Sustainability reporting: The New Normal

– Vinod Kothari and Payal Agarwal | corplaw@vinodkothari.com

Readers of financial statements get to know the performance of the company in terms of its financial accomplishments, asset values, etc. However, in a world where sustainability of business models in not very long run will be impacted by environment, climate change, social factors, etc., readers of financial statements also need to be informed about the sustainability aspects of a company’s business model.

Over time, sustainability reporting, either on voluntary basis or as a part of listed company reporting, has become a widely accepted practice, at least by large companies. A KMPG Survey of 2022 states that “rates of sustainability reporting among the world’s leading 250 companies are at an impressive 96 percent”.

While there have been various voluntary sustainability reporting standards such as GRI Standards, SASB Standards, CDP Standards, IIRF, GHG protocol etc, the most recent development in the field of sustainability reporting standards is the IFRS Sustainability Standards, prepared as a consolidation of various major sustainability reporting standards around the world. Further, various countries, mostly through the stock exchanges, have formulated their own mandatory sustainability reporting requirements in full or partial adoption of such voluntary standards.

Currently, the sheer multiplicity of standards is baffling. In mid-2019, the NYSCPA ran an article titled As Sustainability Frameworks Multiply, Navigating Them Becomes a Concern. It quoted the-then chair of IASB saying: “There are simply too many standards and initiatives in the space of sustainability reporting”. The situation is seemingly leading to some consolidation, as the various standards bodies are collaborating. However, even as of now, there is no clear sense of direction, as the requirements of mandated sustainability reporting quite often differ from those of voluntary standards such as GRI.

Voluntary Sustainability Reporting Standards

Sustainability Accounting Standard Board standards

Climate Disclosures and Standard Board Framework

International Integrated Reporting Framework

Task Force on Climate-related Financial Disclosures

International Sustainability Standards Board

IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information

IFRS S2: Climate-related Disclosures

Mandatory sustainability reporting

EU’s CSRD proposal and EFRAG reporting requirements

Indian companies to report on Business Responsibility and Sustainability

Sustainability reporting requirements from stock exchanges

Benefits of sustainability reporting

Challenges and gaps in sustainability reporting

Epilogue: Is it all about responsibility reporting, or responsible behavior:

Voluntary Sustainability Reporting Standards

Global Reporting Initiative

The Global Reporting Initiative (GRI) is among the earliest of the bodies that propounded sustainability reporting standards. The genesis of GRI lies in the public outcry over the Exxon oil spill, spilling an estimated 11 million gallons of crude oil, polluting 1300 miles of indent shoreline as well as adjacent waters, and causing massive damage to sea life. GRI published its first GRI Guidelines in 2000, which gradually evolved into Standards in 2016.

GRI has gained tremendous acceptability over time. In over 100 countries, more than 10,000 entities have adopted voluntary standards of reporting by GRI. KPMG Survey notes that GRI is the most dominant standard used across the world. Singapore, Taiwan and Chile lead the uptake of this reporting standard.

The latest version of the GRI Standards, as available on its website is of June, 2022. This updated draft is applicable and effective for reports published on or after 1st January, 2023. Further, a draft GSSB Work Program 2023-2025 has been released for public consultation for the revision of existing standards and the development of new standards.

The Standards are categorised as –

- Universal Standards – The universal standards comprise of GRI 1, GRI 2 and GRI 3.

GRI 1 introduces the purpose and system of GRI Standards and explains the key concepts for sustainability reporting, along with the broad reporting principles that the organization must comply with to report in accordance with the GRI Standards.

GRI 2 focusses on general disclosures about the organization such as its activities, governance, and policies. It includes details of entities covered within the organisation’s sustainability reporting, the period and frequency of reporting, details of the value chain and business relationships, details of workers and employees, governance structure and compensation policy and approach to stakeholder engagement. It also requires disclosure of the policy commitments and process to remedy negative impacts.

GRI 3 contains guidance on determination of material topics for the reporting organisation, and requires disclosure of the process of determining the material topics, list of material topics and process of management of those material topics. It requires understanding the organisation’s context, identification and assessment of impact on an ongoing basis, assess the significance and then prioritize the most significant impacts for reporting.

- Sector Standards – The Sector Standards provide information about the likely material topics of an organisation, by application of the sector-specific standards.

These include sector-specific standards with likely material topics, such as oil and gas sector, coal sector, agriculture aquaculture and fishing sectors.

- Topic Standards – The Topic Standards contain disclosures for the organization to report information about its impacts in relation to particular topics that are identified as material topics by the reporting organisation. These include economic performance, market presence, indirect economic impacts, procurement practices, anti-corruption, anti-competitive behavior, tax, materials, energy, water and effluents, biodiversity, emissions, waste, child labor, customer privacy, health and safety, public policy, local communities etc.

GRI will be collaborating with ISSB for further standards development[1].

Sustainability Accounting Standard Board standards

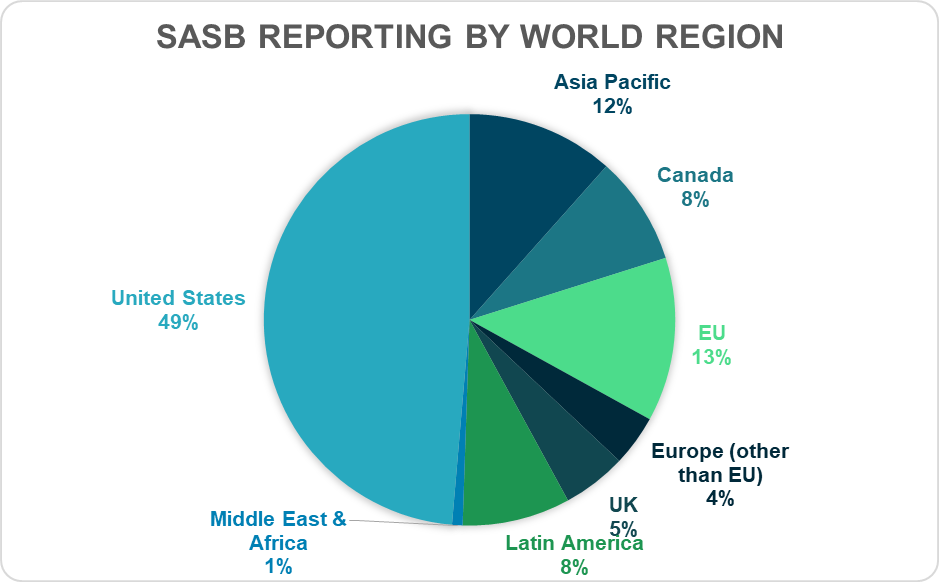

Sustainability Accounting Standards Board (SASB) standards have major usage in the USA, Canada, Brazil, etc. SASB standards were developed in 2011 to guide companies on investor-focused sustainability reporting. The SASB Standards identify the subset of ESG issues most relevant to financial performance in each of the 77 industries, and provide a separate set of standards for the same. The industry categories include consumer goods, mineral extraction, financial services, healthcare, infrastructure, food & beverage, technology & communication, transportation, renewable resources and alternative energy, service sector etc which are again bifurcated into various subsets.

The industry-specific standards contain guidance on disclosures of those ESG topics that may be relevant to the particular industry in which the organization operates. For example, the Standard on agricultural products contain disclosures on topics such as greenhouse gas emissions, water management, food safety etc; whereas the Standard on insurance business contain guidance on reporting of topics such as transparent information & fair advice for consumers, incorporation of ESG factors in investment management, systemic risk management etc.

Apart from the industry-specific standards is a general SASB Standards Application Guidance that is applicable to all industries and provides a generic guidance on the definitions, scope, implementation, compilation, and presentation of the accounting metrics of the industry-specific standards.

SASB will be merged with ISSB’s standards, pursuant to the formation of the latter in Nov 2022.

Climate Disclosures and Standard Board Framework

The Climate Disclosures and Standards Board (CDSB) is an international consortium of business and environmental NGOs. It provides a voluntary framework for reporting environmental and social information in mainstream annual reports of organizations. The first CDSB Framework was released in 2010 and the latest updated version was published in 2022. The Framework provides a few guiding principles followed by specific disclosure requirements.

The guiding principles include the following –

- Environmental and social information shall be prepared applying the principles of relevance and materiality

This requires the reporting entity to identify relevant environmental and social information and report material information based on the relevant environmental and social information. It also provides guidance on determining the “relevance” and “materiality” of the information.

- Disclosures shall be faithfully represented

The reporting entity needs to ensure that information is complete, neutral and free from error in order to be useful.

- Connections shall be made between environmental, social and other information in the mainstream report

This requires explaining the links between environmental and social information, as well as between this information and the other information in the mainstream report, including financial information.

- Disclosures shall be consistent and comparable

It requires information to be disclosed with a consistent approach and comparable with prior period information.

- Disclosures shall be clear and understandable

This requires the presentation of information in a clear, concise and easy-to-follow structure with visual representations through graphs and charts.

- Disclosures shall be verifiable

The basis on which the environmental and social information are disclosed should be capable of verification, that is, free from material error or bias.

- Disclosures shall be forward-looking

It requires complementing historic data with reasonable narrative on future performance of the reporting entity.

The reporting requirements in the CDSB Framework broadly include disclosures of the following –

| A. Governance B. Management’s environmental and social policies, strategies and targets C. Business risks and opportunities D. Sources of environmental and social impact E. Performance and comparative analysis F. Outlook | G. Organizational boundary H. Reporting policies I. Reporting period J. Restatements K. Conformance L. Assurance |

It is to be noted that the CDSB has been consolidated into the IFRS Foundation towards the establishment of the International Sustainability Standards Board (ISSB). The ISSB has also released the draft IFRS Sustainability Disclosure Standards (refer to discussion below).

International Integrated Reporting Framework

The International Integrated Reporting Council (IIRC), formed as a global coalition of regulators, investors, companies, standard setters, the accounting profession, academia and NGOs, published the Integrated Reporting Framework (‘IR Framework’) first in the year 2013. Following a series of consultations, the latest revised version of the same was published in the year 2021. The IR Framework is used in 75 countries around the world to advance communication about value creation, preservation and erosion[2].

The IR Framework is a principles-based, multi-capital, framework that is used to accelerate the adoption of integrated reporting across the world. Reporting under the IR Framework is based on 7 guiding principles and contains 8 content elements.

The guiding principles are –

- Strategic focus and future orientation

An integrated report should provide insight into the organization’s strategy, and how it relates to the organization’s ability to create value in the short, medium and long term and to its use of and effects on the capitals.

- Connectivity of information

It should provide a holistic picture of the combination, interrelatedness and dependencies between the factors that affect the organization’s ability to create value over time.

- Stakeholder relationships

It should provide information on the nature and quality of the organisation’s relationship with its stakeholders, taking into account the extent of understanding and responsiveness to the legitimate needs of the stakeholders by the organisation.

- Materiality

It requires identification of relevant matters, having an impact on the organisation’s value-creation abilities, thereafter, prioritising the material matters, based on evaluation of importance of the same.

- Conciseness

An IR should be concise and should provide sufficient context to understand the organization’s strategy, governance, performance and prospects without being burdened with less relevant information.

- Reliability and completeness

The disclosures should be complete, by including both positive and negative information, and shall be free from material errors. The report should include future-oriented information along with historic data.

- Consistency and comparability

The reporting policies should be used consistently unless changes are required for improving the quality of reporting. This also contributes to the comparability of the reported information over years, as well as with other entities.

The content elements under IR are as follows –

- Organizational overview and external environment

These are general disclosures about the purpose, mission and vision of the organization, ownership and operating structure, principal activities and markets, type of stakeholders and countries of operation, regulatory and political environment, environmental challenges, economic conditions and societal issues etc.

- Governance

The IR should report the governance structure of the organisation, to provide an insight on its ability to create value in short, medium and long-term. This includes details of leadership structure (including skills and diversity), strategic decision-making processes, approach to risk management, linkage of remuneration and incentive with value-creation etc.

- Business model

It provides a description of the business model of the organisation, viz., inputs, activities, outputs and outcomes.

- Risks and opportunities

This includes identification of the specific sources of risks and opportunities, assessment of likelihood and magnitude of the fruition of the same, and specific steps taken towards mitigation or management of key risks or creation of value from key opportunities.

- Strategy and resource allocation

It identifies the short, medium and long term objectives of the organisation, the strategies in place towards achieving the same, the resource allocation towards implementation of the strategies and manner of measurement of achievements and target outcomes.

- Performance

It requires reporting of the extent to which the target outcomes have been achieved by the organisation and its impact on the various capitals.

- Outlook

It provides a view of the potential challenges and uncertainties in meeting the planned target outcomes, from the perspective of the organisation and the potential impact it may have on the future performance of the organisation.

- Basis of preparation and presentation

It requires reporting of the basis of the information reported in the IR, the method of determining the inclusion of an information, as well as quantification of the same.

The IR has also been made a part of the IFRS Foundation.

Task Force on Climate-related Financial Disclosures

TheTask Force on Climate-related Financial Disclosures (TCFD) was constituted by the Financial Stability Board (FSB), to develop recommendations on the types of information that companies should disclose to support investors, lenders, and insurance underwriters in appropriately assessing and pricing a specific set of risks—risks related to climate change.The main focus of TCFD is clearly on climate change.

In 2017, the TCFD released climate-related financial disclosure recommendations designed to help companies provide better information to support informed capital allocation.

The recommendations are grouped into 4 major heads and requires disclosure of –

- Governance: recommends disclosure of organization’s governance around climate-related risks and opportunities, through description of –

- the board’s oversight of climate-related risks and opportunities, and

- management’s role in assessing and managing climate-related risks and opportunities

- Strategy: recommends disclosure of the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning where such information is material, through description of –

- the climate-related risks and opportunities the organization has identified over the short, medium, and long term.

- the impact of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning, and

- the resilience of the organization’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario.

- Risk Management: recommends disclosure of how the organization identifies, assesses, and manages climate-related risks, through description of –

- the organization’s processes for identifying and assessing climate-related risks,

- the organization’s processes for managing climate-related risks, and

- how processes for identifying, assessing, and managing climate-related risks are integrated into the organization’s overall risk management.

- Metrics and targets: recommends disclosure of the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material, through description of –

- the metrics used by the organization to assess climaterelated risks and opportunities in line with its strategy and risk management process.

- Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks, and

- the targets used by the organization to manage climate-related risks and opportunities and performance against targets.

TCFD has further developed 7 principles for effective disclosures of the climate-related financial reporting that requires the disclosures to be relevant, specific and complete, clear, balanced and understandable, consistent over time, comparable over sectors, reliable, verifiable and objective, and on a timely basis.

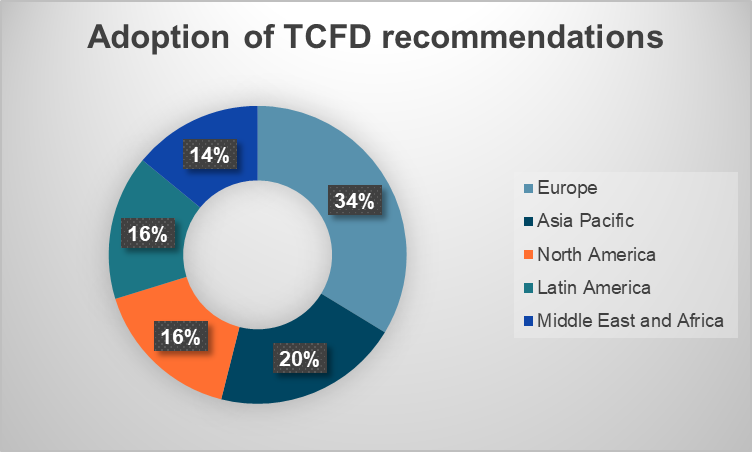

The 2022 Status Report of TCFD indicates that the TCFD recommendations have been largely adopted in the sustainability reporting of Europe, followed by Asia-Pacific. These disclosures are generally made part of the sustainability report, or annual report of the reporting entities. The Status Report also provides samples of the manner in which the recommended disclosures are made by the entities.

International Sustainability Standards Board

One of the issues in achieving global sustainability is sustainability reporting, that is, reporting by companies and entities about their business models and their impact on the environment and climate. To this end, various voluntary standards have been issued and used around the world.

In November, 2021, at the COP 26 meet at Glasgow, the International Sustainability Standards Board (ISSB) was constituted under the auspices of the IFRS Foundation. The ISSB will carry forth the work done by Climate Disclosure Standards Board (CDSB), the Task Force for Climate-related Financial Disclosures (TCFD), the Value Reporting Foundation’s Integrated Reporting Framework (IIRF) and SASB Standards, and the World Economic Forum’s Stakeholder Capitalism Metrics, etc. These will be merged into standards to be developed by ISSB.

The ISSB will develop standards that provide a comprehensive global baseline of sustainability disclosures and develop the standards in such a way that they can be mandated and combined with jurisdiction-specific requirements or requirements aimed at meeting the information needs of broader stakeholder groups beyond investors. Consistent with the approach taken for the IASB’s Accounting Standards, it is for jurisdictional authorities to decide whether to mandate use of the ISSB’s standards.

Until ISSB standards are framed, entities are expected to continue to adhere to the voluntary frameworks and guidance currently in place, including the following:

- TCFD Recommendations

- CDSB Framework

- Integrated Reporting Framework

- SASB Standards

- WEF Stakeholder Capitalism Metrics

The major disclosures required by entities are around the following:

- Governance: the governance processes, controls and procedures the entity uses to monitor and manage climate-related risks and opportunities;

- Strategy: the climate-related risks and opportunities that could enhance, threaten or change the entity’s business model and strategy over the short, medium and long term, including:

- whether and how information about climate-related risks and opportunities inform management’s strategy and decision making;

- the current and the anticipated effects of climate-related risks and opportunities on its business model;

- the impact of climate-related risks and opportunities on the entity’s financial position, performance and cash flows, both at the end of the reporting period and the anticipated effects over the short, medium and long term; and

- the resilience of the entity’s strategy to climate-related risks;

- Risk management: how climate-related risks are identified, assessed, managed and mitigated by the entity; and

- Metrics and targets: the metrics and targets used to manage and monitor the entity’s performance in relation to climate-related risks and opportunities over time.

The ISSB has published the Exposure Drafts of the proposed sustainability standards on 31st March, 2022. The IFRS Sustainability Standards have been categorized into –

- IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, and

- IFRS S2 Climate-related Disclosures

IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information

An Exposure Draft[3] was issued in March, 2022. As for December 2022, it was reported that the ISSB was redeliberating on some of the proposals[4]. As the name suggests, the proposed standard requires reporting of the general information in relation to the entire sustainability-related risks and opportunities.

The major requirements of the Exposure Draft are as follows:

- The Standard will require a reporting entity to report significant sustainability-related risks and opportunities. This disclosure will be a part of the general purpose financial statements, that is, the annual report of the entity. Consequently, the periodicity is also the same as general purpose financial statements.

- The 4 major areas of disclosures required are the same as under TCFD: governance, strategy, risk management, and metrics and targets.

- Governance: The disclosures under this head are aimed at enabling the user of the information to understand the governance processes, controls and procedures used to monitor and manage sustainability-related risks and opportunities.

- Strategy: These disclosures are aimed at providing an understanding of the strategy for addressing significant sustainability-related risks and opportunities.

This requires disclosure of the significant sustainability-related risks and opportunities that is expected to affect its business model, strategy and cash flows, its access to finance and its cost of capital, over the short, medium or long term and their impact on the business model and value chain, strategy and decision-making, financial position, performance and cash flow for the reporting period etc. The disclosure of the resilience of the entity’s strategy contributes to the completeness of the information.

- Risk Management: The purpose of these disclosures is to enable users of the information to understand the process(es) by which sustainability-related risks and opportunities are identified, assessed and managed, integration of those processes into the entity’s overall risk management processes and evaluation of the entity’s overall risk profile and risk management processes.

This includes disclosure of the process to assess the likelihood and effects associated with such risks, input parameters used for such assessment, process of prioritization of such risks relative to other types of risk, and the changes in the processes as compared to the prior reporting period. It also includes disclosure of the extent to which and how the processes are integrated into the entity’s overall management process.

- Metrics and targets: The objective of this disclosure is to enable users to understand how an entity measures, monitors and manages its significant sustainability-related risks and opportunities and how the entity assesses its performance, including progress towards the targets it has set.

Starting from the manner in which the metric has been defined, validation of the same by an external body, if any, and details of such external body, explanation of the method along with assumptions and limitations to the same, the disclosure ranges up to disclose the target set on the basis of the metric and the actual performance against the set targets, along with revision to such targets, if any and the explanation thereof.

The Standards lay down specific disclosure requirements against each of the four components, apart from providing a general guiding framework on the same.

As in case of financial statements which are supposed to reflect a true and fair value, IFRS S1 requires entities to “present fairly the sustainability-related risks and opportunities to which an entity is exposed. Fair presentation requires the faithful representation of sustainability-related risks and opportunities in accordance with the principles set out in this Standard”

IFRS S2: Climate-related Disclosures

S2[5] is specifically on climate related disclosures. Hence, it requires the reporting entity:

- to assess the effects of significant climate-related risks and opportunities on the entity’s enterprise value;

- to understand how the entity’s use of resources, and corresponding inputs, activities, outputs and outcomes support the entity’s response to and strategy for managing its significant climate-related risks and opportunities; and

- to evaluate the entity’s ability to adapt its planning, business model and operations to significant climate-related risks and opportunities.

Climate risks include physical risks, that is, the risks due to climate change, and transition risks, that is, the risks associated with the transitioning to a low carbon economy.

- The 4 broad captions of disclosures are the same here too: governance, strategy, risk management and metrics. Further, the disclosure requirements are also on similar lines, with the difference being that the broad “sustainability” related disclosures are replaced with focussed “climate” related disclosures.

- Governance: This is similar to its S1 version, with the difference being that the disclosure under S2 is focussed specifically on the “climate-related” risks and opportunities.

In view of the similarity in disclosure requirements under S1 and S2, it is specified that unnecessary duplication shall be avoided by the reporting entity, to the extent possible.

- Strategy: These disclosures are aimed at providing an understanding of the strategy for addressing significant climate-related risks and opportunities.

It requires reporting entities to additionally report on whether the identified significant risks are physical risks or transition risks. Addressing the climate change concerns require major revamping of various existing business models, and therefore, the disclosures are also required on current and anticipated changes to the business model of the reporting entity including information about direct and indirect adaptation and mitigation efforts it is undertaking. It also requires disclosures on the processes in place for review of climate-related targets set by the reporting entity, specifying the amount of the entity’s emission targets to be achieved through emission reductions as well as through carbon offsets.

- Risk Management: The purpose of these disclosures is to enable users of the information to understand the process(es) by which climate-related risks and opportunities are identified, assessed and managed, integration of those processes into the entity’s overall risk management processes and evaluation of the entity’s overall risk profile and risk management processes.

- Metrics and targets: The objective of this disclosure is to enable users to understand how an entity measures, monitors and manages its significant climate-related risks and opportunities and how the entity assesses its performance, including progress towards the targets it has set.

This requires disclosures of the relevant cross-industry metric categories as well as industry-based metrics along with the other metrics used by the board or management of the reporting entity, and the climate-related targets set by the entity.

- The metric-based information requires disclosure of the entity’s absolute gross GHG emissions (expressed as metric tonnes of CO2 equivalent) classified as Scope 1, Scope 2 and Scope 3 emissions and its GHG emissions intensity for each scope. These disclosures are to be provided separately for the consolidated entity (parent and subsidiary) and other group entities (associates, joint ventures, affiliates etc) along with the approach used to include emissions of group entities and reasons for applying such approach. Certain additional information are also required to be disclosed in relation to Scope 3 emissions specifically.

- Apart from this, the proportion of business activities vulnerable to physical risks and transition risks and climate-related opportunities are to be disclosed separately. The internal carbon prices and the capital deployment towards climate-related risks and opportunities also require reporting. The linkage of executive management remuneration with climate-related considerations is also required to be reported.

- Disclosure of climate-related target includes information on the specific target set by the entity, nature of the target as absolute or intensity target, objectives of the target, metrics used to assess performance against such target, base period from which progress is to be measured and period over which such target is to be achieved along with interim targets, if any. It also includes comparison of the targets set by the entity to that of the latest international agreements on climate change and validation of the same by a third party.

Mandatory sustainability reporting

EU’s CSRD proposal and EFRAG reporting requirements

In April 2021, the European Commission adopted a proposal for a Corporate Sustainability Reporting Directive (CSRD). The EU parliament voted to approve it on 10th November, 2022. The Directive amended the non-financial reporting requirements to have a specific section on sustainability, with a management discussion on the following:

- The company’s business model and strategy, noting resilience to risks and opportunities.

- The plans of the company group to limit global warming to 1.5 °C in accordance with the Paris Agreement and achieve climate neutrality by 2050.

- Relevant policies and roles of administrative, management and supervisory bodies.

The final version of CSRD was adopted on 5th Jan., 2023, and will, therefore, be applicable based on the roadmap discussed below.

In addition, companies will be required to sustainability according to standards to be framed by the European Financial Reporting Advisory Group (EFRAG).

The reporting will be applicable for “large companies” within the Non-Financial Reporting Directive starting 2024 (reports to be published in 2025), and then to other companies, in phases over the next 4 years.

EFRAG has issued several draft standards, which will be put to EU regulators for implementation.

ESG reporting in UK

ESG reporting in the UK has been formally brought into regulations vide amendments to the Companies Act, 2006 during 2022 amending the existing non-financial information statement to non-financial and sustainability information statement, a part of the strategic report. The statement is applicable to a traded company, banking company, insurance company or a company whose securities are traded on Alternative Investment Market. It is also applicable to high turnover companies having turnover of more than £500 million. Section 414CB of the Act prescribes the content of the statement as amended vide the Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022. The climate-related financial disclosures are aligned with the TCFD’s recommendations.

In addition to the same, the large UK companies, having consumed more than 40,000 kilowatt-hours (kWh) of energy in the reporting period, are required to include energy and carbon information within their directors’ report in terms of the Companies (Directors’ Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018. ‘Large company’ would mean a company meeting two or more of the following criteria:

- turnover (or gross income) of £36 million or more,

- balance sheet assets of £18 million or more,

- 250 employees or more.

The latest development in line with the sustainability reporting requirements is the Sustainability Disclosure Requirements (SDR) and investment labels, currently open for consultation. This includes sustainable investment labels, disclosure requirements and restrictions on the use of sustainability-related terms in product naming and marketing, in order to clamp down greenwashing.

SEC proposal for US

Sustainability reporting in the US is largely voluntary as on date. However, the proposed rules of Securities and Exchange Commission (SEC), once adopted, will require registrants to mandatorily include certain climate-related information in its registration statements and periodic reports[6], such as –

- Climate-related risks and their actual or likely material impacts on the registrant’s business, strategy, and outlook;

- The registrant’s governance of climate-related risks and relevant risk management processes;

- The registrant’s greenhouse gas (“GHG”) emissions, which, for accelerated and large accelerated filers and with respect to certain emissions, would be subject to assurance;

- Certain climate-related financial statement metrics and related disclosures in a note to its audited financial statements; and

- Information about climate-related targets and goals, and transition plan, if any

The rules are proposed to be made applicable to the registrants in a phased manner, starting with the large accelerated filers who would be required to file such disclosures starting from fiscal year 2023, in the year 2024 and thereafter.

The proposed disclosures are aligned with the internationally recognised standards such as TCFD recommendations and Greenhouse Gas Protocol.

In addition to the same, the State laws of California, the Climate Corporate Accountability Act, has become the first law in the country to require U.S.-based companies — those doing business in California and generating over $1 billion in gross annual revenue — to disclose all of their greenhouse gas emissions to the California Secretary of State’s office[7].

Indian companies to report on Business Responsibility and Sustainability

In India, the top 1000 listed entities, based on market capitalization as on the last day of the preceding financial year, are required to disclose various qualitative and quantitative information with respect to their business activities and related ESG factors in the Business Responsibility and Sustainability Report (BRSR)[8].

The report is structured into three prominent sections, being –

(i) General disclosures – about the organisation,

(ii) Management and process disclosures – about the governance structure in relation to BRSR,

(iii) Principle-wise disclosures – based on the nine principles of NGRBC

BRSR has a high degree of comparability with the globally recognised reporting standards such as GRI, and therefore, the GRI Standards can be used as guidance by companies in BRSR implementation. The interoperability between the various principles of BRSR and GRI Standards can be referred to in Getting ready to implement BRSR from FY 2022-23.

There are various other countries[9] where sustainability reporting has either been made a part of the regulations, on a “comply-or-explain” basis, or “mandatory” basis, or otherwise, consultations/ discussions have been commenced towards such mandatory reporting requirements. Further, there are several environmental/ other sector-specific laws and regulations that require covered entities to report on one or more ESG factors.

Sustainability reporting requirements from major stock exchanges

Apart from the specific disclosure mandates from the primary governing laws applicable on the entities, in the case of listed entities, the stock exchanges with which their securities are listed may also require an additional level of compliance by such entities. This also includes issuing guidelines by the stock exchanges on sustainability reporting by the listed entities.

A KPMG’s Survey of Sustainability Reporting 2022 indicates that nearly one-quarter of both the N100[10] and G250[11] use their domestic stock exchange guidelines or standards. Adherence is particularly high among the N100 in the Middle East & Africa region (48 percent) and the Asia Pacific region (40 percent). The leading adopters of stock exchange guidelines are South Africa, Malaysia and India.

With effect from July 2020, the Hong Kong Exchanges and Clearing Limited (HKEX) updated its ESG Reporting Guide to include disclosures in alignment with the TCFD recommendations. While the TCFD-aligned disclosures in Hong Kong will assume a mandatory flavour by 2025, in order to smoothen the transition to such reporting requirements, HKEX has published a Guidance on Climate Disclosures for the listed entities.

The listing rules (Rule 711A) of the Singapore Exchange (SGX) requires the issuers to publish a sustainability report in each financial year, describing the issuer’s sustainability practices with reference to five primary components, namely:

(a) material environmental, social and governance factors;

(b) policies, practices and performance;

(c) targets;

(d) sustainability reporting framework; and

(e) a statement from the board of directors.

Following a Consultation Paper in 2021, the SGX has introduced a phased approach to mandatory climate reporting based on the TCFD recommendations. The disclosures are based on a “comply-or-explain” approach for all entities for the first FY 2022 (reporting in 2023), and thereafter, becomes mandatory in a phased manner[12].

The Johannesburg Stock Exchange (JSE) has published its Sustainability Disclosure Guidance in June 2022. The Guidance is voluntary in nature, however, KPMG’s survey indicates that all South African companies (covered in the research) have adopted the Guidance in their reporting. The Guidance is aligned with the universally recognised GRI Standards, IR Framework, TCFD recommendations, as well as the most recent IFRS Sustainability Standards and a number of ESG framework and standards from peer exchanges.

A press release by Korea’s Financial Services Commission (FSC) announces that the Korea Exchange will provide guidance on ESG disclosure to promote voluntary disclosure of sustainable management reports by listed companies and gradually expand the mandatory disclosure of sustainable management reports to all KOSPI-listed companies from 2030.

Japan’s Stock Exchange has also published a document to support ESG disclosure in 2022, to introduce ESG-specific disclosures for public companies in Japan, proposed to be made applicable from the fiscal year ending 31st March 2023 or onwards. The disclosures under the new Sustainability Perspective and Measures include disclosure of the governance and risk management, strategy, index and target, in relation to the identified sustainability issues of the reporting entity[13].

Benefits of sustainability reporting

The benefits of sustainability reporting include improved corporate reputation, building consumer confidence, increased innovation, and even improvement of risk management[14]. The benefits are both internal as well as external. While the internal benefits include identification of weaknesses and strengths in an organisation, thereby making improvements in management approach and processes; the external benefits include enhanced transparency with stakeholders through demonstration of one’s commitment and performance to sustainability[15].

A study by Philipp Krueger, Zacharias Sautner, Dragon Yongjun Tang and Rui Zhong suggests that mandatory ESG disclosure increases the accuracy of analysts’ earnings forecasts, lowers analyst forecast dispersion, reduces negative ESG incidents, and lowers the likelihood of stock price crashes.

Challenges and gaps in sustainability reporting

While the benefits of sustainability reporting are evident, however, the same is not free from shortcomings and require some modifications to make it more effective. In a recent working paper, author V. Umakanth identifies existing gaps in BRSR applicable on Indian listed companies. The findings may be relevant for various sustainability reports around the world. Various other studies identify certain gaps in the sustainability reports around the world. A Harvard paper[16] (published in 2021) indicates that the quality of most Sustainability Reporting is suboptimal, leaving stakeholders with opaque views of company performance.

- Multiplicity of sustainability standards – The existence of multiple sustainability reporting standards causes confusion among the users of the information and the reporting entities itself, and affects the comparability of the information. The consolidated IFRS Sustainability Standards seems to be a potential solution to this issue.

- Focus only on listed entities or large companies – The mandatory sustainability disclosure frameworks are currently applicable only on large entities or listed entities. However, the small and medium enterprises form a significant proportion of the economy of a country and therefore, a need is felt towards introducing mandatory ESG reporting requirements for the same.

- Lack of sector-specific approach – Various sustainability standards and reporting frameworks adopt a “one-size-fits-all” approach, therefore, giving equal attention to all ESG factors irrespective of their significance for the particular industry or sector in which the reporting entity operates. The sector-specific disclosures provide a more useful picture of the sustainability situation of an entity. Further, too much information on factors that may not be material to the reporting entity, causes an information overload leading to diverting attention from the relevant information.

- Absence of third-party verifications – While majority of the framework requires the entities to report on the planned and achieved targets, the disclosures are generally not backed by any third-party verifications to render reliability and assurance on the reported information.

Epilogue: Is it all about responsibility reporting, or responsible behavior:

The ultimate objective of sustainability reporting is not mere reporting, but responsibility, which should reflect in behavior. The GRI initiative is now more than two decades old, and in the meantime, its acceptance by companies all over the world has increased manifold. However, did that make companies more responsible? “During this same 20-year period of increased reporting and sustainable investing, carbon emissions have continued to rise, and environmental damage has accelerated. Social inequity, too, is increasing.”[17] Eventually, if the world is still focused on growth, the idea of protecting the planet does not seem to reconcile. Noted author E H Schumacher, in Small is Beautiful, beautifully puts it: “Modern man does not experience himself as a part of nature but as an outside force destined to dominate and conquer it. He even talks of a battle with nature, forgetting that, if he won the battle, he would find himself on the losing side.”

[1] https://www.ifrs.org/news-and-events/news/2022/06/issb-and-gri-provide-update-on-ongoing-collaboration/

[2] https://www.integratedreporting.org/the-iirc-2/

[3] https://www.ifrs.org/content/dam/ifrs/project/general-sustainability-related-disclosures/exposure-draft-ifrs-s1-general-requirements-for-disclosure-of-sustainability-related-financial-information.pdf

[4] https://www.ifrs.org/projects/work-plan/general-sustainability-related-disclosures/

[5]https://www.ifrs.org/content/dam/ifrs/project/climate-related-disclosures/issb-exposure-draft-2022-2-climate-related-disclosures.pdf

[6] https://www.sec.gov/files/33-11042-fact-sheet.pdf

[7] https://sd11.senate.ca.gov/news/20220126-senator-wiener%E2%80%99s-climate-corporate-accountability-act-passes-senate

[8] Our various resources on BRSR can be accessed at – https://vinodkothari.com/resource-center-on-business-responsibility-and-sustainable-reporting/

[9] See Internet Appendix Table 2: Mandatory ESG Disclosure Policies for The Effects of Mandatory ESG Disclosure around the World by Philipp Krueger, Zacharias Sautner, Dragon Yongjun Tang and Rui Zhong

[10] N100 refers to a worldwide sample of the top 100 companies by revenue in 58 countries,territories and jurisdictions researched in the study.

[11] G250 refers to the world’s 250 largest companies by revenue based on the 2021 Fortune 500 ranking

[12] https://www.sgx.com/sustainable-finance/sustainability-reporting

[13] https://www.morganlewis.com/pubs/2022/12/japan-introduces-mandatory-esg-disclosures-for-public-companies

[14] https://ccc.bc.edu/content/ccc/research/corporate-citizenship-news-and-topics/sustainability-reporting.html

[15] https://www.bsigroup.com/en-IN/sustainability-reporting/Benefits-of-Reporting/

[16] See Sustainability Reporting: A Gap Between Words and Action published in the Harvard Law School Forum on Corporate Governance

[17] HBR article titled https://hbr.org/2021/05/overselling-sustainability-reporting

Leave a Reply

Want to join the discussion?Feel free to contribute!