Financial Services firms foray into the metaverse

Beyond Social Media & Gaming

– Subhojit Shome, Executive | finserv@vinodkothari.com

Introduction

The ‘Metaverse’ has become the latest favourite buzzword on Wall Street with players from Big Tech, Gaming, Entertainment and the FMCG Industries touting it as the best thing to happen since sliced bread.

It is now the turn of the Banking and Financial Services Industry to jump onto the bandwagon and with big ticket traditional players, like JPMorgan and PwC, buying up prime virtual real estate in the metaverse and with revenue estimations from opportunities in the metaverse being projected at $1 trillion and beyond,[1] other players (both traditional and new age) cannot help but take notice.

In this overview, we attempt to provide a bird’s eye view of what the metaverse is and the opportunities that it offers specifically to those involved in the financial services space.

The Many Definitions of the Metaverse

The term – ‘Metaverse’ – is borrowed from American writer, Neal Stephenson’s dystopian sci-fi novel – Snow Crash – wherein it is used to describe a virtual-reality based successor to the internet.[2]

In the real world context, the term has been variously defined and used, be it by tech gurus or c-suite executives. In general it has come to imply an interactive digital world with online communities providing immersive experiences.

With the proliferation of smartphones and with WiFi and AR/VR/XR technologies maturing, the metaverse has taken the form of 3D virtual worlds where people located anywhere can socialise in real-time leading to the advent of an internet based economy spanning both the physical and virtual worlds.

JPMorgan in its report – ‘Opportunities in the Metaverse’ – points out that it is not a single virtual world that exists but many worlds, which are taking shape to enable people to deepen and extend social interactions digitally.[3]

While the term still remains nebulous, Global X ETFs, has identified six main characteristics that substantially describe the metaverse – identity, multi-device, immersive, economy, community and real-time persistence.[4]

| Characteristic | Description |

| Identity | While digitally present in the metaverse, users can express themselves as whoever or whatever they want to be with their own avatar |

| Anywhere access with multi-device support | The ability to access and exist in the metaverse from anywhere be it by using internet enabled mobile phone, PC, tablet, or any other device |

| Immersive | A truly immersive experience that engages an individual’s mind and the senses |

| Economy | A functioning economy where users can earn and spend in digital or fiat currencies |

| Community | Users are not alone but connected with other users in real time providing them the ability to share experiences and information |

| Real-time persistence | The metaverse exists in real-time with no ability to pause it or fundamentally change its characteristics. It continues to exist and function even after the user has left |

Added to these features the metaverse needs to offer a seamless convergence between the virtual and the physical lives of individuals in order that they may form e-communities where they can work, play, socialise, relax or engage in commercial transactions.

In Real Life

In its web 3.0 version the metaverse is visualised as decentralised, open, unified (or at least inter-operable and inter-connected) virtual spaces which are each inhabited by communities of individuals who own and manage such space and no single individual or entity wields sufficient influence to significantly affect its persistence, general characteristics or the behavioural norms followed by the members of the community.

The picture as we see it today is much more complex. With web 2.0 structures and protocols still existing, big tech firmly entrenched and significantly invested in the current technologies, media and e-markets and with community-centric / open source platforms largely under-funded and scattered; the race between Web 2.0 vs 3.0 reminds one of the fable of the Hare and the Tortoise.

Big tech has been making all the right noises, including social media giant Facebook rebranding itself as ‘Meta’,[5] when it comes to the metaverse. They are most definitely interested in helping themselves to a big and fat piece of the virtual pie, however, they are also intent on protecting their current market and revenue streams. This is demonstrated by the fact that Alphabet, Facebook (Meta), Amazon continue to augment, segregate and fortify their own social media and e-commerce ecosystems.

Big tech’s interest in the metaverse has also led to big ticket deals in the M&A space with Microsoft’s acquisition of Activision Blizzard valued at $68.7 billion, by far the biggest deal in the gaming industry.

| Web 2.0 | Web 3.0 | |

| Overview | Closed Corporate Metaverse: centrally owned and controlled by big tech | Open Crypto Metaverse: democratically owned and managed by global users communities |

| Organisation | Centrally owned by corporate entities with decisions based on adding shareholder value | Community governed generally through a decentralized anonymous organization (DAO) with decisions based on user consensus |

| Platform Architecture | Closed architecture using proprietary technology and hosted on in-house servers or (private) cloud services | Open architecture using distributed ledger and crypto (Blockchain) technology and hosted on (public) cloud services |

| User interface (hardware) | 1. PC/console 2. Mobile/app 3. Limited VR/AR hardware | 1. PC/Console 2. Mobile/app 3. Hi-tech VR/AR hardware |

| Virtual Asset Ownership | Confined within the platform/system where purchased and difficult to convert to real world currency | Transferable between environments and better liquidity and convertibility |

| Payment Systems | Traditional channels (electronic fund transfer, use of credit or debit cards) | Crypto wallets |

| Content Creators | Game studios and developers | User community, game studios and developers |

| Content revenues | [Example Model – Roblox][6] 1. Platform or app store earns 30% of of the transaction value of the virtual asset; 2. 30% goes to developer/creator, 3. 40% is received by the seller | P2P Model 1. Developers/content creators directly earn revenue from sales 2. Users/gamers earn through play or participation in platform governance 3. Royalties on secondary trades of NFTs goes to creators |

Metanomics

The initial growth witnessed in the metaverse economies was largely driven by the ‘Play to Earn’ model that is being adopted in the online gaming industry where premium games are giving way to a ‘free to play’ online gaming experience where players buy in-game items to either enhance gameplay or their social status within the game community.

As per a recent report by Global X ETFs, the metaverse economy has extended beyond gaming communities and continues to do so –

| Economy | Description | Example |

| Creator Economy | Content creator (blogger/vloggers/influencer), content curator, follower and subscriber community | YouTube payout to creators amounted to $30 billion+ during 2018-21[8] |

| Developer Economy | Application, gaming, platform development community | Roblox developer economics[9] |

| Advertising Space | Media giants entering the NFT space | Budweiser partnering with VaynerNFT[10] |

| Social Commerce | Creation of virtual malls, social interaction with friends / influencers, real time virtual demo of products | Samsung 837X virtual showroom[11] |

| Digital Events | Virtually attend concerts, movies, sports, or e-sports events | Ariana Grande’s Fortnite virtual concert[12] |

| Hardware | VR/AR headsets, haptics suits and other wearable, graphic chips, network and wifi components | VR head mounted displays jump to 68 million units in 2020[13] |

| Enabling Applications (incl. FinTech) | AI and NLP services, wallets, physical/virtual currency conversion and custodial service | Soul Machine’s Digital People[14] |

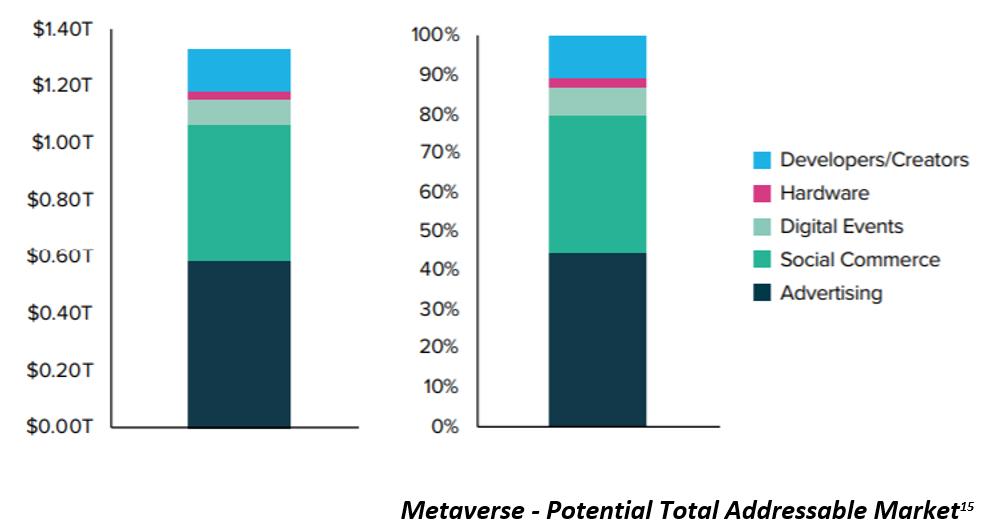

Global X ETFs, along with App Annie, Grand View Research and BCG, estimates (with a fair amount of optimism) that we are looking at a $1 trillion and beyond metaverse economy

Financial Services – Opportunities in the Metaverse

JPMorgan recently made a much publicised entry into the metaverse, opening a lounge in Decentraland.[16] PwC has also bought prime real estate in Sanbox’s metaverse with an intention to construct a Web 3.0 advisory hub as part of its new gen professional services.[17]

Experts, however, believe that the smart money will flow not into buying virtual real estate (NFT) in the metaverse but in financing it and funding the underlying technologies.

|

Area |

Activity |

Example |

|

Point of Presence (PoP) |

Creating a digital presence in the metaverse only as part of it branding and advertising strategy but also to create a virtual workplace to remotely interact with clients and other stakeholders |

i. JPMorgan opens a lounge in Decentraland[1] ii. PwC purchases prime virtual real estate in The Sandbox[2] |

|

Traditional Finance |

Financing hi-tech hardware and network components |

|

|

Financing metaverse building blocks |

Opportunities for funding technologies involved in i. Advanced Discovery Mechanism ii. Data Analytics (KPI Trackers) |

|

|

Financing service providers in the digital space |

Goldman Sachs portfolio[3] includes investments in i. Klook, a digital travel destination products and services company ii. Tuhu, a digital auto aftermarket retailer and service provider in China iii. iTutorGroup, an online on-demand interactive learning platform in China iv. Purplle, India’s 2nd largest beauty and personal care focused online retailer, v. Livspace, a home interiors company using a digital platform to bring together homeowners, interior designers, furnishing vendors and servicing contractors vi. Rebel Foods, an India-based cloud kitchen. |

|

|

Micro Loans funding the Creator, Developer and the Virtual Gig (Event) Economy |

Funding content creation, development and virtual events with loans and advance having flexible disbursement and repayment structures along with integrated services for registration (onboarding and KYC) and payouts (using wallets) |

Patreon Capital[4] |

|

Merchant Banking & Advisory |

Opportunities in the M&A and private equity funding space |

The deals space in metaverse related services and technologies include: i. Amazon acquires Twitch for $970 million[5] ii. Microsoft acquires Minecraft for $2.5 billion[6] iii. Microsoft announces Activision Blizzard deal valued at $68.7 billion[7] iv. Nike acquisition of RTFKT[8] iv. Metaverse platform Bullieverse raises $4 million in funding led by Web3 venture funds[9] |

|

Virtual Real Estate (NFT) ‘Mortgages’ |

Commercial real estate lending to buy space in the virtual world |

The Sandbox had 65,000 transactions in virtual land totaling $350 million in 2021. Decentraland had 21,000 real estate transactions worth $110 million. TerraZero Technologies provided the first-ever metaverse mortgage[10] |

|

FinTech |

Payment solutions – Wallets and other crypto services, custodial services, forex and liquidity services Regulatory solutions – related to AML – CFT, KYC, Tax and Accounting (specifically for cross border and cross currency transactions) |

|

Financial Services in the metaverse

A Micro Loan Use Case

Temporary virtual spaces will continue to be created, maintained and leased given the popularity that such spaces have enjoyed on platforms such as Nowhere to host concerts, festivals, reunions, and conferences for private parties.

In order to host a virtual concert event one will have to bear the costs of –

- Leasing a metaverse space which includes registration and payment services

- Renting a HD broadcast studio

- Setting up network with adequate bandwidth

- Engaging a event manager (MC/moderator)

- Carrying out publicity and marketing

Whereas revenue streams will be in the form of

- Registration Fees,

- Sponsorship packages,

- Onsite product sales and supplementary merchandising

- Rebroadcast and ‘DVD’ deals

The potential for a favourable ROI is sufficiently high and finance companies involved in lending and advances would be wise to fund such events with bespoke lending terms.

A Fintech Use Case

The virtual space, as we observe it today, consists of discrete worlds and communities of users (a tendency called ‘environment sharding’) with their own economies.

To illustrate:

| Platform | Token / Currency |

| Decentraland | MANA |

| Polka City | POLC Token |

| Roblox | Robux |

Transacting in such virtual worlds poses the very real-world problem of converting value received to hard cash. Taking the example of Decentraland’s Mana, in order to convert Mana to a Real-world currency, one will have to sell the metaverse (Decentraland) native token (Mana) on a decentralised exchange (DEX), buy a more recognised and liquid token, exchange the crypto for a stable coin (like Tether) and finally exchange the stable coin for fiat currency in a real-world bank.

A Fintech service provider has the opportunity to convert this circuitous process into a seamless one and given the transaction volumes that we observe in the virtual world, earn a hefty fee doing it.

Disruptions

Ready or not, traditional financial services will need to rise to the opportunities and challenges posed by the new free-market internet-native economy as we have already started witnessing disruptions in the traditional financial services space. There has been a move to social commerce where e-commerce players (Amazon, Shopify, BigCommerce, BackMarket) have started offering payments and credit services . Advent of the Decentralised Autonomous Organisation (DAO) which sees financial transactions executed and records maintained using blockchain technology and which does not pledge fealty to any sovereign or corporation[28] is being seen as one of the most significant challenges facing not just traditional financial institutions but also regulatory authorities globally.

While financial institutions will have to take a call as to when (if at all) they should create a presence in the virtual world; a decision that will be based on their business model, current and prospective client portfolio, in-house tech expertise and access to technology resources, behaviour of competitors and their own brand image, there is little doubt that they will need to start catering to the growing and specific needs of the players in the emerging metaverse else they risk becoming irrelevant.

[1] The Metaverse – Web 3.0 Virtual Cloud Economies, Grayscale Investments LLC – https://grayscale.com/wp-content/uploads/2021/11/Grayscale_Metaverse_Report_Nov2021.pdf

[2] The words “avatar” (in the sense it is used here) and “Metaverse” are my invention, which I came up with when I decided that existing words (such as “virtual reality”) were simply too awkward to use. – Neal Stephenson, acknowledgments section following the text of Snow Crash.

[3] Opportunities in the Metaverse, J.P.Morgan – https://www.jpmorgan.com/content/dam/jpm/treasury-services/documents/opportunities-in-the-metaverse.pdf’

[4] Global X ETFs Research – The Metaverse Takes Shape as Several Themes Converge, Pedro Palandrani – https://www.globalxetfs.com/content/files/The-Metaverse-Takes-Shape-as-Several-Themes-Converge.pdf

[5] (Youtube) Introducing Meta, Mark Zuckerberg (Meta/Facebook) – https://www.youtube.com/watch?v=pjNI9K1D_xo

[6] Developer Economics, Roblox – https://developer.roblox.com/en-us/articles/developer-economics#:~:text=As%20of%20June%202021%2C%201.3,each%20dollar%20spent%20on%20Roblox.

[7] Opportunities in the Metaverse, J.P.Morgan – https://www.jpmorgan.com/content/dam/jpm/treasury-services/documents/opportunities-in-the-metaverse.pdf

[8] https://www.bloomberg.com/news/articles/2021-08-23/youtube-boasts-30-billion-in-payments-as-creator-wars-heat-up

[9] https://developer.roblox.com/en-us/articles/premium-payouts

[10] https://bitcoinist.com/budweiser-signs-nft-agency-deal-with-new-vaynerx-nft-division/

[11] https://www.samsung.com/us/explore/metaverse-837x/

[12] https://www.forbes.com/sites/paultassi/2021/08/02/ariana-grande-should-earn-a-fortune-from-her-fortnite-rift-tour-concert/?sh=4c531e76130b

[13] https://www.statista.com/statistics/697159/head-mounted-display-unit-sales-worldwide/

[14] https://www.soulmachines.com/home-new/

[15] The Metaverse Takes Shape, Global X ETF, App Annie, Grand View Research, BCG – https://www.globalxetfs.com/content/files/The-Metaverse-Takes-Shape-as-Several-Themes-Converge.pdf

[16] https://www.forbes.com/sites/ronshevlin/2022/02/16/jpmorgan-opens-a-bank-branch-in-the-metaverse-but-its-not-for-what-you-think-its-for/?sh=61c34c60158d

[17] https://www.consultancy.uk/news/30011/pwc-buys-virtual-land-nft-in-the-sandboxs-metaverse

[18] https://www.forbes.com/sites/ronshevlin/2022/02/16/jpmorgan-opens-a-bank-branch-in-the-metaverse-but-its-not-for-what-you-think-its-for/?sh=61c34c60158d

[19] https://www.consultancy.uk/news/30011/pwc-buys-virtual-land-nft-in-the-sandboxs-metaverse

[20] https://www.growth.gs.com/content/dam/GSGrowth/pdf/GS-Growth-Equity.pdf

[21] https://techcrunch.com/2020/02/18/patreon-enters-the-micro-lending-game-with-patreon-capital/

[22] https://www.reuters.com/article/us-amazon-com-twitch-idUKKBN0GP1N820140826

[23] https://www.reuters.com/article/us-microsoft-mojang-idUSKBN0HA1CS20140915

[24] https://www.reuters.com/technology/microsoft-buy-activision-blizzard-deal-687-billion-2022-01-18/

[25] https://www.reuters.com/markets/deals/nike-buys-virtual-sneaker-maker-rtkft-metaverse-push-2021-12-13/

[26] https://economictimes.indiatimes.com/tech/funding/metaverse-platform-bullieverse-bags-4-million-funding-led-by-web3-venture-funds/articleshow/89659823.cms

[27] https://www.forbes.com/sites/ronshevlin/2022/02/14/the-coming-boom-in-metaverse-lending-for-banks/?sh=6594bfc65984

[28] Decentralized autonomous organizations (DAOs), Ethereum – https://ethereum.org/en/dao/

Thanks for simplifying the complex topic at the meta level.