The emerging concept of embedded finance

In the future will every company be a FinTech company?

- Timothy Lopes, Manager | tim@vinodkothari.com

- Subhojit Shome, Executive | subhojit@vinodkothari.com

Introduction

Everyone has probably had some form of interaction with the concept of embedded finance while possibly not knowing what it is. This budding concept has its eyes set on massively changing the way business is done.

Today, convenience in trade and commerce is probably the most sought after by customers. The idea of having everything in one place at high speeds is what drives trade in this modern world. This is where embedded finance would come into play.

Embedded Finance (‘EmFi’) is a concept that typically allows non-financial entities to integrate financial services/ products into its own platform through the use of APIs (‘Application Programming Interface’) which is a software intermediary that allows two applications to talk to each other.

Put simply in the form of an example, let’s say you want to purchase a flight ticket. You reach the payment stage and see an option to purchase insurance as well, without having to leave the app you are currently using. This integration of an insurance purchase on a non-financial entities platform is just one small part of the bigger picture of embedded finance.

This article will focus on explaining the concept of embedded finance with specific focus on embedded lending.

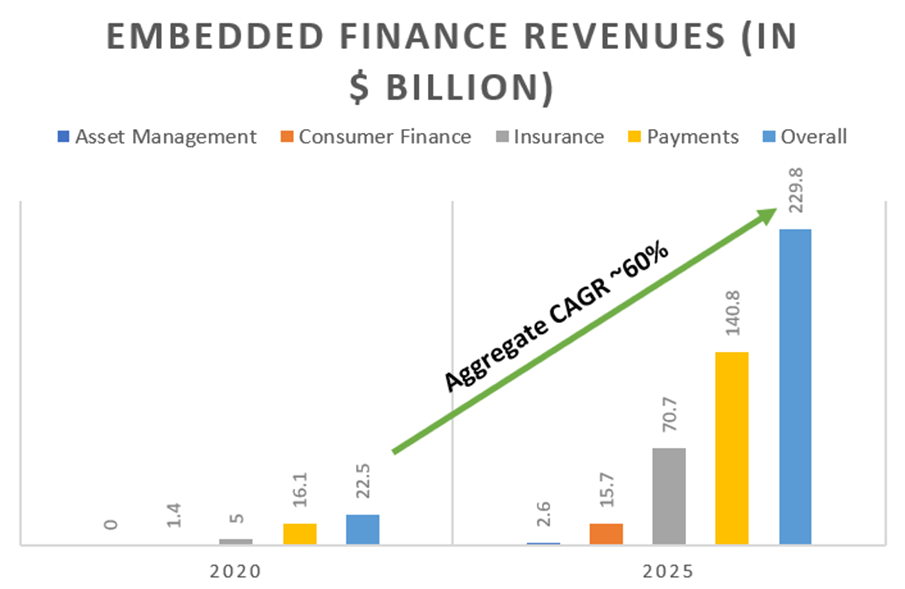

Rapid growth for a budding concept

According to a forecast by Lightyear Capital (quoted in a Forbes article[1]) the global market for embedded finance is estimated to grow more than tenfold from approximately $22.5 billion in 2020 to around $230 billion by 2025.

The several forms of embedded finance

Embedded finance comes in several forms. The core idea is to allow a non-financial entity to integrate financial services through the use of APIs that will not require the customer to switch to a third party website to avail a financial service.

For instance, the integrated insurance example discussed at the beginning is one form of embedded finance. Another form is the ‘Buy Now Pay Later’ (‘BNPL’) trend evolving across online retail platforms. This model allows you to convert your purchase amount into monthly instalments that are normally free of interest. Further, there are platforms that integrate investment and trading services as well.

Integration of payment systems is a widely known and used form of embedded finance. For example, an e-wallet embedded into an e-commerce platform, UPI, etc. would fall under this category.

While the above example highlights how non-financial businesses integrate financial systems into their user applications to bolster their existing product and service offerings, the emergence of payment services like Google Pay or Amazon Pay shows how e-commerce players, especially Big Tech, are adding financial services as new verticals to their existing business model.

Another interesting form, which we will discuss in more detail later in this article, is embedded lending.

The Embedded Finance Ecosystem

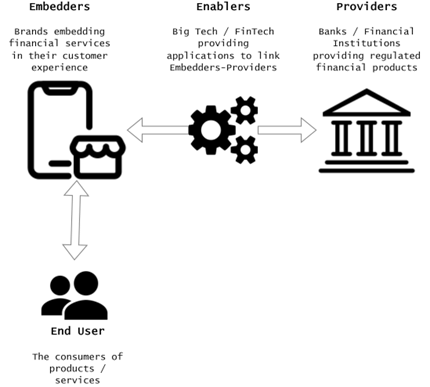

Be it existing market players or new entrants looking at exploiting niche opportunities, the industry has been actively seeking to bolster its core product offerings and competencies by integrating financial services to enhance the customer experience. This has led to the emergence of a new participant – the ‘enabler’ – which may either be new businesses (start ups) or new verticals in existing Big Techs, who play the role of bridging the gap between the marketplace and the financial services industry.

From a birds’ eye point of view the embedded finance ecosystem is populated by three distinct categories of participants – the embedder[2], the enabler and the provider (and, of course, the end consumer of the goods and services of the marketplace):

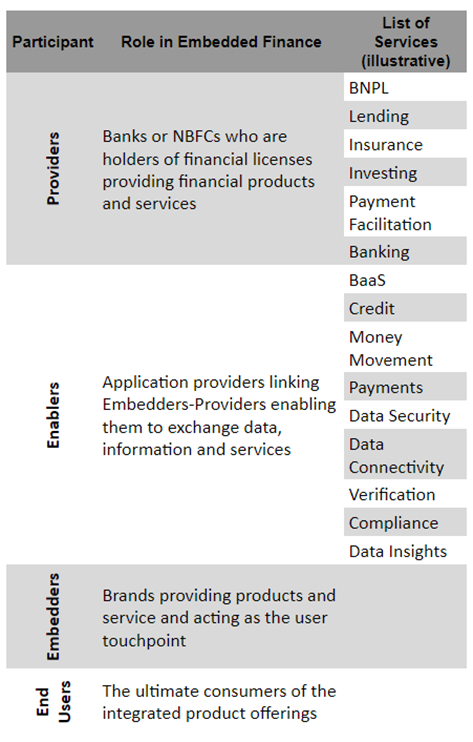

We can further elaborate on the roles and the services that the providers and enablers provide using the list below:

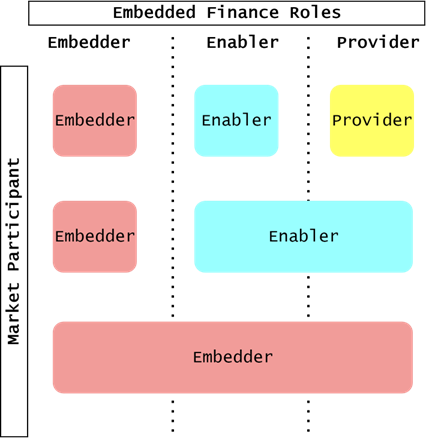

The situation on the ground, of course, is not as cut and dried as the graphics above suggest and actual implementation in the various global markets has often seen a commingling of roles and a single participant wearing multiple hats. Business models have largely been a progeny of the level of technology and the attitude towards innovation in the economies and the nature and extent of regulation in the different legal jurisdictions.

Research published by MGSSI[3] indicate that the EmFi models across the various economies may be visualised as below:

In the US, where regulatory barriers to entry are significantly high when it comes to financial services especially full licence banking, the embedder-enabler-provider roles are played by different participants, each restricted to their own but narrow area of core competence.

Europe in recent times has seen marked development in the regulatory landscape for financial services with revision of the E.U.’s Payment Services Directive (PSD2)[4] and the establishment of the U.K.’s Open Banking Standard[5]. Financial services have experienced considerable innovation and the roles of enabler and provider are often being played by the same entity/group.

The nascent EmFi space in India has also witnessed a few developments of note in recent time especially innovations that are redefining how financial institutions interact with and expand their user base and we take a look at them in the following sections.

Embedded lending and OCEN

This new concept is gaining momentum in the digital lending space and is enabling financial inclusion like never before. The Report of the Working Group on Digital Lending including Lending through Online Platforms and Mobile Apps[6] recognises the concept of ‘Embedded Credit’ while stating that –

“Embedded credits are also slowly gaining traction which need due regulatory attention. A blueprint of a forward-looking framework for identifying and managing risks arising from BigTech/ DeFi lending in a graded manner may be worked out in advance.”

The essential idea of embedded credit/ lending is to provide access to credit by enabling non-financial entities to plug in/ embed/ integrate lending capabilities which would ordinarily be done by banks/ NBFCs.

In this, the entities that provide credit are still banks/ NBFCs. The non-financial entities merely act as intermediaries between the end-consumers and the lending institutions by use of APIs that integrate the whole process of availing credit at a single point.

Open Credit Enablement Network (OCEN) –

IndiaStack (which is collective of disparate technology products and frameworks as stated in their FAQs[7]) launched OCEN in July, 2020. OCEN[8] is a set of standardised tools that provide an infrastructure that can be adopted to integrate lending onto platforms of non-financial entities.

Any platform that interfaces with customers can use OCENs standardised APIs that enable it to integrate lending capabilities as well. These entities, called ‘Loan Service Providers’ (LSPs) play the role of an intermediary, much like that of a ‘Direct Sourcing Agent’. These LSPs act as an agent for the financial institutions providing the credit by sourcing customers and through the use of OCEN APIs that integrate every aspect of a lending value chain such as credit underwriting, monitoring, collections, etc. LSPs also act as a point of credit delivery.

Further, the LSPs can also act in the interest of the borrower to allow access to favourable credit terms and conditions while borrowing from the lending institution.

Regulations for the financial entity involved in digital lending –

The Reserve Bank of India (‘RBI’) issued guidelines for ‘Loans sourced by banks and NBFCs over digital lending platforms’ on 24th June, 2020[9] that places responsibilities on the lender to ensure that they adhere to the ‘Fair Practice’ norms while lending through digital platforms. This is to ensure that the ultimate borrowers’ interests are protected and he has full information about the lending institutions ultimately providing the credit through the use of another entity’s digital platform.

For instance, the names of digital lending platforms engaged as agents are required to be disclosed on the website of banks/ NBFCs. Further, the digital lending platforms engaged as agents must disclose upfront to the customer, the name of the bank/ NBFC on whose behalf they are interacting with him, etc.

Accordingly, embedded lending can be said to be regulated in the sense that the financial institutions ultimately providing credit have to ensure that they adhere to the digital lending guidelines while sourcing customers through digital lending platforms.

Benefits of embedded lending and OCEN –

Integration of lending capabilities into the non-financial platform has several benefits. In the traditional lending model, the time involved in the process of extending credit would be longer in comparison to that of the embedded credit model since the entire process would be digitised and the borrower would not need to approach the lender separately for the credit. Thus, embedded finance would reduce time involved in the lending process.

Further, for the lender/ the financial entity, there is better control in terms of the end utilization of funds, given that the borrower would receive credit for the purpose incidental to the product of the non-financial service provider. The borrower approaches the non-financial service provider for a purchase of say product X and receives credit for the purpose of purchasing that product. Thus, the purchase and funding is linked with one another and not separated.

There would also be a higher level of transparency in data obtained by the lender, through the use of Account Aggregators (‘AAs’) discussed below.

Account Aggregators play an important role in the OCEN framework

RBI came up with a framework for NBFC – Account Aggregators (NBFC-AA)[10], which is essentially an entity that pulls financial data of the customer from various sources and aggregates it in a specific manner for use by relevant parties, such as lending institutions.

These entities play a crucial role in the embedded lending model, since they also form part of the integration with the LSP and pull financial information for the banks/NBFCs to use as part of their credit underwriting process.

This aggregation of financial information from the NBFC-AAs as well as the information already available with the LSPs, allows the lending activity to become more ‘cash flow based’ as opposed to the current ‘balance sheet’ based model of lending.

Conclusion

The concept of embedded finance is growing rapidly, with several non-financial entities investing in this marketplace. In essence, every company eventually would seem to become a fintech in some form or another because of this integration of financial technology onto a non-financial platform. Embedded finance seems to be heading toward becoming the future of business as it sets out to break into the industry through several use cases.

OCEN brings several benefits to the system as it enables those who need credit to avail it seamlessly. Embedded lending seems to be the future of how most digital lending platforms will function.

Regarding a regulatory framework, there are regulations currently in place for Account Aggregators and of course, banks/NBFCs. Further, there are several benefits of integration of the embedded finance models into business, including reduced time involvement, increased transparency, better control, etc. which makes the embedded finance industry even more attractive.

[1] Uber’s Departure From Financial Services: A Speed Bump On The Path To Embedded Finance, Forbes (August, 2020) – https://www.forbes.com/sites/ronshevlin/2020/08/03/ubers-departure-from-financial-services-a-speed-bump-on-the-path-to-embedded-finance/?sh=30c930897673#484180287673

[2] With the market still emerging, the nomenclature is not yet set in stone and terms like “Containers” (Mitsui & Co. – Global Strategic Studies Institute Monthly Report, March 2021) or “Distributors” (Finastra – Banking as a Service:

Outlook 2022) are also used in place of the term “Embedders” by market participants, experts and researchers.

[3] Mitsui & Co. Global Strategic Studies Institute Monthly Report, MGSSI (March 2021) – https://www.mitsui.com/mgssi/en/report/detail/__icsFiles/afieldfile/2021/05/25/2103i_ohnishi_e.pdf

[4] The revised Payment Services Directive (PSD2) and the transition to stronger payments security, ECB (March 2018) – https://www.ecb.europa.eu/paym/intro/mip-online/2018/html/1803_revisedpsd.en.html

[5] https://standards.openbanking.org.uk/

[6] https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1189

[7] https://indiastack.org/faq.html

[8] More on OCEN is provided by Sahamati (A non-profit collective of Account Aggregators) – https://sahamati.org.in/blog/ocen-account-aggregators-will-change-digital-lending-in-india/

[9] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11920&Mode=0

[10] https://rbidocs.rbi.org.in/rdocs/notification/PDFs/MD46859213614C3046C1BF9B7CF563FF1346.PDF

Leave a Reply

Want to join the discussion?Feel free to contribute!