Security Token Offerings & their Application to Structured Finance

Moving to DeFi

– Subhojit Shome, Executive | subhojit@vinodkothari.com

Introduction

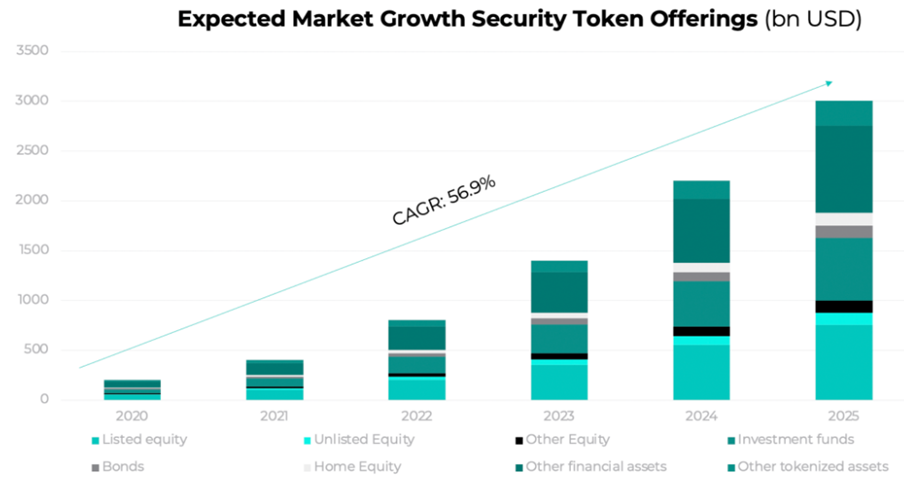

As per a Forbes article[1] published in early 2021, DeFi and Security Token Offerings (STO) had scaled new heights with 2020 being “a banner year for capital formation and secondary trading” using security tokens. DeFi applications were reported to be prevalent across 15 countries around the world (including the major developed economies) and 39 of the top 100 largest banks in the world were reportedly working on security tokens or blockchain applications. Expert estimates[2] predict the security tokens industry to surpass the market volume for cryptocurrencies in the next five years and in terms of issue proceeds, the global security token market reaching $3 billion by 2025.

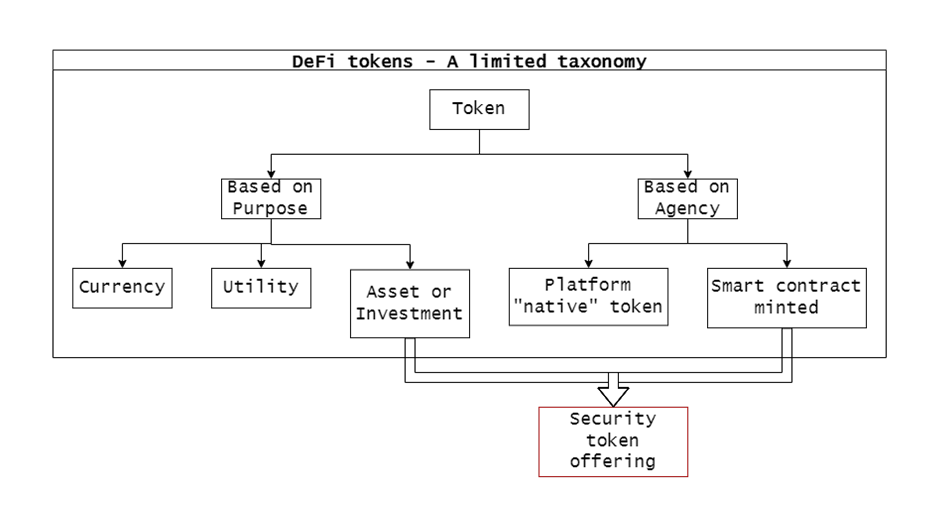

Blockchain-based tokens can be described as digitally scarce units of value the characteristics and circulation of which are prescribed via computer code.[4]

Tokens are created and distributed by firms and platforms for a variety of purposes. They can grant users access/participation to online services (utility tokens); they can serve as a means of payment or assure the right to purchase products (payment/currency tokens) or they can represent a stake in the issuer’s enterprise, asset or liability (asset/investment token).

In this article, we specifically look at the third variety of tokens, ie, asset or investment tokens that issuers use to raise funds and investors invest in to earn returns. These tokens get classified as ‘Securities’ in the various legal jurisdictions across the US, the UK and the EU (and other countries where DeFi is prevalent) applying the criteria provided in advisories and guidance notes issued by the financial market regulatory authorities of such countries and are referred to as ‘Security Tokens’. Security tokens are issued through a security token offering (STO).

We also take a brief look at how the concept of STO is applied to structured finance, especially to the securitisation of asset-backed securities (ABS).

Market Overview

The total value of crypto-assets locked in the various DeFi applications is estimated to be over $230 billion. The IOSCO Report[5] on DeFi identifies capital formation, development and deployment of DeFi platforms, investment and settlement of trades to be the primary causes leading to the rise in crypto-assets.

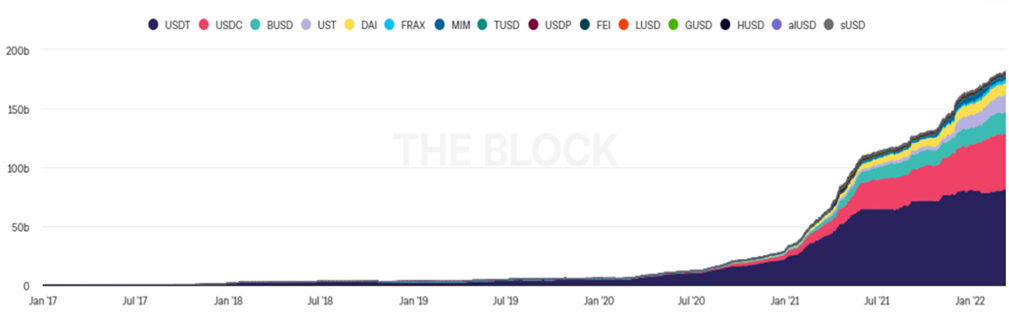

The total supply of stablecoins (more on stablecoins later) saw a significant rise during 2021. The rise is seen to be fuelled by an increased need for liquidity for DeFi applications. USD pegged fiat-stablecoins account for a significant share of the liquidity.

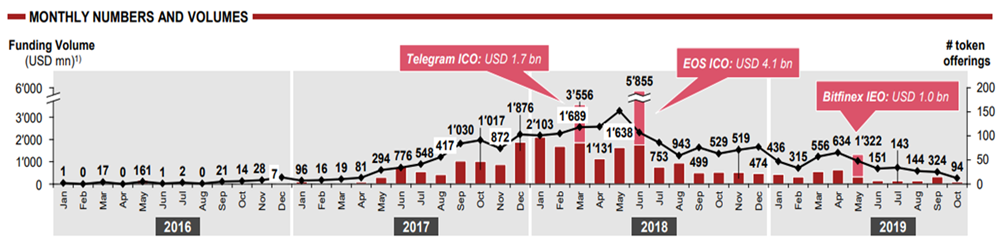

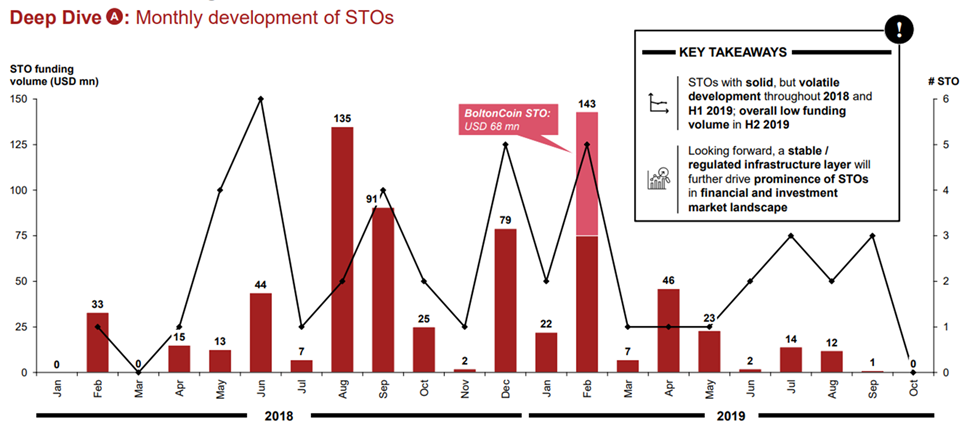

During the pre-COVID-19 era, overall token issuances (security tokens and other coins) peaked during 2017-18 to flatten out and experienced a dip in 2019.[8] Security tokens were the most significant blockchain-based funding instrument.

STO – Understanding the Process

Before we delve into the details of how an STO works we need to understand another specific type of token – the stablecoin.

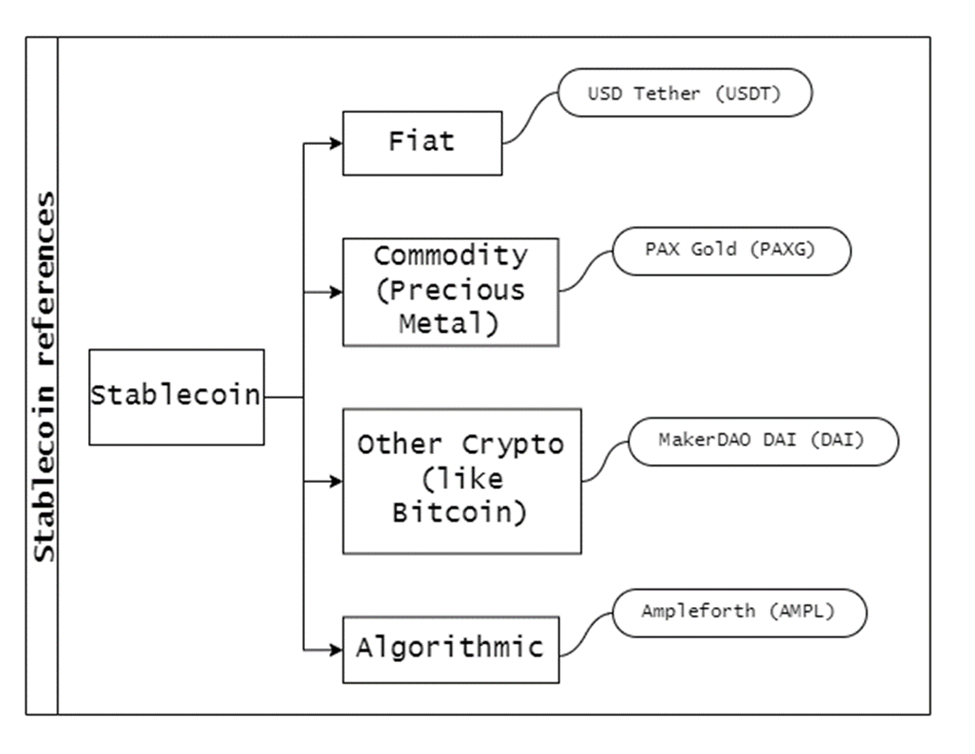

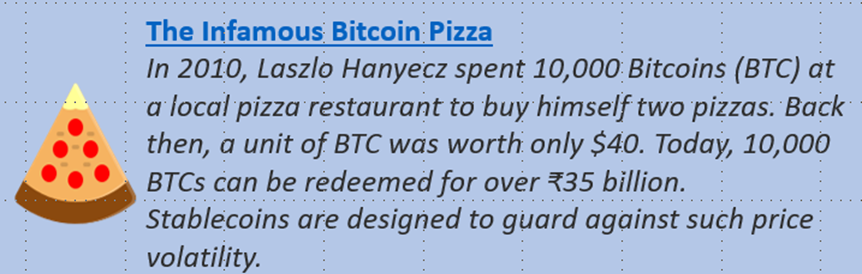

Stablecoins are tokens that seek to achieve a particular characteristic (ie, price stability).[9] They act as a low volatility store of value and means of exchange that is global, efficient and accessible. Stablecoins attempt to achieve price stability by being pegged to one or a basket of fiat currencies, other real-world assets, and other crypto-assets or have their values being algorithmically maintained by adjusting token supply to fluctuations in demand.

The STO Process – A Bird’s Eye View

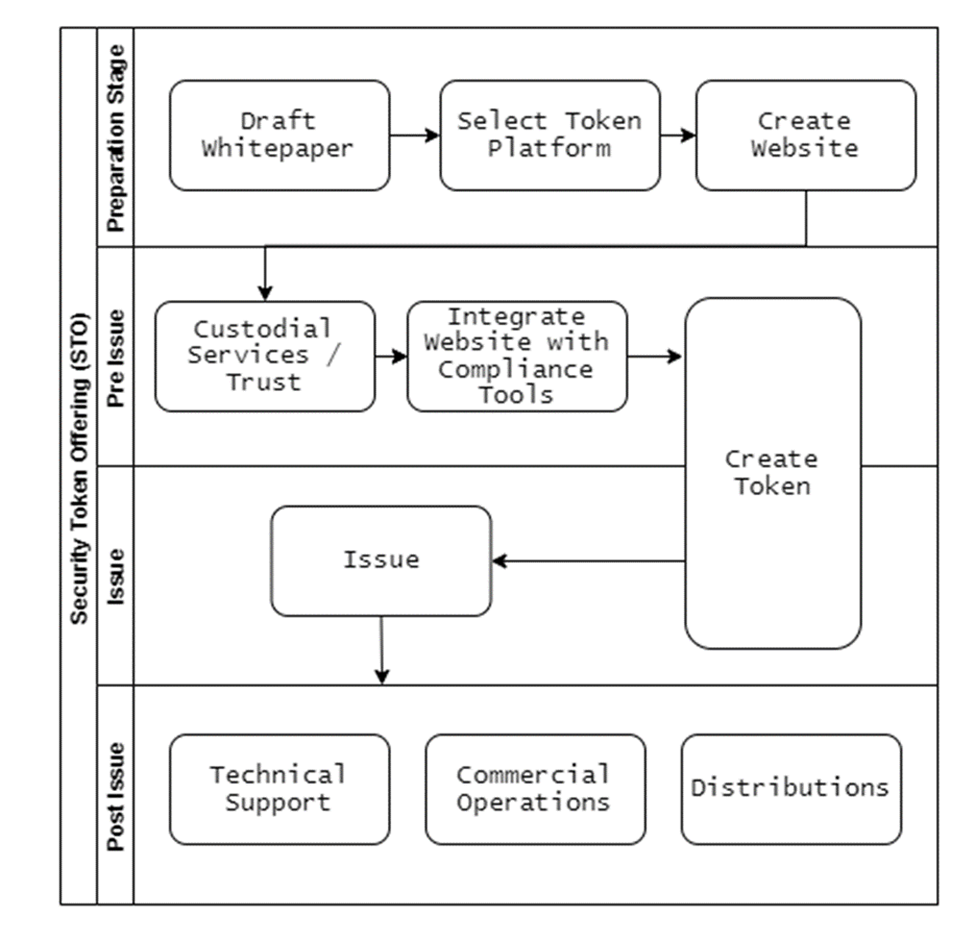

An STO usually starts with creating a white paper[12] / offer memorandum that contains details of the business model, project team and management, the risk factors of the project and rights and restrictions built into the token being issued.

Then follows selecting the platform to issue and manage the tokens, plugging in the offer details, compliance tools (KYC/AML) and the issue interface with the project’s website or app (often the token platform itself provides such services or user interface).

The actual issue takes place by registering the token on the platform and configuring and executing a smart contract[13] which mints and issues the token against receipt of investor funds and writes the transactions to the underlying distributed digital ledger (DLT, usually a blockchain).

Post issue ‘distributions’ (such as dividends, and interest payments) continue to be managed by the smart contract through the issue of additional tokens to investors and writing of the transactions to the underlying blockchain.

The Token Issue Process

There are a number of platforms in the DeFi world that an issuer can utilize for raising funding through token issues. Some of these platforms offer end to end services including providing tools for analytics, marketing the issue, compliance (KYC/AML) and also secondary market platforms where investors can trade the tokens they have purchased.

An illustrative list of such platforms includes –

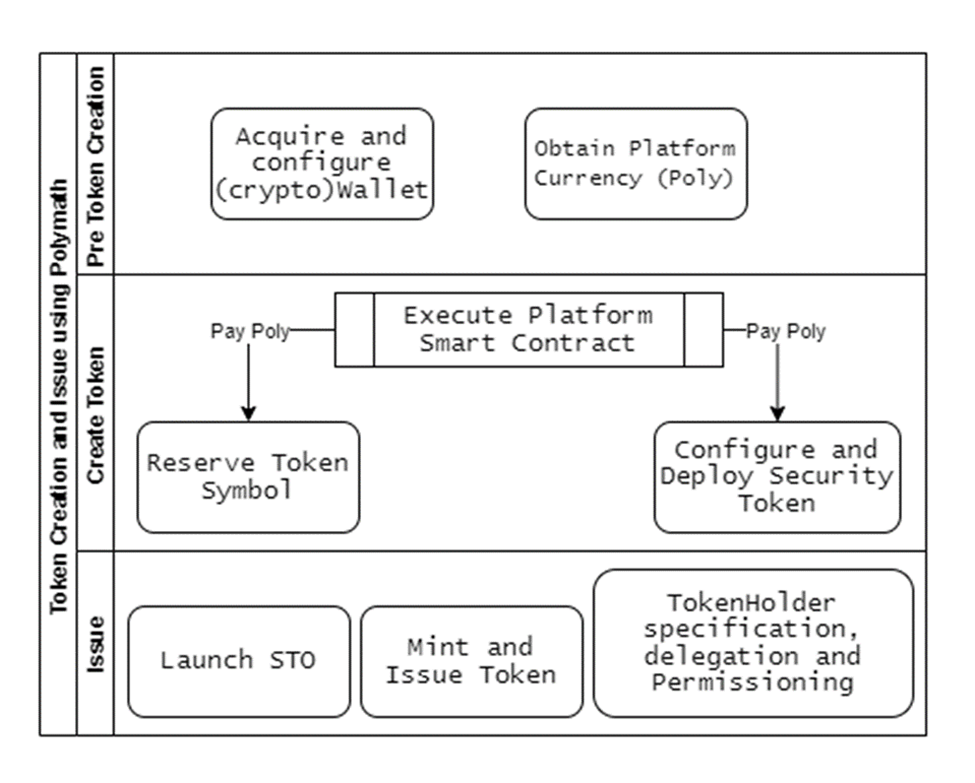

For the purposes of illustrating the token issue process we have used the example of the Polymath platform which uses as its native cryptocurrency the ‘Poly’.

On the Polymath platform, the issuer needs to register its token on the platform by executing the platform’s smart contract which will charge the issuer a certain amount of poly to register the token and write the transaction to the underlying blockchain (Algorand).

Then the issuer configures a customisable smart contract on the platform (‘LaunchSTO’) to mint and issue the token to investors. The smart contract, based on its configuration, may mint all the tokens on the start date of the issue itself or it may mint (and issue) tokens as and when investments are received.

The smart contract may also write certain specifications or permissions (like the right to transfer tokens) or delegate token management capabilities to the issuer (or any digital identity registered on the platform).

A look at the Smart Contract launching the STO

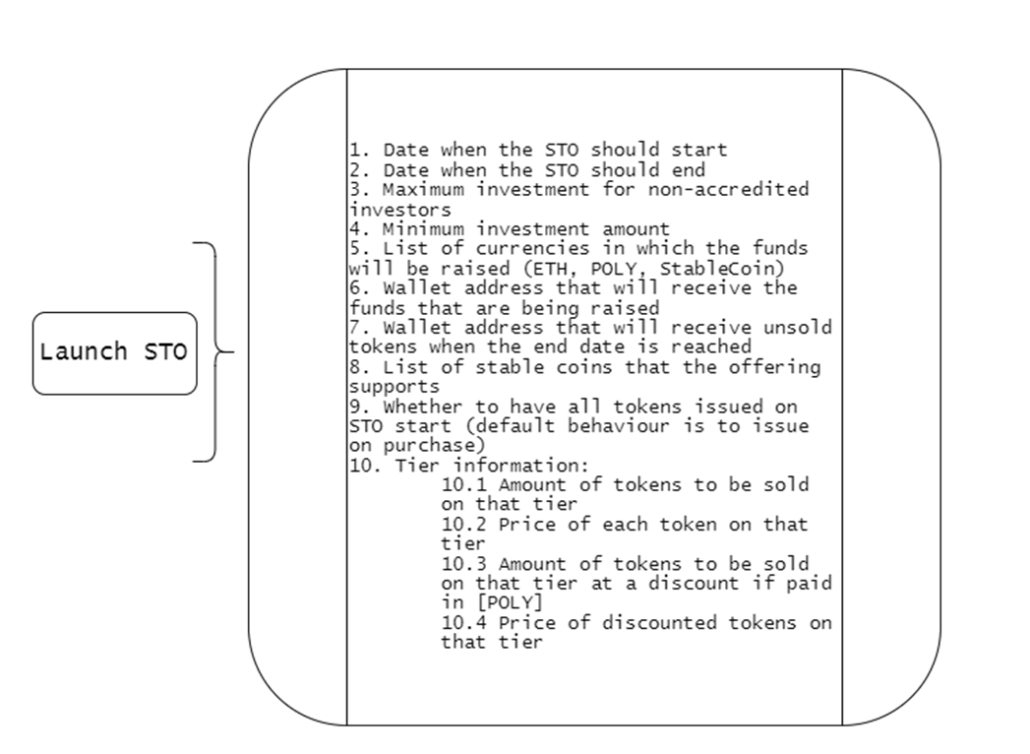

The smart contract used to launch the STO allows the issuer to configure certain parameters and ‘if-then-else’ criteria to control token issue and token holder (investor) behaviour.

Such parameters include the specifications regarding when the STO should launch or close, the minimum investment increment, the maximum investment permitted from non-accredited investors,[19] the currencies (native platform currency, other cryptocurrencies, stablecoin or fiat) that the investor may invest in, the wallet (electronic) to which issue proceeds should be credited, the price of tokens and discounts available in each tier of the STO, etc.

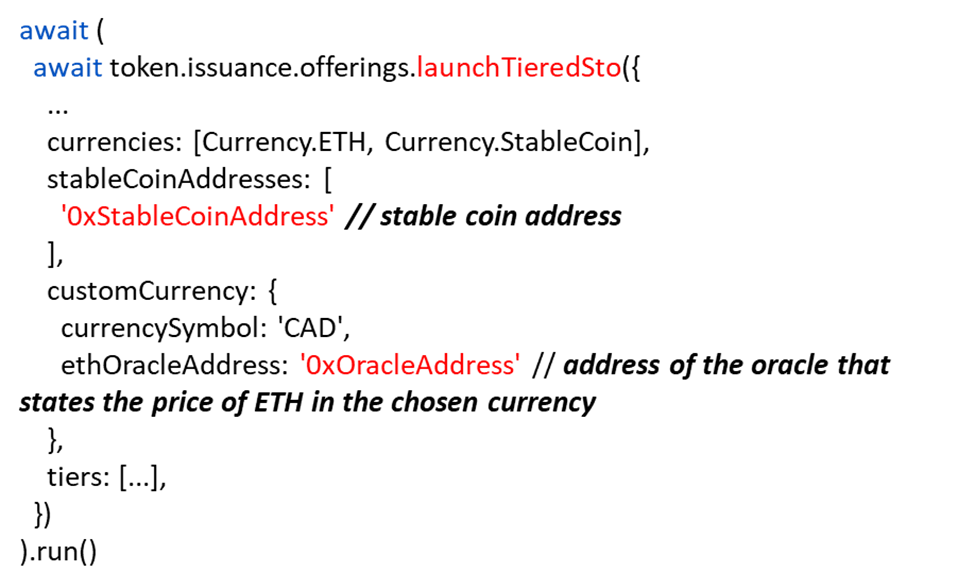

Smart contracts allow issues/investments to be denominated in a number of crypto or fiat currencies and this is where stablecoins play a major role, for in the case of the issue being denominated in a specific fiat currency the issuer needs to indicate the stablecoin pegged to that currency. The smart contract uses an interface (open source data feeds called an ‘oracle’)[20] to convert the value of the specified currency as represented by the stablecoin to other cryptocurrencies.

In this illustrative snippet, the code converts Canadian dollars (CAD) to ETH (the native currency of the Ethereum blockchain platform).

This is one of the reasons why stablecoins are significant to DeFi adoption. It becomes difficult to incorporate into a DeFi application a fiat currency not having a corresponding stablecoin implementation.

Tokenised issue of Asset-Backed Securities (ABS)

Terminology Alert

In traditional finance (TradFi), asset-backed security is a type of financial investment that is collateralized by an underlying pool of assets—usually ones that generate a cash flow from debt such as loans, leases, credit card balances, or receivables.

In the DeFi world, where physical world assets are represented in digital forms (tokens) usually recorded on a distributed digital ledger (blockchain) the term asset-backed security is sometimes used to denote a token that represents a real/physical assets or an ownership stake in such asset.

One needs to differentiate between the concepts of an asset-backed security (TradFi) and an asset-backed token (DeFi) when coming across the term ‘securitization’ in the context of STOs.

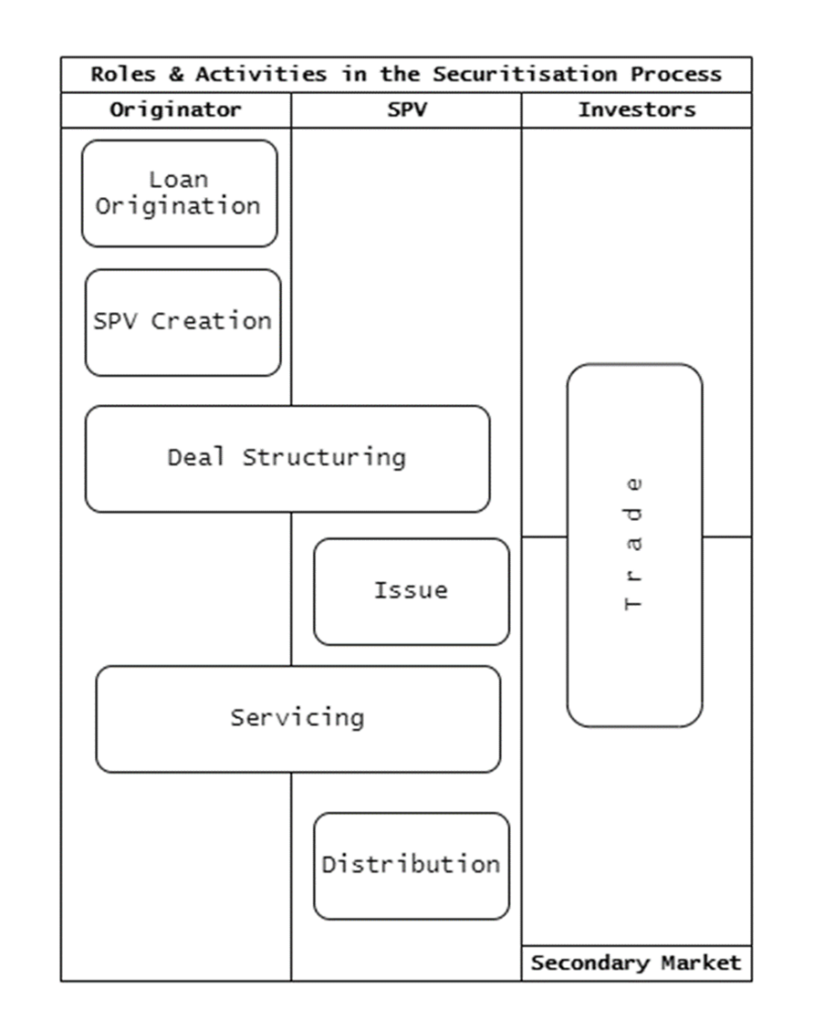

In TradFi, the process of securitisation of asset-backed securities (ABS) (usually collateralised loans) involves, at a high level of abstraction, an ‘originator’ having a loan portfolio creating an ‘SPV’ (a legal entity bankruptcy-remote to the originator), transferring the loan portfolio to the SPV, packaging the portfolio into investment products (securities) and offering such securities to investors against returns.

Investors may also earn returns by trading such securities amongst themselves or on established secondary markets.

The SPV/originator continues to service the loans and the SPV makes distributions (coupon payments, redemptions) to the investors.

Tokenisation of ABS Contracts

| Activity | Process of tokenisation |

| Loan Origination | Loan origination happens offline and the originator seeking to perform an STO usually already holds the portfolio of loans that it seeks to securitise. |

| SPV Creation | This is also an offline activity. There are custodial services provided by DeFi platforms (e.g. Aegis Custody)[23] that maintain asset records on-chain, however, this does not create a bankruptcy-remote entity. E2E asset-backed digitization solutions providers (e.g. Alphapoint)[24] provide services to write – loan portfolios transferred to the SPV (and audited) – as transactions to an underlying blockchain. |

| Deal Structuring | Deal structuring occurs off-chain using analytic tools provided by digitization solution providers, however, the parameters of the deal are configured onto a smart contract residing on-chain based on which tokens get minted and issue and distributions take place. |

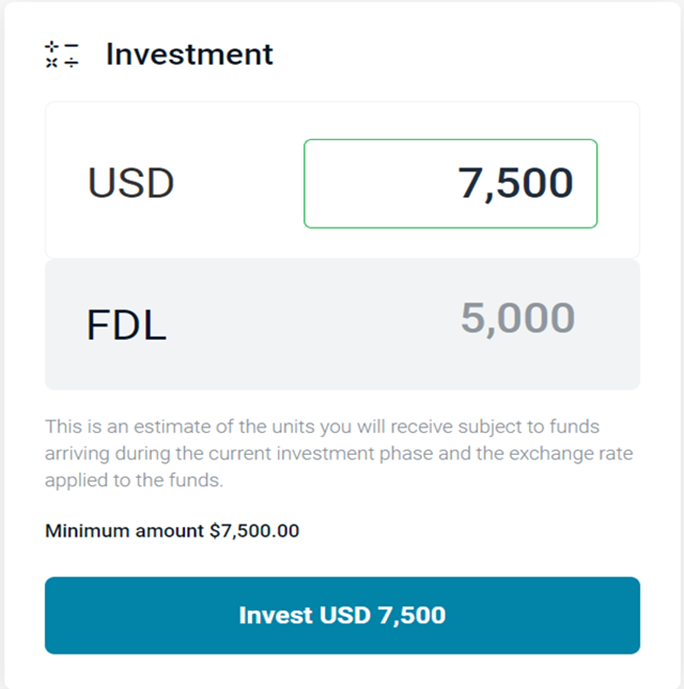

| Issue | Investors can invest in the issue using their crypto-wallets and tokens are issued to such investors by the smart contract in parity with their investment amounts. Issue proceeds and unsubscribed tokens are credited to the issuer’s wallet. The smart contract may also be programmed to return the investment amounts to the investors in case the issue fails (say if the minimum investment requirement is not met by STO close). |

| Servicing (inflows) | Loan servicing essentially takes place offline. |

| Distribution (outflows) | Distributions are executed by the smart contract based on pre-defined criteria. Smart contracts employ the use of ‘oracles’ in case distribution criteria refer to information (say benchmark interest rates, credit ratings, etc.) that are maintained off-chain. Smart contracts may also ‘burn’ tokens if necessary (redemptions, clean-up calls[25]). |

| Trade | Investors can trade issued tokens on ‘exchanges’ native to the platform or other exchanges (DEx[26] or otherwise) and receive value in their crypto-wallets. STO solution providers usually provide facilities to investors to continue to stay on the platform of issue by using ‘oracles’ and ‘bridge coins’ to interact with off-chain and 3rd party platform exchanges. |

Benefits of Tokenisation

The primary benefit of implementing tokenisation for structured finance products and for that matter, any TradFi transaction, is disintermediation (between issuer/originator and investor) and increased liquidity (price discovery and market access). There is a substantial reduction in issue cost compared to the traditional means of raising funds.

Increased liquidity also means opportunities for investors to earn higher returns by trading in secondary online markets and to exit the market when needed. Another important benefit is the feature of fractional ownership available for tokenised securities where investors may own or transfer only a fraction of the token value held as an investment.

Settlement time is also significantly lower on 24/7 digital platforms (almost real-time, subject to computational capacity and transaction traffic) compared to exchanges in the TradFi world (usually T+2).

Regulatory Overview

When it comes to the regulation of crypto-assets across various jurisdictions, it can be divided into three broad types based on their regulatory approach –

‘Prohibited’ (as in the PRC) where the jurisdiction does not allow issue or trading of crypto-assets. As per the directions[27] from the Peoples Bank of China (PBC), financial intermediaries are prohibited from entering into transactions involving cryptocurrency and individuals or corporates (including foreign entities) may be held in breach of the country’s laws (including criminal laws) in case they are parties to contracts involving crypto-assets.

‘Unregulated but legal’ – countries where crypto-asset specific regulations do not yet exist or exist in only a draft state but transactions in crypto-assets per se do not invite economic or criminal penalties. This is the case, currently, for the majority of countries where crypto-assets as prevalent including major economic jurisdictions like the US, UK and the EU. ‘Unregulated’, of course, does not mean laissez-faire as such jurisdictions subsume crypto-asset transactions under their existing economic, revenue, information technology and data privacy laws.

To illustrate, in the case of security token offerings in the US, its entire gamut of security laws[28] are applicable to such offerings and issuers will have to comply with such laws or take the shelter of explicit exemptions (safe harbour regulations)[29] provided under them.

The US SEC has issued a guideline containing the framework[30] for analysing whether “digital assets” fall under such the category of securities. Policy statements and guidance have also been published by the UK FCA[31] and the ESMA.[32]

‘Regulated’ – this forms the minority of jurisdictions which have implemented DeFi/crypto-asset specific legislation like Gibraltar[33] and Malta.[34]

Conclusion

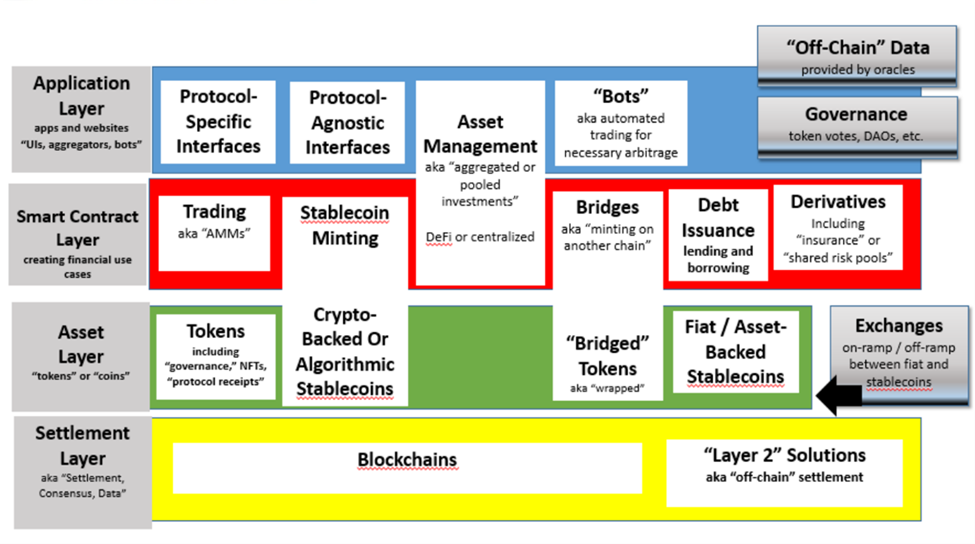

Transactions in the TradFi space can be translated and implemented using the process of tokenisation and moving on to a DeFi platform. The IOSCO Report on decentralised finance has identified the building blocks of DeFi to consist of a number of layers and such DeFi implementation can support a large variety of transactions that take place in the physical world.

Decentralised Finance (DeFi) by its very name suggests all transactions be written to a distributed digital ledger (a public blockchain) and smart contracts built on top of the blockchain to execute the transactions.

A scrutiny of the current implementation of the STO solution as applied to an ABS security issue indicates that a number of structured finance transactions straddle the blockchain platform and the physical world (offline), and are executed on pure DeFi as well as centralised platforms (CeFi: non-public-blockchain or non-DLT platforms) or 3rd party platforms (off-platform) via various application interface (API) protocols. Hence, issuers and investors may still be subjected to commercial terms and conditions framed, altered and imposed by private for-profit players.

In terms of promoting adoption, there needs to be work done on the regulatory front in terms of removing the uncertainties related to the legal ramifications of tokenised transactions for all parties involved in it – the issuer, the investor, the platform and other ancillary service providers. Legislative work is already underway in the major economies like the US where bills like the Blockchain Regulatory Certainty Act[36] have been introduced in the House of Representatives and “Token Safe Harbor Proposals” have been recommended by the security market regulators.[37]

[1] https://www.forbes.com/sites/nisaamoils/2021/01/25/security-token-industry-in-2021/?sh=187d6d5761cb

[2] https://www.nasdaq.com/articles/security-token-market-shows-signs-of-resurgence-2021-06-22

[3] https://www.coindesk.com/markets/2021/06/22/security-token-market-shows-signs-of-resurgence/

[4] Maastricht Journal of European and Comparative Law, Valeria Ferrari [2020] – https://journals.sagepub.com/doi/pdf/10.1177/1023263X20911538

[5] IOSCO Decentralized Finance Report, IOSCO [March 2022] – https://www.iosco.org/library/pubdocs/pdf/IOSCOPD699.pdf

[6] DeFi Dashboard – https://defillama.com/

[7] IOSCO Decentralized Finance Report, IOSCO [March 2022] – https://www.iosco.org/library/pubdocs/pdf/IOSCOPD699.pdf

[8] 6th ICO/STO Report – Spring 2020 Edition, PWC [2020] – https://www.pwc.com/ee/et/publications/pub/Strategy&_ICO_STO_Study_Version_Spring_2020.pdf

[9] Gobal Stablecoin Initiative – Public Report, IOSCO [March 2020] – https://www.iosco.org/library/pubdocs/pdf/IOSCOPD650.pdf

[10] Stablecoins – Digital Money for Everyday Use, Ethereum.org – https://ethereum.org/en/stablecoins/

[11] https://www.ndtv.com/business/the-first-bitcoin-transaction-was-for-buying-pizzas-more-interesting-tidbits-inside-2512643

[12] https://efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2019-Azores/papers/EFMA2019_0509_fullpaper.pdf

[13] https://ethereum.org/en/developers/docs/smart-contracts/

[14] https://securitize.io/raise-capital

[15] https://polymath.network/issuers

[16] https://swarmnetwork.org/about/

[17] https://harbor.com/platform

[18] https://stokr.io/how-stokr-works/for-ventures

[19] https://www.investor.gov/introduction-investing/investing-basics/glossary/accredited-investors

[20] https://ethereum.org/en/developers/docs/oracles/

[21] Launching a non-USD STO, code snippet from the Polymath SDK – https://developers.polymath.network/developers/tutorials-1/sto

[22] A substantially more detailed view of securitisation is provided in our ‘Securitisation Primer’ – https://vinodkothari.com/2013/12/seccont/

[23] https://aegiscustody.com/asset-digitization/

[24] https://alphapoint.com/security-token-offerings-sto-for-asset-backed-securities-abs/

[25] “clean-up call” means an option that permits the securitisation exposures to be called before all of the underlying exposures or securitisation exposures have been repaid, and in the context of a traditional securitisation, typically is an option available to the originator to buy back the remaining assets underlying a securitisation structure when the outstanding value of the underlying assets falls below a pre-defined threshold, thereby extinguishing the remaining securitisation exposures of all parties,

Draft Framework for Securitisation of Standard Assets, RBI [June 2020] – https://m.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=958

[26] https://www.coinbase.com/learn/crypto-basics/what-is-a-dex

[27] http://www.pbc.gov.cn/en/3688253/3689012/4353814/index.html

[28] https://www.investor.gov/introduction-investing/investing-basics/role-sec/laws-govern-securities-industry

[29] https://corpgov.law.harvard.edu/2020/11/25/sec-adopts-rules-to-modernize-and-streamline-exempt-offerings/

[30] https://www.sec.gov/files/dlt-framework.pdf

[31] https://www.fca.org.uk/publication/policy/ps19-22.pdf

[32] https://www.esma.europa.eu/sites/default/files/library/esma50-157-1391_crypto_advice.pdf

[33] https://www.gibraltarlaws.gov.gi/legislations/financial-services-distributed-ledger-technology-providers-regulations-2020-4774/download

[34] https://www.mfsa.mt/our-work/virtual-financial-assets/

[35] IOSCO Decentralized Finance Report, IOSCO [March 2022] – https://www.iosco.org/library/pubdocs/pdf/IOSCOPD699.pdf

[36] https://www.congress.gov/bill/117th-congress/house-bill/5045/text?r=46&s=1

[37] https://www.sec.gov/news/public-statement/peirce-statement-token-safe-harbor-proposal-2.0

Readers may also refer:

Leave a Reply

Want to join the discussion?Feel free to contribute!