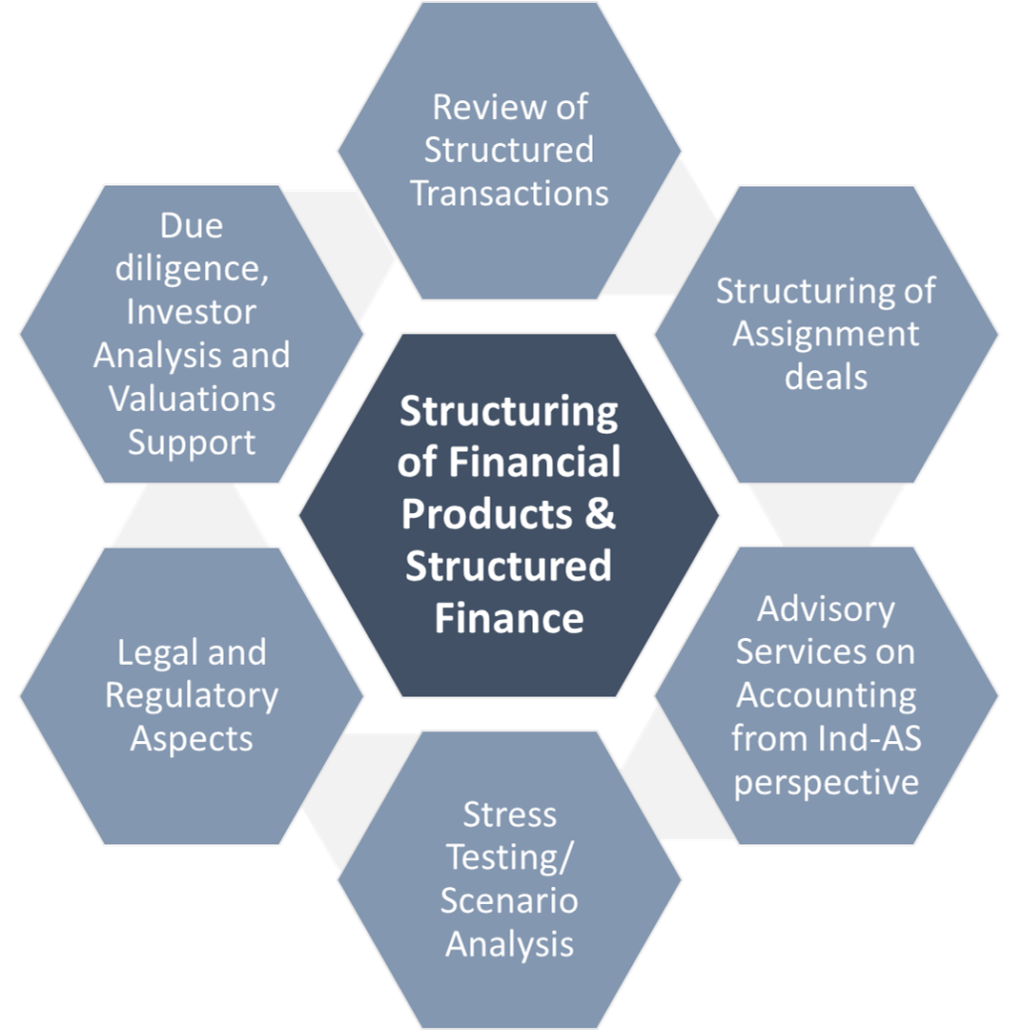

We provide consultancy & advisory services in the following areas:

- Carry a review of the transaction for specific attributes of the pools, including financial and operational aspects such as:

- Cashflows

- Credit Enhancement

- Capital Relief

- Waterfall Mechanism

- Assignment/transfer of security interest

- Tax efficiencies: Direct Tax, Indirect Tax, Stamp Duty

- Accounting aspects

- Operational feasibility and modalities

- Review in accordance with the applicable regulatory guidelines, including transfer of loan exposure/Securitisation of Standard Assets guidelines and other RBI guidelines, to the extent applicable

- Devising structure for the transfer/securitisation based on requirements of the entity, and/or investors in such transactions, keeping in light the intention to enter into such transactions and the regulatory provisions

- Advising on the structuring and day to day queries faced by Company

- Ensuring efficiency of the structure considering and accounting, taxation and financing aspect

- Structuring deals for derecognising the assets under IFRS/Ind AS

- Assistance/hand holding in the implementation of structures

Providing advisory services pertaining to accounting for assignment transactions, under Ind AS 109 and other relevant accounting standards. This includes:

- Fair valuation of the asset portfolio

- Computation of any expected credit losses, etc.

- Advising on derecognition of assets under IFRS/Ind AS

- Other aspects such as income recognition etc

Regulators worldwide require banks to stress-test their exposures. In India, the RBI guidelines, require Investors (Banks/FIs/NBFCs) to regularly perform their own stress tests appropriate to their purchased positions. The results of stress test should be taken into account in Pillar II exercise under Basel II framework and additional capital be held to support any higher risk, if required.

Further, banking institutions also need to comply with the ICAAP guidelines on Stress Testing as per Pillar 2 of the Basel II framework.

The required stress test analyses incorporate sound economic forecasting, an understanding of the impacts of economic changes on borrower behavior and defaults, and structural data on specific structured finance deals to develop reliable estimates of values and risks in the current market.

Stress Testing – steps in brief:

- Design economic and deal specific scenarios: Macro-economic factors impacting the particular asset class are identified and economic forecasts are built under various conditions. Each forecast represents a plausible scenario

- Establishing statistical relationship – Econometric model: Each loan is classified in a risk class/group that can be ranked from low to high risk. Empirical data are used to establish relationship between loan level repossessions/repayments/defaults and the various macrovariables identified. This is done via a probability model, which, by the use of grouped data, can be transformed into a regression model.

- Simulations / Scenario Testing: Analysing the risk factors that may impact the underlying pool, and stressing each of the risk factors to their theoretical but plausible levels. Important risks which are analysed are – correlation, concentration, decrease in the value of the underlying security/collateral, shifts in the probability of default across the loans in the pool, etc

- Advisory on transfer/securitisation of standard loans on applicable regulatory provisions,

- Drafting/ Review of policies for transfer of loan exposures/Securitisation of standard assets

- Carry out assessment of arm’s length criteria for transactions between related parties

- Providing detailed written opinion on legal and or regulatory aspects

- Providing legal opinion on transfer of loan exposure as per the TLE Directions

- Providing legal opinion on securitisation of standard assets

- Assisting in drafting responses to regulatory/audit concerns on the structure of the deal

- Carry out a macro due diligence to point out any specific risk attributes of the pools.

- Provide support to the Investors on the valuation of the structured finance securities/facilities, be it for mark-to market accounting purposes or for the purpose of shareholder/ management evaluation.

- Provide Investor level analysis for making buy-side decisions on asset pools. This includes, end-to-end analysis of all the transactional level aspects, detailed understanding of the structure of the deal and risk underlying the loan portfolio.

- Identifying the risk underlying the individual asset position – this involves analysis of structural features, sensitivity of the pools to the interest rates and prepayments, the waterfall mechanism, and expected defaults.

- Identifying the risk characteristics of the loans assigned under the transaction – this involves analysing the credit quality of the loans on the basis of diversification/homogeneity of the loan pool, analysing the defaults, losses and prepayment on the individual loans based on the loan features/characteristics as well as macro-economic indicators

- Static analysis (vintage performance analysis) – to figure out loss/default experience in previous pools of the originators in the relevant exposure classes underlying.

Our buy side analysis and valuations support are based on comprehensive analysis of both loan and pool level features, structural and vintage data analysis. This includes:

- Cash flow analysis is a critical part of the direct assignment transactions.

- Our team of cash flow experts has global experience in building cash flow models and to reverse-engineer transactions assuming various liability structures and stress scenarios.

- Our cash flow models are very comprehensive and incorporate each and every aspect of the deal from loan level data to the tranche payments and the detailed waterfall

- Our models also include development of probability distribution for defaults and losses with imbedded scenario analysis.

- Carrying out risk profiling and end-to-end analysis of the transactions which involves analyses of the business model of the Originators

| Securitisation in India | Transfer of Loan Exposures |

| Securitisation in India is now gradually becoming a preferred channel for the Originators/Issuers (Banks/FIs/NBFCs) in sourcing of funds and credit risk mitigation; as well as for the Banks/FIs/MFs as an attractive investment option. Securitisation investing is fast moving away from the traditional mould of priority sector investing; it is now attracting investors with a view on yields, better credit, possibility of arbitrage profits, and so on. As investors’ attention to securitisation is intensifying, the need for understanding the pools, their inherent risks, data analytics, etc. cannot be over-emphasised. It is also important to examine very closely the inherent tenacity of the transaction to withstand questions on legal structure, bankruptcy remoteness and so on – issues which were never seen seriously enough in the past. Further investors in securitisation need to put in place systems for robust risk analysis, timely credit monitoring and stress testing of the securitisation exposures. Risk analysis of securitisation investing is not merely a regulatory requirement; it is prudential requirement as well. From regulatory stand-point, investors not following the minimum risk evaluation requirements would have to assign higher risk weights to their securitisation exposures. Considering the complexity of securitisation transactions, it also otherwise becomes important for the Investors to engage in close examination of the credit quality and valuation of securitized transactions. A reliable, quantitative assessment of the risk in your structured finance holdings is necessary to build valid and timely valuations; informed decision-making including decisions to hold, sell, or hedge assets; estimate risk capital; and assess loss reserves. Vinod Kothari Consultants, with the vast experience and capabilities in the securitisation space, helps institutional clients in their investment decisions as well as risk management of their securitisation exposures. Broadly speaking, we provide below services to the Banks/FIs/NBFCs: – Cash Flow Modeling / Analytics – Due diligence, Investor Analysis and Valuations Support – Advisory services on Accounting from Ind-AS perspective – Stress Testing / Scenario Analysis | Transfer of Loan Exposures/ Assignment (TLE) is one of the preferred channels for the Originators (FIs/NBFCs/HFCs) in sourcing of funds and credit risk mitigation; as well as for the Banks/FIs/MFs as an attractive investment option. TLE has always been a key component of Bank’s priority sector pools. However, it is fast moving away from the traditional mould of priority sector investing; it is now attracting institutional investors with a view on yields, better credit, possibility of arbitrage profits, and so on. The need for understanding the pools, their inherent risks, data analytics, etc. cannot be over emphasised. It is also important to examine very closely the inherent tenacity of the transaction to withstand questions on legal structure, derecognition and so on – issues which were never seen seriously enough in the past. Further, participants in such transactions need to put in place systems for robust risk analysis, timely credit monitoring and stress testing of their exposures. Risk analysis is not merely a regulatory requirement; it is prudential requirement as well. Considering the complexity of transactions, it also otherwise becomes important for the Investors to engage in close examination of the credit quality and valuation of the assignment transactions. A reliable, quantitative assessment of the risk in your structured finance holdings is necessary to build valid and timely valuations; informed decision-making including decisions to hedge assets; estimate risk capital; and assess loss reserves. Vinod Kothari Consultants, with the vast experience and capabilities in the said space, helps institutional clients in their investment decisions as well as risk management of their assigned/bought pools. Broadly speaking, the following services are provided to Banks/FIs/NBFCs: – Review of transactions from legal, regulatory, taxation and accounting aspects – Structuring transactions considering requirements of entity – Advisory on regulatory aspects – Advisory services on Accounting from Ind-AS perspective – Stress Testing / Scenario Analysis – Cash Flow Modeling / Analytics – Due diligence, Investor Analysis and Valuations Support |

We are able to offer these types of services because of the depth and breadth of our in-house expertise.

We have done numerous consulting assignments on securitisation and our clients include some of the top Investment Banks, Rating Agencies, Government Agencies, Securities and Exchange Commissions, Financial Institutions and NBFCs in India and globally.

Advisory/Consulting Assignments:

- Currently engaged by World Bank for a high profile assignment on mortgage securitisation in India

- Regular advisor for Karur Vysya Bank, for their direct assignment and securitisation transactions – provided transaction advisory and stress testing services – we have advised them on at least 15 transactions so far dealing with gold loans, auto loans, housing loans, SME loans etc.

- Advised HDFC AMC from the investor’s perspective for one their investments in a securitised paper backed by receivables from a service contract

- Stress testing (ICAAP) of LAP pools acquired by ECL Finance Limited

- Ind-AS advisory on de-recognition of financial assets, computation of gain on sale etc. for Magma Fincorp Limited

- Structuring of consumer durables securitisation for Home Credit India

- Advisory on home loan securitisation by an Indian housing finance company, India Shelter

- Advisory on securitisation transaction for Indian MFI, Satin Creditcare

- Ind-AS advisory on de-recognition of financial assets, computation of gain on sale etc. for Orix India

- Valuation and structuring of securitisation transactions for a financial institution in Morocco

- Comprehensive modeling and structuring consulting to a South African boutique investment bank on securitisation of mortgage loans.

- Comprehensive consulting on securitisation of consumer finance receivables in Malaysia.

- Structuring of a transaction involving securitisation of pawn receivables in Sri Lanka

- Assisting the South African Revenue Service (income-tax department of South Africa) in preparation of a taxation manual for securitisation and synthetic securitisation transactions.

- Retainership with Citibank for their securitisation activities in the country.

- Advising Cognizant Technologies, IT Company headquartered in the USA, on structuring and modeling of residential mortgage backed transactions.

- Advising Infosys Technologies, a leading IT company, to set up the functional requirements for a securitisation module to be added to their software products.

- Advising GE Capital, a leading finance house, on several of their securitisation transactions.

- Advised the SEBI on drafting of the regulations relating to listing of asset backed securities.

- Advised the SEC, Sri Lanka on drafting of the securitisation law.

- Assistance in preparation of draft securitisation law of Nigeria

- Our services were retained for 2 years by CARE a rating agency on a retainership basis for advisory on structured finance transactions.