Proxy advisors and their role in corporate decision making on questions of law

Sharon Pinto, Manager, corplaw@vinodkothari.com

Concept of proxy advisors

Proxy advisors are research based entities that formulate recommendations on the decisions of companies which require shareholder approval. SEBI (Research Analysts) Regulations, 2014 (‘SEBI Regulations’), defines proxy advisors “as any person who provides advice, through any means, to institutional investor or shareholder of a company, in relation to exercise of their rights in the company including recommendations on public offer or voting recommendation on agenda items”. Thus, these advisory firms guide shareholders to make sound investment decisions and exercise their voting rights effectively. Matters that require shareholder approval under the Companies Act, 2013, are of significant importance and include decisions pertaining to appointment of directors (including managing director, whole-time directors, independent directors), manager, approval of their remuneration, alteration of Articles or Memorandum of Association of the company, etc. The clientele of the proxy advisory firms includes institutional investors, who are usually not privy to the affairs of the company. Thus, they may rely on the recommendations issued by the said entities. As in case of certain companies the shareholding/voting rights of such investors may be considerably large, the recommendations of a proxy advisory firm may substantially affect the decision-making by the investor, and in turn, the affairs of the company.

As per Regulation 2 (1) (m) of SEBI (Investment Advisors) Regulations, 2013, ‘investment advisor’ means a person who is engaged in the business of providing investment advice for a consideration. However, a proxy advisor is into recommending voting decisions to shareholders, and are not into recommending whether an investor or a potential investor should or should not make/keep an investment.

Investment advisors are entities that specifically provide financial advice. They undertake research in order to provide advice relating to investment decisions of their clients, separating them from proxy advisors, who provide voting recommendations on agenda items, which may also include approval of public offer by the shareholders. Thus, the role of proxy advisors does not entail provision of financial advice.

In this article, the author deliberates on the role of proxy advisors and the issues concerning their functioning, the enforceability of the recommendations, while perusing the position of applicable laws in India as well as in the global context.

Effect of proxy advisor recommendation on corporate decisions

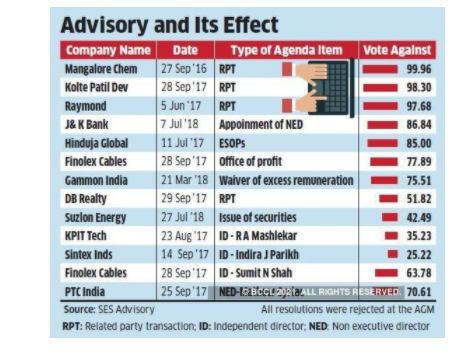

The role of proxy advisors is of a benign nature. They perform the function of educating investors of the right corporate governance practices on the basis of the research undertaken by them. Thus, they may act as catalysts in strengthening corporate governance. However, the downside to the process is the possibility of concentration of power with the proxy advisors and lack of regulatory overview or safeguards w.r.t. their opinions. Since the guidelines are based on best governance practices, they may go beyond the provisions of law. Further, the recommendations and guidelines thus issued are not subject to regulatory overview or approval. They are solely the views of the advisory entities and may thus differ on the grounds of interpretation or factual information. Thus, the said recommendations and guidelines must be used as a tool for further analysis by the investor and thereafter making independent decisions and not as views of the regulator, on account of the proxy advisors being licensed market intermediaries. The below figure shows an analysis of the effect of negative voting recommendations of the proxy advisor on the resolutions pertaining to related party transactions, appointment of non-executive directors, independent directors and other significant corporate decisions:

The current provisions applicable to proxy advisory entities in India do not prescribe for prior interaction of the firms with the company. While the same may act as a safeguard for the freedom of proxy advisory entities to express their opinions, the recommendations of the advisory entities may lack the consideration of necessary facts or information in order to give a comprehensive picture of the proposed decision of the company.

Concerns stemming from voting guidelines and recommendations of proxy advisors and existing regulatory framework

As the regulatory framework governing proxy advisors is still evolving, certain issues relating to the functioning of the proxy advisors and the guidelines and recommendations issued by them require further regulatory oversight. The existing regulatory framework and safeguards in place have been discussed below with respect to the said concerns.

India

Proxy advisory firms operating in India are required to obtain a license under the afore-mentioned SEBI Regulations. They are also required to mandatorily adopt a code of conduct as prescribed under the SEBI Regulations. The SEBI Regulations have set forth provisions relating to registration, eligibility criteria, management of conflict of interest, adoption of code of conduct among other matters.

- Conflict of interest

Conflict of interest is a major concern in case of proxy advisory firms providing other services like consultancy services to the company in addition to being advisors to its investors. Thus, it may give rise to biased opinions which are reflected in the recommendations of the advisory entity, resulting in negative impact on the shareholder interest. Chapter III of the SEBI Regulations deals with management of conflict of interest and disclosure requirements which mutatis mutandis applies to proxy advisors.

As per Regulation 15 (1) of SEBI Regulations, the entities are required to maintain internal policies and procedures governing the dealing and trading by any research analyst for addressing actual or potential conflict of interest arising from such dealings or trading of securities of the subject company. The said Regulations further prescribe restrictions on the dealings by employees of the advisory firms. Regulation 17 provides for the conditions on the compensation received by research analysts, wherein the compensation is required to be reviewed by the board of the research entity and is to be independent of the brokerage services division. Further, the SEBI Regulations prescribe for restriction on publication and distribution of reports of a subject company in which the research analyst has acted as a manager or co-manager.

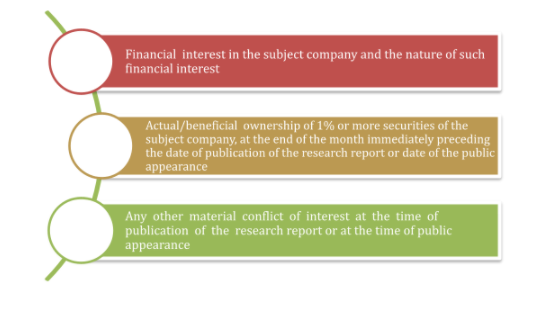

In addition to other disclosures, following w.r.t. whether the research analyst or research entity or his associate or his relative has any, will form part of the research report:

As per SEBI procedural guidelines for proxy advisors issued on August 3, 2020, proxy advisors are required to disclose conflict of interest on every specific document where they are giving their advice. Further, the disclosures should especially address possible areas of potential conflict and the safeguards that have been put in place to mitigate possible conflicts of interest. They are also required to establish clear procedures to disclose, manage and/or mitigate any potential conflicts of interest resulting from other business activities including consulting services, if any, undertaken by them and disclose the same to clients.

- Material misstatements and factual errors

Proxy advisors are required to additionally disclose in their reports the extent of research involved in a particular recommendation and the extent and/or effectiveness of its controls and procedures in ensuring the accuracy of issuer data in accordance with Regulation 23 of the SEBI Regulations. Further, the above-mentioned procedural guidelines issued by SEBI state that proxy advisors shall ensure that the recommendation policies are reviewed at least once annually. They shall further disclose the methodologies and processes followed in the development of their research and corresponding recommendations to their clients.

Regulation 20 of the SEBI Regulations, has prescribed the following with regard to contents of the Report:

- Research analyst or research entity shall take steps to ensure that facts in its research reports are based on reliable information and shall define the terms used in making recommendations, and these terms shall be consistently used.

- Research analyst or research entity that employs a rating system must clearly define the meaning of each such rating including the time horizon and benchmarks on which a rating is based.

- If a research report contains either a rating or price target for subject company’s securities and the research analyst or research entity has assigned a rating or price target to the securities for at least one year, such research report shall also provide the graph of daily closing price of such securities for the period assigned or for a three-year period, whichever is shorter.

- Interaction with the subject company

Regulation 23 of the SEBI Regulations, stipulates a proxy advisor to disclose the policies and procedures for interacting with issuers, informing issuers about the recommendation and review of recommendations. The afore-mentioned SEBI procedural guidelines for proxy advisors state that the proxy advisor shall have a stated process to communicate with its clients and the company. Further, proxy advisors shall share their report with their clients and the company at the same time. The said ‘sharing policy’ is required to be disclosed by proxy advisors on their website. Timeline to receive comments from company may be defined by proxy advisors and all comments/clarifications received from the company, within the said timeline, shall be included as an addendum to the report. If the company has a different viewpoint on the recommendations stated in the report of the proxy advisors, then proxy advisors, after taking into account the said viewpoint, may either revise the recommendation in the addendum report or issue an addendum to the report with its remarks, as considered appropriate.

- Difference of opinion

The views of proxy advisors as discussed herein are solely based on their research and interpretation not subject to the approval of any regulator. Further, the benchmarks set by the entities are based on highest corporate governance principles, hence they may surpass the requirement of law.

The procedural guidelines issued by SEBI state that they shall clearly disclose in their recommendations the legal requirement vis-a-vis higher standard they are suggesting if any, and the rationale behind the recommendation of higher standards.

The Report of the Working Group dated July 29, 2019, formulated by SEBI on issues concerning proxy advisors has proposed for proxy advisors to send an unedited response of the company to all its subscribers. In case a company is not satisfied with the response, it may write again to proxy advisors and in case the response is still not acceptable, the Company concerned may approach SEBI under the SEBI Regulations seeking SEBI’s intervention. However, mere differences based on opinion, which are backed with authentic public data and analysis, cannot be the basis of any complaint or litigation. Litigation should not be initiated merely because an opinion is not favourable to the management of a company, especially if opportunity had been given by proxy advisors to the company and the same has been duly addressed. Thus, an objection may only be raised by companies in case of abuse of power by the proxy advisors by violating the Code of Conduct as mandatorily prescribed under SEBI Regulations. A mere case of difference of opinion basis different interpretations, which is not on account of factual misstatement or lack of material facts, cannot be the basis of contention.

United States of America

Under the Securities Exchange Act of 1934 (‘Exchange Act’), Securities and Exchange Commission (‘SEC’) regulates the proxy solicitation process for publicly traded equity securities. SEC also regulates the activities of proxy advisory firms that are registered with SEC as investment advisers under the Investment Advisers Act of 1940 (Advisers Act). As per the SEC’s Interpretation and Guidance on Applicability of Proxy Rules on Proxy Voting Advice, it has stated that proxy voting advice should be considered a solicitation, subject to the federal proxy rules because it is “a communication to security holders under circumstances reasonably calculated to result in the procurement, withholding or revocation of a proxy.”

- Conflict of interest

SEC in its Guidance on Investment Advisor’s use of Proxy Advisors states that an investment adviser’s decision regarding whether to retain a proxy advisory firm should also include a reasonable review of the proxy advisory firm’s policies and procedures regarding how it identifies and addresses conflicts of interest. Since proxy voting advice has been considered as solicitation, relevant federal proxy rules shall apply. Solicitations that are exempt from the federal proxy rules’ information and filing requirements remain subject to Rule 14a-9 of General Rules and Regulations of Exchange Act. Accordingly, the provider of the proxy voting advice should consider whether, depending on the particular statement, it may need to disclose about material conflicts of interest that arise in connection with providing the proxy voting advice in reasonably sufficient detail so that the client can assess the relevance of those conflicts in order to avoid a potential violation of the aforesaid rule.

SEC has proposed amendments to regulate proxy advisors which shall be mandatory from December 1, 2021. As per the said amendments, any person providing proxy voting advice within the scope of proposed rules, who wishes to utilize the exemption in either Rule 14a–2(b)(1) or (b)(3) must include in their voting advice (or in any electronic medium used to deliver the advice) prominent disclosure of:

- Any information regarding an interest, transaction, or relationship of the proxy voting advice business (or its affiliates) that is material to assessing the objectivity of the proxy voting advice in light of the circumstances of the particular interest, transaction, or relationship; and

- Any policies and procedures used to identify, as well as the steps taken to address, any such material conflicts of interest arising from such interest, transaction, or relationship

- Material misstatements and factual errors

Rule 14a–9 prohibits any proxy solicitation from containing false or misleading statements with respect to any material fact at the time and in light of the circumstances under which the statements are made. In addition, such solicitation must not omit to state any material fact necessary in order to make the statements therein not false or misleading. As per the SEC amendments mentioned above, entities providing proxy voting advice, in case of failure to disclose material information regarding proxy voting advice, ‘‘such as the proxy voting advice business’s methodology, sources of information, or conflicts of interest’’ could, depending upon particular facts and circumstances, be misleading within the meaning of the rule. It has been further stated that, the amendment does not make mere differences of opinion actionable under Rule 14a–9.

- Interaction with the subject company

SEC amendments in Rule 14a of the Exchange Act, 1934, provide certain exemptions with respect to filing requirements of the proxy rules subject to the condition that registrants that are the subject of proxy voting advice have such advice made available to them at or prior to the time when such advice is disseminated to the proxy voting advice business’s clients.

The amendments also provide for safe harbour rules specifying policies and procedures of the proxy advisors may include conditions requiring registrants to –

- file their definitive proxy statement at least 40 calendar days before the security holder meeting

- expressly acknowledge that they will only use the proxy voting advice for their internal purposes and/or in connection with the solicitation and will not publish or otherwise share the proxy voting advice except with the registrant’s employees or advisers.

- Difference of opinion

While Rule 14a-9 of Exchange Act, 1934 states that no solicitation subject to this regulation shall be made by means of any proxy statement or other communication, written or oral, containing any statement which, at the time and in the light of the circumstances under which it is made, is false or misleading with respect to any material fact, the same is not applicable in case of difference of opinion. However, since as per the proposed SEC amendments, entities will be required to make their proxy voting advice available to the registrants at or prior to the time when such advice is disseminated to the proxy voting advice business’s clients, the same shall provide a fair opportunity for representation to the registrant companies.

United Kingdom

As per the Directive (EU) 2017/828, a proxy advisor is a legal person that analyses, on a professional and commercial basis, the corporate disclosure and, where relevant, other information of listed companies with a view to informing investors’ voting decisions by providing research, advice or voting recommendations that relate to the exercise of voting rights. The Proxy Advisors (Shareholders’ Rights) Regulations 2019, came into force on 10th June, 2019. The Proxy Advisors (Shareholders’ Rights) Regulations in part implement the revised Shareholders Rights Directive (Shareholder Rights Directive II).

- Conflict of interest

The Proxy Advisors (Shareholders’ Rights) Regulations, 2019, under Regulation 5, state that the proxy advisor must take all appropriate steps to ensure that it identifies any actual or potential conflict of interest or any business relationship that may influence the advisor in the preparation of research, advice or voting recommendations. Further, such a conflict of interest or business relationship is required to be identified without delay after the time at which it arises. In case of identification of an actual or potential conflict of interest, the proxy advisor must disclose the fact to its clients together with particulars of the conflict of interest or business relationship concerned, in addition to a statement of the action it has undertaken to eliminate, mitigate or manage the conflict of interest or business relationship concerned.

- Material misstatements and factual errors

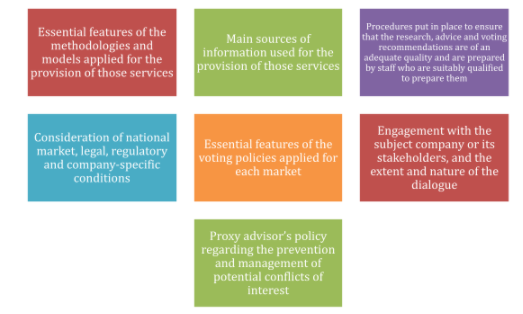

Regulation 4 of the Proxy Advisors (Shareholders’ Rights) Regulations, 2019, prescribes minimum information to be disclosed relating to preparation of research, advice and voting recommendations, as given below:

Similar to the legislation in India, the policies and procedures are required to be reviewed at intervals of no more than twelve months beginning with the date on which it was last updated.

- Difference of opinion

Adoption of Code of Conduct is not mandatory under the Proxy Advisors (Shareholders’ Rights), 2019, provided the proxy advisors provide a clear and reasoned explanation of reasons for not doing so. The provisions prescribe a person may submit a complaint to the Financial Conduct Authority (FCA), in case of contravention of any requirement. Further, the Code of Conduct is required to be updated at an interval of not more than twelve months.

Australia

Under the Australian regime, only the proxy advisors providing financial services are required to obtain a license referred to as Australian Financial Services (AFS) license, under the Australian Corporations Act, 2001. Thus, the obligations set forth under the said Act are not applicable to proxy advisors that undertake research and provide voting recommendations.

- Conflict of interest

In case of proxy advisory firms providing financial services pursuant to Australian financial services (AFS) license, one of the obligations under Section 912A of the Corporations Act stipulates that the proxy advisors are to have adequate arrangements in place for the management of conflicts of interest that may arise wholly, or partially, in relation to activities undertaken in the provision of financial services.

- Interaction with the subject company

On the same lines as the amendments proposed by SEC, in the consultation paper issued by the Treasury of Australian Government in April 2021, it is proposed that proxy advisers will be required to provide their report containing the research and voting recommendations for resolutions at a company’s meeting, to the relevant company before distributing the final report to subscribing investors. It has also been proposed that the advisory entities will be required to notify their clients on how to access the company’s response to the report, by providing a website link or instructions on how to access the response elsewhere. Thus, at present there is no requirement of prior engagement with the subject company.

- Difference of opinion

Section 912D of the Corporations Act of Australia states that a licensed financial advisor is obligated to lodge a written report with the ASIC in case of a breach of the obligation prescribed under the Act, as soon as practicable but not later than 10 business days after becoming aware of the breach. However, as proxy advisory entities are currently not required to obtain a license under the Corporations Act, the said provisions are not applicable to them.

ASIC in its review of proxy advisor engagement practices dated June 2018, recommended that if a subject company discovers a matter that is materially false or misleading in a proxy adviser report, the company should:

- notify the proxy adviser of the matter promptly and seek a correction

- consider whether it would be appropriate to respond to the matter by way of an ASX announcement or other communication to investors.

Closing thoughts with respect to tightening of norms relating to proxy advisors

Fair disclosure of information: Proxy advisory entities have garnered more attention in recent years. They have an increased influence over institutional investors and thus have the power to affect the functioning of companies on the basis of the voting recommendations they provide. It is thus necessary that fair and complete disclosure relating to the facts and interpretation of the proxy advisor entity be stated. While certain advisory firms state a disclaimer in their reports, mentioning the fact that the views of the report are not approved by the regulatory authorities, but based on their own benchmarks, the same is not a requirement specified under the regulations governing the entities.

Regulatory oversight of adherence of code of conduct: While it is mandatory for the proxy advisory entities to adopt a code of conduct under the SEBI Regulations, there should be a regulatory oversight on the adherence of the said Code. Further, there is a requirement of placing a fiduciary responsibility on the proxy advisory entities as the guidelines and recommendations published by them are available in the public domain and may affect the opinions of the shareholders of the company. Therefore, the same is required to be unbiased and must state a fair representation of the facts involved. Further, it may be stipulated that, in cases where the proxy advisor is taking a view based on an interpretation of law, which might differ across market participants, the proxy advisor shall specifically state so, and advise the client to take an independent view.

Representation of the subject company: Currently, SEBI procedural guidelines require that the proxy advisors share the report with their clients and the subject company at the same time. However, as per the amendments proposed in the US and Australian regulatory framework, proxy advisors would be required to provide their report to the subject company prior to the issue of the same to its clients. The same may fill the gap arising out of incomplete or obsolete information. Hence, it may be more relevant if the draft report is shared with the subject company before the same is shared with the client/investors; such that a consolidated report, including the views and interpretations of the subject company, may be issued to the shareholders/clients. This would ensure – (i) a fair opportunity to the subject company to rebut the views/interpretations taken by the proxy advisor, (ii) that the shareholder’s views are not pre-conditioned by the sole views of proxy-advisors, as they do not get the views of the subject company at the first instance. As a matter of reasonable checks, the shareholders may be given the right to seek for the draft report shared by the proxy-advisor with the subject company.

Responsibility of institutional investors – The institutional investors should appropriately weigh on the views of the proxy advisors and the subject company, and ultimately make their own independent analysis of the facts in hand to decide on the issue.

Other articles on proxy advisors:

- Dance of Corporate Democracy: The rise of proxy advisors

- SEBI prescribes stricter regimes for Proxy Advisors; Issues procedural guidelines to be followed in addition to Code of Conduct

- SEBI revisits regulatory framework for Proxy Advisors

- Scope of Proxy Advisors to issue general voting guidelines

http://vinodkothari.com/2021/06/scope-of-proxy-advisors-to-issue-general-voting-guidelines/

Leave a Reply

Want to join the discussion?Feel free to contribute!