Growth of factoring services in India

-An analysis of the current scenario

By Simran Jalan (finserv@vinodkothari.com)

What is factoring?

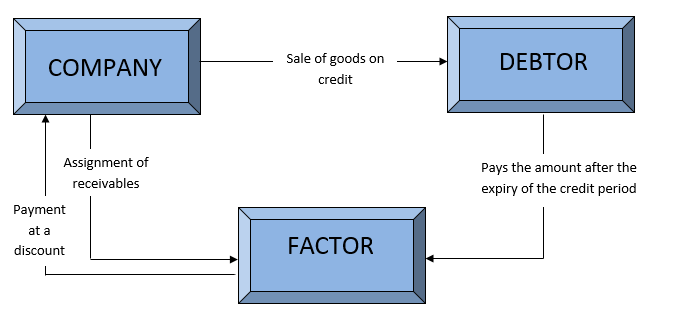

Receivables form a major part of the current assets of a company and management of such receivables is the most important concern for the company. Factoring is a financial option for the management of receivables. It is a tool to obtain quick access to short-term financing and mitigate risks related to payment delays and defaults by buyers. In the process of factoring, the seller sells its receivables to a financial institution (“Factor”) at a discount. After the sale, there is an immediate transfer of ownership of the receivables to the factor. In the due course of time, either the factor or the company, depending upon the type of factoring, collects payments from the debtors. Factoring helps the company to improve the cash flows and cover the credit risk of the company. The following chart depicts the factoring process:

The business of factoring in India is regulated by the Factoring Regulation Act, 2011. Section 2(j) of the Factoring Regulation Act, 2011 defines factoring business as

“factoring business” means the business of acquisition of receivables of assignor by accepting assignment of such receivables or financing, whether by way of making loans or advances or otherwise against the security interest over any receivables but does not include—

i) credit facilities provided by a bank in its ordinary course of business against security of receivables;

ii) any activity as commission agent or otherwise for sale of agricultural produce or goods of any kind whatsoever or any activity relating to the production, storage, supply, distribution, acquisition or control of such produce or goods or provision of any services.”

At present, the factoring business can be carried out by either banks or NBFCs. The Reserve Bank of India (RBI) is the regulatory body supervising the factoring business. Banks can undertake factoring business without the prior approval of RBI. However, NBFCs intending to carry out factoring business as their principal business are required to obtain a prior approval from RBI.

Further, the Factoring Regulation Act, 2011, states that the NBFCs which intend to engage itself in the factoring business have to fulfill the principality test. To determine whether the principal business of the NBFC is factoring, it needs to fulfill the following conditions

“(a) if its financial assets in the factoring business are more than fifty per cent. of its total assets or such per cent. as may be stipulated by the Reserve Bank; and

(b) if its income from factoring business is more than fifty per cent. of the gross income or such per cent. as may be stipulated by the Reserve Bank.”

Market for factoring in India

SBI Factors and Commercials Limited was the first factoring company to start its operation in India in April, 1991. Since then a number of companies have started factoring business in India. At present, there are only 7 NBFC factors registered with RBI.

The list of NBFC Factors registered with RBI as on September 11, 2018[1], is mentioned below:

| Regional Office | Name of the Company |

| Bengaluru | Canbank Factors Limited |

| New Delhi | IFCI Factors Ltd. |

| Bibby Financial Services (India) Pvt. Ltd. | |

| Mumbai | SBI Global Factors Ltd. [Formerly: Global Trade Finance Limited] |

| India Factoring & Finance Solutions Pvt Ltd | |

| Siemens Factoring Private Limited | |

| Patna | Pinnacle Capital Solutions Private Limited |

Since its inception, factoring business has made a significant progress in India. The total factoring volume has increased in the past 7 years. The factoring volume was highest in 2013 and subsequently decreased till 2015. In the years 2016 and 2017, there was again a rise in the volume. The following graph depicts this increase:

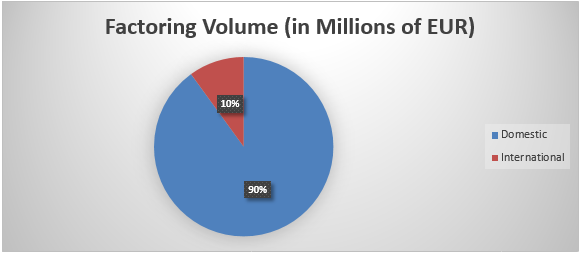

In the year 2017, the total volume of factoring was Rs. 361811 million[2] (4269 in million EUR[3]). Out of this, the major contribution was from the domestic sector. The domestic sector contributed Rs. 325622 million (3842 in million EUR) and the international sector Rs. 36189.60 million (427 in million EUR). The following pie chart shows the percentage contributed by the domestic and international sectors in the total factoring volume in the year 2017.

Several factors such as lack of awareness, a perception of high interest rates and cumbersome documentation processes, have prevented the growth of factoring services in India.

Global Scenario

Factoring business is becoming popular over the world on account of various services offered by the factors. The world factoring statistics indicate that the factoring industry volume have shown a significant growth. The total volume estimated for 2017 amounts to Rs. 209510 billion (2,472 billion EUR).

Though the Asian market for factoring has declined by 4% in 2017 but Indian market for factoring has increased by 10% in 2017 as compared to 2016.

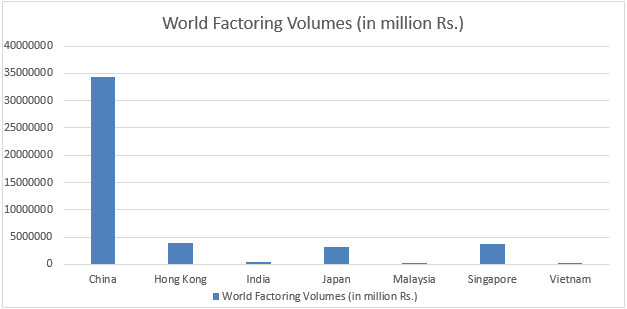

However, the contribution of India in the global factoring market is way too less than the other Asian countries. The factoring volume in India in 2017 is Rs. 361811 million (4269 in million EUR) as compared to other Asian countries like Rs. 34370500 million (405537 in million EUR) in China, Rs. 3978650 million (46944 in million EUR) in Hong Kong, Rs. 3159940 million (37284 in million EUR) in Japan and Rs. 3729140 million (44000 in million EUR) in Singapore. The following chart shows a comparison of Indian factoring market with other Asian countries factoring market.

Conclusion

Factoring is an accepted method of receivables financing across the globe and is regulated by a stringent set of rules and procedures. Initially, factoring was not a typical or mainstream financial service in the absence of a legislation. However, with the enactment of Factoring Regulation Act in 2011, the necessary legal framework is now in place for factoring volumes to grow. But unfortunately, reservations on part of corporates and PSU buyers to accept assignment of receivables made in favour of factors, issues with the legal system and dominance of banking have been restricting the growth. Given the fact that the RBI and several other associations have been taking initiatives to create an awareness about factoring and its superiority as a receivable management service, an increase in the volumes is expected.

Also refer our Articles on:

MSME factoring gets a priority sector status

RBI FAQs muddle up Factoring Business in India

You can also refer our Book on Guide to Factoring

[1] http://rbidocs.rbi.org.in/rdocs/content/docs/FACNBFC220914.xlsx

[2] Conversion rate: 1 EUR = Rs. 84.7531

[3] Factor Chain International

Dear Team @ Vinod Kothari Consultants.

We are looking for International Factoring Services from India. Please call me further to discuss.