Closing in on Implementation of IFRS for banks: RBI proposes expected loss write down for banks

Qasim Saif, Vice President | finserv@vinodkothari.com

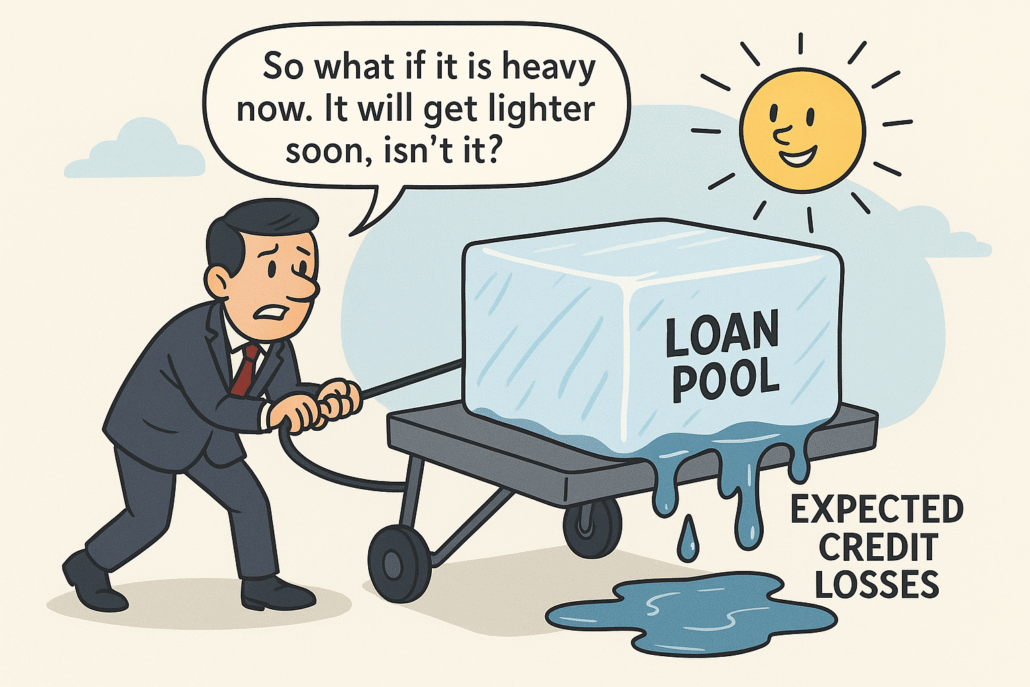

This was being deferred for quite some time, but now it is time to move to expected credit loss provisioning. In a spate of regulatory proposals on 1st October, as a part of Statement on Developmental and Regulatory Policies, the RBI has proposed to come with proposed implementation of ECL, requiring banks to provide for credit losses on the globally followed “expected loss”, rather than the current regulatory provisioning approach. Looking at the experience in case of NBFCs, this move may increase banks’ credit provisioning by multiples

Ind AS, the IFRS-convergent accounting standards, were adopted in India in a phased manner beginning April 2016. However, full implementation of IFRS for banks was deferred indefinitely in 2019[1].

It now seems that RBI intends to implement IFRS for banks in a phased manner, as accounting for investments by banks had already been aligned with Ind AS 109, and the next step would be adoption of Expected Credit Loss (ECL) provisioning for banks. Vide the Statement on Developmental and Regulatory Policies dated October 01, 2025, RBI has proposed to implement the ECL framework for banks as well.

Further, in the Governor’s Statement dated October 1st, it was provided that the requirements of ECL are proposed to be made applicable from 1st April 2027, additionally to abosorb the one-time impact a glide path till March 31st 2031 is proposed to be provided.

Over the years, there have been several discussions on bringing banks under the IFRS/Ind AS framework. RBI had even mandated banks to prepare parallel financial statements as per Ind AS and submit them, which was viewed as a pre-implementation monitoring exercise.

While never officially communicated, ECL was seen as the major hurdle for adoption of Ind AS by banks, as provisions under ECL are expected to be multifold of those required under the current provisioning norms of RBI[2]. The transition would therefore materially impact banks’ profitability and earnings ratios.

ECL provisions are forward looking provisions based on estimation of credit losses on financial assets. It provides for entities to provision based on their past experience and future expectations of recoveries from financial assets, other than those classified under FVTPL. The manner of computation of ECL is based on credit quality based classification.

A detailed analysis on computation of ECL can be read here.

While adoption of ECL is undoubtedly a step towards more prudent and forward-looking financial reporting, it also carries the risk of earnings volatility. For listed banks in particular, the resultant shocks to profitability could impair their market valuation and fund-raising capacity. Though ofcourse glide path would assist in absorbing the losses.

For next steps, we would need to await a detailed guidance circular by RBI on adoption of ECL. Though banks may have already debated their ECL policies while preparing Ind AS-compliant financials for reporting to RBI, the same would now require an even closer look considering the probable impact.

[1] https://www.rbi.org.in/scripts/NotificationUser.aspx?Id=11506&Mode=0

[2] Based on experience of NBFCs

Leave a Reply

Want to join the discussion?Feel free to contribute!