The big buzz on small business payment delays

Mahak Agarwal | corplaw@vinodkothari.com

The Micro, Small and Medium Enterprises Development Act, 2006 (‘MSME Act’) has been around for close to 2 decades now, providing for penal interest for delayed payments to MSMEs; yet, it is only of late that there has been buzz around this. Why?

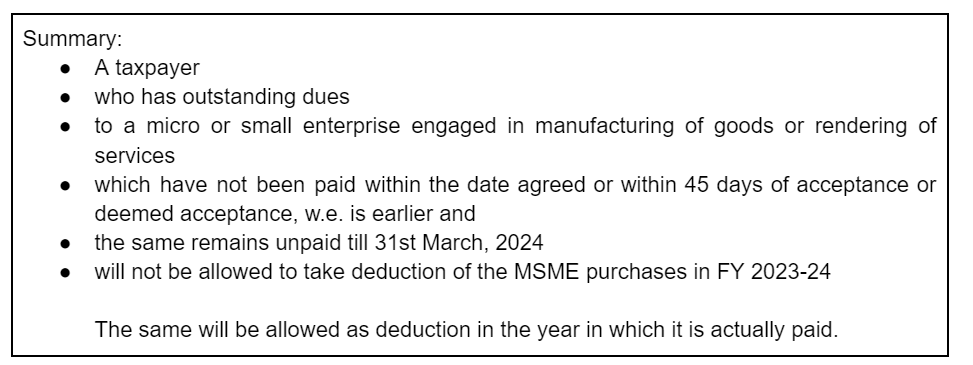

This attributes to clause (h) of Section 43B of the Income Tax Act, 1961 (IT Act, 1961), inserted by the Finance Act, 2023, effective FY 23-24. That is to say, its impact will be faced for outstanding payments as on 31st March, 2024. Now, with the year end fast approaching, there’s a sense of confusion amongst taxpayers who buy goods or services from MSMEs.

S. 43B(h) of the IT Act, 1961

What it is:

Deals with deductions which are allowed only on actual payment basis.

Clause (h) to the section was introduced as an effort to ensure prompt payment to MSMEs. Pursuant to this clause, all invoices in respect of MSMEs for the FY 2023-24 are to be paid within the time specified in Section 15 of the MSME Act else, the same will be allowed on actual payment basis, i.e. in the year in which the payment is actually made.

When does it become applicable?

FY 23-24 is the first year of applicability for outstanding payments as on 31st March, 2024.

What is covered?

While the MSME Act is applicable to micro, small and medium enterprises, the IT Act has specifically covered micro and small enterprises only. Medium enterprises are not covered under its ambit. Further, the definition of ‘enterprise’ under the MSME Act includes only manufacturing concerns. Accordingly, trading concerns are not covered in its scope.

S. 2(e) “enterprise” means an industrial undertaking or a business concern or any other establishment, by whatever name called, engaged in the manufacture or production of goods, in any manner, pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 (55 of 1951) or engaged in providing or rendering of any service or services”

What is not covered?

As discussed above, the following are not covered under 43B(h)

- Medium enterprises

- Trading concerns

What is the time specified under Section 15 of the MSME Act?

S. 43B(h) covers payments to micro and small enterprises beyond the time specified under Section 15 of the MSME Act. Section 15 of the MSME Act provides timeline as: on or before the date agreed between the parties or 45 days from the day of acceptance[1] or day of deemed acceptance[2], whichever is earlier.

Illustrations:

| Payment made within the day agreed/45 days | deduction available in FY 2023-24 |

| Payment made after the day agreed/45 days but prior to year end (31st March, 2023) | deduction available in the year of actual payment i.e. in FY 2023-24 |

| Payment made after year end but prior to return filing | deduction in the year of actual payment i.e. FY 2024-25 |

| Payment after return filing date | deduction in the year of actual payment i.e. FY 2024-25 |

Note that irrespective of when the payment is made, compound interest at three times the RBI rate (S. 16 of MSME Act) will apply from the appointed day where payment is made beyond the timeline specified above.

Actionable

The immediate actionable for enterprises now will be to clear their MSME dues prior to the end of the FY so as to avail deduction in the FY 2023-24.

[1] Day of acceptance is the day:

Where a dispute has been raised within 15 days: the day on which the dispute is resolved

Where a dispute has not been raised within 15 days: the date of actual deliveryof goods/rendering of services

[2] Day of deemed acceptance: If the buyer has not communicated his acceptance within 15 days of receipt of goods or availing of services, the same are deemed to be accepted on the day when they were actually delivered/rendered.

Also refer to our YouTube video on this here: https://youtu.be/Q2dq5ag4Udc

Our other resources on MSMEs:

Leave a Reply

Want to join the discussion?Feel free to contribute!