Majority Shareholders: New Dictators in a Democratic Institution by Parul Bansal

In this era, where the country is going through immense economic growth, more and more investors are coming up with the intention to invest in the equity of the companies. Such investments lead to acquisition of interest and rights by the investors in the company. Intention of every investor varies from each other. Where one invests with the intention to earn short term profit by trading in the securities of the company, the other may invest with an intention of long term investment and enjoying the dividend ownership and / or controlling rights over the company. While each and every investor does not participate into the everyday affairs of the business, however, with the level of transparency being visualised, each investor, especially, the long term investors surely have a crucial role to play in the company.

Admittedly, both the erstwhile CA and CA, 2013 contain dedicated chapters to provide law for protecting the interest of the minority shareholders in the company. Despite all the provisions, the majority shareholders, by virtue of holding dominant stake in the company, enjoys high privilege as to rights and control.

On December 7, 2016, Ministry of Corporate Affairs (“MCA”) has notified Section 236 of the Companies Act, 2013 (“Act, 2013”). Pursuant to section 236 of the Act, 2013, majority shareholders, having 90% or above shareholding in the company, may acquire the shares of the minority shareholders without the approval (for that matter without even consent) of such minority shareholders or the Tribunal.

The fate of the minority shareholders seems to be brushed with a darker hue with the coming into effect of the aforesaid section. Where on the one hand, majority shareholders of the company are blessed by MCA with the power to squeeze out the minority at a pre-determined price with the intention to acquire complete control over the company or to reduce the minority stake in the company, on the other hand the interest of the minority shareholders is jeopardized by bounding them to sell/transfer their shareholding.

Prior to the enforcement of section 236; Act, 2013 provided assorted ways to majority shareholders to acquire the minority shareholding in the company however, so far none could compel the minority to transfer the same except with the consent of requisite majority of shareholders and appropriate Order of the Tribunal. Now, in a democratic institution known as “company”, having a separate legal entity, minority shareholders are coerced to transfer their shares.

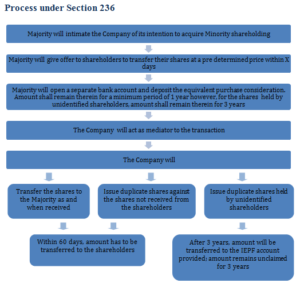

Process under Section 236

Acquisition of shares already transferred to IEPF

Pursuant to section 124 & 125, shares on which the dividend remains unclaimed for a period of seven years or more shall be transferred to the Investment Education and Protection Fund Account (“IEPF account”). Now the question arises that how will the majority shareholder acquire the shares which are already transferred to the IEPF Account?

The answer to the question is secured in the logic hereafter. This should be understood that the IEPF only acts as a custodian to the shares transferred to it by the company under section 124 & 125 of the Act, 2013 and as such, it is not bestowed with the authority to sell/transfer the same. However, for the purpose of acquisition under section 236, consent of shareholders is not required. Therefore, in such circumstance, the shares transferred to IEPF shall stand transferred by issuance of duplicate share certificate by the Company to the Majority and transferring the purchase consideration against the same to the IEPF account. Shareholder has the right to claim the amount paid as purchase consideration from IEPF at any point of time.

Acquisitions of shares held by shareholders who cease to exist or are unidentified

Pursuant to section 236(7) of the Act, 2013, any shares held by such minority shareholders who ceases to exist or are unidentified and whose legal heirs are also unidentified – shall be transferred to the majority shareholder by issuance of duplicate share certificate by the company. The purchase consideration against the same shall remain in the separate bank account opened by the majority shareholder for a period of 3 years.

In case, where same is not claimed by the minority shareholders or legal heir thereof within the time stipulated above, the same shall be transferred to the IEPF account and the minority shareholder may claim the same from such account at any time.

Deposit of purchase consideration in separate bank account

Pursuant to section 236 of the Act, 2013, purchase consideration shall remain deposited in the separate bank account for a period of 1 year. However, purchase consideration payable to the unidentified shareholder shall remain deposited for a period of 3 years therein and thereafter, the same shall be transferred to IEPF account.

Amount which remained deposited in the said bank account for 3 year, will be vain for the company since, the company won’t be able to earn return over the same. Therefore, looking into the intent of law which is to secure the payment of purchase consideration payable to the minority shareholder on being identified, the same can be secured by the company by way of bank guarantee or taking an over draft facility on the account.

by Parul Bansal (parul@vinodkothari.com)

Leave a Reply

Want to join the discussion?Feel free to contribute!