Digital deceptive practices: Dark Patterns get blacked out

– Vinod Kothari, finserv@vinodkothari.com

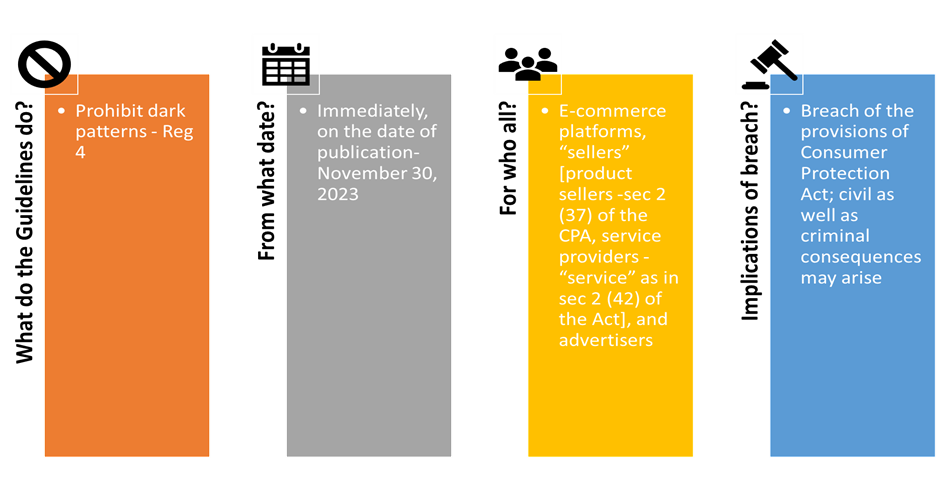

Central Consumer Protection Authority (“CCPA”), issued the Guidelines for Prevention and Regulation of Dark Patterns, 2023 (“Guidelines”) on November 30, 2023 to prohibit any person or platform from engaging in the dark pattern practices.

Dark Patterns Explained

The term “dark patterns” was first coined by Harry Brignull a long time back in 2011, when digital marketing was in its early phases. “We might not like to admit it but deception is deeply entwined with life on this planet. Insects evolved to use it, animals employ it in their behavior, and of course, we humans use it to manipulate, control, and profit from each other. With this in mind it’s no surprise that deception appears in various guises in user interfaces on the web today”, he said. And his prognosis was absolutely correct: most e-commerce marketing employs devices to make consumers pay for what they would, based on application of free discretion, not have procured.

Dark patterns are tricky user interfaces “that benefit an online service by leading users into making decisions they might not otherwise make. Some dark patterns deceive users while others covertly manipulate or coerce them into choices that are not in their best interests” [Arvind Narayanan and Others, March 2020].

As digital marketing becomes the way billions procure goods, groceries, services, tickets, movies, telephony or whatever else is required on a day-to-day basis, the list of deceptive practices that influence free and informed choice continues to evolve.

CCPA Guidelines

Regulatory disapproval of dark patterns is common world-over. However, generally speaking, in most countries, the regulations are either scattered (for example, bait and switch selling in the USA come under unfair trade practices law), or they require consent. The notable thing about the CCPA Guidelines of 30th November, 2023 is that it provides a single place listing what is permitted and what is prohibited, more of the latter.

The Guidelines apply immediately, and will put a huge number of e-commerce sellers, platforms and entities into immediate action, because a number of practices barred in the Guidelines are quite commonly pursued.

How are Digital lenders affected

First question quickly: if there are dark patterns being used by the platform or seller whose products I am financing, am I liable as a financier? Short answer would be no, unless there are dark patterns in your own financial offering. However, please be cautioned of the reputational risk, and the risk that a consumer action may include you as well, even if you succeed in your case.

Digital lenders themselves may quite often be employing practices such as:

- Drip pricing: elements of pricing which are not disclosed.

- BNPL offerings: Please make it clear that after the so-called free credit period, if you choose to convert the purchase into financing, the same will start incurring interest. Give the offer to pay and avoid interest.

- Adding subscriptions, donations or other discretionary items with EMIs or borrower payouts, if they are pre-ticked

- Repeated and persistent messages or calls to avail credit facility

- Reduced ROI for a limited period to create false demand

- Not opting for insurance in case of asset finance is shown as shaming the borrower of agreeing to keep the asset unsecured

- Pressuring the borrower to share personal information like Aadhaar or credit card details, even when the information is not mandatory

- Hiding the cancellation option to opt out of the loan/ close the loan during the cooling off period

The Guidelines prohibit and restrict digital lenders, extending loans through its own platform or other digital lending platforms, to engage in such practices.

Read our resources on digital lending at: https://vinodkothari.com/digital-lending/

Leave a Reply

Want to join the discussion?Feel free to contribute!