SEBI automates continual disclosures under PIT and SAST regulations

Physical disclosures to continue in certain cases

Updated as on September 23, 2020, June 16, 2021, August 25, 2021 and March 07, 2022

– Team Vinod Kothari and Company

Introduction & Background

SEBI, in its Board meeting dated June 25, 2020, discussed and approved necessary amendments[1] in SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) that were notified vide gazette notification[2] dated July 17, 2020. One of the amendments made pertained to insertion of enabling power to prescribe format for continual disclosures under PIT Regulations in order to mandate System Driven Disclosures (‘SDD’).

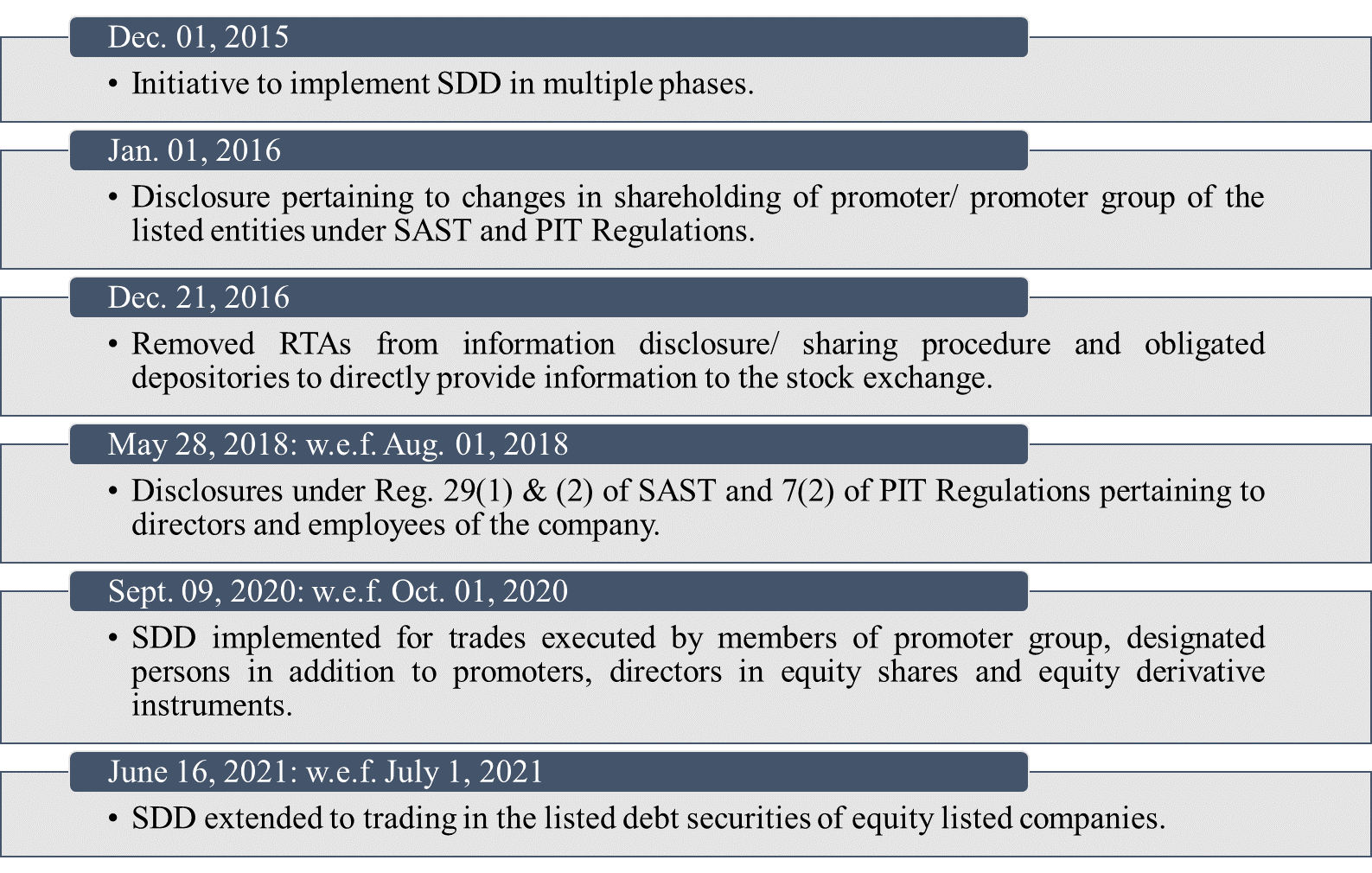

Earlier, in December 2015[3], SEBI had notified SDD in the first phase pertaining to acquisition/ disposal of equity shares by promoters/ promoter group based on specified thresholds under the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (‘SAST Regulations’) and PIT Regulations and pledge of equity shares by promoters/promoter group under the SAST Regulations. Thereafter, in May 2018[4] next phase of SDD was implemented for disclosure under Reg. 29(1) and 29(2) of SAST Regulations by non-promoters and continual disclosures under Reg. 7(2) of PIT Regulations for directors and employees. Refer Figure 1: Flow of events in relation to SDD.

Thereafter, SEBI vide circular[5] dated September 09, 2020, superseded the aforesaid circulars dated December 01, 2015, December 21, 2016 and May 28, 2018 with respect to implementation of SDDs under PIT Regulations and mandated SDD for trading in equity shares and equity derivative instruments i.e. Futures and Options of the listed company (wherever applicable) by the entities.

Figure 1: Flow of events in relation to SDD

Applicability of SDD under PIT Regulations

SDD, under PIT Regulations, was initially made applicable for continual disclosures relating to trading in equity shares and equity derivative instruments i.e. Futures and Options of the listed company (wherever applicable) by the entities by members of promoter group and designated persons in addition to the promoters and directors of the company (collectively referred as ‘Entities’).

Thereafter, SEBI vide circular dated June 16, 2021[6] extended the SDD to trading in the listed debt securities of equity listed companies.

However, SDD has not been extended for reporting the trading in listed debt securities by debt listed company and listed preference shares by equity listed companies (‘excluded securities’). Accordingly, the requirement to submit manual disclosures in case of trade value in excess of 10 lakh rupees in a calendar quarter, by promoters, members of promoter group, designated persons and directors of the Company, will continue in case of excluded securities. On receipt of said disclosures, the listed entity will be required to intimate information about such transaction to the stock exchange on whose platform the securities of such company are listed, within two trading days of receipt of the disclosure or on becoming aware of such information.

Dissemination of information collated through SDD

Under SDD, the depositories and stock exchanges are required to adopt suitable arrangement for generating SDDs under PIT Regulations and such disclosures shall be disseminated on the website of respective stock exchanges w.e.f. October 01, 2020. With respect to the trading in listed debt securities of equity listed companies, depositories and stock exchanges are required to comply with the same procedure w.e.f. July 01, 2021.

Process of Implementation

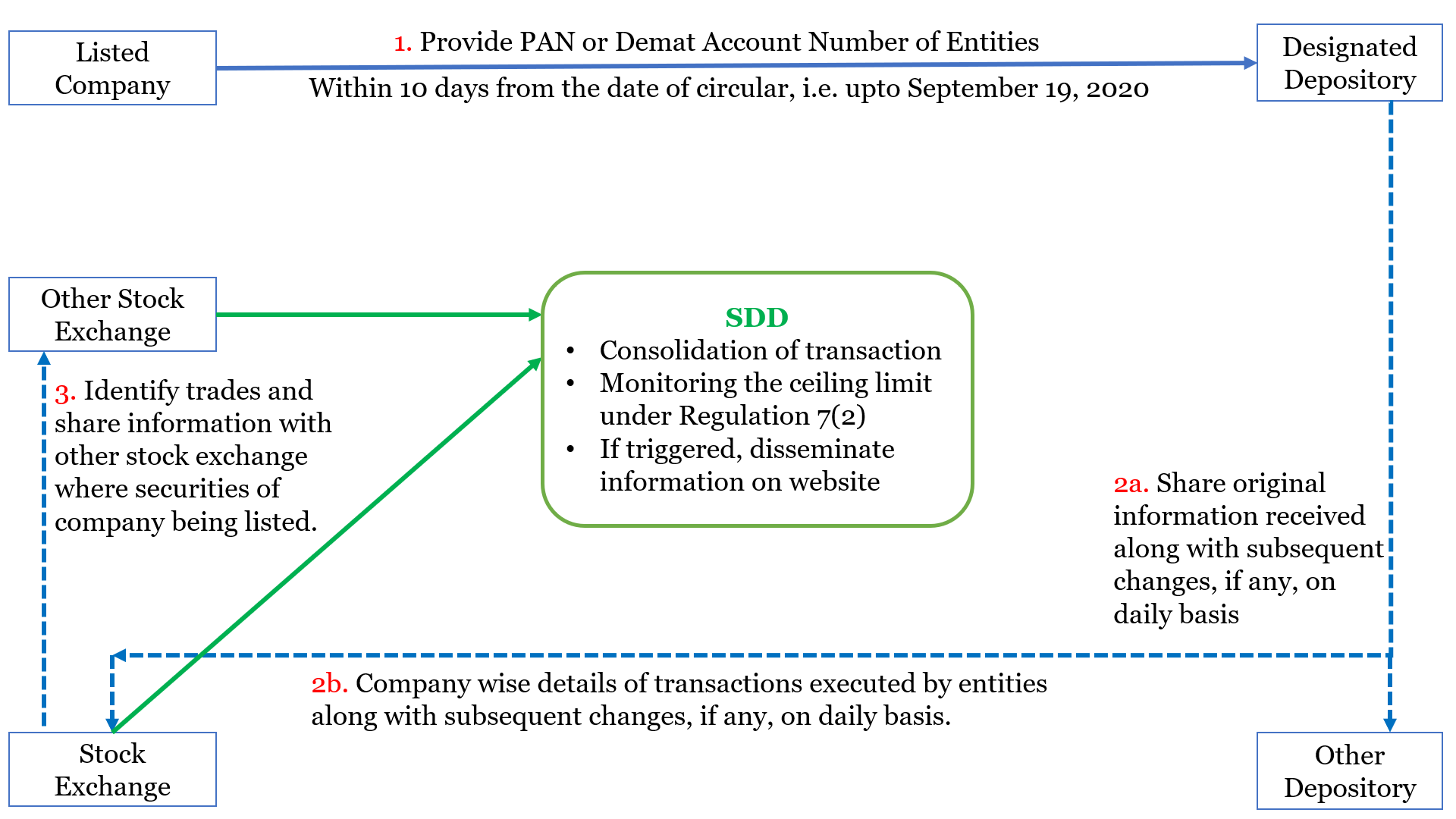

Pursuant to SEBI circular dated May 28, 2018, the listed entity was required to select one of the depositories as a ‘Designated Depository’ (‘DD’) for the purpose of disclosure of data for that particular company.

Pursuant to the circular dated September 09, 2020, the listed entity was required to provide information including PAN number of Entities to the DD in the manner and format prescribed by the depositories within 10 days of the said circular, i.e. upto September 19, 2020. SEBI received certain representations from listed companies for extending the due date for sharing information to DD. In this regard, SEBI informed the stock exchange about the extension of due date till September 30, 2020.[7]

However, in case of PAN exempted entities, the listed company were required to provide demat account number of entities. The DD were required to share such information with other depository.

In case of subsequent changes in the details of the Entities, the listed company is required to update the DD, on the same day and the DD shall share such updated information to other depository on the same day on which information received from the listed company.

Based on information of PAN or demat account number, as the case may be, the depositories tag such demat accounts in their system at ISIN level. This facilitates depositories to track trading activities of Entities and to monitor ceiling prescribed under Regulation 7(2) of PIT Regulations for the purpose of disclosure requirements.

The depositories are required to provide the following data regarding tagged demat account to the stock exchanges on daily basis.

- Details of transactions for pledge/revocation/invocation of shares and other encumbrances such as NDU etc. of the entities.

- Details of off market transactions of the entities.

- Details of transmission of shares of the entities.

- Details of corporate actions such as ESOPs, Bonus, Rights, etc. of

- the entities

- Additionally, details of market transfers in case of PAN Exempt entities.

Based on the above data, stock exchange identifies transactions carried out in their trading system and such trading information is shared by stock exchange with other stock exchanges where the securities of the company are being listed. Every stock exchange is required to consolidate such information of various trading activities and if the consolidated transaction value exceeds the ceiling prescribed under PIT Regulations then the Stock exchange is required to disseminate information about these transactions on its websites.

Refer Figure 2: Flow of events for process implementation.

Figure 2: Flow of events for process implementation

Procedure for submitting information to DD

In terms of SEBI circular dated May 18, 2018, the listed entities were required to provide the information including PAN of the directors and employees (CEO and upto two levels below CEO) through NSDL’s issuer services portal under below mentioned categories/level.

| Code | Category level |

| 1 | Director |

| 2 | CEO with Directorship |

| 3 | CEO without Directorship |

| 4 | Employees upto two levels below CEO |

For providing information including PAN of promoters, members of promoter group, and designated persons, additional categories/levels were added:

| Code | Category level |

| 5 | Promoter |

| 6 | Promoter Group |

| 7 | Other Designated Person |

Process to be followed for providing the information as per aforesaid SEBI circular dated September 9, 2020:

For Listed companies who have designated NSDL and registered on NSDL issuer portal following steps may be followed:

- Log-in to NSDL issuer services portal https://issuer.nsdl.comby using existing log-in credentials received from NSDL.

- There are two options by which the company can provide information about Promoters, members of the promoter group, designated persons to NSDL on the issuer services portal:

Option 1 – Issuer can provide the aforesaid information by directly capturing data on the screen available under menu ‘Add Promoter / Designated Person Details’ under the tab ‘System Driven Disclosure’.

Option 2 – Alternatively, Issuers can upload the details through file upload facility available under the menu ‘Upload Promoter / Designated Person Details’ under the tab ‘System Driven Disclosure’. The format for upload is available in Annexure I and how to create/fill up the upload file is given in Annexure III. Also refer to Annexure II as a reference file i.e. example of data will look post creating in upload file.

- Once the details of Promoters, members of the promoter group, designated persons and directors are provided on NSDL issuer services portal, the same can be viewed under the menu ‘ View/Delete Promoter / Designated Person Details’.

- NSDL will identify demat accounts in NSDL Depository System based on the PAN details of Promoters, members of the promoter group, designated persons and directors provided by Companies. The same can be viewed under the menu ‘View Demat Account Details’.

In case users have forgotten their password, they can reset their password by clicking on the ‘Forgot password’ link on the login page of Issuer portal. The user will need to follow to below mentioned steps:

- Enter the User ID in the ‘Username’ field and click ‘Forgot password’ link;

- User will be need to click on radio button for OTP;

- User will be prompted to enter the mobile number registered with NSDL and click on ‘Send Code’;

- On receipt of the OTP on the registered mobile number, user will need to enter the same in the said field and submit;

- Once the OTP validation is done User will have the option to enter their new password and submit.

Whether PAN of the entire promoter group to be given to DD?

In order to enable the system to capture the trading activities of entire promoter group, the listed entity is required to shall provide PAN/Demat account number, as the case may be, of all the members belonging to the promoter group irrespective of the fact that person belonging to promoter group is holding any shares or not.

Whether PAN/Demat Account number of immediate relatives and persons for whom DP takes trading decisions also to be provided?

SEBI, in its Comprehensive FAQs dated April 29, 2021[8], has clarified that the SDD is extended only to trades executed by promoters, members of promoter group, directors and DPs. Thus, as of now, PAN/ Demat Account details of immediate relatives and persons for whom the above mentioned persons take trading decisions are not covered under SDD and any trades executed by them will be required to be disclosed manually in accordance with reg. 7(2) of the PIT Regulations.

For e.g., trades executed by DP is Rs. 6 lakhs and by immediate relative is Rs. 4 lakhs. While the trades by DP will be captured by the depositories, it will not be disclosed on the stock exchange under SDD as the value is below Rs. 10 lakhs. Thus, the Company will be required to disclose the trades executed by the immediate relatives along with the trades by DPs in accordance with Reg. 6(2) read with reg. 7(2) of the PIT Regulations.

Similarly, if the immediate relative of DP trades for Rs. 8 lakhs and person for whom DP takes trading decisions trades for Rs. 2 lakhs, the same will be required to be disclosed manually.

Whether PAN details shall be provided separately for SAST disclosures?

Pursuant to SEBI circular[9] dated December 01, 2015, listed companies were required to provide information about promoters and promoter groups to the depositories through the RTA for the purpose of disclosures under SAST Regulations. The intent was to build an accurate database of the existing holdings at ISIN level of all the promoters / promoter group. However, SEBI vide circular[10] dated September 23, 2020, informed that the procedure used under PIT Regulations shall be used for SAST disclosures too. Therefore, where details of promoter or promoter group were required to be provided through the RTA, now the same can be provided directly to the DD for all members of promoter group irrespective of their holdings. The idea behind the same is to align the practices of SDD for both PIT Regulations and SAST Regulations.

Selective discontinuation of manual disclosure under PIT Regulations

With the successful implementation of SDD by the depositories and stock exchanges, SEBI in its circular dated August 13, 2021[11] discontinued the manual disclosure under Reg. 7(2) of PIT Regulations giving reference to the circular dated September 09, 2020. While the circular intends to achieve ease of doing business, it has created an ambiguity with respect to discontinuation of manual disclosure of trading in the listed debt securities of equity listed companies. Refer Figure 3 below.

Figure 3: Selective discontinuation of continual disclosure

In addition to the above, the manual disclosure for trades executed by the immediate relatives and persons for whom the DP takes trading decisions will continue since the SDD is not yet extended to them.

Selective discontinuation of manual disclosure under SAST Regulations

On August 13, 2021, SEBI notified SEBI (SAST) (Second Amendment) Regulations, 2021[12] effective from April 1, 2022. Pursuant to the notification, SEBI deleted reg. 30 which provided for annual disclosures by the promoter/ promoter group and persons holding shares/ voting rights of 25% or more in the target company discontinuing the requirement of manual disclosure on annual basis. SEBI also amended reg. 31 which deals with disclosure of encumbered shares by the promoter to the stock exchange by inserting a clause for not making disclosure if such creation/ invocation/ release of encumbrance has taken place in a depository.

SEBI, vide circular dated March 07, 2022, effective from July 01, 2022, has provided that transactions undertaken in the depository system under reg. 29 (disclosure of acquisition or disposal) and reg. 31 (disclosure of encumbrance) of SAST Regulations will no longer require manual filing except for following transactions:

- Triggering of disclosure requirements due to acquisition or disposal of shares, as the case may be, by the acquirer together with persons acting in concert (PACs);

- Triggering of disclosure requirement in case the shares are held in physical form by the acquirer and/or PACs;

- Listed companies who have not provided PAN of promoters/ promoter group to the designated depository or not appointed any designated depository.

Whether SDD is applicable to trading in GDRs and CPs?

SEBI extended the applicability of SDD to trading in the equity shares and equity derivatives instruments vide circular dated September 09, 2020 and to trading in listed debt securities of equity listed companies vide circular dated June 16, 2021. The circulars are silent about applicability in case of trading in the Depository Receipts (‘DRs’) and Commercial Papers (‘CPs’) of equity listed companies.

Since, the commercial paper is a promissory note and not covered under the definition of securities under Securities Contracts (Regulation) Act, 1956, it is clear that the PIT Regulations do not apply to it. Hence, SDD will not extend to it.

DRs are considered as securities and its trading is covered under the relevant provisions of PIT Regulations. This was also clarified by SEBI in its Comprehensive FAQs[13] dated April 29, 2021. However, the DRs are traded on the overseas stock exchanges and it is not within the jurisdiction of SEBI to issue directions to such stock exchanges. Thus, it can be concluded that the SDD is not applicable to trading in DRs. However, the foreign nationals who are the DPs would be required to follow the Code of Conduct framed by the companies and report the trades in DRs in accordance with such Code.

Conclusion and Actionable

The automated process of generating disclosures under PIT and SAST Regulations will do away the instances of late filing of disclosures by the Entities or the listed company and will enable transparency in trading activities of Entities. SEBI may achieve its intention to create a centralized database system by implementing such an SDD process. Listed entities will also be saved from the perfunctory task of submitting the disclosures received from promoters, members of promoter group, DPs and directors in case of trading in securities as specifically covered vide aforesaid circulars.

The actionables for the listed entities will be as under:

a. Communication to the Entities: The equity listed companies will be required to inform the Entities about the discontinuation of manual disclosure. Thus, if the Entities of the equity listed company trade in its equity shares or equity derivative instruments or listed debt securities, they need not notify the company under Reg. 7(2) of the PIT Regulations. Further, such companies will not be required to inform the stock exchange about such trades executed by the Entities. However, the Entities will be required to intimate the trades executed by their immediate relatives and persons for whom they take trading decisions if the value of trades executed by them along with the trades by Entities exceeds Rs. 10 lakhs in a calendar quarter.

However, as SDD has not been implemented for listed debt securities of debt listed entities and towards listed preference shares, the companies should communicate the Entities about continuance of requirement to furnish manual disclosure in those cases.

b. Amendment to the Code of Conduct: Equity listed entities will be required to amend their Code framed under PIT Regulations doing away with manual disclosures under Reg. 7 (2) (b) for trades in equity shares and listed debt by the Entities. However, the listed entity will be required to specify that the trades by immediate relatives and persons for whom the Entities take trading decisions will require manual disclosure. Further, if the equity listed entities has preference shares listed as well, then the disclosure requirement will be retained for the said securities.

c. Reconciliation of data on quarterly basis: e.f July 01, 2022, listed entities, stock exchanges and depositories will be required to reconcile the data at least once in a quarter or immediately whenever any discrepancy is noticed to ensure proper dissemination of disclosures under SDD.

[1] https://www.sebi.gov.in/sebi_data/meetingfiles/jul-2020/1593688502334_1.pdf

[2] http://egazette.nic.in/WriteReadData/2020/220574.pdf

[3] https://www.sebi.gov.in/sebi_data/attachdocs/1448970446882.pdf

[4] https://www.google.com/url?q=https://www.sebi.gov.in/legal/circulars/may-2018/system-driven-disclosures-in-securities-market_39066.html&sa=D&source=hangouts&ust=1599820781246000&usg=AFQjCNFhzfPepN6664i07H5bGTBz6b0YFQ

[5] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/sep-2020/1599654391917.pdf#page=1&zoom=page-width,-16,559

[6] https://www.sebi.gov.in/legal/circulars/jun-2021/automation-of-continual-disclosures-under-regulation-7-2-of-sebi-prohibition-of-insider-trading-regulations-2015-system-driven-disclosures-for-inclusion-of-listed-debt-securities_50572.html

[7] https://static.nseindia.com/s3fs-public/inline-files/NSE_Circular_18092020.pdf

[8] https://www.sebi.gov.in/enforcement/clarifications-on-insider-trading/apr-2021/comprehensive-faqs-on-sebi-pit-regulations-2015_49999.html

[9] https://www.sebi.gov.in/legal/circulars/dec-2015/introduction-of-system-driven-disclosures-in-securities-market_31159.html

[10] https://www.sebi.gov.in/legal/circulars/sep-2020/system-driven-disclosures-sdd-under-sebi-sast-regulations-2011_47632.html

[11] https://www.sebi.gov.in/legal/circulars/aug-2021/automation-of-continual-disclosures-under-regulation-7-2-of-sebi-prohibition-of-insider-trading-regulations-2015-system-driven-disclosures-ease-of-doing-business_51848.html

[12] https://www.sebi.gov.in/legal/regulations/aug-2021/securities-and-exchange-board-of-india-substantial-acquisition-of-shares-and-takeovers-second-amendment-regulations-2021_51886.html

[13] https://www.sebi.gov.in/enforcement/clarifications-on-insider-trading/apr-2021/comprehensive-faqs-on-sebi-pit-regulations-2015_49999.html

Leave a Reply

Want to join the discussion?Feel free to contribute!