Furniture rental startups: A financial perspective

Estimates peg the global furniture rental market at anything between $5-8 billion. Leasing/renting of home durables has seen steep growth. The idea of ownership has been superseded by the desire to gain better experiences by renting or sharing resources. Whatever the absolute numbers, the growth in mobility and intra-country migration suggests that there is a large and ever growing clientele of urban professionals with transferrable jobs and disposable income. Increasing numbers of furniture and appliance rental startups have sprung up to cater to this clientele. This article takes a quick look at the market and its potential in time to come.

The economics from the customer’s point of view:

A bed on Rentomojo can be rented for Rs.600 a month, along with a refundable security deposit of Rs.1099/-. On UrbanLadder a similar bed can be purchased for an upfront price of Rs.17000/- or on EMIs of Rs.1500 over 12 months.

A crude calculation would suggest that it would only if the usage period is more than 2.5 years, ownership would be a cheaper option. Generally, it is admitted that rentals are feasible if the period of use is under two years. If upfront payment is not an option due to shortage of cash, on EMIs it would take even longer usage durations to make it cheaper than rentals. There is, of course, the vital difference between rentals and EMIs/upfront payment: in the latter case, the user owns the asset and hence also has access to its residual value after the usage period, which can be realized by selling it. However, this does come along with practical hassles of finding buyers, and disposal, which, for an urban professional, is least pleasant or convenient.

Thus, within the economy furniture segment, for usage periods under 2 years, it makes sense to avail the rental option. The following picture will explain the economic advantages of renting furniture vs buying them:

Asset Classes in Furniture Renting

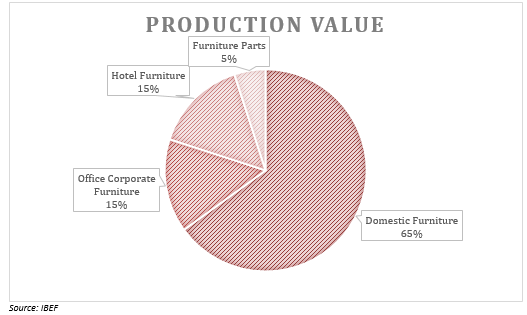

The global furniture market can be broadly categorised into four categories:

- Domestic Furniture

- Office Corporate Furniture

- Hotel Furniture

- Furniture Parts

As the chart shows, the global furniture market is dominated by domestic furniture accounting for 65% of production value. These consists of beds, closets, and other household furniture items. Followed by office furniture and hotel furniture accounting for 15% each. Office furniture consists of furniture used in corporate office mainly tables and chairs whereas, hotel furniture are deployed in hotels and are very similar to household furniture with design and finesse. Lastly, furniture parts constitute 5% of production value which constitutes of table bases, closet doors, sofa legs, etc.

Global Markets

Globalization resulted in corporate workers needing to relocate homes on a regular basis. This has resulted in , many companies are incorporating furniture and home accessory rental into their relocation policies as a core service offering.

The furniture rental market is expected to grow at a robust growth over the next 6 years i.e. 2018-2024. The primary factor responsible for the growth is an increase in number of employers that are incorporating rental furniture’s into their corporate mobility policies as a core service offering. The practice of renting instead of purchasing furniture has proven to be beneficial for consumers because of lower price with reduced expense and maintenance which will drive the furniture rental market size. The industry is driven by wide range macroeconomic factors, such as the number of businesses operating domestically, the unemployment rate and the business sentiment index, all of which are expected to get better during that timeframe. Growth in the number of businesses stimulates the demand for office furniture. Moreover, as the unemployment rate falls, demand for office furniture is anticipated to rise, as businesses require furniture for new employees.

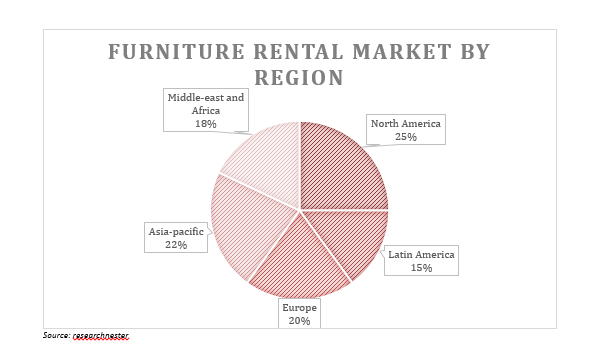

North American region has been consistently dominating the market globally, in terms of the demand for rental furniture. It is followed by Asia-Pacific occupying the second position in the market. Massive growth in urbanization along with rising number of corporate offices is expected to fuel the growth of furniture rental market in Asia Pacific region. Europe is anticipated to showcase robust growth in the next few years.

Indian scenario

AirBnB and Uber are successful companies which provide access to things that last for fixed, short periods of time and can be shared. The organized furniture industry is expected to grow by 20 per cent every year. A large part of this growth is expected to come from the rapidly growing consumer markets of Asia, implying significant potential for growth in the Indian furniture sector.

Market

The total market size for India’s rental businesses is hard to ascertain as many categories remain fragmented. But experts cumulatively peg the market to be around 6 Billion USD (including appliances in this) The rental market in India is still at a nascent stage, with high-growth potential. Now, bachelors, who average 28 years of age and constitute 60% of customers, have the choice of renting furniture via apps. Often, newly-married couples, with a joint income of Rs 10 lakh a year, opt to rent furniture.

Furniture renting is expected to be bullish in the next few years as startups in this sector are attracting promising investments by marque investors. The driving force is the exposure renting is getting as people are starting to understand the economic viability of renting over purchase.

Major players in this sector today include Furlenco, Rentomojo and Cityfurnish.

Business models

Asset heavy model:

The furniture rentals company may want to own its full inventory on offer. This requires a heavy upfront investment.

Asset-light model:

The furniture company has a tie-up with various vendors and offers their products on its website. Once it receives an order for a piece of furniture, it purchases the piece and rents it out. The upfront investments are comparatively lower-the company buys furniture only when it receives the first rental order for it. Thereafter, the piece remains on its inventory.

Marketplace model:

The company acts as a marketplace, where various verified vendors offer their products on rent. The company can evolve various methods of charging such as for example, charging the vendors a percentage of their total billing on the platform.

Lease model:

The company itself leases its inventory from a leasing company on a long term lease. It then rents out this furniture. Here, the upfront investments are lower, but there are monthly obligations of the company to its lessor- hence requires a steady cashflow.

More often than not, the actual model is a hybrid of two or more of the above models.

As these entities are essentially leasing out furniture, the question arises that what is the exact nature of this entity- i.e. does it qualify as a financial sector entity. There are two types of leasing : financial lease and operating lease.

An operating lease is a true lease, a financial lease is really a loan dressed up as a lease. Whether a lease is a financial lease or an operating lease depends on the substance of the transaction rather than its form.

Examples of situations which would normally lead to a lease being classified as a finance lease are:

(a) the lease transfers ownership of the asset to the lessee by the end of the lease term;

(b) the lessee has the option to purchase the asset at a price which is expected to be sufficiently lower than the fair value at the date the option becomes exercisable such that, at the inception of the lease, it is reasonably certain that the option will be exercised; (Bargain purchase)

(c) the lease term is for the major part of the economic life of the asset even if title is not transferred; (75%)

(d) at the inception of the lease the present value of the minimum lease payments amounts to at least substantially all of the fair value of the leased asset; (90%) and

(e) the leased asset is of a specialised nature such that only the lessee can use it without major modifications being made (customised)

In the present circumstances, the leases are short term, the residual value of the asset at the end of the term is usually significant, the leased asset is certainly not specialized, there is no transfer of title and lastly there is no bargain purchase option. Hence, there can be no ambiguity that that these transactions would qualify as operating lease transactions. It is notable that while financial lease is a financial activity; operating lease is not. Hence the renting entities are not financial sector entities.

Funding models

Other than the usual equity and debt routes for raising funds, the nature of the business also opens up other avenues for funds.

FDI: The Government has liberalized its FDI policy in ‘Other financial services’ and ‘Non-Banking Financial Companies (NBFC)’. It was announced that 100% FDI is to be allowed in regulated financial sector entities. However, the entities in question do not qualify as NBFCs. It is a stated view of the Department of Economic Affairs that the present regulation on NBFCs stipulate that 100% through FDI through automatic route is allowed in 18 NBFC activities including merchant banking, underwriting, portfolio management services, stock broking and financial consultancy.

While it may be argued that furniture rental companies are not financial entities at all, and are actually service sector entities, the position as regards FDI is not entirely clear.

Securitization of receivables on owned assets: In the ownership models (both asset light and asset heavy), companies can explore the securitization route to raise funds. It can sell its rental portfolio onwards and get funds upfront, hence raising immediate capital for its business.

Arranging trade receivables financing for vendors in marketplace model: For vendors listing on the platform in the marketplace model, it can arrange trade receivables financing. The vendor can thus raise immediate funds against its rental portfolio, thus easing the cash crunch and allowing the vendor to list further inventory on the platform.

Taxation issues

Direct tax –

The income earned by the renting company will have to be offered to tax under Income Tax Act, however, it will be able to claim depreciation on the value of the furnitures on its books at the rate of 10% on reducing balance method.

Indirect tax –

The transactions will also suffer GST. The rentals will be subject to GST at the rate at which sale of furnitures are charged tax. For example, if the company has to pay GST on purchase of a furniture at 12%, it will have to charge GST on the rentals at the same rate. The GST paid by the company on the purchase of asset can however be adjusted against its liability towards GST charged on lease rentals.

For further queries, please reach out to us on finserv@vinodkothari.com.

By Ameet Roy, Vineet Ojha and Vishes Kothari

Leave a Reply

Want to join the discussion?Feel free to contribute!