Indefinite deferral of IFRS for banks: needed reprieve or deferring the pain?

Vinod Kothari (vinod@vinodkothari.com); Abhirup Ghosh (abhirup@vinodkothari.com)

On 22 March, 2019, just days before the onset of the new financial year, when banks were supposed to be moving into IFRS, the RBI issued a notification[1], giving Indian banks indefinite time for moving into IFRS. Most global banks have moved into IFRS; a survey of implementation for financial institutions shows that there are few countries, especially which are less developed, where banks are still adopting traditional GAAPs. However, whether the Notification of the RBI is giving the banks a break that they badly needed, or is just giving them today’s gain for tomorrow’s pain, remains to be analysed.

The RBI notifications lays it on the legislative changes which, as it says, are required to implement IFRS. It refers to the First Bi-monthly Monetary Policy 2018-19[2], wherein there was reference to legislative changes, and preparedness. There is no mention in the present notification for preparedness – it merely points to the required legislative changes. The legislative change in the BR Act would have mostly been to the format of financial statements – which is something that may be brought by way of notification. That is how it has been done in case of the Companies Act.

This article analyses the major ways in which IFRS would have affected Indian banks, and what does the notification mean to the banking sector.

Major changes that IFRS would have affected bank accounting:

- Expected Credit Loss – Currently, financial institutions in India follow an incurred credit loss model for providing for financial assets originated by them. Under the ECL model, financial assets will have to be classified into three different stages depending on credit risk in the asset and they are:

- Stage 1: Where the credit risk in the asset has not changed significantly as compared to the credit risk at the time of origination of the asset.

- Stage 2: Where the credit risk in the asset has increased significantly as compared to the credit risk at the time of origination of the asset.

- Stage 3: Where the asset is credit impaired.

While for stage 1 financial assets, ECL has to be provided for based on 12 months’ expected losses, for the remaining stages, ECL has to be provided for based on lifetime expected losses.

The ECL methodology prescribed is very subjective in nature, this implies that the model will vary based on the management estimates of each entity; this is in sharp contrast to the existing provisioning methodology where regulators prescribed for uniform provisioning requirements.

Also, since the provisioning requirements are pegged with the credit risk in the asset, this could give rise to a situation where the one single borrower can be classified into different stages in books of two different financial institutions. In fact, this could also lead to a situation where two different accounts of one single borrower can be classified into two different stages in the books of one financial entity.

- De-recognition rules – Like ECL provisioning requirements, another change that will hurt banks dearly is the criteria for derecognition of financial assets.

Currently, a significant amount of NPAs are currently been sold to ARCs. Normally, transactions are executed in a 15:85 structure, where 15% of sale consideration is discharged in cash and the remaining 85% is discharged by issuing SRs. Since, the originators continue to hold 85% of the SRs issued against the receivables even after the sell-off, there is a chance that the trusts floated by the ARCs can be deemed to be under the control of the originator. This will lead to the NPAs coming back on the balance sheet of banks by way of consolidation.

- Fair value accounting – Fair value accounting of financial assets is yet another change in the accounting treatment of financial assets in the books of the banks. Earlier, the unquoted investments were valued at carrying value, however, as per the new standards, all financial assets will have to be fair valued at the time of transitioning and an on-going basis.

It is expected that the new requirements will lead to capital erosion for most of the banks and for some the hit can be one-half or more, considering the current quality of assets the banks are holding. This deferment allows the banks to clean up their balance sheet before transitioning which will lead to less of an impact on the capital, as it is expected that the majority of the impact will be caused due to ECL provisioning.

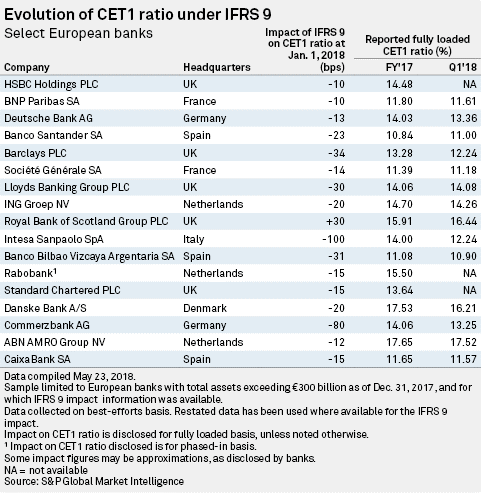

World over most of the jurisdictions have already implemented IFRS in the banking sector. In fact, a study[3] shows that major banks in Europe have been able to escape the transitory effects with small impact on their capital. The table below shows the impact of first time adoption of IFRS on some of the leading banking corporations in Europe:

Impact of this deferment on NBFCs

While RBI has been deferring its plan to implement IFRS in the banking sector for quite some time, this deferral was not considered for NBFCs at all, despite the same being admittedly less regulated than banks. The first phase of implementation among NBFCs was already done with effect from 1st April, 2018.

This early implementation of IFRS among NBFCs and deferral for banks leads to another issue especially for the NBFCs which are associates/ subsidiaries of banking companies and are having to follow Ind AS. While these NBFCs will have to prepare their own financials as per Ind AS, however, they will have to maintain separate financials as per IGAAP for the purpose of consolidation by banks.

What does this deferment mean for banks which have global listing?

As already stated, IFRS have been implemented in most of the jurisdictions worldwide, this would create issues for banks which are listed on global stock exchanges. This could lead to these banks maintaining two separate accounts – first, as per IGAAP for regulatory reporting requirements in India and second, as per IFRS for regulatory reporting requirements in the foreign jurisdictions.

—

[1] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11506&Mode=0

[2] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=43574

[3] https://www.spglobal.com/marketintelligence/en/news-insights/research/european-banks-capital-survives-new-ifrs-9-accounting-impact-but-concerns-remain

Leave a Reply

Want to join the discussion?Feel free to contribute!