The basics of bringing an IPO

Mahak Agarwal | corplaw@vinodkothari.com

The Indian IPO market is currently booming. The performance of the Indian markets is a testament to the growth potential that it has for investors as well as the issuers. The markets are at an all time high in almost all sectors hitting new peaks everyday, giving companies an opportunity to hit the ‘jackpot’ with their issues. A 2023 Report by EY[1] on IPO trends in India bears witness to the impressive positive outlook for IPO activity in India. The India Stock Exchanges have ranked 1st in the world in terms of the number of IPOs during 2023 and in the times to come, a fresh and significant momentum is anticipated in the Indian IPO markets encompassing both, the Main Board and the SME Board.

Having discussed the above, companies looking to bring an IPO may often find themselves bogged down by several basic questions including the ‘what’ of everything. This article proposes to answer such questions and capture the basics of bringing an IPO.

What is an IPO?

An IPO, short for Initial Public Offer, is a mechanism whereby a company offers its shares to the public for the first time via the primary market. It provides funds for business expansion, repayment of existing debt and adds to the credibility of a company by making its operations more transparent.

Follow on Public Offer (FPO), as the name itself suggests, is an offer that is a follow up to an initial public offer. The companies which have already raised funds through IPOs may issue additional shares through FPOs.

Where to bring an IPO?

IPOs are brought into capital markets by a public offer. Hence the question as to where to bring an IPO may seem strange. However, the company has the choice of listing its shares on one of the two major exchanges – viz., National Stock Exchange(NSE) and Bombay Stock Exchange(BSE). Further, there is an SME listing option too, discussed at length below.

Hence, an IPO may either be brought on the BSE or the NSE. The BSE has a main board and a BSE SME(for small and medium enterprises). Similarly, the NSE has a main board and an NSE Emerge. Depending upon the size of issue, an IPO may either be brought on the main board or on the SME/Emerge platform of the NSE or BSE. The mainboard IPO is opted for by large companies that have an extensive track record and meet the IPO eligibility criteria set by SEBI. The minimum post issue paid up share capital for a main board IPO is Rs. 10 cr. An SME/Emerge IPO is opted for by small and medium enterprises or start ups where the post issue paid up capital does not exceed Rs. 25 cr.

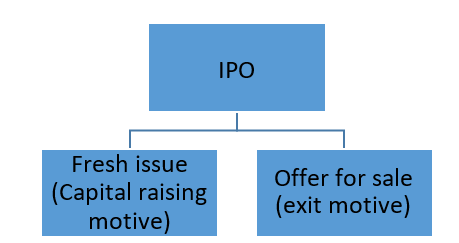

Offer for sale vs IPO

Contrary to general belief, an IPO can be more than just a fund raising exercise. It can either take the form of a fresh issue or an Offer for Sale(OFS) or be a combination of both. An OFS, as opposed to a fund raising IPO, is a means by which existing investors or promoters can reduce their stake in the company by selling their existing shares to the general public. It acts as an exit opportunity for early investors who wish to seek new opportunities. Whether an organization opts for fresh issues or an offer for sale will depend on its motive.

Pre-issue requirements of an IPO

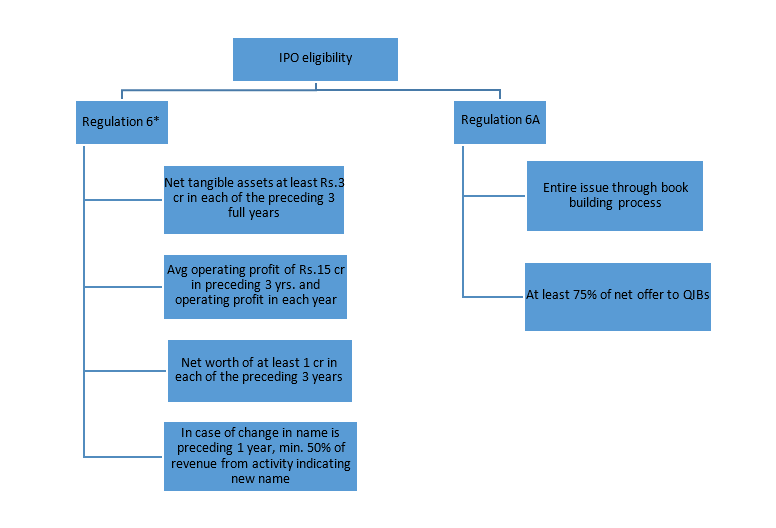

Mainboard

- Asset requirement:

- Net tangible assets of at least Rs. 3 crs either on a standalone or on a consolidated basisIn each of the preceding 3 full years of 12 months each

- Maximum 50% of the net tangible assets can be held as monetary assets; in case more than 50% of the assets are held as monetary assets, the issuer must make firm commitment to utilize the excess in the upcoming projects

- Profitability requirement:

- Average operating profit of at least Rs. 15 crs either on a standalone or on a consolidated basis During preceding three years of 12 months each and

- Operating profit should be there in each of these three years

- Net worth requirement:

- Net worth of at least Rs. 1 cr either on a standalone or on a consolidated basis

- In each of the preceding 3 full years of 12 months each

- Requirement in case of name change within last one year

- At least 50% of revenue either on a standalone or on a consolidated basisFor preceding one full year

- Has been earned from activity suggested by the new name

If a company fails to meet such criteria as specified above, it may still bring an IPO if:

- at least 75% of the net offer is made to qualified institutional buyers and

- the entire issue is carried out by the book building process

Bringing an IPO on the Main Board Vs SME Platform

| Basis of distinction | Main Board | SME segment(BSE SME) |

| Eligibility Conditions | ||

| Net tangible assets | Minimum Rs. 3 crores in each of the preceding 3 years | Rs. 1.5 crores[2] |

| Net worth | At least Rs. 1 crore in each of the preceding 3 years | Positive net worth requirement |

| Profit track record Average operating profit | Positive in each of the immediately preceding 3 years At least Rs. 15 crores, calculated on a restated and consolidated basis, during the preceding 3 full years | Positive in at least 1 out of immediately preceding 3 years Not specified |

| Name change during preceding 1 year | Minimum 50% of the revenue should be earned by the activity suggested by the new name | No such criteria |

| Approval of offer document | SEBI & Stock exchange(s) | Stock exchange(s) [SEBI not to issue any observation on offer document] |

| IPO grading | May obtain from credit rating agencies | Not required |

| IPO underwriting | Not mandatory | 100% |

| Minimum application value | Rs. 10,000- Rs. 15,000 | Rs. 1 lac |

| Minimum subscription | 90% | 100% |

| Minimum no. of allottees | 1000 | 50 |

| Approx timeline | 6- 9 months | 3- 5 months |

| Costs (generally, based on research) | 6-8% of fund raising | 10-15% of fund raising |

| Post-issue paid-up capital | Minimum – Rs. 10 crores Maximum – not specified | Minimum – not specified Maximum – Rs. 25 crores |

| Annual listing fees (based on paid-up capital) | Minimum Rs. 3,25,000 | Min Rs. 10,000 (in NSE SME) |

| Corporate governance provisions under LODR | Applicable except for de-minimis exemption for such listed companies having both paid-up equity capital and net worth less than Rs. 10 crores and Rs. 25 crores respectively | Not applicable |

Costs involved in an IPO

Bringing an IPO is a long drawn and a cumbersome process, it involves a wide range of expenses. Amongst several others, the following are the costs involved in an IPO

- Underwriting fees is the largest cost associated with an IPO ranging between 4.1-7%[3] of the IPO proceeds. This, however, depends on the size of the offer.

- Fees and expenses for legal counsel for due diligence services, advisory, filings, etc.

- Accounting costs including accounting, advisory, advice of audit and non-audit matters, etc

- Listing fees, stamp duty payable on on issue of securities

- Printing costs including document management

- Annual listing fees

- Other miscellaneous fees

On a more practical front, it has been seen that the offer expenses associated with an IPO may range from Rs. 50 lakhs to a few crores depending upon the size of issue which generally comes to around 10-15% of the issue size.

Professional Assistance required for an IPO

An IPO is a complex process and requires the assistance and expertise of several professionals. Some of the indispensable professionals required for an IPO include the following:

- Merchant bankers/Lead managers: They are persons who manage the IPO end to end. Among the various activities they perform are initiation of the IPO process, creating Draft Red Herring Prospectus (DRHP) and Red Herring Prospectus (DRHP), getting approval of SEBI and Stock Exchanges for offer document, assisting in listing the shares of the Company on the stock exchange, etc, conducting roadshows, etc.

- Self-certified syndicate banks: They are responsible for performing all banking related tasks in an IPO. Their functions include acceptance of application through Application Supported by Blocked Amount (ASBA), receiving application money, payment of fees, costs and expenses of IPO, refunding applications and payment of dividends.

- Registrar to the Issue: A registrar to the Issue assists in allotment of the IPO shares. He is responsible for preparing a list of valid applications, deciding basis of allotment, making allotment, dispatching allotment letters and initiating refund in case of non-allotment.

- Share transfer agents: They are responsible for maintaining shareholder information and making changes therein to show the ownership of securities

- Underwriters: He is one who takes the risk of purchasing the shares in case of under subscription of IPO in return for an underwriting commission

- Market maker: These are persons who buy and sell stocks at specific prices so as to improve market liquidity.

Time involved in an IPO

The time involved in an IPO may depend on several factors. An IPO generally lasts over a period of one year beginning right from internal assessment of the company with respect to the state of its management and corporate governance structure. The planning of an IPO may alone take 12-18 months while the execution requires a good 6-9 months generally.

The average time involved in an IPO on the Mainboard may range anywhere between 6-9 months. As regards an IPO on the SME, the time involved may range anywhere between 3-5 months.

Failure of IPO: reasons

Every IPO need not necessarily be successful. India has witnessed several failed IPOs. Based on an analysis of such failures, some of the common reasons associated with failure of IPOs are may be listed as below:

- Incorrect pricing: One of the major reasons for failure of an IPO is companies overvaluing themselves. Companies may believe that they believe that they are worth more than what they actually are and may accordingly set unrealistic prices. On the contrary, companies may set prices that are very low and accordingly may not benefit from its ability to raise capital.

- Insufficient preparation: Lack of proper preparation such as failure to get financials audited, failure in drafting of prospectus or developing a business plan may cause the public to view the company as disorganized and unreliable. Poor company fundamentals may result in failure of IPO.

- Ineffective communication: Investors often look for clear understanding of the Company they are proposing to invest in, whether it be the company’s business model or its financial performance. Accordingly, inability to effectively communicate with prospective investors may not attract investors for the Company. Furthermore, information in the media also plays a very important role in deciding the success of an IPO. Negative information about the company circulated by the media may adversely affect the IPO.

- Insufficient Market Information: Customers often fail to conduct adequate market research to understand prevailing market conditions, demand and market trends. Launching IPOs in unfavorable markets like bearish markets may pose a risk to the success of the IPO.

Alternatives to an IPO

Traditionally, IPO was the method that was preferred for early stage investors with the aim of enabling them to reach their full corporate maturity. Today however, several alternatives to IPO are available. These include debt funding, entering into joint ventures and alliances to raise additional capital, entering into fundraising deals with private equity firms, venture capital firms, etc. Funds may also be raised through the private placement basis involving selling of shares to identified While normally, crowdfunding can also be one of the sources of fund raising, neither equity nor debt crowdfunding is permitted in India as the same may lead to breach of the private placement norms.

Concluding remarks

Whether or not to bring an IPO is one of the most important and significant decisions a company may take for itself. Accordingly, while making this decision, companies must consider all interrelated factors, consider the alternatives, the pros and cons of bringing an IPO and then take an objective decision.

[1] https://www.ey.com/en_in/news/2023/08/ey-ipo-trends-report-indian-stock-exchanges-continue-to-lead-global-ipo-activity-in-ytd-23

[2] https://www.bsesme.com/static/getlisted/criteriaisting.aspx?expandable=0

[3] https://www.pwc.com/us/en/services/consulting/deals/library/cost-of-an-ipo.html

Leave a Reply

Want to join the discussion?Feel free to contribute!