Covered bonds backed by SME receivables: a nice thought, or a sellable product?

February 19, 2013

The covered bonds market is testing new geographical territories, and new asset classes. From what has been its mainstay over decades, it is moving out of Europe, and out of the mortgage market.

In terms of asset classes, one of the asset classes recently to hit headlines was a structure proposed by Commerzbank to sell covered bonds backed by SME receivables. It is not for the first time that such a structure has been tried – a transaction from Turkey was also backed by SME receivables, but the Turkish deal may not have been a global highlight. However, something from a German bank, which is where most covered bonds issuances have come from, is surely a different thing.

In early Dec 2012, rating agencies published ratings on SME-covered bonds to be issued by Commerzbank. Moody's had assigned a rating of Aa2 to the issuance[1].

The structure was unusual for several reasons. First, while most German transactions are issued under the Pfandbrief Act. This one is not a pfandbrief structure under the Act, but a so-called “contractual structure”. Contractual structures refer to the transaction relying on common law principles, usually by a true sale to an SPV. Similar transactions have so far been structured from out of countries which do not have dedicated covered bonds laws, such as UK, USA, etc. The second speciality is obvious – that the bonds are based on SME loans, while most covered bonds so far have been mortgage receivables-backed. SME loans are not an eligible collateral under the German pfandbrief law – hence, the transaction anyways could not have been covered by the law.

The deal was based on a substantial over-collateralisation – 30%. The final prospectus of the transaction was placed on Commerzbank's website[2].

Return of the CLOs?

Standard and Poor's brought a generalised report on SME covered bonds[3]. The report generally discusses the structure of SME-covered bonds, and likens them to SME securitisation structure. This is the familiar CLO structure, with the difference that here, investors have a recourse against the issue too.

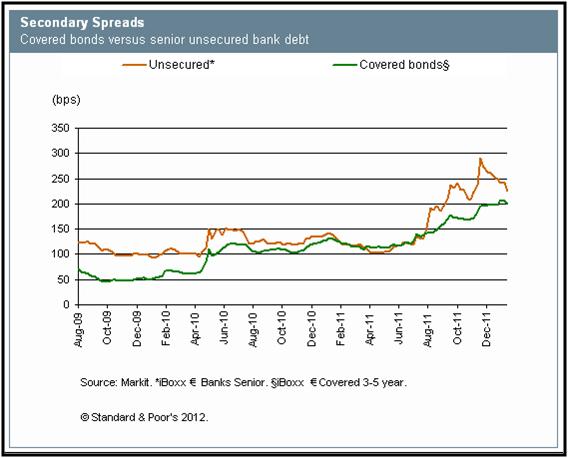

The S&P report says that SME covered bonds may become as systematically important as mortgage covered bonds. The underlying strength is the fact that most of the European economies, with Germany in particular, have substantial reliance on SMEs. SME funding is high on the agenda of European governments – hence, governmental action will only promote new avenues of SME funding.

Ground realities:

However, as Commerzbank went out to sell the product in the market, investors have been demanding triple digit spreads[4]. This may be due to the recently reported losses of the issuer[5].

However, as a general instrument available in the market, the debutante covered bond initiative is both a landmark in the covered bonds development, as also in funding of SMEs.

[1] http://www.moodys.com/research/Moodys-assigns-PAa2-to-Commerzbanks-SME-structured-covered-bonds–PR_225006

[2]https://www.commerzbank.com/media/aktionaere/emissionsprogramme/sme_programme/SME_Prospectus_approved_05122012.pdf

[3] http://www.standardandpoors.com/spf/upload/Ratings_EMEA/04Feb2013_CouldSMEBackedCoveredBondsGainPopularity.pdf

[4] http://www.reuters.com/article/2013/01/30/commerzbank-sme-covered-bonds-idUSL5N0AZAG320130130

[5] https://www.commerzbank.com/media/aktionaere/emissionsprogramme/sme_programme/Supplement_07022013.pdf

Reported by: Vinod Kothari