RPT compliances by subsidiaries of listed entities (Presentation)

– Vinita Nair & Sikha Bansal | corplaw@vinodkothari.com

Loading…

Loading…

Our Related Party Transactions Resource Centre can be accessed here

– Vinita Nair & Sikha Bansal | corplaw@vinodkothari.com

Loading…

Loading…

Our Related Party Transactions Resource Centre can be accessed here

– Team Corplaw | corplaw@vinodkothari.com

Loading…

Loading…

– Team Corplaw | corplaw@vinodkothari.com

SEBI, vide its notification dated November 09, 2021 amended the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) carrying out radical changes in the regulatory framework for the Related Party Transactions (‘RPTs’), including but not limited to the definition of Related Party (‘RP’), RPTs, its approval mechanism and disclosure requirements to the stock exchange. The amended provisions have been effective from April 01, 2022, except for the few provisions which will be applicable w.e.f. April 01, 2023. Information to be placed before the Audit Committee and shareholders (in case of material RPT) and the format of disclosure of RPTs to be filed with the Stock Exchanges (‘SEs’) has been separately prescribed vide SEBI Circular dated November 22, 2021. The circular was also made applicable to High Value Debt Listed Entities (‘HVDLEs’)[1] vide SEBI Circular dated January 7, 2022.

Read more →

– Whether, when and how much?

Team Corplaw, Vinod Kothari & Company (corplaw@vinodkothari.com)

Regulation of remuneration to managerial personnel (viz., directors, managing director, manager) (“managerial remuneration”) is an important aspect of corporate governance. Sections 197 of the Companies Act, 2013 (“Act”) read with Schedule V impose limits on managerial remuneration. Additionally, Section 197 (12) read with Rule 5 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 requires certain disclosure of managerial remuneration as a part of the board report, in particular, the ratio of remuneration of each director to the median remuneration of employees; percentage increase of remuneration of each director, CEO, CFO, CS or manager in a financial year; comparison of percentile increase in managerial remuneration with percentile increase in remuneration of employees other than managerial personnel etc.

Akin to India, laws globally also keep checks over managerial remuneration. Although laws in countries like the US, UK, Switzerland, etc. do not require approval from any government authorities, suitable control is ensured through shareholders, or appropriate disclosures. There have been corporate disputes around managerial remuneration in the UK where stockholders have challenged payments made to the CEO, having been paid large salaries and bonuses [Feuer v. Redstone][1]. The global practices of disclosing managerial remuneration to the shareholders has been discussed in the later part of this article.

The same has a potential of conflict of interests, since the matter relates to the direct pecuniary interest of the decision-makers of the company. In view of the same, while limits are provided in the Act itself, a partial control is being exercised on the matter through the requirement of shareholders’ approval (earlier, Central Government’s approval was required in case of payment of managerial remuneration in excess of the specified limits under Section 197, the same has now been omitted).

In this article, the authors attempt to demystify some questions revolving around the concept of managerial remuneration, as follows –

While we focus on throwing light on the treatment of ESOPs as managerial remuneration from the viewpoint of the statutory limits and approval requirements in terms of the Act and the Listing Regulations[2],the taxation and accounting aspects of the ESOPs are also discussed briefly in this article.

There exists a nexus between compensation and motivation. The corporates appreciate this fact and have taken progressive steps to upheave the same. One move towards this is the Employee Stock Option Purchase or ESOPs. The ESOPs are based on the principle that an adequately compensated employee would work diligently and help in wealth creation for the stakeholders which in turn would help the Company to grow. ESOPs embrace this consensual approach. Stock Options or ESOPs as we call it, entitles the holder of the option with a right to convert such options into stock of the company at a future date.

ESOPs are frequently used as a measure to reward employees, including directors and other key managerial personnel. Dylon Minor, in his CEOs with Lots of Stock Options Are More Likely to Break Laws, published by Harvard Law Review, states that “For many executives, the bulk of their compensation comes in the form of equity compensation, which includes both stock options and stock awards”. The figures show the proportion of stock options and stock awards along with other components of compensation paid to chief executive officers (CEO) and non-executive officers (NEO) of the top companies included under the Russell 3000 Index. In the year 2020, around 64.6% of CEO’s compensation consisted of stock options and stock awards, whereas, the same constituted about 56% of the compensation mix of the NEOs. In view of the significance of managerial remuneration in corporate governance of a company and the remarkable magnitude of stock options, it becomes crucial to identify its impact on the managerial remuneration, so as to ensure that proper approvals and disclosures are in place with respect to such stock options.

Remuneration as defined under 2(78) of the Companies Act, 2013 means;

“any money or its equivalent given or passed to any person for services rendered by him and includes perquisites as defined under the Income-tax Act, 1961.”

Further, in terms of clause (vi) of Section 17(2) of the Income Tax Act, 1961 (“IT Act”), perquisites includes – (vi) the value of any specified security or sweat equity shares allotted or transferred, directly or indirectly, by the employer, or former employer, free of cost or at concessional rate to the assessee.

Explanation.—For the purposes of this sub-clause,—

(a) “specified security” means the securities as defined in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 (42 of 1956) and, where employees’ stock option has been granted under any plan or scheme therefore, includes the securities offered under such plan or scheme.

Further, Schedule V of the Act requires some disclosures to be made in the “corporate governance” part of the board’s report, relating to the managerial remuneration such as –

“(i) all elements of remuneration package such as salary, benefits, bonuses, stock options, pension, etc., of all the directors;

XX

(iv) stock option details, if any, and whether the same has been issued at a discount as well as the period over which accrued and over which is exercisable.”

Similar disclosures are required to be made in the “corporate governance” section of the Annual Report of a listed company, in terms of Schedule V of the Listing Regulations.

These disclosure requirements establish beyond doubt that the ESOPs are included under the managerial remuneration, and therefore, the provisions, as applicable to the other components of managerial remuneration, are applicable to ESOPs mutatis mutandis.

The above explains that ESOPs are certainly treated as part of remuneration. The rationale for the same is based on the concept of Cost to Company (“CTC”). One may question as to how the same can be treated as cost to the company, since there is no explicit payout by the company for ESOPs. Let us understand the same with the help of the table below –

| Price at which ESOPs are granted | Cost to the company | Benefit to the employees |

| Market price on the date of grant | Intrinsic value – Nil Time value – difference between market price on the date of exercise and on the date of grant | The employee gets a right to obtain equity shares of the company at a later date, without paying the premium accrued on the time value of the equity shares. The employee has the right to the upside in the price of the shares, without getting exposed to the risk of downside movement in prices of the shares at the time of exercise |

| Market price on the date of exercise | Nil | Such options are as good as purchase of shares from the market directly. There is no motivation to the employees in getting such options and therefore, completely redundant and practically ruled out. |

| Any price lower than the market price on the date of grant | Intrinsic value – difference between market price on the date of grant and exercise price offered by the company Time value – difference between market price on the date of exercise and on the date of grant | The employee gets a right to obtain equity shares of the company at a later date, without paying the differential value between the actual market price on the date of exercise and the price at which the options have been exercised to the employee. |

The company, by providing stock options that permit an employee to obtain equity shares of the company at a particular price, forgoes its claim to a higher value, which is no different from an expense. Given the fact that the options will be exercised only where the exercise price is lower than the prevailing fair value of the share, the exercise reduces the market capitalization of the company on the date of actual exercise of the option by the employee. Thereby, there is a loss in shareholder value, and hence, there is cost to the company.

In view of the arguments above, we have no doubt in holding that ESOPs are as much a cost to a company as any other pay-outs given to managerial personnel. Therefore, to the question “whether ESOPs may be considered a part of the managerial remuneration”, the answer is certainly in the affirmative.

That brings us to the question of “when” and “how much” of ESOPs are to be treated as managerial remuneration. We approach this question with prefatory remarks such as, the various stages of ESOP cycle, valuation of options, accounting and tax treatment of ESOPs, etc.

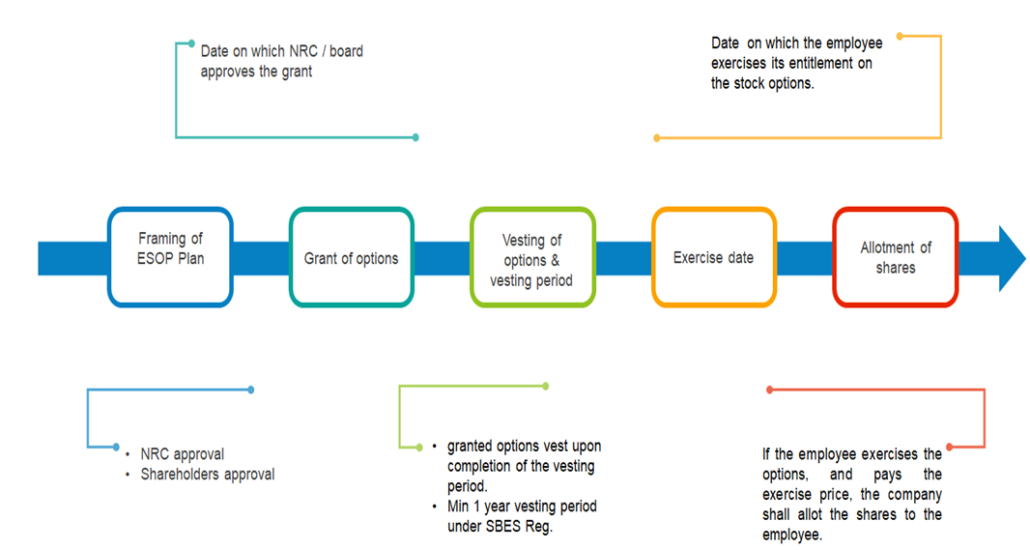

The whole cycle of ESOP passes through a series of stages as discussed below –

The different stages of the ESOP cycle results in varying practices in treating the same as part of managerial remuneration, which we will discuss in the later part of this article.

Valuation for ESOPs can be done by following either of the two methods:

Intrinsic Value, in case of a listed company, is the amount by which the quoted market price of the underlying share exceeds the exercise price of an option or the value of the underlying share determined by an independent valuer in case of an unlisted company, exceeds the exercise price of an option.

For example, an option with an exercise price of INR 100 on an equity share whose current quoted market price is INR 125, has an intrinsic value of INR 25 per share on the date of its valuation.

Accordingly, if the market price of the underlying share at the grant date is the same as the exercise price, then the intrinsic value of the options is Nil.

Ind AS- 102 (“Standard”) also provides for valuation under IVM, in those exceptional cases where fair value of the equity instruments cannot be estimated reliably (Para 24). However, Income-tax law is concerned with intrinsic value only, since income tax law taxes the option as a perquisite only on the exercise date. Given the fact on the exercise date, the time value is always zero, whatever value the option has is its intrinsic value only.

In terms of Ind AS 102, in the books of the company, ESOPs are to be recognized at an estimated fair value of the options from the date of grant of options, spread over the vesting period (if any). Fair value of an ESOP is estimated using an option-pricing model like the Black-Scholes or binomial model on the date of grant. In the case of listed stocks, Black Scholes method is the most commonly used model. The model takes into consideration the exercise price of the option, life of the option, current price of underlying shares, risk-free interest rate, expected volatility of the share, expected dividend and the tenure at the end of which the options vest (Para B6 of Ind AS 102).

While we understand that ESOPs are to be treated as a part of managerial remuneration, the question is, at what stage, and with what valuation. There are possibly three approaches to the regulation of managerial remuneration:

We discuss below why approach (a) and (b) both lead us to incoherent results as far as regulation of managerial remuneration is concerned.

The tax treatment of ESOPs needs to be examined from the point of view of the employer as well as the employee. In the hands of the employer/ company, the cost of the options entails a tax deduction, and the benefits are taxable in the hands of the employee as perquisites.

Since the definition of “remuneration” under section 2(78) of the Companies Act refers to perquisites as defined under Income-tax Act, the most obvious approach, which seems very tempting to accept, is that ESOPs become a part of remuneration when they become taxable, and based on how much value they become taxable. Thus, the timing of treating the ESOPs is the time of exercise, and the amount at which it is taken as remuneration is the difference between the fair value at the time of exercise, and the exercise price.

While for the purposes of the discussion contained herein, the taxability in the hands of the employee is relevant and deserves consideration, we have also included the tax deductibility of the ESOPs in the hands of the company, for a comprehensive understanding.

As far as the tax deductibility of the ESOP expense in the hands of the company is concerned, the same is deductible as debited in accordance with generally accepted accounting principles. As the cost of the ESOPs is an employee benefit expense, it is to be considered under the generic provisions under Section 37 (1) of the IT Act.

The debit happens from the date of grant over the vesting period, at par with the accounting treatment. Such deduction is allowable for tax purposes, as held in various rulings, such as the Commissioner Of Income – Tax vs M/S Biocon Ltd [I.T.A. No.653 of 2013] and M/s. Lemon Tree Hotels Ltd., New Delhi v. Addl. Cit, New Delhi [I.T.A. No. 4588/Del/2013].

The Mumbai ITAT, in the matter of Unnikrishnan V S Vs. Income Tax Officer, International Taxation 4(3)(1), Mumbai [ITA Nos. 1200 and 1201/Mum/2018 ] has held that while the ESOPs are taxable at the time of exercise of the options by the employees, the benefits accrue from the date of grant of options itself and during the tenure of vesting period. The learned Tribunal stated that –

“The character of income may be inchoate at that stage but certainly what is being sought to be taxed now, on account of the specific provision under section 17(2)(vi), is a fruit of services rendered much earlier and the benefit, which has now become a taxable income, accrued to the assessee in 2007. All that section 17(2)(vi) decides is the timing of an income, but it does not dilute or negate the fact that the benefit, in which is being sought to be taxed, had arisen much earlier i.e. at the point of time when the ESOP rights were granted.” [Emphasis supplied]

As mentioned above, ESOPs are identified as perquisites for the provisions of IT Act, and therefore, become a part of the remuneration on the exercise date at a value which is the exercise price as reduced from the Fair Market Value (FMV) of the underlying equity shares. FMV is calculated as per Rule 11UA of the Income Tax Rules, 1962. In the case of listed stocks, the listed price is the fair market value. Further, capital gains may arise at the time of sale of shares by the employee, being the difference between the FMV on exercise date, and the actual realization upon sale of shares.

Our article, Employee share based payments: Understanding the taxation aspects, contains a detailed elaboration of the same.

Now let us take help of an example to understand the implications if ESOPs are taken as part of managerial remuneration from the taxation perspective as discussed above.

Company A grants 5,00,000 options to Mr. X, the Managing Director, with the following information:

| Grant date | Vesting Date | Exercise date | |

| Market value | 100 | 150 | 200 |

| Exercise price | 50 | 50 | 50 |

| Date | 1st April, 2022 | 1st April, 2025 | 1st April, 2027 |

| Value of the option | |||

| Fair value (as computed by option pricing model) | Say, 80 | Say, 140 | 150 |

| Time value (diff. Between fair value and intrinsic value) | 30 | 40 | 0 |

| Intrinsic value (market value – exercise price) | 50 | 100 | 150 |

In the instant case, the perquisite value to be included in the remuneration will be Rs. (200-50), i.e. Rs. 150. The same, being exercised in April, 2027, shall form part of the remuneration of Mr X in the FY 2027-28 and therefore, the same has to be calculated as a percentage of the net profits for FY 2027-28, to identify whether the remuneration exceeds the limits given under Section 197 of the Act.

Therefore, going by the income-tax approach, the entire value of Rs. 150 will be treated as managerial remuneration at the time of exercise. One may note that there is a huge difference between the accounting treatment, accounting cost is Rs. 80, spread over the vesting period.

However, there are several issues with treating ESOPs based on taxability for the purpose of regulation of managerial remuneration.

It has to be understood that the ESOPs are a cumulative payment for the services rendered over a period of years, and not solely related to the year of exercise. This is also substantiated by the ITAT in the matter of Unnikrishnan V S (supra). Recognising ESOPs as part of managerial remuneration as per its taxability in the hands of the recipient will lead to a situation where the ESOP, though pertaining to the services rendered for a cumulative set of financial years, only be considered for the calculation of managerial remuneration for a particular year. This approach therefore is inconsistent and does not seem reasonable.

Under the provisions of Ind AS- 102, ESOPs shall be recognised by the company in its books, on i.) the grant date (where options vest immediately) or ii.) during the vesting period (where there is a vesting period) at the fair value of the options.

This standard states that in case of equity settled options, the company shall recognise the services received by it from an employee on the date of grant of options to the employee, till the date of vesting. There is, accordingly, a debit to employee benefit expense, and credit to equity by way of creation of a reserve in this regard.

The relevant para(s) of the Standard has been produced herein below:

10 For equity-settled share-based payment transactions, the entity shall measure the goods or services received, and the corresponding increase in equity, directly, at the fair value of the goods or services received, unless that fair value cannot be estimated reliably. If the entity cannot estimate reliably the fair value of the goods or services received, the entity shall measure their value, and the corresponding increase in equity, indirectly, by reference to the fair value of the equity instruments granted.

11 To apply the requirements of paragraph 10 to transactions with employees and others providing similar services, the entity shall measure the fair value of the services received by reference to the fair value of the equity instruments granted, because typically it is not possible to estimate reliably the fair value of the services received, as explained in paragraph 12. The fair value of those equity instruments shall be measured at grant date.

The above case refers to recognising ESOPs as CTC on grant date. However, where there is a predetermined vesting period, the same shall be recognised during the vesting period and not on the grant date. [refer to para 14 and 15 of the Standard].

Comparison of i.) (immediate vesting) and ii.) ( vesting on satisfaction of vesting conditions and/or a vesting period)

| Basis | i.) on grant date | ii.) during vesting period |

| Vesting period | In cases where options vest immediately upon granting | In cases where there is a vesting period viz. a specified period of service is required to be completed |

| Receipt of services | Presumption that services (as consideration of equity shares) has been received | Presumption that services will be received during vesting period |

Let us take an example to understand the manner in which the value of the ESOPs under managerial remuneration will be recognised applying the logic of the accounting standards.

i.) Options granted on grant date with immediate vesting

Company A grants 5,00,000 options to Mr. X. Grant date – January 1, 2022.

In this case the 5,00,000 options shall vest with Mr. X on January 1, 2022 at fair value of the options. Let’s say the exercise price of the option is fixed at Rs. 50. The fair value of the options shall be recognised in the year of grant i.e. in FY 2021-22, and amounts to Rs. 120. The accounting entry shall be:

Recognition of services as an expense:

Director’s Remuneration a/c … Dr {less from P/L}

To Outstanding Options {increase in liability}

This will result in an increase in the managerial remuneration of Mr. X in the FY 2021-22 by Rs. (120-50)*5,00,000 = Rs. 3,50,00,000.

ii.) Options granted with a vesting schedule spread over 3 years

Company A grants 5,00,000 options to Mr. X. Grant date – January 1, 2022. The vesting period is fixed at 3 years from the date of grant. The exercise price of the options are Rs. 50. Fair value of the option as on the date of grant is Rs. 50, at the end of one year from the grant date – Rs. 80, at the end of second year – Rs. 100, at the end of third year – Rs. 120.

The vesting schedule is as under:

In this case the same will be included in the managerial remuneration as under –

Rs. 80 * 30% of 5,00,000 = Rs. 1,20,00,000 – on December 31, 2022 – to be included in the managerial remuneration of FY 2022-23

Rs. 100 * 30% of 5,00,000 = Rs. 1,50,00,000 – on December 31, 2023 – to be included in the managerial remuneration of FY 2023-24

Rs. 120 * 40% of 5,00,000 = Rs. 2,40,00,000 – on December 31, 2024 – to be included in the managerial remuneration of FY 2024-25.

If the remuneration is treated based on the accounting treatment, there are some contentious issues:

Based on the above discussions, one can argue that both the cases are not entirely appropriate for considering ESOPs as CTC. In such a situation, a combination of (A) and (B) may be proposed to be opted by the companies for the recognition of ESOPs as managerial remuneration.

The proposed alternative seeks to treat ESOPs as managerial remuneration in the following manner –

The proposed alternative seems comparatively reasonable than the other options since though the employee derives benefits on or after the exercise date, the benefits actually accrue during the vesting period itself, since vesting is actually the condition to be satisfied in order to be eligible for the exercise of the options granted to the employee. Linking the same with the taxable value, instead of the accounting treatment, provides a realistic view of the remuneration actually given to the managerial personnel.

A company has in January 2022, offered to grant a maximum no. of 5,00,000 equity shares under its ESOP scheme to Mr X, MD of the Company. The vesting period is fixed at 3 years from the date of grant. The vesting schedule is as under:

On completion of 12 months from the date of grant of options = 30%

On completion of 24 months from the date of grant of options = 30%

On completion of 36 months from the date of grant of options = 40%

The exercise price of the share is Rs. 50 and fair value/ market value on the date of exercise is Rs. 200.

The above options shall form part of the managerial remuneration of Mr. X as follows:

Some of the advantages of this approach are:

Now a question arises as to what if the values calculated as above lead to breach of limits as per the net profits of corresponding financial year or as already sanctioned by shareholders. Therefore, if in any of the years, the managerial remuneration has exceeded the limits cast by sec. 197/Schedule V, the approval may be sought at any time before allotment of the shares. If, and to the extent, the shareholders do not approve the managerial remuneration, the shares cannot be allotted, beyond the shareholders’ approval.

In terms of section 197 of the Act, read with Schedule V, the shareholders’ approval is required to be taken where the remuneration payable to a managerial personnel exceeds the limits of net profits as provided for under the section or in the event of loss or inadequacy of profits for the year to which the same relates. Limits on managerial remuneration, by the very nature, are always calculated retrospectively, and therefore, a post facto approval for managerial remuneration is almost a regular feature.

Consider the following situation: The managing director is receiving remuneration, say Rs 25 lacs a month, on a monthly basis. Obviously, he takes this money home every month. It is only after the end of the year, when the financial statements have been drawn, that we know the profits for the year, and compute whether the amount paid over the year is within the limit of 5%, or within the approved limit as per shareholders’ resolution.

Assuming that we find that the profits are falling inadequate [if the remuneration paid is Rs 25 lacs *12 = Rs. 300 lacs, and the profits are less than Rs 60 crores, the limit of 5% will be breached], the company shall take the amount of remuneration paid in excess of the limits for approval by shareholders. If the shareholders do not approve such payment, the amount paid in excess shall be refundable by the managerial personnel, within a period of 2 years or such lesser time as may be allowed by the shareholders. Until such refund, the managerial personnel shall be deemed to be holding the money in trust for the company. [sec 197 (9)].

In our suggested methodology for ESOPs, in case the value of the option during the vesting period, along with other remuneration paid, is exceeding the limits, the approval shall be taken after exercise and before allotment of the shares. This is similar to the retrospective approval for excess remuneration, and fits into the structure of sec. 197 (9). That the allotment is subject to the shareholders’ approval, may be suitably incorporated in either the ESOP Plan itself, or at the time of approval of grant of such stock options by the board committee.

Once we have arrived at the conclusion that ESOPs are considered as a part of the managerial remuneration, and given the values involved, it becomes important to give appropriate disclosures around the same. While there are specific requirements on disclosures of ESOPs as a part of managerial remuneration, under applicable laws as discussed above, it is important that companies go by the spirit and not only letter-compliance of law, and disclose information in such a manner so as to present a fair and conclusive view before the shareholders and other stakeholders.

As discussed above, managerial remuneration is either regulated or disclosed in several other major jurisdictions too, requiring the companies to put managerial remuneration in the domain of shareholders, either for explicit approval, or at least for disclosure. Specific disclosure is also, in the manner of speaking, a regulatory requirement, as the shareholders may then put curbs by shareholders’ vote. The concept of “say on pay”, that is, the right of shareholders to have a mandatory non-binding vote on the compensation of their executives has been in existence since a long time, and legislation to this effect has been enacted in countries all around the world such as UK, US, India, Singapore, Netherlands,Switzerland, Belgium etc. Further, some countries are moving towards binding votes in place of advisory votes of shareholders. The International Scope of Say on Pay published by the European Corporate Governance Institute (ecgi) in September, 2013 defines Say on Pay as: “(1) a recurring, mandatory, (2) binding or advisory shareholders’ vote, (3) provided by law, that (4) directly or indirectly through the approval of the remuneration system, remuneration report or remuneration policy, (5) governs the individual or collective global remuneration package of the executive or managing directors of the corporation.”

Wide attention to managerial remuneration, mostly called “CEO compensation”, was drawn during the passage of the Dodd Frank law[3]. The Dodd Frank law brought the concept of “say on pay”, that is, shareholders have a say on the pay of the CEO. Consequently, amendments have been made to the Securities Exchange Act of 1934 (“SEC Act”) to enforce the concepts introduced by the Dodd Frank laws by way of regulatory enforcement. Section 14A of the SEC Act requires shareholders to approve the executive compensation by way of a separate resolution at least once in every 3 years, or such other frequency of lesser duration (i.e., 1 or 2 years) as may be approved by the shareholders once in every 6 years. However, the approvals are non-binding in nature. Section 14 of the SEC Act has also been amended to require disclosure of such “information that shows the relationship between executive compensation actually paid and the financial performance of the issuer, taking into account any change in the value of the shares of stock and dividends of the issuer and any distributions.” It also seeks disclosure in the annual meeting of shareholders as to whether any employee or director of the company is permitted to purchase financial instruments that are designed to hedge or offset any decrease in the market value of equity securities granted as part of compensation or held directly/ indirectly by the employee or director.

A substantial portion of a US executive’s compensation package typically consists of equity-based incentive awards. Title 26 of the United States Code provides the amended Internal Revenue Code of the US, a part of which deals with the meaning and taxability of ESOPs. Though originally defined in Section 4975(e)(7), it requires to qualify the conditions given under section 401(a) and various conditions of section 409. For tax purposes, the income in respect of stock options is recognised when the stock options are exercised by the option-holder. [4] However, there are special Incentive Stock Options (ISOs) as defined under section 422(b) in which case, no income is recognised at the time of transfer of shares to the employees pursuant to the exercise of the options, and no deduction is available to the employers. On the sale of shares, capital gains accrue as usual in either of the cases.

In the UK Companies Act, 2006, the managerial payment under section 226A is defined as ‘any form of payment or other benefit made to or otherwise conferred on a person as consideration for the person holding, agreeing to hold or having held office as director of a company…’ This indicates that the remuneration to directors also includes stock options.

The remuneration to directors has to be paid as per the remuneration policy which is approved by the shareholders. The policy and the remuneration to be paid has to be recommended by the committee constituted for the said purpose. (Section 226B)

As per Section 412, the notes to financial statements must disclose the gains made by the directors on exercise of share options. Further, the Directors’ remuneration report has to be approved by the shareholders (Section 439). In addition to this, Article 9A of the Directive of the European Parliament and the Council lists down the matters to be disclosed in the remuneration report regarding each individual director’s remuneration which, inter alia, includes the number of shares and share options granted or offered, and the main conditions for the exercise of the rights including the exercise price and date and any change thereof.

Therefore, presently, in UK, there are two lines of control on director’s remuneration –

Various aspects of the Employee Share Plans in the UK along with the regulatory overview and taxation aspects may be accessed in the Q&A guide.

Article L225-44 to L225-47 of the French Commercial Code deals with director’s remuneration. As per the said articles, the directors shall receive an annual fixed remuneration fixed by the shareholders at the general meeting. Such an amount is distributed among the directors as determined by the Board. The directors may also receive exceptional remunerations for the missions conferred upon the directors. As per Article L225-177, the shareholders may authorize the board of directors or the executive board to grant stock options to the employees of the company. In terms of Article L225-185, the executive directors of the company may be granted stock options.

The remuneration to directors, including the stock options, is recommended by the compensation committee and decided by the board. Such remuneration is annually approved by the shareholders. (Para 26 of French Corporate Governance Code of listed corporations).

The Board is required to present the compensation of directors in respect of the closed financial year at the annual general meeting which includes stock options, performance shares and multi-annual variable compensation plans together with the performance criteria used to determine these compensation components. If the shareholders vote against the resolution, the Board is required to examine the reasons and expectations of shareholders and accordingly rule on the modifications to be made to the compensation due or paid or the future compensation policy.

In terms of Section 169 of the Companies Act, 1967 of Singapore, a director cannot be paid any emoluments in respect of his office, unless the same is approved by the shareholders of the company. In the context of Singapore, the term “emoluments” has been given a wider meaning and includes “any fees, percentages and other payments made (including the money value of any allowances or perquisites) or consideration given, directly or indirectly, to the director…. in the director’s capacity as such or otherwise in connection with the affairs of that company…”. Such a wide definition of emoluments, includes, beyond doubt, the stock options granted to the directors.

Section 161 of the Singapore Act requires prior approval of shareholders for issue of any shares to the directors. In case of issue of shares as a part of the options granted to the directors, the approval is required to be taken at the time of granting of such options to the directors. Such options granted to any director and CEO of the company, if any, are required to be disclosed in the register of directors’ and CEO’s shareholding.

Sections 164A and 165 of the Singapore Act obligates a director to disclose when asked for by way of a notice by a specified percentage of shareholders (in number/ by value) and annually as when as there is some change in the particulars, the particulars of the emoluments received by him. Further, the Director’s Statement required to be annexed with the annual financial statements in terms of Section 201 read with the Twelfth Schedule requires the following disclosures pertaining to the options granted to the directors, as following –

2. Where any option has been granted by a company, other than a parent company for which consolidated financial statements are required, during the period covered by the financial statements to take up unissued shares of a company —

(a)the number and class of shares in respect of which the option has been granted;

(b)the date of expiration of the option;

(c)the basis upon which the option may be exercised; and

(d)whether the person to whom the option has been granted has any right to participate by virtue of the option in any share issue of any other company.

4. Where a parent company or any of its subsidiary corporations has at any time granted to a person an option to have shares issued to the person in the company or subsidiary corporation, the directors’ statement of the parent company must state the name of the corporation in respect of the shares in which the option was granted and the other particulars required under paragraphs 2, 5 and 6.

5. The particulars of shares issued during the period to which the statement relates by virtue of the exercise of options to take up unissued shares of the company, whether granted before or during that period.

6. The number and class of unissued shares of the company under option as at the end of the period to which the statement relates, the price, or method of fixing the price, of issue of those shares, the date of expiration of the option and the rights (if any) of the persons to whom the options have been granted to participate by virtue of the options in any share issue of any other company.

From the aforesaid, it seems that in Singapore, the managerial remuneration is governed to a great extent by way of initial approvals and continual disclosures.

Apart from the approval requirements, there are some restrictions on the number of shares that can be issued as a part of the ESOP plan. The number of shares issued to directors, chief executive officers, general managers, and officers of equivalent rank is restricted to 50 percent of the total number of available shares under the plan. The maximum entitlement of each participant is 25 percent of the total number of shares available in the ESOP.

A detailed regulatory overview of the current ESOP scenario can be referred to in the question-answer guide to the Singapore ESOP plans.

As discussed above, the emoluments to be paid to directors is required to be approved by the shareholders (in the Annual General Meeting, generally) before being paid to the directors. Director’s fees are taxable in the year in which the director becomes entitled to the fees, which is said to be the date on which the same is approved by the shareholders.

From the Inland Revenue Authority of Singapore’s guide to employment income, the gains on ESOP are taxable when the stock options are exercised, however, if the ESOP plan imposes a restriction on the sale of shares for a definite period, the same is exercisable once the restriction period ends. For ESOP plans with a vesting period, the gains become taxable as per the vesting schedule and are recognised on the date of vesting. Further, currently, a tax-deferment scheme is also effective – Qualified Employee Equity-based Remuneration Scheme (Qualified EEBR Scheme), which provides an option for the deferment of tax for a period of five years, subject to certain qualifying conditions for the same.

The significance of managerial remuneration in ensuring an effective corporate governance has been recognised in almost all the major countries of the world, due to its potential of conflict of interest. However, presently, there is an anomaly in the presence of adequate controls over ESOPs, accounting for a major part of the managerial remuneration/ executive compensation in many companies, especially, the listed ones. While the total pool of options under an ESOP plan is approved by the shareholders, as also the managerial remuneration of the managerial personnel at the time of his appointment/ re-appointment, what generally does not come before the shareholders for approval is the exact number of share options granted to one person, and its effect on the net profits of the company at the time of exercise. Therefore, there is an evident gap that requires appropriate treatment. While disclosures with respect to ESOPs are required to be made in annual reports, companies generally disclose it in terms of the fair value of the options, and sometimes, also ignore the same in the computation of the managerial remuneration. A definite approach of treating ESOPs as part of managerial remuneration, stating the time and value at which the same is taken and the manner in which shareholders’ approval will be taken is the need of the time, so as to do away with the existing reflecting gaps.

[1] https://courts.delaware.gov/Opinions/Download.aspx?id=271690

[2] Reg 17(6)(e) requires shareholders’ approval by way of a special resolution for compensation payable to executive directors who are promoters or members of the promoter group if –

(i) the annual remuneration payable to such executive director exceeds rupees 5 crore or 2.5 per cent of the net profits of the listed entity, whichever is higher; or

(ii) where there is more than one such director, the aggregate annual remuneration to such directors exceeds 5 per cent of the net profits of the listed entity

[3] Subtitle E of the Dodd Frank Wall Street Reform and Consumer Protection Act is based on accountability and executive compensation. It requires the executive compensation to be approved by the shareholders of the company, as also, the same to be disclosed to the shareholders in terms of pay vs performance of the directors.

[4] The Executive Remuneration Review: USA by Michael J. Albano and Julia M. Rozenblit published in The Law Reviews

Making sense of SEBI’s 8th April clarification

Vinod Kothari & Vinita Nair | corplaw@vinodkothari.com

It has been 5 months since notification of SEBI (Listing Obligations and Disclosure Requirements) (Sixth Amendment) Regulations, 2021 making major recast of the regulatory processes on related party transactions; the 8000 odd corporates consisting of the bulk of India’s financial as well as real sector continue to decode, interpret, and implement the revised framework. On the advocacy front, companies continue to make representations to, seek clarifications from SEBI ((including through stock exchanges). There is no doubt that SEBI, as a regulator, is open to interface with companies and is often receptive to useful suggestions.

Within a span of 10 days, the 8th April clarification is the second clarification on the approval for material related party transactions (‘material RPTs’). SEBI circular dated March 30, 2022 provided a one-time relaxation by allowing companies to seek prior approval for material RPTs at the first general meeting convened after April 1, 2022. This time the clarification vide SEBI circular dated April 8, 2022 pertains to the validity term of the prior approval of shareholders for material RPTs. The circular has been rolled out, clearly, in response to the representations made seeking clarity. The issue in hand is the insistence of the new RPT framework requiring prior approval of shareholders if the materiality threshold is crossed, which, now, has an absolute monetary frontier of Rs 1000 crores as well. So, when do companies seek shareholders’ approval, if they clearly estimate the value of the transactions with a related party crossing the frontier? The 30th March circular granted a time upto the first general meeting in FY 22-23, but what about the next financial year? Not to see their transaction volumes suddenly hitting the Rs 1000 crores limit, do companies necessarily have to get shareholders’ approval before the beginning of the financial year? For most companies, the usual routine process of shareholders’ approval is through the annual general meeting, which happens around the July-September period. But what about continuing transactions from April, till the AGM date?

It seems that the SEBI’s circular of 8th April was trying to answer this question. However, as companies try to decipher and knit-pick each word of the regulator, they may possibly be left with so many different questions after reading the 8th April circular.

We had, in our earlier write up titled ‘New Materiality Thresholds for RPTs: Nagging questions on shareholders’ approval’, done a detailed analysis of transactions and contracts and discussed various aspects of shareholders’ approval for material RPTs. In this article, we intend to help companies to avoid any “confusification”, and see the 8th April circular as SEBI’s attempt to help companies to implement the process of shareholders’ approval, without affecting business and commercial considerations.

Click here to access our article corner on Related Party Transactions

Registrations can be made at –

https://docs.google.com/forms/d/e/1FAIpQLSdPUjdFQCfxiVulF4dfuprZqEg-DlfyLvXMweDL-1MrOJeuwQ/viewform

| Update: Please note, the workshop is deferred and will not be held on April 4, 2022. Revised date for the workshop will be announced shortly. Do express your interest in the form above for further communications! In case of any queries reach out to anushka@vinodkothari.com |