Grounds for grant of waiver under section 244 of Companies Act

Exploring the Judicial Perspectives

– Pieyusha Sharma, Assistant Manager | corplaw@vinodkothari.com

PROLOGUE

Majority always prevails in corporate democracy. The management of the company is based on the majority rule i.e all matters decided in a general meeting ensue from majority voting which may overlook interests of minority. The need to balance the rights of majority and minority members is well recognized in the Sec 241 of the Companies Act, 2013 (the “Act”) thereby providing protection against oppression and mismanagement for the members of a company. It enunciates the rights of minority to impinge the decisions of majority by applying before Tribunal.

Section 241(1) of the Act states that the complaint can be filed by aforesaid mentioned member(s) before Tribunal when:

(a) the affairs of the company have been or are being conducted in a manner prejudicial to public interest or in a manner prejudicial or oppressive to him or any other member or members or in a manner prejudicial to the interests of the company; or

(b) the material change, not being a change brought about by, or in the interests of, any creditors, including debenture holders or any class of shareholders of the company, has taken place in the management or control of the company, whether by an alteration in the Board of Directors, or manager, or in the ownership of the company’s shares, or if it has no share capital, in its membership, or in any other manner whatsoever, and that by reason of such change, it is likely that the affairs of the company will be conducted in a manner prejudicial to its interests or its members or any class of members.

However, for seeking relief in case of oppression and mismanagement, eligibility requirements as provided under Section 244(1) of the Act must be satisfied by minority member(s) unless otherwise waived off by the Tribunal on application made by member(s).

This article intends to exhibit the grounds considered by Tribunal while passing the order and in exercise of the authority for grant of waiver in applications.

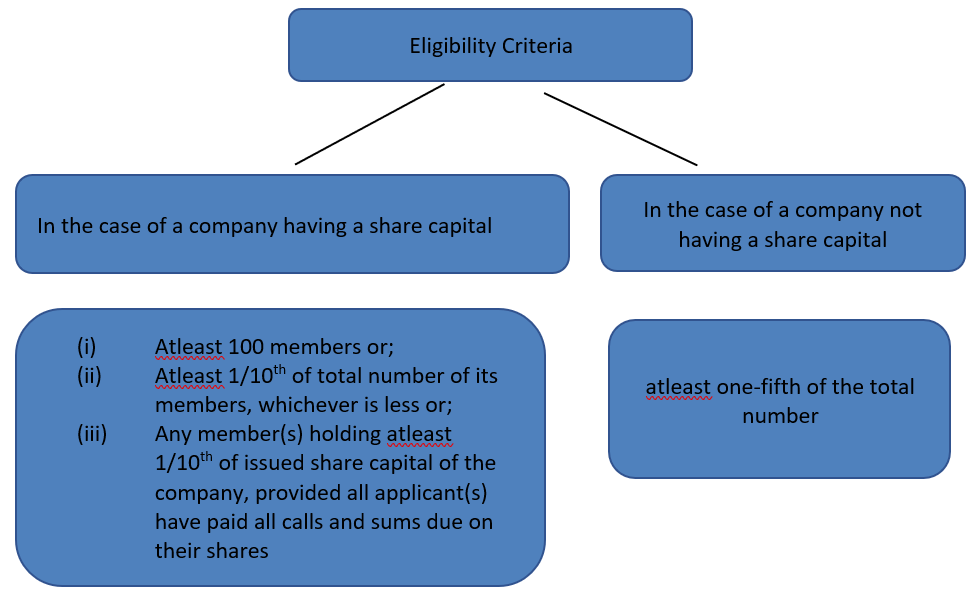

Eligibility for filing applications under Section 241

Section 244(1) of the Act provides the eligibility criteria for filing an application before tribunal to seek relief in case of oppression and mismanagement.

However, as per various judicial precedents merely fulfilling the aforesaid criteria is not the only ground considered by Tribunal to pass an order in favor of the minority. The Tribunal may exercise its power to waive off all or any of the aforesaid mentioned eligibility requirement on justifiable grounds. Such power of exemption is specifically provided in the proviso to section 244 (1), which states,

“Provided that the Tribunal may, on an application made to it in this behalf, waive all or any of the requirements specified in clause (a) or clause (b) so as to enable the members to apply under section 241.”

Notably, the proviso does not hint at the possible ‘reasons’ which can be considered by the Tribunal to grant exemptions. However, section 399 of the predecessor Companies Act, 1956 empowered the Central Government to authorise any member or members of the company to apply to the Company Law Board under section 397 or 398, notwithstanding the minimum requirements. At this point, it would be pertinent to note that the Tribunal too, has to observe principles of natural justice as per Rule 14 of the NCLT, 2016.

Accordingly, few extracts from judicial pronouncements are illustrated herein discussing the grounds considered by Tribunal while passing the order.

Cases and circumstances where waiver has been granted

● Principle of Natural justice, serious injury

Essentially, natural justice requires that a person receives a fair and unbiased hearing before a decision is made that will negatively affect them. Courts have always emphasized on presence of “just and equitable” as the main intent while passing any order which acts as one of the grounds for the grant of waiver. Accordingly, the Tribunal may grant waiver, if in its opinion, it is just and equitable.

Same was established in Sri Krishna Tiles & Potteries v. The Company Law Board And Ors., where petitioner Arunachalam was the lone shareholder out of the members of the company and does not have support of the remaining 49 members. He held only 3015 equity shares which was obviously less than 10 per cent of the paid up share capital of the company. It was contended that no opportunity be granted to the petitioner to show to the Company Law Board that substantiates the waiver of locus standi.

Court held that It is not a protection, granted to the company because the company is after all constituted by its members. It is a bar on the members. In removal of that bar the members have a right of hearing and not the company. Normally, any citizen in a free democratic country has a right to go to court if his interests are adversely affected by the action of anyone. Such right cannot be denied to members of the company qua the working of their company. The statutory bar created can be removed if circumstances exist. This is in consonance with the principle that everyone has a right to approach the court for redress of his grievance. If 11 per cent shareholders can move an application under Section 397 or Section, 398 of the erstwhile Companies Act without the intervention of the Company Law Board or the Central Government then a lesser number should have a right to do so on being authorised without having to fight first a battle with the company before the Company Law Board and then in court.

Similarly, in Photocon Infotech Pvt. Ltd. v. Medici Holdings Ltd. , the Tribunal granted the waiver to the applicant which was subsequently aggrieved by Respondent that the applicant does not fulfil locs standi and filed appeal before NCLAT.

NCLAT upheld the decision of Tribunal and stated that it is open ended wide discretion of NCLT and all judicial powers and discretions are to be so exercised that it should not be arbitrary or whimsical. Interest of justice should always been the guiding factor.

● Substantial Interest in Company

Substantial interest is an exceptional circumstance meriting the grant of waiver. It can be substantial monetary investment or substantial long-standing relationship with the company forming a substantial emotional investment in the company.

The same can be well construed from Thomas George v. Malayalam Industries Ltd., where the locus standi was waived off High Court of Kerala. The applicant and his wife together held 8.84 per cent of the total issued share capital of the respondent company, and thus fell short of the requirement under Sec 244(1). However, the applicants were subscribers to the charter documents of the company and the husband was a managing director and responsible for setting up of the hotel that was being run by the first respondent-company.

The Kerala High Court held that despite not meeting the ten per cent requirement, the applicants’ well established relation with the company as promoter and key managerial personnel reflected their substantial interest in the company’s affairs. Accordingly the waiver was granted.

Similarly, referring to Cyrus Investments Pvt. Ltd. v. Tata Sons Ltd & Ors, the appellants had an interest to the extent of one-sixth of the overall value of the company. Failure to meet the criteria of 1/10th of the share capital was because of the inclusion of preference share capital in the share capital reducing the appellants issued share per centage from eighteen per cent to 2.71 per cent.

The NCLAT held the appellant’s substantial interest in the overall value of the company was exceptional and compelling enough to grant a waiver under Section 244 of the Act.

Also, in this case, there were forty-nine minority shareholders all having shareholding less than 2% individually. This meant that they could not form the required 10% unless they approached the Tribunal in groups of six or more. This showcased the dependence of minority shareholders on one another for their rights.

Tribunal admitted the waiver application observing that the members cannot always be expected to approach the Tribunal in groups where the minority shareholding was disintegrated to an extent that multiple shareholders would have to rely on one-another to fulfil the ten per cent requirement under Section 244(1).

● Dilution in Shareholding because of oppression

In Manoj Bathla v. Vishwanah Bathla, the shareholding of the respondent was dramatically reduced from twenty-five per cent to 0.33 per cent in the company. This was the subject-matter of the application under Section 241 as well as the plea for warrant of grant of waiver. The NCLT had already granted the waiver, but appealing to the NCLAT, the appellants argued that the respondent does not fulfil the criteria for a section 241 application or the waiver application , as his shareholding was virtually zero per cent, even disentitling him from the status of a member.

The NCLAT upholding the decision of the NCLT, observed that refusing the grant of waiver herein would be depriving the respondent from the relief sought against allegations of oppression manifesting from manipulation of shareholding, because of which the respondent’s interest in the company seemed prejudiced. Noting this, the NCLAT upheld the grant of waiver to enable the respondent to proceed under Sec 241.

Similarly, in Photocon Infotech Pvt. Ltd. v. Medici Holdings Ltd., the reason for application under section 241 was the attempt of the management in demerging key assets of the company in slump sale. However, the Tribunal observed that the shareholding of the aggrieved were also purposely diluted and left with a minute shareholding of 0.038 per cent and 6.62 per cent in order to prevent them from filing a case of oppression and mismanagement. This was done by increasing the number of members of the company by transferring fifteen shares to the employees.

It was held that this dilution of the aggrieved, preventing them from fulfilling the criterion under Section 244 is an exceptional circumstance and in the interest of justice, Hence, waiver was granted.

Similarly, in Farhat Sheikh v. Esemen Metalo Chemicals Pvt. Ltd., where the respondents have increased the issued and subscribed capital in Esemen by issue of further 5,000 equity shares which were allotted to applicant thereby reducing the petitioner’s holding from 16.25 per cent. to approximately 8 per cent. The increase in the capital has been made by the respondents only with the ulterior motive of diluting the shareholding of the petitioner and to take away her qualification under Section 399 of the Companies Act, 1956.

Court granted waiver as issue of shares by respondents was an ulterior motive to dilute the shareholding of petitioner thereby taking away her qualification.

Considering the significance of the minority in aforesaid cases, Tribunal granted waiver of locus standi specified in Section 244.

Cases and circumstances where waiver has not been granted

The object of prescribing a qualifying percentage of shares to file petitions is clearly to ensure that frivolous litigation is not indulged in by persons who have no real stake in the company. Hence, the said requirement is vital and can not be overlooked unless public interest is involved.

● In V.K. Mathur And Others v. K.C. Sharma And Ors, petition was originally filed under section 397 and 398 of the Companies Act, 1956. Later, some of those who moved to Central Government back out from giving a written consent to the original petition when made. Members applied to the Company Law Board for an authorisation in terms of section 399(4) of the Act to enable them to move an application under section 397 and 398 in the High Court. Company Law Board authorised “the applicants” to apply to the court under the above section in relation to the company.

The Delhi High Court held that a petition moved by only some of the persons authorised by the Central Government may not, in fact or in principle, be an application by the authorised persons unless their written consents to the petition are available. section 399(4) is intended to waive the minimum requirements of section 399(1) and, normally, it is the nature of the allegations made rather than the number of members who make an application to it that is considered by the Central Government while granting permission. But, it would perhaps not be correct to say that the numbers is totally irrelevant particularly in cases where no public interest is involved and the disputes are only the result of inter-group rivalries in the organisation.

● In Syed Musharraf Mehdi And Syed v. Frontline Soft Limited And Ors., the petitioners together was holding 6.5% of the paid up share capital of M/s Frontline Soft Limited and constituting less than one-tenth of the total number of its members. They, on being aggrieved by a series of purported acts of oppression and mismanagement in the affairs of the Company, filed application before Company Law Board stating therein that The requirements of section 399 of the Act are directory and not mandatory and that the petitioners will be able to show in due course of the present proceedings that they have support of several other shareholders thereby the petitioners would be able to satisfy in future the requirements of section 399.

Company Law Board dismissed the application stating that petitioners do not possess the requisite locus standi to maintain the petition. It was held that the plea of the petitioners that they will be in a position to muster the requisite percentage shareholding subsequent to filing of the present company petition does not at all merit any consideration. The requirement of requisite percentage is vital and go to the root of the matter, which cannot be broken and overlooked as envisaged therefore, cannot be directory.

CONCLUSION

Law do intend to strike the right balance between majority rule and minority rights is always an intention. However, minority too, cannot be allowed to disturb the corporate democracy using frivolous tactics.

Hence, decisions taken by majority not divulging any act of oppression and mismanagement are never interrupted. But where any decision is prejudicial to the interest or minority, a right can be exercised by the minority by filing an application before Tribunal pursuant to Section 241(1). Also, Tribunal may even waive off the locus standi considering the significance of interest of minority in the company.

However, as discussed above, it is the sole and wide discretion of the Tribunal to pass order in favor/against the minority based on the facts and circumstances of each case. In any case, in making a decision under section 244, the Tribunal would be driven by the overarching principles of natural justice, as the author discussed above.

Good article All cases rolled nicely into one article 🙏