News on Securitization: Bank of England speaks pro-securitisation once again

November 29, 2013

The latest issue of Financial Stability Report[1], released by the Bank of England, speaks a lot once again by the needed initiatives to revive securitisation.

It notes, of course, that there are visible signs of positive investor interest in the sector in the recent past, evidenced by several proxy measures. First, the volumes of CLOs has been around USD 75 to 80 billion this year, which is close to the pre-Crisis levels. Second, there have been innovative deals – such as residential rental securitisation, securitisation of peer to peer loans, etc. However, with all this, the reduction of securitisation volumes in Europe has been alarming – coming from $ 1.2 trillion in 2008 to $ 322 billion in 2012.

The Report notes: “Better functioning and safe and robust securitisation markets have the potential to diversify banks’ funding sources and create securities that are better tailored to the needs of non-bank investors, such as insurers and pension funds. Securitisation can also transfer risk outside the banking sector. For example, banks that have the expertise to originate loans may not always be best placed to bear the risk of those loans. In those circumstances, banks can free up capital for new lending by securitising loans and selling them to other investors. This process diversifies sources of finance available to the real economy and potentially increases its stability”[2].

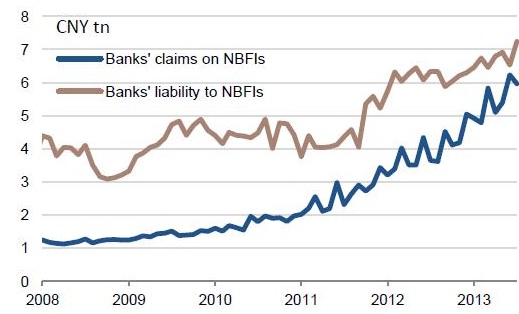

The Committee notes the useful purpose served by “shadow banking” – a term applied to paralller alternative non-banking financial system supplying money to the financial system.

“The provision of finance from outside the traditional bankingsystem can play an important role in the financial system and wider economy but it can also be a source of systemic risk”, notes the Report. The Committee will focus on mitigating these risks, rather than curbing shadow banking.

Vinod Kothari adds: The CLO/CDO volumes, for the first 10 months of this year, is reportedly about $ 68.5 billion, which compares with $ 39.4 billion for the same period in 2012. This is surely a substantial increase. However, considering that there has not been much pick up in traditional asset classes, the aggregate ABS/MBS issuance for 2013 may end up lower than that for 2012.