IRDA rolls out conditions for common directorship in insurance company and intermediary

If compliant, to be regarded as deemed approval under Section 48A of the Insurance Act, 1938.

– Aanchal Kaur Nagpal, Manager & Sharon Pinto, Manager (corplaw@vinodkothari.com)

Insurance relationships are fundamentally built on trust between insurers and their customers. (Insurance and Regulatory Development Authority of India (‘IRDA’) has been quite stringent with respect to curbing instances of conflicts of interest in case of insurance companies and/ or insurance intermediaries.

As per Exposure Draft on IRDAI (Conflict of Interest) Guidelines, 2019[1], “Conflict of Interest” means a situation in which a person or organization is involved in multiple interests, financial or otherwise, and serving one interest could involve working against another and includes situations when a person’s impartial and objective performance of duties or decision-making could be jeopardized because of personal interests being involved;

One such possibility of conflict of interest is likely when there is a common director between an insurance company and an insurance intermediary. Insurance intermediary includes a corporate agent and there are several financial sector entities that are currently registered as a corporate agent[2]. Presently, the IRDAI (Registration of Corporate Agents) Regulations, 2015[3] (‘Corporate Agent Regulations’) read with section 48A of the Insurance Act, 1938, do not allow a corporate agent/ principal officer/ specified person to become a director in an insurance company, except with the prior approval of IRDA. The proviso section 48A gives the power to IRDA to specify conditions with a view to protect the interest of policyholders or to avoid conflict of interest, for granting such permission.

The existing circular by IRDA dated August 30, 2018 (superseded by the Present Circular, defined below) provided for conditions to be fulfilled by insurance companies while obtaining approval from IRDA for appointing common/ nominee director.

Present Circular granting conditions for deemed approval

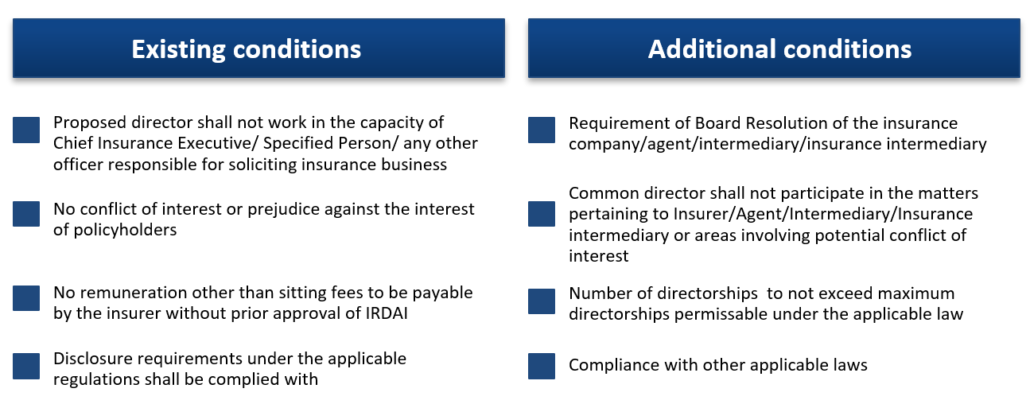

IRDA vide Circular dated September 2, 2022 (‘Present Circular’) has now done away with the requirement of obtaining prior approval of IRDA for appointing director representing insurance intermediaries on the Board of an insurance company, subject to certain additional conditions which, along with the existing conditions, are to be fulfilled by the insurance company.

The appointment or continuation of common director representing insurance agent, intermediary or insurance intermediary on the board of insurance company shall be deemed to have been permitted,, subject to the conditions specified in the Present Circular.

Conditions to be fulfilled by the insurance company –

While the Present Circular now allows Insurance companies to have common directors with deemed approval subject to fulfillment of the conditions, the Corporate Agent Regulations still restrict a corporate agent, a specified person or a principal officer from becoming or remaining as a director of any insurance company, except with the prior approval of IRDA. An amendment to the Regulations is required to be made.

Executive Directors as Common Director

The Present Circular states that a person who is currently appointed as an Executive Director/ Whole-Time Director on the Board of the Insurer/Agent/Intermediary/Insurance intermediary, shall not be appointed as nominee/common director. However, the restriction shall not be applicable to nominee directors appointed as the nominee director of the promoter of the insurance company.

Common Director appointed as Chairperson

If the common director is proposed to be appointed as Chairperson on the Board of theInsurance Company or the Intermediary, the same may done provided necessary safeguards are ensured to protect the interest of policyholders and to avoid the conflict of interest that may arise due to such appointment.

Existing obligation on Corporate Agents under Annexure 2C

Currently, IRDAI also already restricts common directorship between insurance intermediaries/ agents as well. You may refer to our article on the same here.

Existing Directors

IRDA, vide its clarification dated September 13, 2022[4], has clarified that directors that were appointed with the due approval of IRDAI, can continue to hold office till the end of their tenure.

Actionables from Present Circular:

- Insurers/ Agents/ Intermediaries/ Insurance intermediaries to take note of the additional conditions which will be required to be complied with. In case the same are fulfilled, the appointment of a common director shall not require prior approval. Companies with pending approvals from IRDA to ascertain the compliance with the conditions of this circular, seek necessary declaration from the appointee and ascertain if approval is required or not.

- Insurers will be required to file a certificate duly certified by the CEO affirming compliance with the provisions of the Present Circular on an annual basis, on or before April 30th of the next financial year.

- Further, it shall be ensured that common directors do not hold positions as disallowed under the Present Circular.

[1] https://www.irdai.gov.in/ADMINCMS/cms/frmGeneral_Layout.aspx?page=PageNo3751

[2]https://www.irdai.gov.in/ADMINCMS/cms/NormalData_Layout.aspx?page=PageNo2818&mid=38.2.5

[3] https://www.irdai.gov.in/admincms/cms/frmGeneral_Layout.aspx?page=PageNo2611&flag=1

[4] https://www.irdai.gov.in/ADMINCMS/cms/whatsNew_Layout.aspx?page=PageNo4809&flag=1

Leave a Reply

Want to join the discussion?Feel free to contribute!