Social stock exchanges: philanthropy on the bourses

– Payal Agarwal, Senior Executive | payal@vinodkothari.com

This version: 30th December, 2022

History

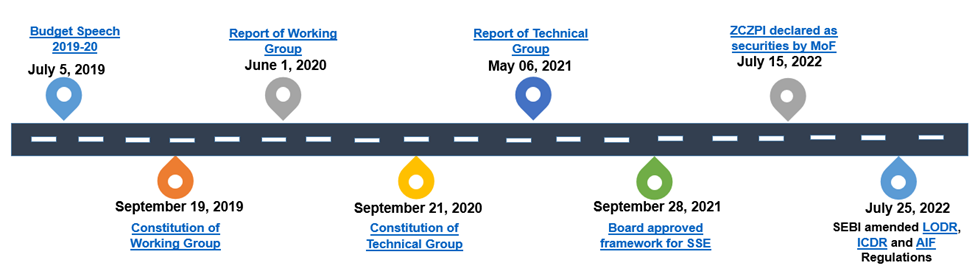

The discussions around the concept of social stock exchanges (“SSEs”) were first initiated in India with the 2019-20 Budget Speech[1] of the Finance Minister, followed by the Working Group Report of SEBI dated 1st June, 2020 (“WG Report”) and Technical Group Report dated 6th May, 2021 (“TG Report”), and public comments thereon. On the basis of the WG Report and TG Report, SEBI in its meeting held on 28th September, 2021 approved a broad framework for establishment of SSEs in India (“SSE Framework”), and an updated status on the action matrix was also released in the meeting held on February, 2022. The concept of SSEs has been incorporated in the rulebook vide the notification of SEBI (Issue of Capital and Disclosure Requirements) (Third Amendment) Regulations, 2022 (“ICDR Amendment Regulations”), SEBI (Listing Obligations and Disclosure Requirements) (Fifth Amendment) Regulations, 2022 (“LODR Amendment Regulations”) and SEBI (Alternative Investment Fund)(Third Amendment) Regulations, 2022 (“AIF Amendment Regulations”), respectively (see timeline below).

In this write-up, we focus on understanding the basic concept of SSEs in India, how the Indian version of SSEs is different from the global counterparts, whether SSEs will be used for investing by impact investors or for those searching for avenues of responsible philanthropy, and what are the potential benefits of listing and participation in SSEs.

Read more →