SEBI mandates timely disclosure of ‘default’: intends to fill credit information gaps

By Vallari Dubey, (vallari@vinodkothari.com)

The Securities and Exchange Board of India (‘SEBI’) has vide circular dated 4th August, 2017[1], issued a set of additional disclosures for default in payment of interest/repayment of principal amount on loans from banks/financial institutions, debt securities etc. the same are to be complied with by all listed entities,

The circular is issued by SEBI, by virtue of ‘the power to remove difficulties’ granted under Regulation 101 of Chapter XII of LODR Regulations, 2015. This circular shall take effect from 1st October, 2017.

Background

As per the existing disclosure requirements, a listed entity is required to intimate or bring it into records of public and/or the stock exchange, the details of any material event or action as specified in the regulations.

Existing disclosures in case of ‘default’

Disclosures by entities which has listed its specified securities[2]

Regulation 30 deals with disclosure of any events/information which, in the opinion of the board of directors of the listed entity are considered material.

The events specified in Para A, Part A of Schedule III are deemed material events, and the listed entity is required to disclose the same to the stock exchange as soon as reasonably possible and not later than twenty four hours from the date of occurrence of event/information. Further, the listed entity shall make disclosures updating material developments with respect to the disclosures already made. The disclosures are also required to be hosted on the website of the company for a minimum period of 5 years.

Inter-alia the events mentioned, para 6 reads as:–

- Fraud/defaults by promoter or key managerial personnel or by listed entity or arrest of key managerial personnel or by listed entity or arrest of key managerial personnel or promoter.

It may be noted that the term ‘default’ is not defined for the purpose of disclosure under this para.

Disclosures by listed entities which has listed its non-convertible debt securities or non-convertible redeemable preference shares or both

Regulation 51 deals with disclosure of information having a bearing on the performance/operation of the listed entity and/or price sensitive information. Sub-regulation (2) refers to Part B Schedule III and the events specified therein shall be promptly disclosed to the stock exchanges.

Inter-alia the events mentioned, para 1, 4, 9 and 11 read as:-

- Expected default in timely payment of interests/preference dividend or redemption or repayment amount or both in respect of the non-convertible debt securities and non-convertible redeemable preference shares and also default in creation of security for debentures as soon as the same becomes apparent;

- Any action that shall affect adversely payment of interest on non-convertible debt securities or payment of dividend on non-convertible redeemable preference shares including default by issuer to pay interest on non-convertible debt securities or redemption amount and failure to create a charge on the assets;

- Delay/ default in payment of interest or dividend / principal amount/redemption for a period of more than three months from the due date;

- Any instance(s) of default/delay in timely repayment of interests or principal obligations or both in respect of the debt securities including, any proposal for re scheduling or postponement of the repayment programmes of the dues/debts of the listed entity with any investor(s)/lender(s).

Explanation – For the purpose of this sub-para, ‘default’ shall mean Non-payment of interest or principal amount in full on the pre-agreed date and shall be recognized at the first instance of delay in servicing of any interest or principal on debt.

Additional disclosures to be made w.e.f. 1st October, 2017

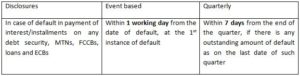

Pursuant to the said circular, disclosures in the format prescribed therein (not covered under the existing disclosure regime) are required to be made. As stated in the circular, the disclosures seek to imbibe a culture of discipline amongst the listed entities and facilitate to fill the existing gaps in terms of credit and default information of listed entities, in respect of loans and borrowings from banks. Such detailed information which is to be provided, along with strict timelines, will prove to be fruitful to the banks and other stakeholders, in cases where any application is initiated against any listed entity before the National Company Law Tribunal under the Insolvency and Bankruptcy Code, 2016.The disclosures shall be made when the listed entity has committed “default” in its obligation towards any of the following:-

- Debt securities (including commercial papers)

- Medium Term Notes (MTNs)

- Foreign Currency Convertible Bonds

- Loans from banks and financial institutions

- External Commercial Borrowings (ECBs)

- Any other case as and when required

For the purpose of the aforesaid, default shall mean non-payment of interest or principal amount at a pre-agreed date.

Information to Credit Rating Agencies (CRAs)

All information pertaining to ‘default’ by the listed entities shall also be supplied to Credit Rating Agencies. Reference may be made to the recent SEBI circular dated 30th June, 2017[3]. The circular clarifies the applicability of the obligation on the Debenture Trustee to monitor and share information about default in payment of interest/principal amount, with registered CRAs. Another circular on the same date was issued[4], laying down a comprehensive monitoring and review mechanism for ratings given by CRAs; the circular also provide for submission of No Default Statement by the issuer to the CRA on a monthly basis.

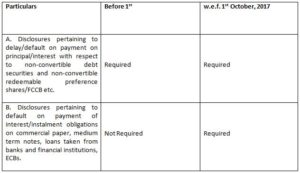

A tabular comparison of disclosures before and after October 1, 2017

An effective date of 1st October, 2017 has been provided in the circular to enable enough flexibility to the listed entities, to set up proper systems in place for compliance of the disclosures to be made therein.

[2] Regulation 2 (zl) defines: ‘specified securities’ means ‘equity shares’ and ‘convertible securities’ as defined under clause (zj) of sub-regulation (1) of regulation 2 of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009;

[3] http://www.sebi.gov.in/legal/circulars/jun-2017/clarification-on-monitoring-of-interest-principal-repayment-and-sharing-of-such-information-with-credit-rating-agencies-by-debenture-trustees_35219.html

[4] http://www.sebi.gov.in/legal/circulars/jun-2017/monitoring-and-review-of-ratings-by-credit-rating-agencies-cras-_35220.html