Finance Bill 2023 amends section 56(2)(viib): How will it impact the startups?

– Abhirup Ghosh, Partner | finserv@vinodkothari.com

Background

The Finance Bill 2023 has proposed amendments to section 56(2)(viib) of the Income Tax Act, which deals with tax on closely held companies for issuance of shares to residents at a premium where the shares are issued at a value higher than the fair market value. The objective of the change is to expand the scope of the section and bring shares issued to non-residents into the reach of the section. This proposal will particularly hit start-ups, which mostly issue equity shares and compulsorily convertible preference shares (CCPS) to their investors, and in most of the start-ups, at valuations which are far higher than the fair values at the time of issuance.

Before we discuss the impact of the section, let us first understand the scope of the section at length.

Also, it is important to note that the focus of this article is to examine the potential impact of the amendment on startups, since, the majority of the foreign investments into closely held companies flow into the startups, therefore, this section will mostly affect the startup segment.

Understanding section 56(2)(viib) of the Income Tax Act

Section 56(2)(viib) of the Income Tax Act provides that where a closely-held company[1] issues shares to a resident investor at a value higher than the “fair market value” of such shares, then the excess of the issue price over the fair value will be taxed as the income of the issuer company. Rule 11UA or of the Income-tax Rules provides the formula for the computation of the fair market value of unquoted equity shares for purpose of section 56(2) (viib) of the Act.

Breaking down the various components of the section will help us understand its incidence of tax better:

(a) Applicable to: Companies, other than those where the public are substantially interested. The term “company in which public are substantially interested” has been defined in section 2(18) of the Income Tax Act. This broadly includes public companies which are listed on stock exchanges, or subsidiaries of listed public companies.

(b) Type of transaction covered: Issuance of shares by companies discussed above, at a value that exceeds the fair market value of the shares. It is important to note that the section uses the term “shares” and not “equity shares”. Therefore, all forms of shares, equity or preference, will be covered under this section. Further, issuances to only residents are presently covered under this section.

(c) Incidence of tax: At the time of issuance of the shares. While it is arguable, it has been held that[2] the section becomes applicable only where the issuance of shares and receipt of consideration takes place in the same AY, therefore, for convertible preference shares, the incidence of taxation can be said to be the issuance of the convertible preference shares only, and there will not be any further incidence of tax in the hands of the issuer upon conversion of such shares into equity. Further, the tax is payable on the amount received against issue of shares, to the extent it exceeds the fair value of the shares.

(d) Fair valuation of shares: Rule 11UA (2) of the Income Tax Rules provides for fair valuation methodologies. For unlisted equity shares, either of the two methodologies can be adopted:

(i) NAV method – The Rule provides for the valuation of equity based on the net asset value method considering the book value of assets and liabilities of the company as per its last audited financial statements. This valuation can be carried by a practicing Chartered Accountant or a Merchant Banker.

(ii) Discounted cashflow method – The Rule also allows the companies to value the equity shares using discounted cashflow method. However, in this case, the valuation must be done by Merchant Bankers only.

For the valuation of preference shares, the Rule does not prescribe any specific method, any internationally accepted valuation techniques can be used.

Exemption in case of certain start ups

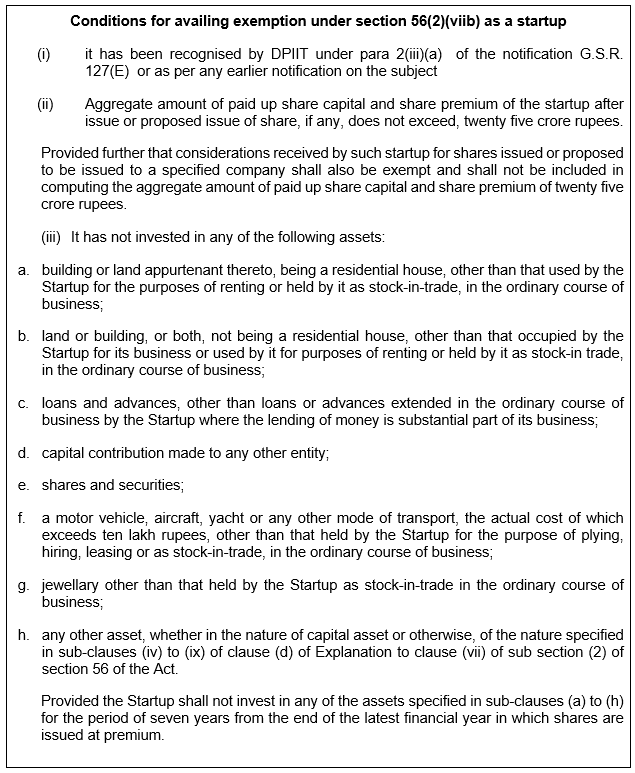

It may be noted that the CBDT vide its notification 13/2019[3] carved out an exemption for any amount received as consideration for shares by startups, provided such entity three essential conditions. The first of which says the entity should be registered as a startup with DPIIT.

Besides, there are other conditions in the notification which restrict the scope of the exemption for “startups” under 56(2)(viib). If an entity fails to satisfy any of the conditions, it will be exposed to the provisions of section.

Not all start-ups qualify for the exemption:

As on 1st February 2023 there are 89,759 startups recognised by DPIIT, while the actual number of startups may be far higher.

Hence, it is quite clear that several of the startups do not qualify for the exemption.

Proposed amendment and its potential impact on startups

Clause (viib) of sub section (2) of section 56 of the Act was inserted vide Finance Act, 2012 to prevent generation and circulation of unaccounted money through share premium received from resident investors in a closely held company above its fair market value. However, the said section is not applicable for consideration (share application money/ share premium) received from non-resident investors.

Accordingly, it is proposed to include the consideration received from a non-resident also under the ambit of clause (viib) by removing the phrase ‘being a resident’ from the said clause. This will make the provision applicable for receipt of consideration for the issue of shares from any person irrespective of his residency status.

These amendments will be effective from the 1st day of April 2024. Only the issuances after the said date will be covered under this.

The impact of this amendment is quite likely to be similar to the impact of angel tax on startups. It must be important to note that as it stands today only funds received from SEBI-registered Category I and II are exempted from the angel tax, therefore, any funds from funds situated outside India will also come under the purview of this.

There is also a dichotomy between the valuation rules under the FEMA regulations and the Income Tax Rules. The FEMA valuation norms provide for the minimum floor for bringing in funds from abroad, and that might not be the same as the fair value under the Income Tax Act. Therefore, if the valuation done under FEMA regulations exceeds the fair value as per Income Tax laws, one can expect scrutiny from the tax department.

The proposed amendment also travels evidently beyond the explicit purpose behind introduction of the section in 2012, that is, to prevent the menace of black money. However, in case of subscription to shares by non residents, the payment would have obviously come though banking channels of an authorised dealer, who would have done a KYC check on the investor. In light of this, to say that such an investment may also be used to channel black money is completely unjustified. Further, one needs to understand that channelization of black money mostly happens by issuing shares at lower than the fair value, not at higher than fair value. If the securities have been issued at higher than the fair value, the only intent of the investor could be to manipulate a loss on sale of shares by subsequently selling the shares at a loss. However, in case of a non resident investor, there will be no question of such non resident claiming a loss on sale within Indian jurisdiction.

[1] Technically, a company not being a company in which the public are substantially interested

[2] https://www.taxmann.com/research/direct-tax-laws/top-story/101010000000321175/sec-562viib-not-applicable-on-conversion-of-optionally-fully-convertible-debentures-into-preference-shares-itat-caselaws

[3] https://incometaxindia.gov.in/communications/notification/notification_13_2019.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!