Succession planning: failing to plan is planning to fail

-Anushka Vohra | Manager | anushka@vinodkothari.com

| The article was also published in the CRA E-Bulletin and can be viewed here |

Background

Passing the torch, lighting the way – an expression that can be used to refer to succession planning. Be it a household, business organization or institution, succession planning is needed everywhere. In a household, as the family possessions and culture are passed on, it is simply termed as continuing the legacy. In an HUF, according to HUF laws, after the Karta (head of the HUF) dies, the senior most coparcener becomes the head of the HUF. In corporates, the larger the scale and complexity of business, the need for succession planning becomes much more important. Unlike in the case of a household, corporates involve the livelihood and interests of thousands of people, i.e., the shareholders, vendors, customers and other stakeholders. The intent of succession planning is not to oust the leader from his / her position but to prepare the next generation to become the future leaders. Succession planning is required to ensure smooth running of business. The torch bearer (leader here), has to groom his / her successor to take over his role.

In an organization, succession planning is an important element of corporate governance. In this write-up, the author has tried to emphasize on the need and importance of succession planning.

Why succession planning?

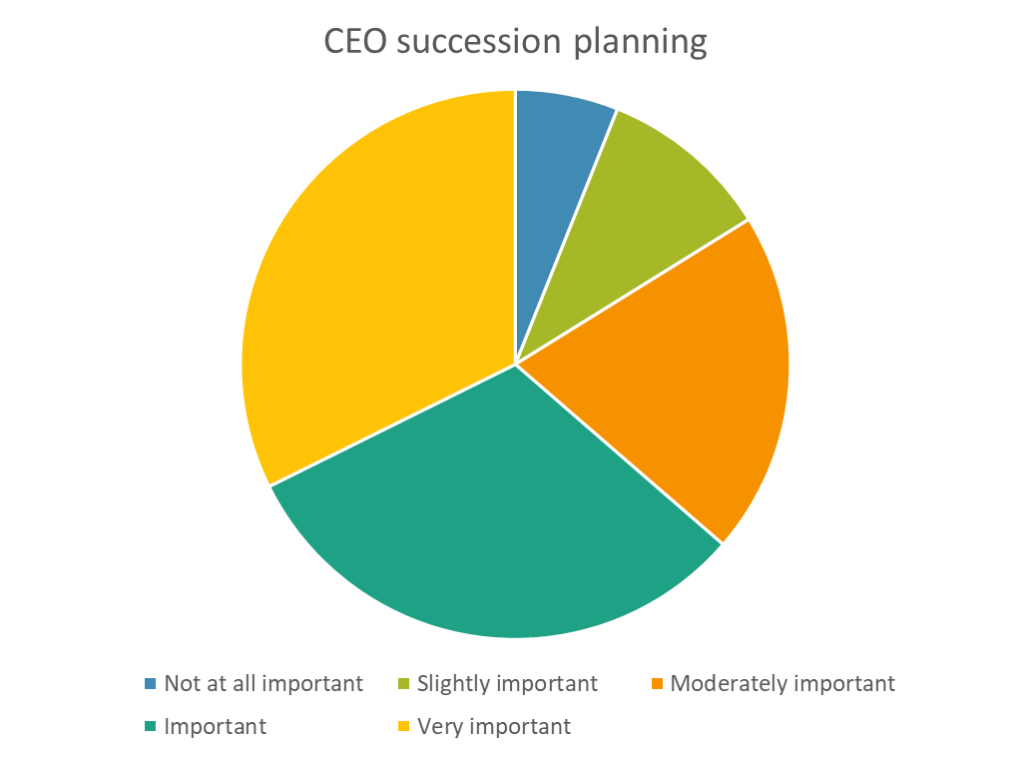

As per Global Corporate Governance Trends for 2023, published by Harvard Law School Forum on Corporate Governance[1], succession planning is one of the most important corporate governance trends in the USA in 2023. . The report mentions that “the challenging economic environment and tumultuous capital markets will, according to many experts we spoke with, lead to even greater attention on CEO performance in 2023, and likely to a higher number of CEO transitions.” The National Association of Corporate Directors conducted an annual Board Trends and Priorities Survey in the US 2023[2] on the practice of CEO succession planning. 37% of the respondents indicated that their board did not allocate sufficient meeting time to CEO succession planning over the past 12 months, and 32% deemed it “very important” that their board improve its practices with respect to CEO succession planning over the next 12 months.

{Source: National Association of Corporate Directors, Annual Board Trends and Priorities Survey in the US 2023}

While the need for succession planning has been recognised globally,, there is even a bigger need for succession planning in India currently, majorly because of the end of 2nd tenure of Independent Directors in 2024. The provision for appointment of IDs was introduced in 2014[3] and thus the second term of the IDs appointed by companies in 2014 will end in 2024. This will require the companies to find the right candidate for the incumbent positions well within timelines to ensure smooth transition.

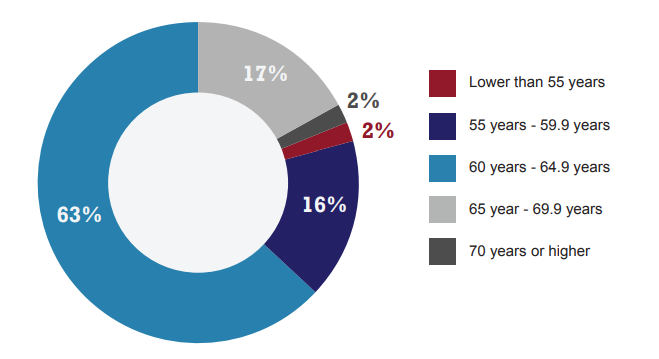

Another need for succession planning is demographics. The need could be seen from the age of the current CEOs where they are near to retirement age. According to research undertaken by IiAS in April 2017, the median tenure of the S&P BSE 100 index company CEOs is only ~3.5 years. Other than retirement, the fact of losing personnel cannot be disregarded. The Covid era has all the more taught us how unpredictable life is.

{Source: Global survey on age diversity within board of directors of the S&P 500 companies conducted by IRRC Institute in 2017[4]}

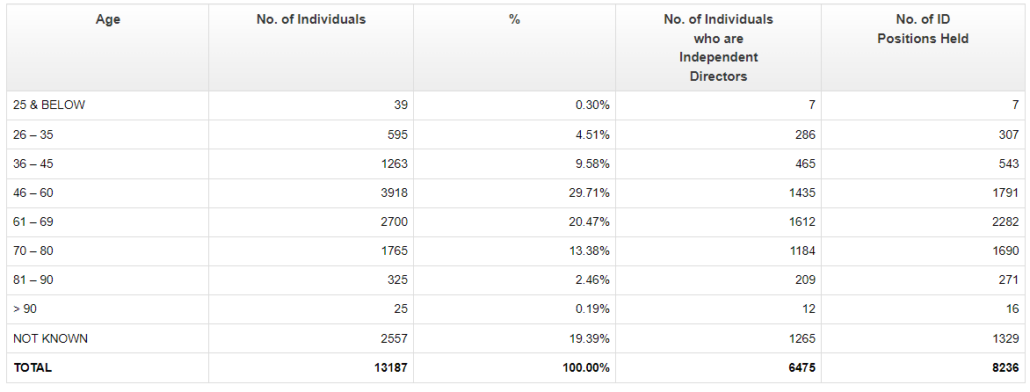

Distribution summary by age of directors in NSE listed companies:

{Source: Indian Boards database by Prime Infobase[5]}

The need for proper succession planning was recently witnessed in one of the landmark judgements of Supreme Court[6], which reflected that there was a lack of smooth transitioning phase. On the other hand, there is an example of great succession planning[7]. What is it that makes the latter exemplary and the former not, it is the planning. There has to be a plan put in place to ensure continuity of business operations, after the head is separated.

Regulatory provisions in India

As per the regulatory requirements in India, the board of directors are cast with the responsibility to ensure succession planning. As per Regulation 17(4) of the Listing Regulations, the board of directors of the listed company shall satisfy itself that plans are in place for orderly succession for appointment to the board of directors and senior management. Further, as per Reg. 4(f)(ii)(3), duty has been cast on the board of directors to oversee succession planning.

When things are laid down in letter, there is always a question of whether the same is being implemented in spirit. The board of directors of listed companies have a duty to ensure that succession plans are put in place. Now how do they ensure this? Is the plan being reviewed and at what periodicity?

The Kotak Committee Report on Corporate Governance, 2017 highlighted the importance of succession planning. The Committee deliberated that substantial time should be spent on strategy, performance, talent, risk management, succession planning and social responsibility. One of the recommendations of the Committee was, ‘that aspects like strategy, succession planning, budgets, risk management, ESG (environment, sustainability and governance) and board evaluation are critical to the medium-term and long – term future of a listed entity – and in order to ensure that there is adequate attention paid thereto, the Committee recommends that, at least once a year, the above – referred aspects should be specifically discussed by the board.’

What to expect from succession planning

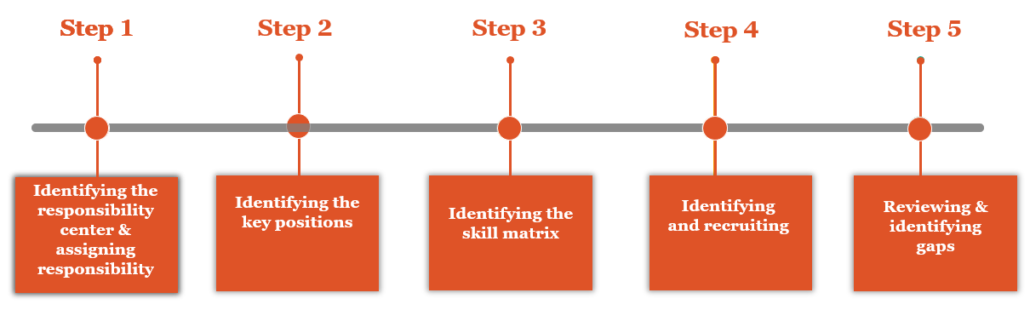

Succession planning is not what is generally documented in black and white, rather it is a cultural practice that companies follow. Having a policy / a plan is not the intent, the intent is to assign responsibilities, sensitize the responsibility centers and monitor the gaps, if any. Steps towards succession planning should be,

- identifying the responsibility center and assigning the responsibilities – preferably the NRC / HR;

- identifying the key positions where succession planning is required;

- identifying the skill matrix required for fulfilling the positions;

- identifying and recruiting sufficient number of such candidates for the position identified; and

- reviewing the process on regular basis to identify gaps and take corrective action

The Nomination and Remuneration Committee (NRC), board of directors and HR should be the responsibility centers where:

- NRC identifies the areas / departments / positions which due to the criticality require succession planning. NRC has also been cast with the responsibility of formulating criteria for determining qualification, skill, capability for appointment of directors and senior management;

- HR conducts the recruitment process and recruit sufficient number of such candidates for position identified;

- Board of directors reviews the overall plan periodically to identify gaps and take corrective action.

The second step which is identifying the key positions would vary with type, structure and size of organization. If a company is a conglomerate with various segments, the position of each segment’s head might be critical for ensuring succession planning.

The third step, identifying the skill matrix, the NRC, where there is one, lays down the criteria for the position of director and senior management.

The fourth step falls within the domain of the HR.

Report by IFC on CEO Succession Planning in India, 2017[8], states that, Many businesses, particularly those run by founders defer succession planning for the ninth hour. This can lead to a crisis, which may cause the organization to fail. This emphasizes the need to give succession planning immediate attention which should make sure that both the board and the CEO start the process as soon as the new CEO is appointed.

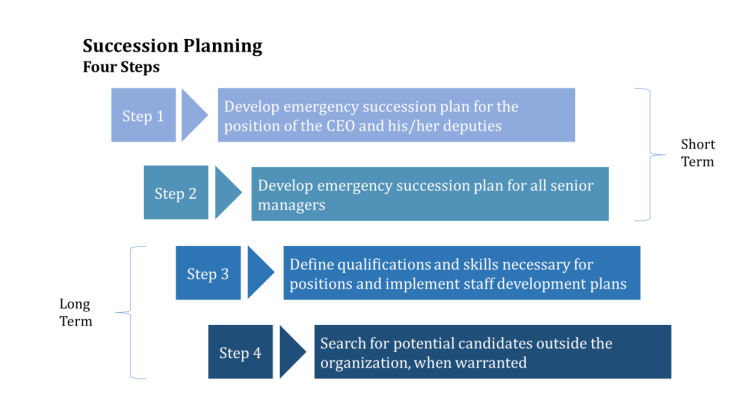

The Report also highlights the 4 steps towards succession planning.

{source: Report by IFC, 2017}

Succession planning – a part of risk management

A business faces different types of risks, geographical risk, product risk, technology risk, etc. Personnel leaving the organization or retiring from their post – is also a type of risk that every business faces. Succession planning should effectively be a part of the risk management framework of the company. Under the Listing Regulations, the role of risk management committee includes formulating detailed risk management policy which shall include business continuity plan. Succession planning is a sub-set of business continuity planning.

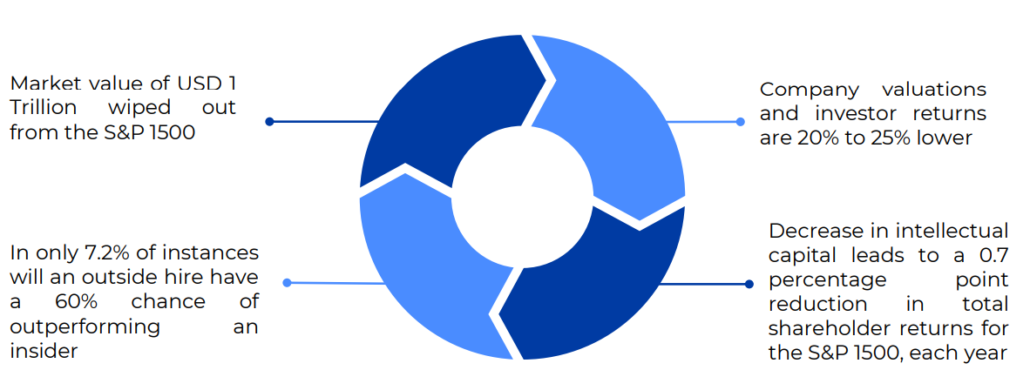

The high cost of poor succession planning, an Article in Harvard Business Review, 2021[9] has quantified the cost of poor succession planning.

{source: High Cost of Poor Succession Planning- a research by Harvard Business Review (2021)}

Global Scenario

Akin to India, there are provisions globally as well. The UK Corporate Governance Code provided for succession planning even before the same came in India in 2015.

| UK Chapter 3 of UK-Corporate-Governance-Code, 2018 [provision 17] | Singapore – Principle 4 of Code of Corporate Governance |

| Principles: Appointments to the board should be subject to a formal, rigorous and transparent procedure, and an effective succession plan should be maintained for board and senior management.4 Both appointments and succession plans should be based on merit and objective criteria and, within this context, should promote diversity of gender, social and ethnic backgrounds, cognitive and personal strengths.XXX 17. The board should establish a nomination committee to lead the process for appointments, ensure plans are in place for orderly succession to both the board and senior management positions, and oversee the development of a diverse pipeline for succession. A majority of members of the committee should be independent non-executive directors. The chair of the board should not chair the committee when it is dealing with the appointment of their successor. 19. The chair should not remain in post beyond nine years from the date of their first appointment to the board. To facilitate effective succession planning and the development of a diverse board, this period can be extended for a limited time, particularly in those cases where the chair was an existing non-executive director on appointment. A clear explanation should be provided. 23. The annual report should describe the work of the nomination committee, including: • the process used in relation to appointments, its approach to succession planning and how both support developing a diverse pipeline; XXX | 4.1 The Board establishes a Nominating Committee (“NC”) to make recommendations to the Board on relevant matters relating to: (a) the review of succession plans for directors, in particular the appointment and/or replacement of the Chairman, the CEO and key management personnel; |

Concluding remarks

Succession planning is a critical part of corporate governance of any organization. It should not be considered as a one off event rather a continuous step. Once, lack of human resources is identified as a potential risk factor by companies, a constructive plan can be put in place to ensure timely succession planning. Succession planning essentially has two elements – i. Succession; and ii. Progression. Succession planning trends should progressively rise in the organization. The responsibility centers should also see the time period for which the personnel hold office ensuring continuous need for succession planning. Further, once succession planning is in place, the companies will also have to do the cost benefit analysis of internal succession planning v. external recruitment.

[1] https://corpgov.law.harvard.edu/2023/03/10/global-corporate-governance-trends-for-2023/

[2]https://boardleadership.nacdonline.org/rs/815-YTL-682/images/2023%20Governance%20Outlook%20Report.pdf

[3] https://www.mca.gov.in/Ministry/pdf/General_Circular_14_2014.pdf

[4] https://assets.kpmg.com/content/dam/kpmg/jm/pdf/FINAL-Age-Diversity-Study-March-2017.pdf

[5] http://www.primeinfobase.com/indianboards/pages/snapshot-reports.aspx?snap=AA

[6]https://main.sci.gov.in/supremecourt/2020/212/212_2020_31_1503_27229_Judgement_26-Mar-2021.pdf

[7]https://cfo.economictimes.indiatimes.com/news/strategy-operations/rajesh-gopinathans-exit-as-tcs-ceo-is-surprising-but-an-example-of-great-succession-planning-say-experts/98729593

[8]https://www.ifc.org/wps/wcm/connect/3de27606-f4d4-4f77-be1f-c49bc5a151b5/CEO_Succession_Planning_in_India.pdf?MOD=AJPERES&CVID=mnFl9eX

[9] https://hbr.org/2021/05/the-high-cost-of-poor-succession-planning

Leave a Reply

Want to join the discussion?Feel free to contribute!