulting in faster disposal of schemes, reduction in the burden on Tribunals and reduction in costs and resources of the companies involved. However, practically, such applications were taking time longer than expected. Thus, to eliminate the barriers on swift implementation of the provision, MCA has come up with the amendments thereby restricting the timeline taken by the regulatory authorities for submission of report and subsequent delayed disposal of applications by Regional directors. Notably, the timeline for disposing off applications u/s 233 within 60 days was there in the provision since inception, however, the timeline for submission of reports by the regulatory authorities and the implication of not submitting the report by regulatory authorities or disposing off the application within the said period of 60 days was not specified earlier. Now, pursuant to the amendment, it is clear that the application u/s 233 shall, in any case, be disposed of within a period of 60 days from filing of the scheme by the transferee company, failing which the scheme shall be deemed as approved by Regional director and accordingly, confirmation order will be issued. However, it will be interesting to see the impact of the amendments in the practical scenario.

[1] http://www.mca.gov.in/Ministry/pdf/commencementnotif_08122016.pdf

[2] https://www.mca.gov.in/bin/dms/getdocument?mds=4IGHqb2kZ0upzWB2xs1Fbw%253D%253D&type=open

Leave a Reply

Want to join the discussion?Feel free to contribute!