Limits on creeping acquisition by promoters increased during COVID-19 crises

Shaifali Sharma | Vinod Kothari and Company

Introduction

SEBI has been taking several proactive measures to relax fund raising norms and thereby making it easier for companies to raise capital amid the COVID-19 pandemic. With a view to further facilitate fund raising by the companies, SEBI vide its notification dated June 16, 2020[1], has relaxed the obligation for making open offer for creeping acquisition under Regulation 3(2) of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Code).

The relaxation allows creeping acquisition upto 10% instead of the existing 5%, for acquisition by promoters of a listed company for the financial year 2020-21. The relaxation is specific and limited to acquisition by way of a preferential issue of equity shares and therefore excludes acquisitions through transfers, block and bulk deals etc. Also recently, SEBI in its Board Meeting[2] held on June 25, 2020 has proposed to provide an additional option to the existing pricing methodology for preferential issue under which the minimum price for allotment of shares will be volume weighted average of weekly highs and low for twelve weeks or two weeks, whichever is higher.However, this new rule shall apply till December 31, 2020 with 3 years lock-in condition for allotted shares. Further, by way of the same notification, SEBI has also relaxed the provisions of voluntary open offer where an acquirer together with PAC will be eligible to make voluntary offer irrespective of any acquisition in the previous 52 weeks from the date of voluntary offer, this will promote investments into various companies in future.

This article tries to discuss on whether the relaxation given by SEBI to the promoters are as encouraging as it seems to be, when connected with the pricing norms for preferential issue under the SEBI (Issue of Capital and Disclosures Requirement) Regulations, 2018 (‘ICDR Regulations’) and how the new pricing methodology proposed by SEBI can leverage the situation.

What is Creeping Acquisition?

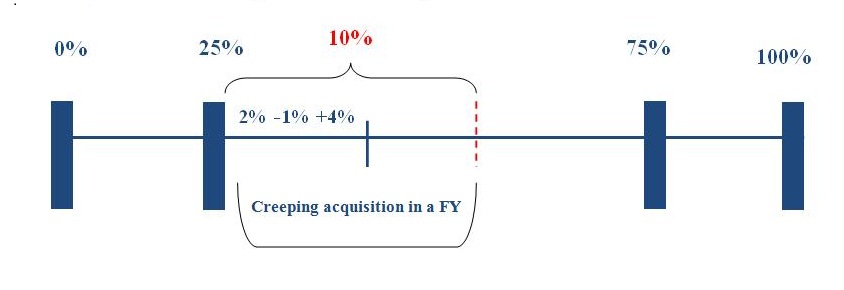

Creeping acquisition, governed by Regulation 3(2) of the Takeover Code, refers to the process through which the acquirer together with PAC holding more than 25% but less than 75%, to gradually increase their stake in the target company by buying up to 5% of the voting rights of the company in one financial year. Any acquisition of further shares or voting rights beyond 5% shall require the acquirer to make an open offer. Further, for the purpose of creeping acquisition, SEBI considers gross acquisitions only notwithstanding any intermittent fall. The same is projected in Figure 1 below. Also, in all cases, the increase in shareholding or voting rights is permitted only till the 75% non-public shareholding limit.

Figure 1: Creeping acquisition limit increased from 5% to 10%

Rationale for easing the norms of Creeping Acquisition

While the companies are currently struggling to manage their cash flows due to the financial challenges faced on account of COVID-19, the amendment will allow companies to raise funds from promoters to tide over their difficulties for the financial year 2020-21. This revision will also boost the sagging stock market and help sustain the stock prices of the company.

Promoters, on the other hand, owning 25% or more of the shares or voting rights in a company will be able to increase their shareholdings up to 10% in a year versus the previously allowed threshold limit of 5%.

Permutations and Combinations of Creeping Acquisition during FY 2020-21

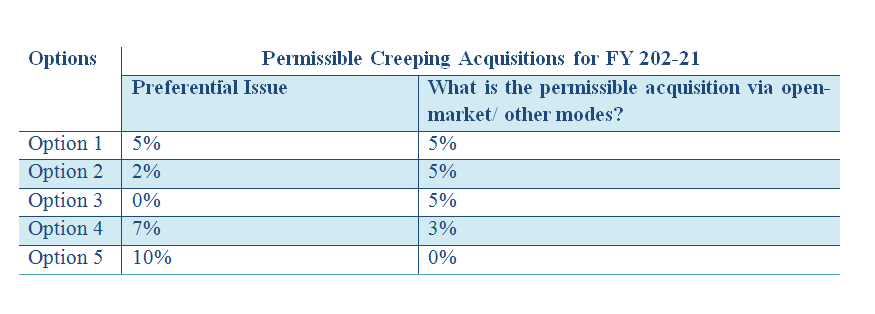

Since the enhanced 10% limit applies only in case of acquisition under preferential issue, the total acquisition of 10% may be achieved by any of the following combinations:

Option 1: Acquire upto 5% shares via open-market purchase or any other form and the remaining 5% shares can be acquired through subscribing to a preferential issue.

Option 2:Acquire 10% shares through preferential issue

Accordingly, in a block of 12 months of financial year 2020-21, if the promoterwants to acquire share through open market, bulk deals, block deals or in any other form, the 5% threshold shall remain in force and additional 5% can be acquired through preferential issue.

Identified below are the permitted acquisitions through open market, transfers or other forms in case promoter opts for preferential issue:

Whether the relaxation in open offer is actually encouraging when read with the pricing norms under ICDR Regulations?

As stated above, the relaxation can be availed only in the cases where the investments are done undera preferential issue. Regulation 164 of the SEBI (Issue of Capital and Disclosures Requirement) Regulations, 2018 (‘ICDR Regulations’) deals with the pricing norms under preferential issue. It provides that the issue price in cases where the shares have been listed for more than 26 weeks on a recognized stock exchange as on the relevant date, the issue price has to be higher of the following:

- the average of the weekly high and low of the volume weighted average price of the related equity shares quoted on the recognized stock exchange during the twenty six weeks preceding the relevant date; or

- the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognized stock exchange during the two weeks preceding the relevant date.

The computation of the prices as per the above stated regulation will lead to a wide gap between the pricing at the beginning of the twenty-six week period and the current price when the company raises funds.

During this time of stock market crises, the stock prices of many companies have dropped sharply from their respective all-time high values recorded 6 months back. Further, in the cases where the market price is lower than the minimum price calculated as per ICDR Regulations for preferential issue, the promoters will be discouraged to acquire shares under preferential allotment as they will end up paying higher values.

Due to the challenges faced by the economy in view of COVID-19, the trading prices of the listed companies have gone down sharply. Accordingly, the price determined under ICDR Regulations may not be a motivating factor for the promoters to subscribe to the additional shares though, elimination of the costs involved in a public offer may compensate the same.

However, to curb the above situation, SEBI in its Board meeting held on June 25, 2020, has proposed an additional option to the existing pricing methodology for preferential issuance as under:

In case of frequently traded shares, the price of the equity shares to be allotted pursuant to the preferential issue shall be not less than higher of the following:

- the average of the weekly high and low of the volume weighted average price of the related equity shares quoted on the recognized stock exchange during the twelve weeks preceding the relevant date; or

- the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognized stock exchange during the two weeks preceding the relevant date.

The new option will consider the weighted average price of equity shares preceding 12 weeks instead of the preceding 26 weeks and therefore reflect the accurate price during the pandemic period. This may prove to be the solution to above crises,making fundraising through preferential issue easier for the corporates and simultaneously encouraging the promoters as well to infuse funds.

Compliances for preferential issue to promoters under PIT Regulations

Considering the fact that promoter is one of the designated person as per the SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’), the companies, in addition to the procedural requirements for preferential issue prescribed under the Companies Act, 2013, ICDR Regulations and other applicable laws, shall also comply with the provisions of PIT Regulations.

Closure of trading window in case of preferential allotment

Designated persons and their immediate relatives shall not trade in securities when the trading window is closed. The trading restriction period shall apply from the end of every quarter till 48 hours after the declaration of financial results.

Further, the trading window shall also be closed when the compliance officer determines that a designated person (DP) or class of designated persons can reasonably be expected to have possession of unpublished price sensitive information (UPSI). Therefore, the trading window shall be closed and communicated to all DPs as soon as the date/notice of board meeting to approve issue of share via preferential allotment is finalized upto 2nd trading day after communication of the decision of the Board to the Stock Exchanges.

Accordingly, promoter/ class of promoters acquiring shares under preferential issue shall conduct all their dealings in the securities of the company only in a valid trading window i.e. once the trading widow is open subject to the pre-clearance norms prescribed under PIT Regulations and the Code of Conduct for prevention of insider trading of the Company.

Concluding Remarks

Given the lack of liquidity in the market, the proposed amendments maybe seen as an opportunity for target companies to raise capital from its promoters. Further, promoters can also infuse funds through equity issuance and will be able to increase their shareholding in the target company without the formalities of making the open offer.

Having said that since the market might take some time to recover, this relaxation provides a gateway for promoters to avoid open offer requirements which would otherwise have involved compliance burden on the promoter. However, the pricing factor may seem to be the only hindrance or a demotivation for actually availing this relaxation which seems to be resolved through the new pricing method proposed by SEBI in its Board meeting.

[1]To view the notification, click here

[2]https://www.sebi.gov.in/media/press-releases/jun-2020/sebi-board-meeting_46929.html

Other reading materials on the similar topic:

- ‘SEBI revisits Takeover Code’ can be viewed here

- ‘Takeover Code 2011’ can be viewed here

- ‘Decoding Takeover Code’ can be viewed here

- Our other articles on various topics can be read at: http://vinodkothari.com/

Email id for further queries: corplaw@vinodkothari.com

Our website: www.vinodkothari.com

Our Youtube Channel: https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Leave a Reply

Want to join the discussion?Feel free to contribute!