Archive for month: November, 2013

Ghost of sale and leasebacks – will we exercise it now?

/0 Comments/in Leasing and Asset Financing /by adminNews on Securitization: Asia-Pacific securitisation reviving, as Singapore registers some securitisation deals

/in Financial Services, News on Securitization, Securitisation /by adminNovember 30, 2013

The market for asset-backed securities, which went into hibernation post the 2007-8 crisis, seems to be coming back to life. Hong Kong and Singapore and the two main centers of financial activity : most of investment banks in both the places had shut their stops and disbanded their investment banking teams post the sub-prime crisis. However, there are clear signs of activity resurfacing in both the places.

As regards Singapore – there have been 2 deals towards October-November.

One is a CMBS deal with pre-sales of properties under construction. This type of transaction has been done in Singapore long time back and was not seen over more than 6-7 years in the past. This deal, brought by T G Master, pertains to sale of spaces in Skies Miltonia, a property in Singapore. The progress payments on the property have been securitised, thus providing construction finance. This deal was structured and sold by DBS Singapore.

Another deal, brought by Courts Asia, uses two distinct SPVs – one in Malaysia and one in Singapore – to structure a multi-currency multi-jurisdiction transaction.

Hong Kong teams also seem busy structuring transactions for China.

Down South, Macquarie Leasing’s SMART template continues to have new issuances – this pertains to a portfolio of financial and operating leases.

In short, the Asian securitisation market has shown signs of clear revival in 2013, and 2014 may be holding the portents for a promising start.

Reported by: Vinod Kothari

Burns of the past continue to haunt SLB transactions – First leasing case, by Nidhi Bothra, November 30, 2013

/0 Comments/in Fintechs and Payment and Settlement Systems /by adminOverview of VCFs

/0 Comments/in Corporate Laws, MCA, SEBI /by Team CorplawSoma Bagaria, Aditi Jhunjhunwala & Abhijit Nagee | corplaw@vinodkothari.com

Loading…

Loading…

News on Securitization- Home rental securitization deals opens up vistas to a massive market: Analysis of Invitation Homes REO-to-rental securitization

/in Financial Services, News on Securitization, Securitisation /by adminNovember 30, 2013

A recent $ 278.7 million REO-to-rental securitization deal from Invitation Homes, a subsidiary of Blackstone, has set the pheromone levels of securitization structurers high. If this is a template that one could write on, there is substantial scope for similar deals to follow.

REO, or “real estate owned” is a property that a lender acquires against a defaulted mortgage loan. The lender puts the property to auction typically at a reserve price equal to the outstanding loan – but if the market value is lower than such reserve price, there may not be takers, and the property then becomes a part of the “owned” stock of the lender – thus called “real estate owned”. REO is a part of the non-performing asset portfolio of the lender. Thanks to the crisis, there were tens-of-thousands of such homes on the books of several lenders which REITs have been acquiring since 2008 –which they rent out. This is the so-called “REO-to-rental” market, having an estimated potential of about $ 1 billion.

The deal structure emulates a typical CMBS transaction, though it has elements of an RMBS inbuilt into it. There are 6 classes of notes, with the bottom two unrated. The over-collateralisation at Class A is approximately 41.8%. The transaction has a term of only 5 years, including 3 one-year extensions. Moody’s rating presale report, detailing the transaction is here: https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBS_SF346785

Reported by: Vinod Kothari

News on Securitization: AIFMD exemption for Irish securitisation companies

/in Financial Services, News on Securitization, Securitisation /by adminNovember 29, 2013

The Central Bank of Ireland has recently clarified that:

- securitisation companies that have registered with the Central Bank as “financial vehicle corporations” pursuant to Regulation (EC) No 24/2009 of the European Central Bank[1] (the “FVC Regulation“); and / or

- securitisation companies funded by way of debt or other non-equity instruments,

are outside the scope of the Alternative Investment Fund Managers Directive (Directive 2011/61/EU)[2] (the AIFMD) and the Commission Delegated Regulation[3] (EU) No 231/2013 as transposed into Irish law under the European Union (Alternative Investment Fund Managers) Regulations, 2013 (the “AIFM Regulations“).Consequently they do not need to seek authorization as, or appoint, an AIFM. The Central Bank of Ireland does not intend to do that at least for so long as ESMA continues its current work on this matter.

Section 110 of the Irish Taxes Consolidation Act 1997[4] creates the legislative framework for securitisation companies in Ireland. Such companies are commonly called “Section 110” companies. Many existing and newly established section 110 companies would be required by the FVC Regulation to register with the Central Bank as “financial vehicle corporations”, by virtue of the fact that they carry out, or intend to carry out, one or more “securitizations” (within the meaning of the FVC Regulation). Following the clarifications, it is now clear that AIFMD and the AIFM Regulations do not apply to such companies.

AIFMD and the AIFM Regulations also do not apply to section 110 companies that are not required to register as FVCs, provided they are not engaged in the activity of issuing shares or units. This would include, section 110 companies that are not FVCs, where they are funded by entering into loans, issuing debt securities, and / or issuing non-debt instruments (such as certificates, warrants and derivative instruments) that do not convert into, and are not convertible into, shares or units giving an ownership interest in the company.

News on Securitization: Rooftop assets securitization deal highlights substantial scope in renewable energy securitization

/in /by adminNovember 29, 2013

SolarCity, a company in the solar energy sector, recently completed a securitization of rooftop solar energy equipment, paving the way for innovative deals in the renewable energy sector coming up in time to come.

Rooftop solar equipment have cashflows spreads over 8 to 15 years, and it is important to find devices of take-out financing that match the financial cashflows with the energy potential of the equipment. Using traditional loan-financing devices, it is difficult to achieve this matching. However, securitization allows this matching comfortably. Thus, where theoretically, securitization is ideally suited for solar equipment financing, there has not been much in practice to show-case the implementation of this method of financing.

The SolarCity transaction uses the future flows device to raise approximate $ 54.42 million funding against assets having a value of $ 87.8 million[1]. This is about 40% overcollateralization, but considering that the defaults in solar power consumer sector may be as high as 25%, the level is not difficult to understand.

The sale of the Notes, with an interest rate of 4.8%, due in 2026, was recently reported completed[2]. The company, it is reported, was quite happy with investor interest.

[1] See Standard and Poor’s presale rating report at http://www.standardandpoors.com/prot/ratings/articles/en/us/?articleType=HTML&assetID=1245360535894

[2] http://www.forbes.com/sites/uciliawang/2013/11/21/done-deal-the-first-securitization-of-rooftop-solar-assets/

Reported by: Vinod Kothari

Our page on Solar Securitization can be viewed here

News on Securitization: Bank of England speaks pro-securitisation once again

/in Financial Services, News on Securitization, Securitisation /by adminNovember 29, 2013

The latest issue of Financial Stability Report[1], released by the Bank of England, speaks a lot once again by the needed initiatives to revive securitisation.

It notes, of course, that there are visible signs of positive investor interest in the sector in the recent past, evidenced by several proxy measures. First, the volumes of CLOs has been around USD 75 to 80 billion this year, which is close to the pre-Crisis levels. Second, there have been innovative deals – such as residential rental securitisation, securitisation of peer to peer loans, etc. However, with all this, the reduction of securitisation volumes in Europe has been alarming – coming from $ 1.2 trillion in 2008 to $ 322 billion in 2012.

The Report notes: “Better functioning and safe and robust securitisation markets have the potential to diversify banks’ funding sources and create securities that are better tailored to the needs of non-bank investors, such as insurers and pension funds. Securitisation can also transfer risk outside the banking sector. For example, banks that have the expertise to originate loans may not always be best placed to bear the risk of those loans. In those circumstances, banks can free up capital for new lending by securitising loans and selling them to other investors. This process diversifies sources of finance available to the real economy and potentially increases its stability”[2].

The Committee notes the useful purpose served by “shadow banking” – a term applied to paralller alternative non-banking financial system supplying money to the financial system.

“The provision of finance from outside the traditional bankingsystem can play an important role in the financial system and wider economy but it can also be a source of systemic risk”, notes the Report. The Committee will focus on mitigating these risks, rather than curbing shadow banking.

Vinod Kothari adds: The CLO/CDO volumes, for the first 10 months of this year, is reportedly about $ 68.5 billion, which compares with $ 39.4 billion for the same period in 2012. This is surely a substantial increase. However, considering that there has not been much pick up in traditional asset classes, the aggregate ABS/MBS issuance for 2013 may end up lower than that for 2012.

News on securitization: China resumes Securitization

/in Financial Services, News on Securitization, Securitisation /by adminSeptember 25, 2013:

Historical Developments:

Asset securitizations in China were halted since 2009 after the credit crisis in US markets started developing. However in May 2012, the activity gained round after the PBoC, CBRC and Ministry of Finance jointly issued a Notice on Matters Concerning Further Expansion of Credit Assets Securitization Pilot Program and planned for the launch of its third pilot program with RMB 50bn limit in the interbank market. A year later, in March 2013, as a part of its deregulation objectives, the CSRC upgraded asset securitization activity to a routine business process by issuing Securities Company Asset Securitization Regulations. The following table outlines the historical developments in the Chinese Securitization market:

Current Reforms:

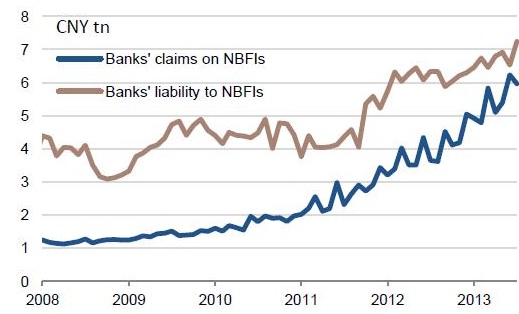

Further to increasing market activity, the State Council executive meeting on August 28, 2013 decided to expand the trial program for securitization of credit assets to make it a more commonplace activity. The Council has allowed the trading of high-quality asset-backed securities on stock exchanges for the first time. The following graph shows that NBFIs in China were acting as virtual conduits for the banks. The move by the State Council to allow securitization activity only legitimizes what is currently happening informally:

Souce: PboC, CEIC, SG Cross Asset Research/Economics

The State Council has called for strict supervision of securitizing credit assets and that the functions and responsibilities of trust companies and accounting firms should further be made clear in this regard. The Chairman of the China Banking Regulatory Commission Shang Fulin has also said that detailed measures should be put in place to enable the expanded credit asset securitization trial to benefit more small and medium enterprises which are cash-strapped. According to the statistics from the CBRC, by the end of July 2013, the outstanding balance of SME loans nationwide amounted to RMB 16.5 trillion. The reforms should also help participating banks expand their funding options. It should also help the government meet funding requirements for infrastructure projects. In addition to this, the CBRC has sent out a circular to insurers to make them actively participate in the pilot. Currently, credit assets that may undergo securitization include credit loans, guarantee loans, small and micro-sized business loans and auto loans.

Remaining Challenges:

Some analysts feel that although the reforms may boost liquidity through stock exchange trading and improve regulatory oversight over the banking sector, it may not spurge activity in this sector, given the illiquid nature of these products and that large scale transfer of NPLs from banks may not be easy because of pricing issues. If volume of issuances increases in the future and the cost of issuances falls, then products will become more liquid.

TIMELINE OF MAJOR SECURITISATION EVENTS

|

Year |

Interbank Market regulated by CBRC |

Securities Companies regulated by CSRC |

|---|---|---|

|

2005 |

Initial Pilot program launched by PBoC and CBRC; Limit of RMB 15 bn for interbank market |

|

|

Pilot securitization program launched with the CICC’s securitization program China Unicom |

||

|

First issue of ABS made by China Development Bank |

||

|

2007 |

Second Pilot Program launched with limit of RMB 60 bn |

|

|

2009 |

Activity halted due to financial crisis |

|

|

CSRC issued Manual for Securities Company Corporate Assets Securitization Pilot Program |

||

|

2012 |

Third Pilot Program launched with RMB 50 bn limit |

|

|

2013 |

PBoC, CBRC and Ministry of Finance jointly issued the Notice on Matters Concerning Further Expansion of Credit Assets Securitization Pilot Program. |

|

|

State Council issued Guidelines on Financial Support for Adjusting, Transforming and Upgrading the Economic Structure |

** The information has been prepared from information in CSRC, CBRC website and Nomura Research Institute.

To read more on the China Regulations please click here

Reported by: Shambo Dey