Reprieve for banks and NBFCs

One-time restructuring of stressed MSME accounts

By Simran Jalan (simran@vinodkothari.com)

Introduction

The Non-Performing Asset (NPA) rates in the Micro, Small and Medium Enterprises (MSMEs) segment have remained stable and range bound. In the Micro segment the NPA rate has moved from 8.9%[1] in March, 2017 to 8.8% in March, 2018. In SME segment, the NPA rate hovered between 11.4% in march, 2017 to 11.2% in March, 2018. Recognised NPA exposure for MSMEs is Rs. 81,000 crores as on March, 2018. While the growth in the NPA rate has moderated, it is too early to conclude that the NPA problem is close to bottoming out.

The RBI, in its board meeting held on November 19, 2018[2], was advised by the Board to consider a scheme of restructuring of stressed standard assets of MSME borrowers with aggregate credit facilities of up to Rs. 25 crores, subject to such conditions as are necessary for ensuring financial stability.

Subsequently, RBI has notified[3] a new one-time measure permitting restructuring of stressed MSME[4] accounts, and save the same from turning to NPAs. This notification is a step to solve the problems of liquidity and cash crunch as faced by the MSMEs which would in turn help in promotion and growth of MSMEs.

Brief measures of the previous notifications

Earlier, RBI had issued a notification[5] in February for every GST registered MSMEs. Pursuant to the said notification, exposure of banks and NBFCs to a MSME borrower were allowed to be classified as a ‘standard asset’, in case the amount remains overdue as on September 1, 2017 and payments from the borrower due between September 1, 2017 and January 31, 2018 are paid not later than 90/180 days from their respective original due dates. Further, the said classification was subject to the following condition:

- the account was classified as standard in the books of the lender as on August 31, 2017, and

- the overdue amount is paid within a period of 180 days from the original due date.

Further, RBI issued another notification[6] in June extending the scope of the same till December 31, 2018 covering MSME account also not registered under GST within its purview. Accordingly, all MSME accounts shall be classified as ‘standard asset’ if the payments due from the borrower as on September 1, 2017 and falling due thereafter up to December 31, 2018 were/are paid not later than 180 days from their original due date. Provided they were classified as standard in the books as on August 31, 2018.

Scope of this notification

This notification is addressed to all banks and NBFCs regulated by the RBI, irrespective of their regulatory classification. This notification attempts to cover all such MSMEs that are either registered under the GST Act or are exempted from GST registration.

Further, RBI has come up with this notification to cover all the MSMEs as defined under the MSMED Act, irrespective of the fact that whether they have registered themselves under the Act or not.

Pre-eligibility criteria

The prescribed criteria for an MSME account to be eligible to be restructured under this notification are as follows:

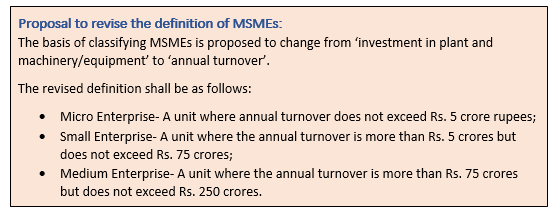

- The borrower must be a MSME as defined under the MSMED Act, not necessarily registered;

- The aggregate exposure of banks and NBFCs to an MSME borrower must not exceed Rs. 25 crores;

- The MSME account must be GST-registered on the date of implementing restructuring or exempted from the GST registration; and

- The MSME account must be a standard asset as on January 1, 2019, tottering to become an NPA.

Highlights of the Notification

| SR. No. | Contents |

| 1. | One-time restructuring of existing loans to MSMEs classified as ‘standard’ without a downgrade in the asset classification. |

| 2. | Restructuring must be implemented on or before March 31, 2020. |

| 3. | Provision of 5% to be created in addition to the existing provision for standard asset. |

| 4. | Post-restructuring, the NPA classification shall be as per extant norms. |

| 5. | Appropriate disclosures to be made in the financial statements of banks and NBFCs |

| 6. | A board approved policy to be in place, within one month from the date of the notification. |

| 7. | The provisions created can be reversed provided the account demonstrates a satisfactory performance. |

Contents of the notification

Asset classification benefit

The notification provides that all GST-registered or exempted MSME accounts that have defaulted but are still classified as a standard asset as on January 1, 2019 and continues to be a standard asset till March 31, 2020 or till the date of implementation of the restructuring, whichever is earlier, are permitted a one-time restructuring of the existing loans.

To take the benefit of this notification, the debt obligation of the MSMEs must not exceed Rs. 25 crores for fund as well as non-fund based facilities from banks and NBFCs.

Further, post-restructuring, NPA classifications of these accounts shall be as per the extant IRAC norms.

Placing a Board approved policy

Banks and NBFCs who are desirous of providing the restructuring benefit under this notification to the MSMEs are required to put in place a Board approved policy on restructuring of the MSME advances within a month from the date of this notification. This policy shall include framework for viability assessment of the stressed accounts and regular monitoring of the restructured accounts.

Implementation of the restructuring scheme

The restructuring of the stressed MSME account may be implemented on or before March 31, 2020.

A restructuring would be treated as implemented if the following conditions are met:

- The execution of necessary agreements and all related documentation are completed by all lenders.

- The books of the lenders and borrowers reflect the new capital structure and the changes in the terms and conditions of the existing loans.

Total provisions to be created

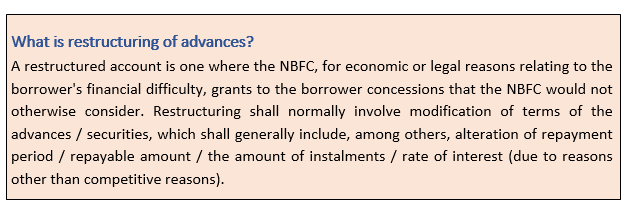

Banks and NBFCs lending to the MSMEs are required to create an additional 5% provision in respect of accounts restructured. At present, Banks and NBFCs are liable to create 0.40% provision in respect of standard assets and 10% provision in respect of sub-standard assets. However, subsequent to this notification, the assets shall continue to be classified as standard asset and provision at the rate of 5.4% (5%+0.4%) shall be created on the restructured asset.

Disclosure requirements

The financiers providing finance to the MSMEs shall make appropriate disclosures in their financial statements, under ‘Notes to Accounts’, relating to the MSME accounts restructured as per the prescribed format.

Some thinkers

Are all the ongoing transactions covered?

The notification provides the benefit of restructuring to the borrower who has defaulted in repayment of loan or shows sign stress but the account is still classified as a standard asset as on January 1, 2019 and continues to be classified as a standard asset till the date of implementation of the restructuring. The restructuring of the borrower account has to be implemented on or before March 31, 2020.

Therefore, only the transactions done before January 1, 2019 are covered under this notification.

When can the provision be reversed?

Banks and NBFCs can reverse such provisions when the MSME account demonstrates a satisfactory performance during the specified period. The satisfactory performance has been defined in the notification to mean that no payment of either interest or principal shall remain overdue for more than 30 days.

What all accounts can be brought under this Scheme?

- It must be standard, that is, the overdues must not be more than 90 days (180 days in case of non-systematically important NBFCs).

- It must be, however, tottering towards turning NPA or else, there is no reason for the lender to take a 5% hit and restructure.

- It must be an MSME as defined in the MSMED Act, satisfying the prescribed pre-eligibility conditions.

What does the term ‘aggregate exposure’ mean?

The term ‘aggregate exposure’ means the net credit facility, including non-fund based facilities, availed by a single MSME. An MSME must not have availed more than Rs. 25 crores from the banks and NBFCs, collectively.

Further, in case of fund-based facilities, the limit of Rs. 25 crores shall be determined based on the principal amount outstanding as on January 1, 2019.

Probable effect of this notification

This notification provides a one-time benefit to the stressed MSME accounts to restructure themselves and still be classified as a standard asset post restructuring. As a general rule, barring this one-time exception, any MSME account which is restructured must be downgraded to NPA upon restructuring and will slip into progressively lower asset classification and higher provisioning requirements as per extant IRAC norms.

Prior to his notification, if an MSME account is restructured, then the stressed asset is downgraded to NPA and therefore, the respective bank or NBFC is required to make a provision of 10% (as applicable on sub-standard asset). However, for any restructuring done under this Notification, banks and NBFCs will be required to maintain a provision of 5.4% on the restructured MSME account.

This notification is a motivation for the banks and NBFCs to provide concessions to the stressed MSME accounts and avail the benefit of creating lesser provision. Further, it is also expected to help the MSMEs solve their liquidity problems which would in turn foster their growth.

Conclusion

MSMEs play a significant role in the India economy and they are vital for economic ascension. Government is taking several initiatives to accelerate MSMEs growth. However, the MSMEs are facing cash crunch and liquidity problems. Further, greater number of NPAs amounts to scarcity of funds in the economy also at the same time it results in meagre generation of revenues to banks and NBFCs. In order to solve the liquidity concerns faced by MSMEs, the RBI has come up with this notification to restructure the NPA classification for MSMEs. The relaxation of lending norm is expected to spur growth of the MSMEs and thereby expected to bring relief to the whole economy.

However, the question arises is that whether this notification is a New Year’s gift to banks or to NBFCs? At least for the NBFCs who are fighting currently for oxygenating liquidity, a measure that helps their treasuries would have been far more welcome than what supports their profit and loss accounts.

[1] https://sidbi.in/news_events/Press-Release-MSME-Pulse-II-20.6.18-Final.pdf

[2] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=45523

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11445&Mode=0

[4] http://pib.nic.in/newsite/PrintRelease.aspx?relid=176353

[5] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11216&Mode=0

[6] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11289&Mode=0

You can also refer our articles on:

Transitory liberalisation of asset classification norms

Leave a Reply

Want to join the discussion?Feel free to contribute!