Downstreamed through intermediaries: Deemed public issue concerns for privately placed debt

– Vinod Kothari and Payal Agarwal | corplaw@vinodkothari.com

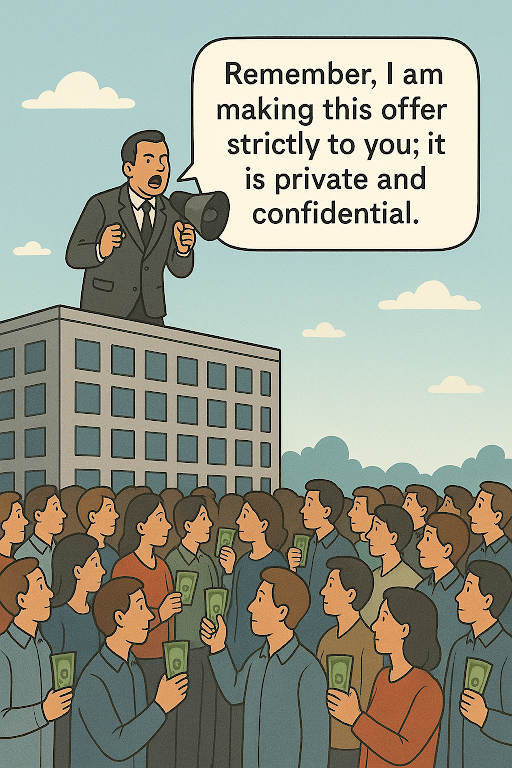

While equity is the “flavour of the season”, companies can produce efficient returns on equity only if they leverage it; therefore, companies are also reaching out to investors through debt issuance. Most of the bond issuance in India is privately placed; however, it is increasingly common for companies to reach out, mostly through intermediaries, to HNIs and other investors to invest in privately placed listed debt. While some of it happens through OBPPs (see an article on Regulatory framework for Online Bond Platform), much of it is simply distributed to investors by brokers, portfolio managers, distributors, investment advisers, and so on. Question is, if a privately placed bond issue is downsold, through intermediaries, to more than 200 investors, will the issue itself be regarded as a “deemed public offer” and therefore, require compliance with public offer norms as per Part I of Chapter III of the Companies Act, 2013 read with Chapter III of the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021.

If you cannot do something, you cannot employ someone to do it. In Sanskrit Nyayavali, there is a maxim that reads:

यः करोति स करोत्येवेति न्यायः

This maxim is used to denote that the responsibility of one who sets another to do a thing is quite equal to that of the doer himself. That is, what you cannot do, you cannot employ someone to do.

If a bond issuer engages an intermediary to downsell an issue to an undefined group of investors, it must be taken to be the act of the issuer itself. While mostly the focus is on the magical number 200, but 200 is only the “deeming line”. The real line of distinction is – did I reach out to a closed group of investors who were known to me, or did I make a wide and open offer to whoever might be interested. Even if one might contend that all the offerees were known to the offerers, the 200 lakshman rekha will still apply and will result in the so-called private placement being taken as a public offer.

This article discusses:

- The contours of the deemed public offer provision in context of bonds

- What difference would be made if the bonds were privately placed and listed

- Is the limit to be counted for all bonds issued in a year, or per ISIN or per bond issuance?

- What if the intermediary buys the bonds from secondary market and then downsells the same?

- How is the nexus between the bond issue and downselling derived/deduced?

- What difference is made if the bonds are sold on OBPPs? What are the defining features of an OBPP, as opposed to securities intermediaries?

- So, in what circumstances will a downsold bond not result in a breach of sec. 25(2) and 42 of the Companies Act / NCS Regs?

There have been various actions taken by ROC against use of crowdsourcing platforms for equity shares. Refer our article on Crowdsourcing funds faces stiff penal actions.

Contours of deemed public offer on bond issuance

Section 25(2) of the Companies Act specifies cases that may be considered as a deemed public offer.

For the purposes of this Act, it shall, unless the contrary is proved, be evidence that an allotment of, or an agreement to allot, securities was made with a view to the securities being offered for sale to the public if it is shown—

(a) that an offer of the securities or of any of them for sale to the public was made within six months after the allotment or agreement to allot; or

(b) that at the date when the offer was made, the whole consideration to be received by the company in respect of the securities had not been received by it.

Additionally, in terms of section 42(11) of the Act, a private placement offer, non-compliant with the provisions of Section 42(2) shall be deemed to be a public offer and shall attract the provisions as applicable to any public offer. Section 42(2) requires that a private placement offer be made only to pre-identified investors and to not more than 200 persons in a financial year. Penalty for breach of section 42 may stretch to the amount of funding raised, capped at Rs 2 crores. Further, the issuer is also required to refund all monies with interest to subscribers within a period of 30 days of the order imposing the penalty. The interest is to be paid at the rate of 12% p.a. calculated from the expiry of the 60th day from the date of the receipt of application money for such securities till the time the money has been refunded.

Thus, downselling of bonds by the investor within 6 months of issuance by the bond issuer results in a deemed public offer. Further, in case of a public offer, section 40 mandates the listing of securities, in case of public offer of securities. In case of listed or proposed to be listed securities, Section 24 of the Act extends SEBI’s authority to administer the provisions of the Act (Chapter III and IV) in relation to the issue and transfer of such securities.

Deemed public issue in privately issued bonds and recent SEBI orders

In an August 2025 order pertaining to downselling of privately placed unlisted NCDs to 699 investors, the issuer contended that the allotment of NCDs was made to a single investor on private placement basis, and any subsequent transfer of such securities within 6 months from its allotment is an independent action of the investor, with no direction or influence from the issuer. Here, SEBI referred to the legal maxim ‘acta exterior indicant interior secreta’ (external action reveals inner secrets) to rule out the aforesaid contention of the issuer.

In the facts of the said case, the investor (primary subscription) was referred to as Debenture Holder Representative (DHR), and the investor was identified as a depository account of such DHR. The issue related documents indicated the primary subscriber’s intention to downsell, and not to hold investments in the NCDs.

In the said case, while dealing with the concept of “deemed public offer”, SEBI also interpreted the construct of section 25, and observed:

The expression “with a view to” in section 25 indicates the reason or goal behind an action. It signifies the action being taken with a specific objective in mind and implies a forward-looking perspective, suggesting that the action is a means to an end. It is pertinent to mention that such intent, design or reason can be drawn from a mass of factual details and can be gleaned from the whole gamut of surrounding foundational facts and circumstances both poste and ante the typical gambit of allotment in this case.

SEBI also held that:

…(unless the contrary is proved) if it is shown that an offer of the securities allotted or of any of them, for sale to the public was made within six months after the allotment or agreement to allot, it is presumed that the allotment or an agreement to allot the securities was made with a view to the securities being offered to the public and the document whereby the offer for sale is made shall be deemed to be a prospectus under section 25(1).

The order also referred to another adjudication order of SEBI dated 20th September, 2023 (subsequently settled on 10th April, 2024). In the said case, the allotment of NCDs was made in the portfolio demat account of the primary investor, which were subsequently transferred to 355 investors. The application money was also received from the portfolio pool account of the investor, and not the proprietary account. In the facts of the case, the investor had also acted as a structurer of the deal and received an advisory fee from the issuer for the same.

Downselling of privately placed “listed” bonds

Securities, once listed, are freely transferable. There is no lock-in period or transfer restrictions on the listed bonds. Therefore, a question arises on whether the downselling restrictions and deemed public issue implications arise in a case where the NCDs are issued through private placement, and listed on the stock exchanges?

In our view, if the bonds were privately placed, but have been downsold in a quick succession, it is implied that the downselling was a part of the primary issuance. In such cases, the issuer may be said to have violated public issue norms by calling what was really a public offer as a private placement. Thus, if the nexus between primary issuance through private placement and secondary transfer to retail investors is clear, it is substantively a public offer, being camouflaged as a private placement. The impugning issue here is not the sale of a listed security, but claiming the issue to be private placement, though with distribution nexus.

Had the securities been intended to be offered to the public, the same should have been done through “public issue” of such bonds, and not through the “private placement” route.

Downselling of bonds purchased from secondary market

The trigger of deemed public issue norms is not based on the number of stopovers; what is relevant is the intent of downselling to the retail public. For instance, consider a case where the issuer issues bonds to XYZ Ltd, an investor. The investor, in turn, transfers the same to a market intermediary (portfolio manager/ stock broker etc). Now, the market intermediary downsells such bonds to a large number of investors. The proximity of each of the aforesaid events, viz., (a) primary issuance, (b) secondary transfer to intermediary and (c) downselling by intermediary to public – are itself suggestive of the ultimate intent of downselling. Therefore, in such cases as well, the provisions of deemed public issue should apply.

Further, where a registered market intermediary acts as a conduit investor to facilitate such transfers, SEBI may also take action against the same. For instance, In an adjudication order dated 25th April, 2023, SEBI has levied penalty on the registered intermediary (portfolio manager) for having facilitated downselling of privately placed securities in violation of the regulatory requirements. Similarly, in the August 2025 order referred above, while penalty has not been levied on the conduit investor, SEBI observed the following in relation to the role of the conduit investor:

Down-selling of the NCDs cannot entirely be a unilateral and independent act without the involvement of other parties and the entire scheme could not have been possible without the connivance of the parties involved.

Nexus between primary issuance and secondary transfers

Section 25(2) of the Act refers to a time gap of six months between primary issuance and secondary transfer for considering the same as a deemed public issuance. The time period of six months is for the purpose of reasonability of connection between the primary issuance and the secondary sale. Thus, proximity between primary issuance and secondary transfer is one of the factors to be considered.

Sometimes, attending circumstances make it clear that the intent of the intermediary was to downsell. For example, the intermediary may have reached out to the potential investors, sourced their intent to subscribe or actually procured their subscriptions, and then may have made the investment in the bonds. Or, as sometimes seen, there may be an irrevocable intent expressed by the ultimate investors to invest the subject bonds.

Charging of fees, by whatever name called, by the primary investor from the issuer may also indicate that the fees is being charged by the investor for acting as a conduit in the private placement offer of the issuer.

Because the substantive view of the arrangement in its entirety is by connecting the dots together, the view may be subjective, but mostly, it is not difficult to discern.

Limit on number of offerees: each ISIN or each issuer?

Section 42(2) r/w Rule 14 of the PAS Rules provides that an offer or invitation to subscribe securities under private placement should only be made upto 200 investors (excluding QIBs and employees under ESOP) in aggregate for a financial year. Further, an explanation to Rule 14(2) clarifies that the limit would be reckoned individually for each kind of security that is equity share, preference share or debenture. The same is based on the recommendations of the Report of the Companies Law Committee, 2016.

The term “securities” is defined to include “debentures”, however, different series of debentures having different terms of issue, inter alia, nature of security, nature of listing, terms of conversion (OCDs, NCDs etc) does not comprise a separate “kind” of security altogether. ISIN (International Securities Identification Number) of securities is a unique 12-character alphanumeric code that identifies a specific financial security, such as a stock, bond, or mutual fund unit. As such, it is merely a tool of identification of security rather than a determinant of the kind of security. Accordingly, the limit of 200 under the Rule should be reckoned at the issuer level for each type of security and not on ISIN basis.

Sale of privately placed bonds by Online Bond Platform Providers

Offer of NCDs in secondary market transactions are permitted through the registered Online Bond Platform Providers (OBPP), as per Reg 51A of NCS Regulations read with Chapter XXI of the Master Circular for issue and listing of Non-convertible Securities, Securitised Debt Instruments, Security Receipts, Municipal Debt Securities and Commercial Paper. However, the OBPP is required to be registered with SEBI and their services are restricted to only (a) listed bonds and (b) bonds that are proposed to be listed through a public offering.

In case of OBPPs, the concept itself was introduced to facilitate offering of listed debentures, in a controlled and compliant environment. That the lock-in restrictions of six months do not apply in case of sale of bonds through OBPP has been discussed by SEBI in its Board Meeting dated 30th Sep, 2022. Para 3.4.3. of the Board Note provides the rationale, as summarised below:

SEBI already has regulations on issue and listing of privately placed debt securities which inter-alia provides for furnishing of private placement memorandum (which itself is very elaborate), memorandum of association, articles of association, requisite resolutions from the board or committees authorizing such listing of securities on stock exchanges. Once listed, the issuer has to follow all the requirements including detailed disclosures at various intervals. Hence, once the securities are listed, there is not likely to be any circumvention of key public issue requirements. Lock-in requirements, if introduced, may rob the investors from liquidity and the opportunity to exit their investments, if so desired. Debt investors may involve mutual funds or other institutional investors. Restrictions on liquidity can have ramifications which could have large scale implications. Accordingly, the lock-in requirement for listed debts is not proceeded with.

However, it is to be noted that the registered OBPP can deal only in listed or to-be listed securities. The OBPP is not permitted to offer unlisted bonds/ other products either through the same platform or through a separate platform/ website. In this regard, SEBI, in its interim order dated 18th November, 2024, took action against three unregistered OBPPs that facilitated the offering of unlisted NCDs to retail investors.

Circumstances where downselling does not result in deemed public issue

We will want to conclude the write up with some thoughts.

The fact that an issuer cannot market debt instruments to over 200 investors surely cannot mean that at no point of time, the number of investors can exceed 200. While securities of a public company are freely transferable, even if the company is a private company, after listing of the debt securities, the transfers thereafter are largely beyond the control of the issuer. Therefore, the real issue is not the actual number of persons who have invested in the bonds: the real issue is, to how many persons was the issue offered?

Hence, if the nexus between the issuance, and the downselling, is not clear or unambiguous, secondary market transactions do not necessarily hint at the intent of offering to over 200 investors. Even the provision of sec. 25 (2) (a) of the Companies Act is a rebuttable inference – it is capable of being dismissed by contrary evidence. Below, we list out some illustrative situations where it may be possible to contend that the issuer did not make an offer to over 200 investors:

- The primary investor of the bonds makes an offer on OBPP. As discussed above, the same is exempt from the deemed public issue restrictions u/s 25(2)(a).

- There are acquirer/acquirers who have made a genuine investment in the bonds, and after a reasonable time, make a phased exit by downselling the bonds

- A portfolio manager acquires the bonds in the names of various clients, spaced over time, indicating clearly that the acquisition by the PMS clients was not a part of the initial offer.

We do understand the growing debt market in India needs wider investor participation, but there have been instances in the past where the device of private placement was exploited to the hilt. Hence there has to be that delicate balance between regulatory concerns and the need for broadbasing of listed debt, which is why instrumentalities like OBPPs have been permitted.

Our other resources:

Crowdsourcing funds faces stiff penal actions

Resource Centre on Corporate Bonds

Introducing common offer document disclosures for Private Placement and Public Issue

Leave a Reply

Want to join the discussion?Feel free to contribute!