Udyam Portal: The pristine MSME Registration Process

-Qasim Saif (finserv@vinodkothari.com)

The Indian government has been taking a number of measures to tackle the disruptions caused by the pandemic, giving special focus on small businesses. The small and medium size businesses form the backbone of any economy, specially developing economies like India, hence, the Micro, Small and Medium Enterprises (MSME) are seen as a key player in promoting momentum in economy once movement restrictions and social distancing norms are lifted. In order to stimulate the post-Covid economic scenarios, it is crucial to focus on the growth and development of the MSME sector.

The definition of MSME comes from section 7 of the Micro, Small and Medium Enterprises Development Act, 2006 (‘Act’) . Based on the proposal of the Finance Minister, he Ministry of Micro, Small and Medium Enterprises on 1st June 2020 via notification, amended the definition of MSME in order to increase the scope and hence bringing larger number of firms within the ambit of MSME. As per the revised definition, the classification is based on the investment and turnover of the entity.

The latest definition of MSME as per the notification is as follows-

| Revised Classification applicable w.e.f 1st July 2020 | |||

| Composite Criteria: Investment in Plant & Machinery/equipment and Annual Turnover | |||

| Classification | Micro | Small | Medium |

| Manufacturing Enterprises and Enterprises rendering Services | Investment in Plant and Machinery or Equipment: Not more than Rs.1 crore and Annual Turnover; not more than Rs. 5 crores |

Investment in Plant and Machinery or Equipment: Not more than Rs.10 crore and Annual Turnover; not more than Rs. 50 crores |

Investment in Plant and Machinery or Equipment: Not more than Rs.50 crore and Annual Turnover; not more than Rs. 250 crores |

The aforesaid definition removes the bifurcation of investment limits for Manufacturing and Service industry which were previously existent. Hence, it is expected that large number of service providers would be covered as they tend to have lesser investment in plant and machinery or equipment and turnover as compared to Manufacturing entity with similar profits.

As the changes in classification are to be applicable from 1st July 2020, the Ministry of Micro, Small and Medium Enterprises have come up with a Notification dated 26-06-2020 which provide for a novel method of registration for MSME (‘Udyam Registration’).

The said notification provides for process for registration of MSME which shall become applicable from 1st July 2020, the requirement of Udyam Registration shall also be applicable on existing MSME’s.

Pursuant to the amendment in the definition of MSME and the introduction of procedure for filing the memorandum under the Udyam Registration, it seems that registration as an MSME shall be a necessity and accordingly be considered as a pre-requisite for availing benefit under the various schemes introduced by the Ministry.

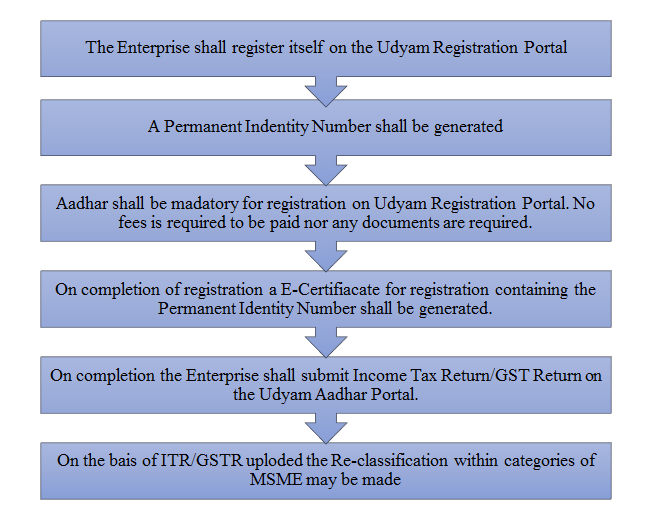

The Process of Registration

Registration on the basis of self-declaration

As per the Udyam Registration requirement it is evident that Udyam Registration can be done on the basis of filing a self-declaration. The relevant extract of the notification states as follows-

“Any person who intends to establish a micro, small or medium enterprise may file Udyam Registration online in the Udyam Registration portal, based on self-declaration with no requirement to upload documents, papers, certificates or proof.”

On review of the registration process on the Udyam Registration portal, it is been observed that the list of major activities contains a specific head for trading activities, land transport as well as an option for selecting ‘Others’. Thus, it may be concluded that trading, transportation and such other activities are included under activities of a service enterprise and shall be required to be registered as an MSME on the Udyam Registration portal.

Requirement of Aadhar

The Aadhaar of following persons shall be required for registration as an MSME.

| Type of Entity | Aadhar of |

| Proprietorship Firm | Proprietor |

| Partnership Firm | Managing Partner |

| HUF | Karta |

| Company / LLP / Co-operatives / Trust / Organisations* | Authorised Signatory |

*PAN and GSTIN of enterprise shall also be required

Non-Availability of Aadhar

In case the person does not have Aadhar, he/she can approach MSME-Development Institutes or District Industries Centres (Single Window Systems) with his Aadhaar enrolment identity slip or copy of Aadhaar enrolment request or bank photo pass book or voter identity card or passport or driving licence and the Single Window Systems will facilitate the process including getting an Aadhaar number and thereafter in the further process of Udyam Registration

Calculation of Investment in Plant, Machinery and Equipment, and Annual Turnover

In order to determine whether the enterprise falls within the limits of MSME and under which category Calculation of amount for Investment in Plant, Machinery and Equipment, and Annual Turnover is required to be calculated.

Plant, Machinery and Equipment.

The Plant, Machinery and Equipment shall have same meaning as under Income Tax Rules, 1962 hence not include land, building and furniture and fittings. Further it shall not include items mentioned in Explanation 1 to Section 7(1) of MSME Act 2006 shall be excluded.

All units with Goods and Services Tax Identification Number (GSTIN) listed against the same Permanent Account Number (PAN) shall be collectively treated as one enterprise and investment figures for all of such entities shall be seen together and only the aggregate values will be considered for deciding the category as micro, small or medium enterprise.

The calculation of investment in plant and machinery or equipment will be linked to the Income Tax Return (ITR) of the previous years. In case of a new enterprise, where no prior ITR is available, the investment will be based on self-declaration of the promoter of the enterprise and such relaxation shall end after the 31st March of the financial year in which it files its first ITR.

However, it shall be noted that in case of new enterprise without any ITR, where calculation is made on self-declaration basis, the purchase (invoice) value of a plant and machinery or equipment, whether purchased first hand or second hand, shall be taken into account excluding Goods and Services Tax (GST).

Turnover

On the similar grounds as investment the turnover shall also be calculated on collective basis for all units with Goods and Services Tax Identification Number (GSTIN) listed against the same Permanent Account Number (PAN) and all such units shall be treated as one enterprise and turnover figures for all of such entities shall be seen together and only the aggregate values will be considered for deciding the category as micro, small or medium enterprise.

Further it shall be noted that the Exports of goods or services or both, shall be excluded while calculating the turnover of any enterprise.

Information as regards turnover and exports turnover for an enterprise shall be linked to the Income Tax Act or the Central Goods and Services Act and the GSTIN. The figures of enterprise which do not have PAN will be considered on self-declaration basis for a period up to 31st March, 2021 and thereafter, PAN and GSTIN shall be mandatory.

Registration by existing MSMEs

In case of existing MSMEs, the registration shall be valid till March 2021. They are required to register themselves under the Udyam Registration portal before the expiry of their registration under Udyog Aadhaar or EM-II.

Updation of information

The registration as an MSME may be obtained based on a self-declaration by the applicant, without submitting any other documents, certificates or proofs of investment in plant and machinery or equipment or turnover. However, once the URM is granted, the MSME is required to update details on the portal, including details of the ITR and the GST Return for the previous financial year and such other additional information as may be required, on self-declaration basis.

Failure to update the relevant information within the period specified [to be specified] in the online Udyam Registration portal will render the enterprise liable for suspension of its status.

Changes in classification

On the basis of information furnished and updated from time to time as well as information from Government sources including ITR/GSTR the classification of enterprise may be changed to a lower to higher category (graduation) or from higher to lower category (reverse-graduation).

In case of graduation an enterprise will maintain its prevailing status till expiry of one year from the close of the year of registration. In case of reverse-graduation of an enterprise, the enterprise will continue in its present category till the closure of the financial year and it will be given the benefit of the changed status only with effect from 1st April of the financial year following the year in which change happened.

Accordingly, it can be inferred that the limits of investment and turnover shall be reckoned on the basis of the ITR and GST returns filed for the previous financial year.

Grievance redressal

The Champions Control Rooms functioning in various institutions and offices of the MSME-Development Institutes along with District Industries Centres in their respective districts shall act as Single Window Systems for facilitating the registration process and further handholding the micro, small and medium enterprises in all possible manner.

In case of any discrepancy or complaint, the General Manager of the District Industries Centre shall undertake an enquiry for verification of the details of Udyam Registration and thereafter forward the matter to the Director or Commissioner or Industry Secretary concerned of the State Government who after giving an opportunity to present its case and based on the findings, may amend the details or recommend to the Ministry of MSME’s, Government of India, for cancellation of the Udyam Registration Certificate.

Further it shall be noted that, if provision for registration under MSME Act, 2006, is violated Section 27 of the Act, provides for a fine which may extend upto one thousand rupees for first conviction and a fine ranging from one thousand to ten thousand rupees for second and subsequent conviction.

Conclusion

The new process provides an easy, quick and simple method for registration that will be linked to information submitted under Income Tax and GST, hence being user friendly as well as keeping a check on reliability of information. The move is intending to promote ease of doing business in lieu of the introduction of Atmanirbhar Bharat scheme.

This process and amended definition would help more MSME to take benefit of government schemes for MSME hence providing them an elevated pedestal to provide a push to kick-start economy after the covid restrictions are lifted.

Our other relevant articles may be referred here:

Does this mean that if me being an MSME and there is an upward change,(Fore ex: From small to medium), the status of small will remaain till 31st March, 2020 as per Clause 8(5) of the 26th June notification?

The Clause 8 (5) state that the prevailing status shall be maintained till expiry of one year from the close of the year of registration. Hence in this case, if there is an upwards change during the FY 2020-21, the status of small enterprise shall remain till expiry of one year from #1st March 2021.

Who can register a msme?